Cathcart Rail Completes The Andersons Transaction; Adds Nuveen

Written by William C. Vantuono, Editor-in-Chief

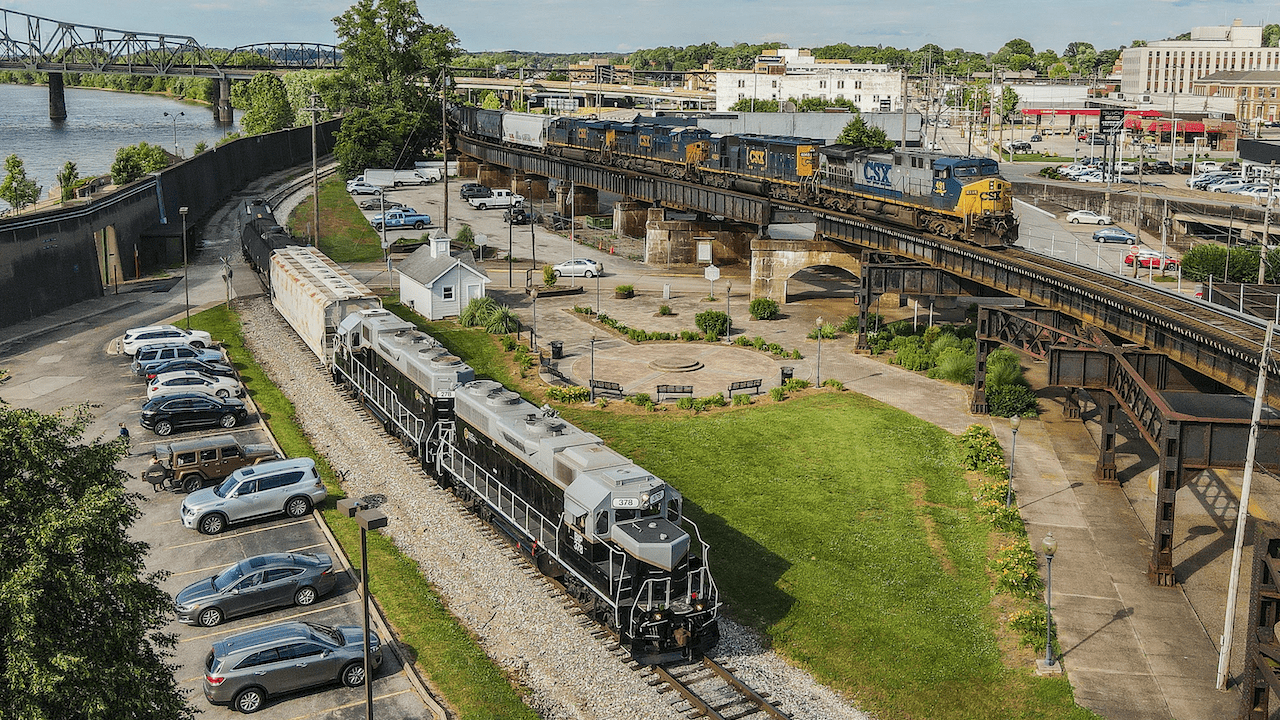

Cathcart Rail photo

Cathcart Rail has completed its acquisition of the railcar repair business of The Andersons, Inc., and welcomes Nuveen, a leading global investment manager with more than $1.2 trillion of assets under management, as an equity stakeholder alongside Star America Infrastructure Partners, LLC.

A senior loan syndicate led by Bank of America, N.A. and BofA Securities, Inc., with Wells Fargo Securities, LLC serving as financial advisor to Cathcart, supported the deal. Milbank LLP served as legal counsel to Cathcart, Morgan, Lewis & Bockius LLP as counsel to Nuveen, and Kelley Drye & Warren LLP as counsel to The Andersons. Railroad Financial Corporation served as transaction advisor to The Andersons, while other advisors of Cathcart included Ernst & Young and Taft Stettinius & Hollister LLP.

