CN to STB: We Want the Springfield Line (UPDATED WITH CP RESPONSE)

Written by Marybeth Luczak, Executive Editor

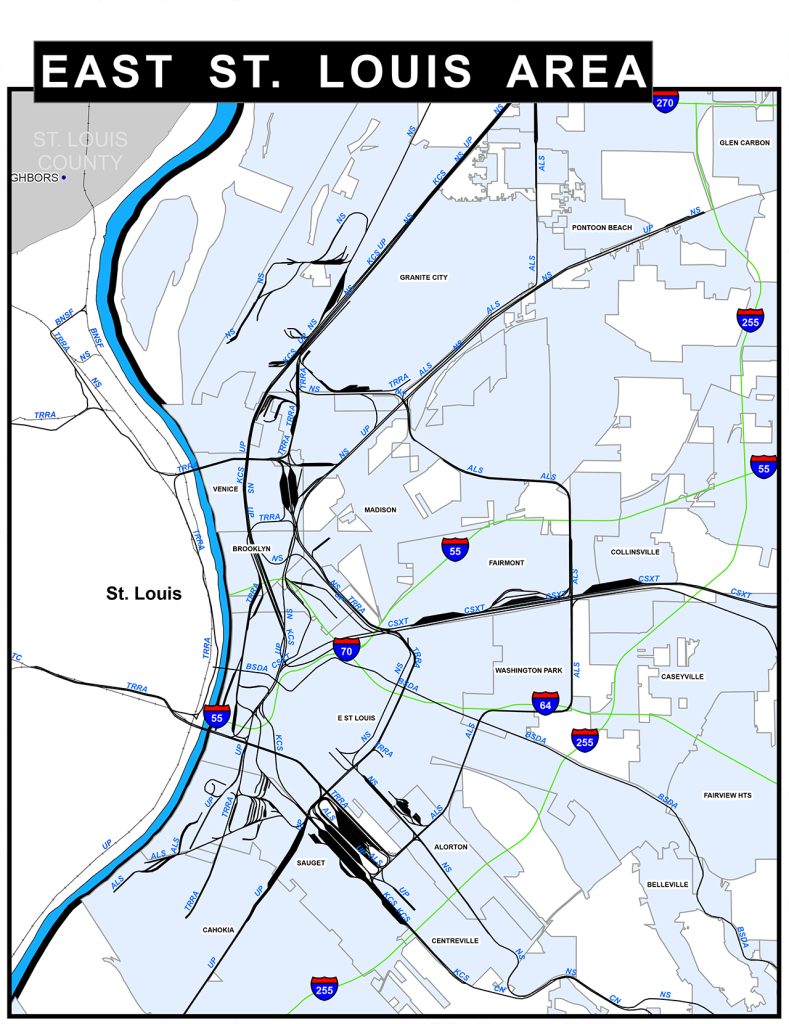

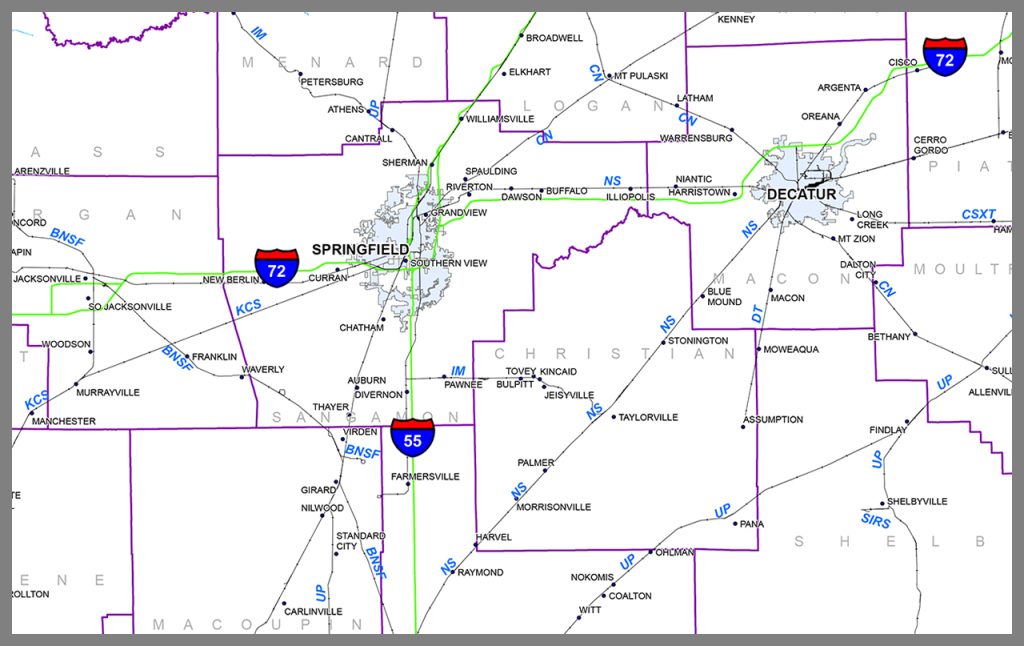

CN reported on Jan. 13 that it will ask the Surface Transportation Board (STB) “to condition any approval of a Canadian Pacific-Kansas City Southern merger on the divestiture of KCS lines from Kansas City, Missouri to Springfield and East St. Louis, Illinois (the Springfield Line) to CN, pursuant to the STB’s statutory authority to order ‘the divestiture of parallel tracks’ as a merger condition.” CP immediately responded, negatively.

