Progress Rail Suing Wabtec Over ‘Anticompetitive Conduct’

Written by William C. Vantuono, Editor-in-Chief

Progress Rail, a Division of Caterpillar, has filed a lawsuit against Wabtec (Westinghouse Air Brake Technologies) in U.S. federal court in Delaware accusing the latter of abusing its market power for diesel-electric main line locomotives, equipment and services.

The 66-page, 326-point lawsuit (download below), PROGRESS RAIL SERVICES CORP., and PROGRESS RAIL LOCOMOTIVE INC., Plaintiffs, v. WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP., and WABTEC RAILWAY ELECTRONICS, INC., was unsealed Sept. 7 in the United States District Court for the District of Delaware. Progress Rail is pressing for Wabtec to divest General Electric’s former Transportation unit, which it acquired in 2019 in an $11 billion deal during GE’s corporate restructuring and is seeking triple damages under U.S. antitrust law. Wabtec, Progress Rail alleges, “has profited, and continues to profit, from its unlawful, exclusionary conduct, to the detriment of consumers … Such unchecked conduct will make the freight locomotives that drive this country’s economy more expensive, less safe, and worse for the environment.”

The U.S. Justice Department in 2019 reviewed Wabtec’s acquisition of GE Transportation but did not move to block the then-pending merger. Wabtec and Progress Rail on Feb. 7 of that year signed a “Joint Development, Compatibility, Interchangeability and License Agreement ” with Progress Rail in which Wabtec said it would “continue the current open marketplace for locomotive cab electronics and other products in furtherance of open competition.”

On June 5, 2020, Wabtec entered into the “Wabtec Railway Electronics Interoperable Electronic Train Management System (I-ETMS) License Agreement” with Progress Rail. This agreement, Progress Rail said, “specifically references the 2019 Interchangeability Agreement and states that it shall be coterminous with the 2019 Interchangeability Agreement, which continues until Feb. 25, 2034. Wabtec professed its desire to ‘facilitate the integration’ of its PTC system to allow Progress Rail’s EMS system to remain compatible and integrated with the PTC system.”

“[T]he competitive balance critical to the freight locomotive industry was disrupted when Wabtec acquired GE Transportation,” Progress Rail said. “That combination merged the sole supplier of certain key freight locomotive inputs, Wabtec, with the dominant supplier of finished freight locomotives and other cab technologies, GE Transportation. It created a vertically integrated entity with dominant positions in multiple products and the incentive and ability to engage in anticompetitive exclusionary conduct to harm the competitive process and consumers.

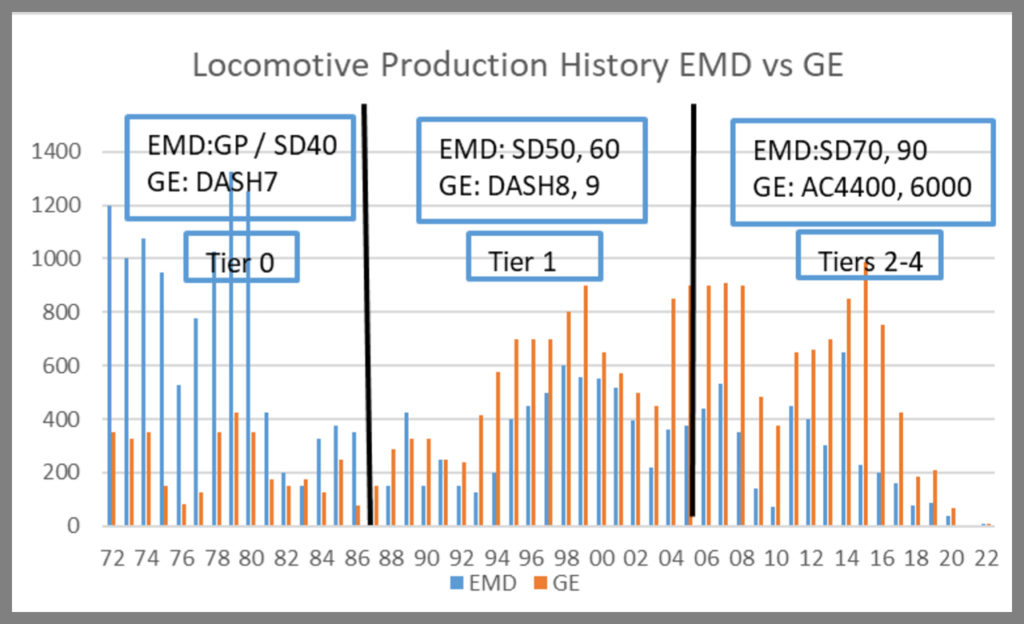

“Wabtec, a conceded monopolist, is one of the only or leading manufacturers of a long list of equipment used in the U.S. freight rail network. It is the dominant supplier of freight locomotives, having manufactured and sold approximately 75% of active diesel long-haul freight locomotives in North America, and approximately 90% of new long-haul freight locomotives that comply with Tier IV rail industry standards and the Environmental Protection Agency’s most recent emissions regulations … Wabtec also commands substantial market power over many inputs that are incorporated into freight locomotives: (a) it is the dominant supplier of Energy Management Systems (EMS), with its Trip Optimizer product holding approximately 79% of the market; (b) it is the dominant supplier of Positive Train Control systems, with its I-ETMS product installed on virtually all freight locomotives, and (c) it is the dominant supplier of distributed power systems, with its LOCOTROL product holding nearly 100% of the market.