“The Andersons railcar repair network aligns perfectly with Cathcart’s strategic goal of offering a broad array of rail services across a national footprint, and we are excited to welcome The Andersons employees to the Cathcart family,” said Casey Cathcart, Chairman and CEO of Cathcart Rail. “With the addition of The Andersons railcar repair network, Cathcart’s nearly 1,000 employees across 110-plus locations make us the leading railcar services company in the country.”

“Cathcart’s acquisition of The Andersons’ railcar repair business is another major step in its development,” said Christophe Petit, President of Star America. “Cathcart and Star America are excited to have Nuveen join us as an equity stakeholder, and we are looking forward to working alongside Nuveen to continue building a premier rail services company.”

“Nuveen’s Infrastructure team is excited to partner with Cathcart and Star America as we continue to grow and diversify our transportation portfolio,” said Andrew Diehl, Sector Head of Private Infrastructure at Nuveen. “The Private Infrastructure team at Nuveen builds on more than 20 years of energy and infrastructure investing to select and structured direct equity infrastructure investments such as I-595, which was named P3 Awards 2020 North American Best Operation Transport Project. Nuveen’s infrastructure portfolio is more than $3 billion with investments in power, transportation, digital and social sectors. The diversified portfolio has included equity, high-yield debt and convertible debt.”

“It is a privilege to work closely with Cathcart’s management team and equity partners to build the leading railcar services company in the country with a rapidly growing national footprint offering a broad array of freight rail services,” said Milbank LLP Global Project, Energy & Infrastructure Finance partner Allan Marks, who acted as counsel to Cathcart Rail. “We are excited to represent Cathcart Rail on its acquisition of The Andersons’ railcar repair business, its new corporate debt facilities, the equity investment by Nuveen, and other transactions.”

“Our railcar repair employees are among the most skilled and experienced in the industry, and they have been critical to our success,” commented Joe McNeely, President, The Andersons Nutrient and Industrial business. “We thank them for their contributions and commitment to The Andersons and our customers throughout the sale process. We are excited for them and the growth opportunities that Cathcart Rail will provide them.”

Cathcart Rail describes itself as “a leading freight rail services and transportation company. The company currently operates the largest railcar services network, encompassing 18 repair facilities and over 75 field services locations, as well as a rail services division that operates three shortline railroads and a dozen contract switching and transloading sites, among other services such as railcar storage, track maintenance, and railcar parts. Cathcart Rail was founded in February 2016 by the father and son team of Thomas Cathcart and Casey Cathcart with 20 employees, and now employs nearly 1,000 people across 110-plus locations in 33 states.

About Star America Infrastructure Partners

Star America, a subsidiary of Tikehau Capital, a European listed asset management and investment group with €35.5 billion of assets under management (as of March 31, 2022) and shareholder equity of €3.0 billion (as of December 31, 2021), is an independent U.S. headquartered developer and manager of infrastructure assets in North America. With an investor base that includes large institutional investors such as insurance companies and pension funds, among others, Star America focuses on delivering infrastructure projects primarily across the transportation, social, environmental and telecommunications sectors. As of March 31, 2022, Star America has more than $850 million of assets under management, and its track record includes investments in 16 infrastructure assets, which have a total project cost valued at greater than $5 billion. Star America says its mission is” to become the preferred partner in rebuilding America’s infrastructure.”

Nuveen, the investment manager of TIAA (Teachers Insurance and Annuity Association of America), says it “offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1.2 trillion in assets under management as of March 31, 2022 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies.”

Founded in 1947 in Maumee, Ohio, The Andersons, Inc. describes itself as “a diversified company rooted in agriculture that conducts business in the commodity merchandising, renewables, and plant nutrient sectors. Guided by its Statement of Principles, The Andersons is committed to providing extraordinary service to its customers, helping its employees improve, supporting its communities, and increasing the value of the company.”