Wabtec: ‘Strong’ Start to 2024 ‘Continues Momentum’ From 2023 (UPDATED, 4/25)

Written by Carolina Worrell, Senior Editor

(Carolina Worrell)

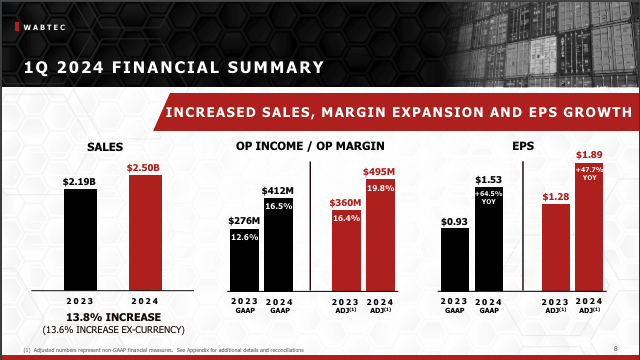

“The Wabtec team delivered a strong start to 2024, continuing the momentum experienced in 2023. This was evidenced by higher sales, margin expansion, and increased earnings in the quarter,” President and CEO Rafael Santana said in an April 24 earnings announcement. Sales were up 13.8% year-over-year, driven by sales growth in both the Freight and Transit segments.

For first-quarter 2024, Wabtec reported GAAP earnings per diluted share of $1.53, up 64.5% from first-quarter 2023; adjusted, they were $1.89, up 47.7% from 2023. “GAAP EPS and adjusted EPS increased from the year-ago quarter primarily due to higher sales, margin expansion and a lower tax rate,” Wabtec reported.

According to Wabtec, sales came in at $2.50 billion for first-quarter 2024, rising 13.8% from the $2.19 billion posted during the same quarter last year. The company attributed this to higher sales in both the Freight and Transit segments.

GAAP operating margin for first-quarter 2024 was higher than the prior year at 16.5%; adjusted, it was higher than the prior year at 19.8%, according to Wabtec. The company said that both “benefited from improved gross margin, as well as operating expenses, which grew at a slower rate than revenue.”

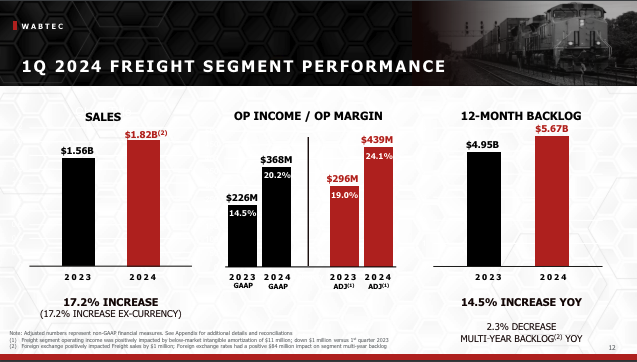

Freight segment sales for first-quarter 2024 were up 17.2%, “driven primarily by Equipment and Services,” according to Wabtec. “GAAP operating margin and adjusted operating margin benefited from higher sales, improved gross margin and focused cost management.”

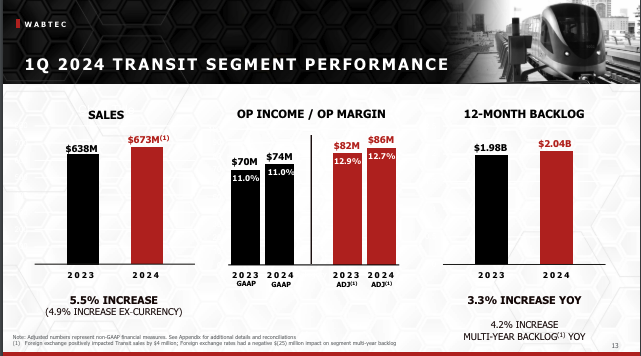

For first-quarter 2024, Transit segment sales were up 5.5% “due to higher OE and aftermarket sales,” Wabtec reported. GAAP and adjusted operating margins were down “driven by lower gross margin, partially offset by operating expenses, which grew at a slower rate than revenue.”

The company’s backlog “continues to provide strong visibility,” Wabtec reported. At March 31, 2024, the 12-month backlog was $785 million higher than that of March 31, 2023. At March 31, 2024, multi-year backlog was $251 million lower than the prior year period and excluding foreign currency exchange, multi-year backlog decreased by $310 million, down 1.4%.

According to Wabtec, for first-quarter 2024, cash provided by operations was $334 million versus cash used for operations of $25 million in the year ago period “due primarily to higher net income, improved working capital and increased accounts receivable securitization funding.”

At the end of the quarter, Wabtec had cash, cash equivalents and restricted cash of $639 million and total debt of $400 billion. At March 31, 2024, Wabtec’s total available liquidity was $2.13 billion, which includes cash and cash equivalents plus $1.50 billion available under current credit facilities.

During the first quarter, Wabtec repurchased $175 million of the company’s shares and paid $36 million in dividends.

2024 Outlook

Wabtec updated its 2024 financial guidance with sales expected to be in a range of $10.25 billion to $10.55 billion and adjusted earnings per diluted share to be in a range of $7.00 to $7.40.

“For full year 2024, Wabtec expects operating cash flow conversion of greater than 90%.”

“Looking ahead, we continue to see underlying customer demand for our products and solutions,” Santana said. “Our orders pipeline and 12-month backlog continue to be strong, which provide visibility for profitable growth ahead. Our team is focused on product innovation, disciplined cost management, and relentless execution for our customers. These factors, coupled with our strong Q1 results, give us confidence to raise our full-year 2024 guidance.

“Overall, we expect to continue building significant long-term momentum with growth in new locomotive sales, modernizations, digital solutions, and in transit systems. Wabtec is well-positioned to drive profitable growth in 2024 and beyond while maximizing shareholder value.”

TD COWEN: ‘Solid Beat; Impressive Execution; Guidance Raise’

“We’re raising our ‘24 and ‘25 EPS estimate to $7.35 from $6.85 and $7.70 from $7.25, respectively,” TD Cowen OEM Transportation Analyst Matt Elkott reported. “Our PT is now $147 based on our new ‘24 EPS estimate and a 20x multiple, up one turn in order to reflect the company’s continued strong execution and solid growth outlook.”

TD Cowen Takeaways:

- “1Q24 adjusted EPS of $1.89 compared to our estimate of $1.52 and consensus of $1.49. Adjusted operating income of $495 MM compared to our and consensus estimates of $410 MM and $408 MM, respectively.

- “The company raised FY24 EPS guidance to $7.00 to $7.40, with a $7.20 midpoint compared to prior guidance midpoint of $6.70 and our estimate of $6.85 at the time of the earnings release and consensus of $6.79. Revenue is now guided to be $10,250 MM to $10,550 MM, with a $10,400 MM midpoint, compared to prior guidance midpoint of $10,200MM vs our estimate of $10,168 MM (at the time of the earnings release) and consensus of $10,204 MM.

- “The total backlog remains strong, increasing 0.4% sequentially. The 12-month backlog increased 3.4% sequentially. 12-month backlog in 1Q24 was up 11.3 y/y while the total backlog in 1Q24 was down 1.1% y/y and down 1.4% y/y excluding foreign currency exchange.”