“Wabtec’s professed commitment to ‘open competition,’ ‘integration,’ and ‘compatibility,’ however, was hollow and instead it has used its dominant market position to engage in anticompetitive exclusionary conduct that has harmed and continues to harm competition and consumers.”

“Wabtec uses its market power to engage in a pattern of anticompetitive conduct, the design and effect of which is to build upon and cement its monopoly by deterring customers from freely switching providers, stifling the ability of existing competitors from effectively competing and reaching scale, and stopping new competitors from entering the market.

“The exclusionary tactics Wabtec uses both individually and in combination to harm the competitive process and consumers include, but are not limited to, using its dominant position to:

- “Reduce rail industry required cross-product compatibility with complementary products through, among other things, restricting the flow of critical data and information.

- “Impose unnecessary costs and delays on competitors with the goal of impairing and forcing competitors out of business and obtaining even greater power to control prices.

- “Make knowingly false statements to consumers about the viability of its competitor.

“Wabtec’s anticompetitive tactics have been, and continue to be, effective in extending and maintaining its monopoly power in the markets for diesel long-haul freight locomotives, Tier IV long-haul freight locomotives, and EMS systems by, among other things, fortifying existing and creating artificial barriers to entry.

“Progress Rail competes against Wabtec in the development, manufacture, and sale of diesel long-haul freight locomotives, Tier IV long-haul freight locomotives, EMS systems, and other equipment used in the U.S. freight rail network. For example, Progress Rail has produced most of the non-Wabtec diesel freight locomotives in the U.S. during the past ten years, and after Wabtec, Progress Rail is the second-largest producer of Tier IV locomotives in the U.S. Progress Rail also develops and sells related solutions and technologies that enhance the safety and efficiency of locomotives, like its next generation EMS system called Talos and its event recorder called PowerView Event Recorder.

“Progress Rail is a direct target of Wabtec’s anticompetitive conduct. For example, Wabtec abuses its complete control over federally mandated PTC systems to cause Progress Rail unnecessary integration issues that are costly and time consuming to rectify. These integration issues are designed to place Progress Rail at a competitive disadvantage with current and potential customers.

“On top of interfering with the interoperability of products and freight locomotives, Wabtec has falsely and publicly stated that Progress Rail is ‘exiting’ the Tier IV locomotive business … ‘won’t be competing going forward’ … and ‘would not be an option for a customer for “anything that’s new in the U.S. from here on out.’

“Such knowingly false public statements directly harm competition and improperly strengthen Wabtec’s existing monopoly over Tier IV locomotives because they intentionally mislead countless exist ng and potential customers to believe that Progress Rail has left or will soon leave the market, and Wabtec is their only choice. Because of Wabtec’s anticompetitive conduct, Progress Rail has lost existing and potential customers for its products. Absent Wabtec’s anticompetitive conduct, Progress Rail’s revenues would be substantially greater, and its competitive influence would have a downward effect on pricing, provide more consumer choice, and enhance innovation and safety in the relevant markets.”

Progress Rail pointed to remarks made by Wabtec Executive Vice President and Chief Financial Officer John Olin at the May 9, 2023 Goldman Sachs Industrials Conference to support its allegation that Wabtec has publicly stated Progress Rail is exiting the U.S. Tier IV locomotive market.

Caterpillar, which owns Progress Rail and its EMD (Electro-Motive Diesel) unit, is not a party to the lawsuit. “Since the enactment of Tier IV in 2015, only about 1,200 units have been built, with more than 1,000 of these Wabtec units,” Railway Age Contributing Editor Bob Cantwell noted in a recent article on locomotive emissions. “Developing Tier IV locomotives has been a long, expensive journey with little payback to date. In fact, Caterpillar, parent company of Progress Rail/EMD, took a $935 million write-down at the end of fiscal year 2022 on its rail business in large part due to the slow adoption of Tier IV locomotives.”

Progress Rail on Sept. 11 responded to Railway Age’s request for comment saying the company “does not comment on ongoing litigation.” Wabtec spokesperson Tim Bader provided the following statement:

“We believe that Progress Rail’s recent complaint against Wabtec at its core is an unsupported attack on the merger of Wabtec and GE Transportation, which was completed more than four years ago. The merger has provided benefits to the entire industry, as well as Progress Rail itself. Progress Rail actively participated in the U.S. Government’s review of that transaction and benefitted by entering into agreements with Wabtec that transferred Wabtec technology to it as part of the United States Department of Justice and global merger clearance process. We also firmly believe that Progress Rail’s assertions that Wabtec breached agreements or engaged in other illegal conduct are wrong. We intend to aggressively defend the case in court.”