Commentary

REF Locomotive Day Takeaways From TD Cowen

Written by Matt Elkott, Transportation OEM Analyst, TD Cowen

Jason Kuehn, Vice President Rail Practice, Oliver Wyman

Most locomotive energy transition scenarios bode well for Wabtec and to a lesser extent Caterpillar. There appears to be a near-consensus within the industry that the fleet will be zero-emission non-diesel in the long term but no clear consensus on what that will be, although hydrogen electrolyzer is a leading candidate. Bridge technologies could include biofuels, renewable diesel, hydrogen ICE, and battery.

TD Cowen takeaways from REF Locomotive Day:

- One expert suggested that replacing 25% of the 24K active North American road diesel locomotives with non-diesel units could take 10 years, including an initial few years of design and resource ramping. The expert suggested that between Wabtec’s Forth Worth and Erie plants and Caterpillar’s Progress Rail’s footprint, there is plenty of plant capacity. However, other constraints, including labor, would put a lid on annual builds.

- The expert also suggested that the Class I rails are eager to identify the zero-emission technology of the future now and begin working toward it, as opposed to experimenting with several options or intermediate solutions. This likely stems from a desire to avoid multiple rounds of CapEx. The uncertainty around what future technology the industry will coalesce around likely means that the rails will be content for the foreseeable future with continuing to seek fuel efficiency through modernizations as well as innovations that do not require much incremental CapEx on the part of the carriers, such as biofuels in diesel locomotives. Wabtec is testing biofuels and other renewables that would allow the rails to switch back and forth between diesel and renewable fuel almost seamlessly as dictated by the availability and the economics of the latter. This applies to just about all tiers of locomotives. Hydrogen ICE is another viable option, but its reversibility to diesel is limited to Tier 4 and Tier 3 locomotives.

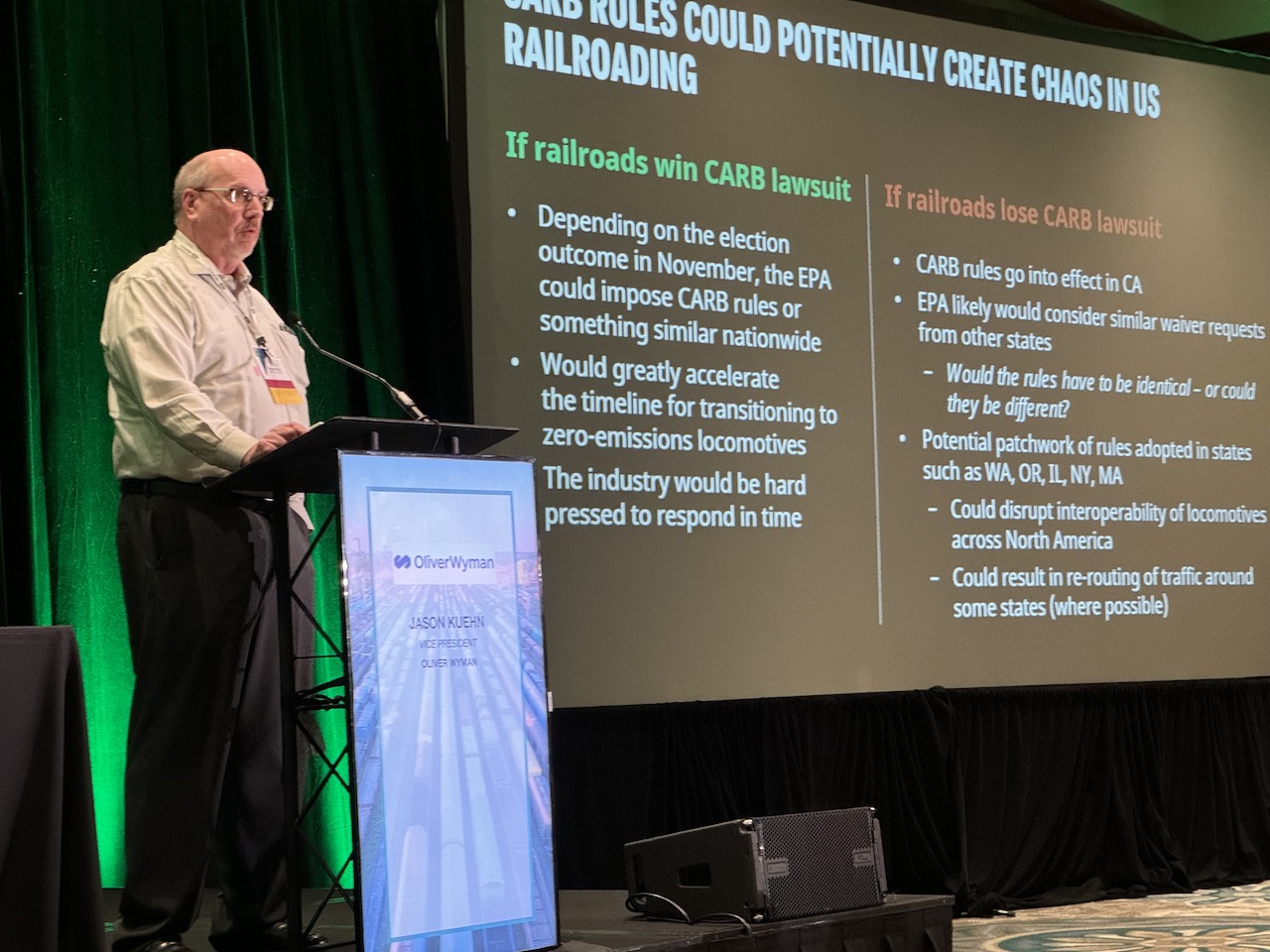

- Most of these scenarios bode well for Wabtec and to a lesser extent Caterpillar in the long term. But if a drastic regulatory mandate (related to the current CARB rule or otherwise) dictates expedited replacement of a large percentage of the fleet, it could slightly elevate the risk of a new manufacturing entrant, a risk that is currently very low, in our view. Another expert, Jason Kuehn of Oliver Wyman, appeared to urge the Class I’s to join forces and take the initiative to devise their own realistic vision rather than continue to field aggressive proposals by various entities, including states. Kuehn cited PTC as a past example of such cooperation that enabled the railroads to assert their perspective and extend the compliance timeline.