The request will be made in CN’s Responsive Application, which the Class I railroad said it would file on Feb. 28, 2022, the deadline set in STB’s procedural schedule for reviewing the pending CP–KCS merger (see schedule below).

CP and KCS in September 2021 agreed to combine and form Canadian Pacific Kansas City (CPKC), the first U.S.-Mexico-Canada rail network. STB in November accepted for consideration their application.

CN claims that the “Springfield Line is a direct competitive alternative to CP’s route from Kansas City to Chicago, and beyond to Detroit and eastern Canada. CP and KCS have made it clear in their merger application that they plan no investment on the Springfield Line, and instead will de-emphasize it in favor of CP’s existing parallel line.

“Putting the Springfield Line under CN’s control represents a major opportunity to improve transportation options, promote rail-to-rail competition, and take many of thousands of long-haul trucks off the road annually through increased rail-to-truck competition. CN’s plan for the line will benefit all stakeholders and will advance CN’s continual efforts to ensure competition and choice in our industry, while also creating new jobs and economic opportunities in the region.”

Under that plan, CN said it would invest at least US$250 million in the Springfield Line to:

• Improve operating speed and terminals.

• Provide “options for customers, including automotive and intermodal traffic, which will lead to increased economic prosperity for the Midwest in line with the goals of President Biden’s executive order on competition.”

• Open new international markets to customers, including “safely and reliably linking Illinois, Indiana and Michigan manufacturers and farmers to the world.”

• Preserve “all existing competitive options by providing KCS access to customers on the line.”

CP: Not So Fast, CN

Canadian Pacific said CN’s quest for the Springfield Line—like its scuttled bid to merge with KCS—is “built on a series of factual errors or misstatements.”

“KCS’s Kansas City-Springfield line is not ‘parallel’ to CP’s line between Kansas City and Chicago,” CP said. “KCS’s line does not reach Chicago, and contrary to CN’s misleading statements, KCS’s line is not part of a through route to Chicago in conjunction with CN. In fact, there is no direct connection between KCS and CN today at Springfield, and historic interchange volumes reflect the absence of any actual service here. Only four cars were interchanged by KCS at Springfield with CN in 2020 and 133 cars interchanged with CN in 2019.

“As part of CPKC, these lines will grow along with CPKC. CP’s proposed pro-competitive combination with KCS is about growth. A future CPKC will not downgrade any lines, these included. Instead, CPKC will maintain existing levels of service on these lines and will not re-route traffic away from these lines, contrary to CN’s assertions.

“In fact, the route from Kansas City to St. Louis and the other assets CN wants the STB to force CP to divest are important parts of the combined CPKC growth story providing new, competitive single-line routes connecting CP’s network with customers and port facilities in St. Louis, and connections to eastern carriers. CP anticipates an increase of traffic on this corridor of 30%.

“CP will be responding to any formal CN request for conditions in the pending STB proceeding at the appropriate time.”

Download the complete Illinois DOT railroad map:

STB Procedural Schedule for CP-KCS Merger Proposal Review:

October 29, 2021: Application filed.

November 26, 2021: Board notice of acceptance of Application to be published in the Federal Register.

December 13, 2021: Notices of intent to participate in this proceeding due.

December 28, 2021: Proposed Safety Integration Plan (SIP) to be filed with STB’s Office of Environmental Analysis (OEA) and the Federal Railroad Administration (FRA).

January 12, 2022: Descriptions of anticipated responsive, including inconsistent, applications due. Petitions for waiver or clarification with respect to such applications due.

February 22, 2022: Responsive environmental information and environmental verified statements for responsive, including inconsistent, applicants due.

February 28, 2022: Comments, protests, requests for conditions, and any other evidence and argument in opposition to the Application due. This includes any comments from the U.S. Department of Justice (DOJ) and U.S. Department of Transportation (USDOT). Responsive, including inconsistent, applications due.

March 30, 2022: Notice of acceptance of responsive, including inconsistent, applications, if any, published in the Federal Register.

April 22, 2022: Responses to comments, protests, requests for conditions, and other opposition due, including to DOJ and USDOT filings. Rebuttal in support of the Application due. Responses to responsive, including inconsistent, applications due.

May 23, 2022: Rebuttals in support of responsive, including inconsistent, applications due.

July 1, 2022: Final briefs due. (Note: “The Board will also determine the page limits for final briefs in a later decision after the record has been more fully developed.”)

TBD: Public hearing (if necessary). (Note: “The Board will decide whether to conduct a public hearing in a later decision after the record has been more fully developed.”)

TBD: Service date of final decision. (Note: “49 U.S.C. § 11325(b)(3) provides that the Board must issue its final decision within 90 days of the close of the evidentiary record and that evidentiary proceedings be completed within one year of the date of publication of this notice in the Federal Register. However, under NEPA, the Board may not issue a final decision until after the required environmental review is complete. In the event the EIS process is not able to be concluded in sufficient time for the Board to meet the 90-day provision set forth in § 11325(b)(3), the Board will issue a final decision as soon as possible after that process is complete.”)