Lalonde Appointed CN Chief Commercial Officer

CN recently announced that Remi G. Lalonde has been as Chief Commercial Officer (COO), effective April 24. He succeeds Doug Macdonald, who will retire from CN following a nearly 35-year career.

CN recently announced that Remi G. Lalonde has been as Chief Commercial Officer (COO), effective April 24. He succeeds Doug Macdonald, who will retire from CN following a nearly 35-year career.

In a message to members of the Chartered Institute of Logistics and Transport (CILTNA), Railway Association of Canada (RAC) President and CEO Marc Brazeau warns of a potential railway labor disruption in

Safety is at the core of everything we do at CN. Leaning back into scheduled railroading has allowed us to optimize our resources while never compromising on safety. Streamlining our operations has

Railway Age’s second-annual Young Professionals conference—the rail industry’s only free event tailored to helping “fast trackers” in the freight, passenger and supply sectors advance their careers—will be held virtually on May 9

CN is taking delivery on 600 new 1,150-cubic-foot iron ore hopper cars, colloquially called “jennies,” from FreightCar America. The new equipment, described as “a significant upgrade to CN’s fleet,” incorporates materials from

The Brotherhood of Locomotive Engineers and Trainmen (BLET) has reached a tentative agreement for 600 engineers at CN/Wisconsin Central (WC), which the union said “provides significant quality of life improvements and comes after several months of negotiations.”

Canadian Pacific Kansas City (CPKC) marks the one-year anniversary of its biofuels pilot. Also, CN appoints a new President and CEO at TransX.

Unifor ends a 37-day strike at CN Autoport in Eastern Passage, Nova Scotia. Also, Union Pacific (UP) participates in a groundbreaking ceremony for a railroad spur to serve an Oklahoma-based industrial park.

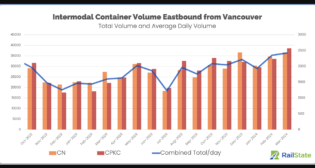

In March, intermodal volume from the Port of Vancouver in British Columbia hit its highest level since August 2022, with a total of 75,110 containers moved eastbound, according to real-time network visibility

BNSF releases 2023 economic development results. Also, CN earns a UPS service award; Norfolk Southern (NS) acquires a Chicago transload and warehouse facility and receives an $8.4 million Georgia Department of Transportation (GDOT) grant for its McDonough passing track improvement project; and Union Pacific (UP) Executive Vice President, Marketing and Sales Kenny Rocker provides a railroad status report.