Greenbrier Reports ‘Strong Momentum’ in 2Q24, Updates Guidance

Written by Marybeth Luczak, Executive Editor

(Greenbrier Photograph)

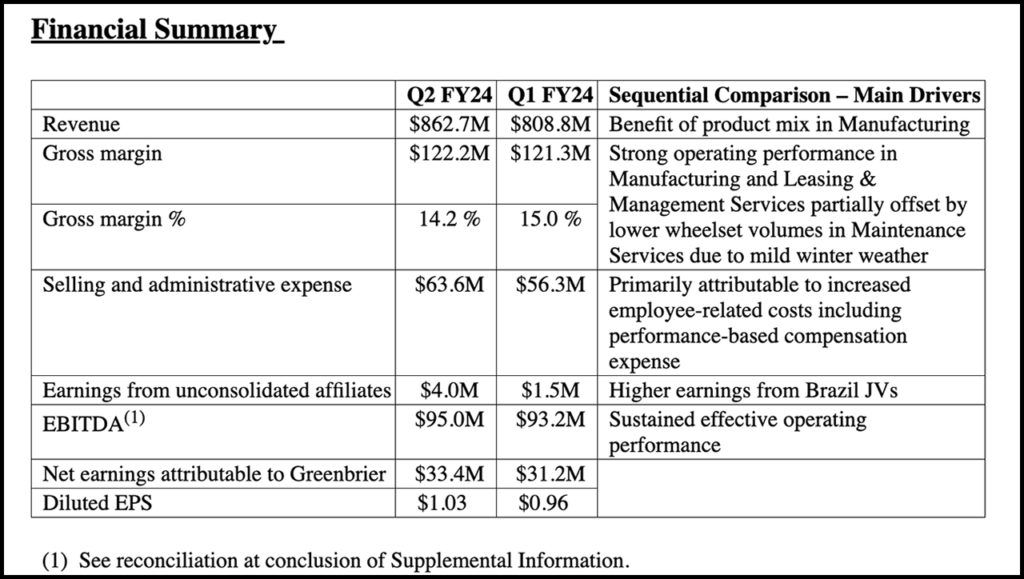

The Greenbrier Companies’ achieved consolidated gross margin “in the mid-teens for the second consecutive quarter as strong momentum continued across our business,” said President and CEO Lorie L. Tekorius, during a report on the freight transportation equipment and services supplier’s second fiscal-quarter ended Feb. 29, 2024.

Through its wholly owned subsidiaries and joint ventures, Greenbrier designs, builds and markets freight railcars in North America, Europe and Brazil. It also provides freight railcar wheel services, parts, maintenance and retrofitting services in North America; owns a lease fleet of approximately 14,600 railcars that originate primarily from Greenbrier’s manufacturing operations; and offers railcar management, regulatory compliance services, and leasing services to railroads and other railcar owners in North America.

“Greenbrier’s broad product lineup, extensive market relationships, supportive customer experience, and deep commercial origination capabilities combine to create our unique leadership position and enable ongoing success,” Tekorius reported April 5. “These factors provide revenue visibility while supporting our profitable leasing business, which is growing through the disciplined investment in our leased railcar fleet and robust lease renewals. We remain pleased with the pace of progress on our strategic goals. As a result, we expect sustained financial performance during periods of healthy market demand and more stable performance at higher levels when markets are less favorable.”

Following are highlights of Greenbrier’s second fiscal-quarter 2024:

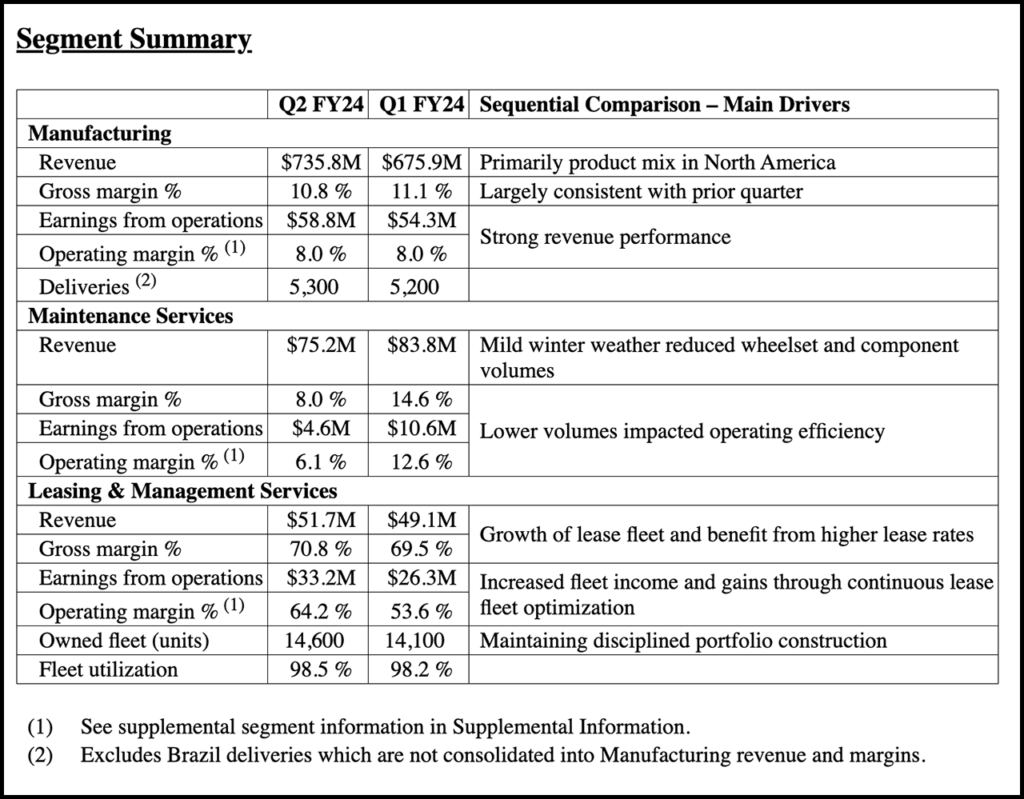

- Grew the lease fleet by 500 units to 14,600 units “with steady lease fleet utilization of nearly 99%,” according to Greenbrier.

- Obtained new railcar orders for 5,900 units, valued at nearly $690 million, and delivered 5,600 units, which Greenbrier said resulted in a new railcar backlog of 29,200 units with an estimated value of $3.6 billion.

- Net earnings attributable to Greenbrier for the quarter were $33 million, or $1.03 per diluted share, on revenue of $863 million.

- EBITDA for the quarter was $95 million, or 11% of revenue.

2024 Outlook

Based on current trends and production schedules, Greenbrier said it is updating guidance for fiscal 2024:

- Deliveries of 23,500-25,000 units, including approximately 1,400 units in Brazil. (Following fiscal-year first quarter ended Nov. 30, 2023, Greenbrier reported deliveries of 22,500-25,000 units, including approximately 1,000 units in Brazil.)

- Revenue of $3.5 billion-$3.7 billion. (Following fiscal-year first quarter, Greenbrier reported revenue of $3.4 billion-$3.7 billion.)

- Capital expenditures of approximately $140 million in Manufacturing and $15 million in Maintenance Services. (Following fiscal-year first quarter, Greenbrier reported capital expenditures of approximately $165 million in Manufacturing and $15 million in Maintenance Services.)

- Gross leasing investment of approximately $350 million in Leasing & Management Services, which includes 2024 capital expenditures and transfers of railcars into the lease fleet that were manufactured and subsequently held on the balance sheet in 2023. (Following fiscal-year first quarter, Greenbrier reported gross leasing investment of approximately $350 million in Leasing & Management Services. According to the company at that time, this included 2024 capital expenditures and transfers of railcars into the lease fleet that were produced and held on the balance sheet in 2023.)

- Proceeds from equipment sales are expected to be approximately $75 million. (Following fiscal-year first quarter, Greenbrier reported revenue of $3.4 billion-$3.7 billion.)

More earnings report details can be found on the Greenbrier website.