Sea Change in Railcar Supply

Written by Robert H. Cantwell, Contributing Editor

(FreightCar America Photograph)

RAILWAY AGE, DECEMBER 2023 ISSUE: A railcar and lease rate outlook for 2024 and beyond.

The North American freight rail industry is the envy of the world. We haul the most freight more efficiently and safely than any other freight rail system. But what makes our system so unique is our commodity diversification. Virtually every other freight rail system relies heavily on bulk products: coal, aggregates and agricultural products. The North American system has diversified into consumer products, automobiles, and many other non-bulk, higher-value goods. This has been accomplished under the backdrop of coal carloads declining from more than 7.5 million to 3.3 million carloads over the past 15 years. For carloads to be down only 2% to 3% from pre-pandemic levels is impressive. Pivoting to growth through better service offers a bright future for the industry. But what does this have to do with railcar demand and lease rates?

In December 2022, I wrote an article titled “Get Used to Higher Railcar Prices and Lease Rates” that caused some debate amid some skepticism. Reflecting on what has transpired during the past 12 months, lease rates are up 26% to 33% and are proving sticky. Lease terms are extended as well, out as far as 60-plus months. Railcar prices are up 12% to 15%, but carbuilders continue to struggle to get to sustained double-digit margins. This has happened within the backdrop of lower carloadings.

Our industry is driven by carloads, rightfully so. There are many experts that use carload-by-commodity analysis to derive railcar demand. As reflected in my article, I looked at railcar demand more strategically through carbuilder consolidation, capacity rationalization, supply chain constraints, disciplined production (no speculation), lessor fleet age management, and improvements in railcar designs and production methods, all of which have contributed to more stable, predictable railcar demand. This is a seismic shift from past behavior.

SIMPLIFIED CARLOAD VIEW

Coal: As mentioned earlier, coal carloads have fallen from more than 7.5 million to 3.3 million today. Over the past two years, coal has stabilized, but we can expect further decline in coal carloads as more coal-fired plants are retired. The key takeaway from coal: The heavy lifting is over. Yes, we may decline to 2 million carloads annually, but that is a far cry from falling from 7.5 million to 3 million.

Intermodal has plateaued for the past Seven years and is pressured today. Service quality has played a big role in intermodal’s pause, but there are far too many compelling reasons favoring intermodal (fuel costs, driver shortages, emission regulations, etc.).

Motor vehicles: North American consumers buy 15 million to 16 million cars, SUVs and light trucks annually. Whenever fewer are sold, it creates future pent-up demand. We are currently seeing a rebound to historical volumes, despite higher interest rates. The shift in car preferences from sedans to SUVs and electric vehicles is creating opportunities in new autorack designs (for example, Greenbrier’s Multi-Max Plus™).

Building materials: Like autos, any time fewer than 1.2 million to 1.4 million homes are built, it creates future pent-up demand. That’s what’s happening today. We went through a prolonged period of underbuilding throughout the 2010s, and now we’re catching up—again despite higher interest rates. Amazing.

Crude oil and chemicals (tank cars): CBR (crude by rail) was a stopgap while pipelines were being built. The industry went crazy over a short-term opportunity, and we’re continuing to feel the hangover (100,000 tank cars in storage). Tank car historical build rates are 10,000 to 12,000, not the 25,000 to 35,000 that we saw in 2013-2016, mostly driven by chemicals.

All other commodities: Surprisingly, the many other commodities hauled on the rails are pretty constant over time. Droughts, geopolitics and economic swings all impact “other commodities” in the short term, but over the long term they’re pretty steady.

All this discussion on carloadings by commodity highlights the diversification the North American rail system enjoys. Besides, 2023 has demonstrated that lease rates and railcar prices can increase in a flat carload environment. Something has indeed changed.

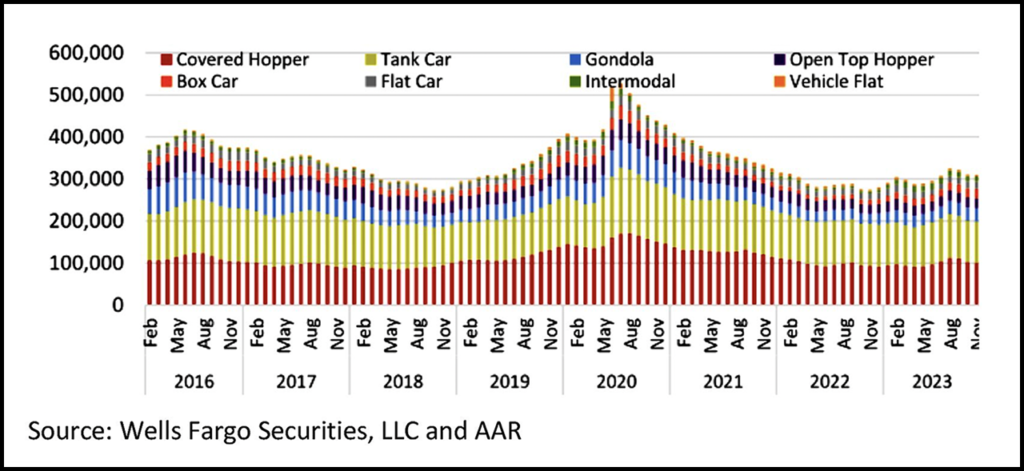

RAILCARS IN STORAGE

As reflected in the chart (above), railcars in storage have hovered around 300,000 over the past two years. Scrap rates remain elevated and the introduction of new cars into the fleet remains disciplined. Importantly, tank cars represent one-third of stored cars, or almost 100,000. Most of these will not return to service. Stored cars over the age of 35 years will likely not return to service as well. In summary, we’re in the sweet spot for railcars in storage: enough to satisfy demand swings, but not too many to depress new railcar demand. Increases in network velocity may drive an increase in cars in storage, but elevated service levels may mitigate this impact by attracting more traffic.

RAILCAR DEMAND

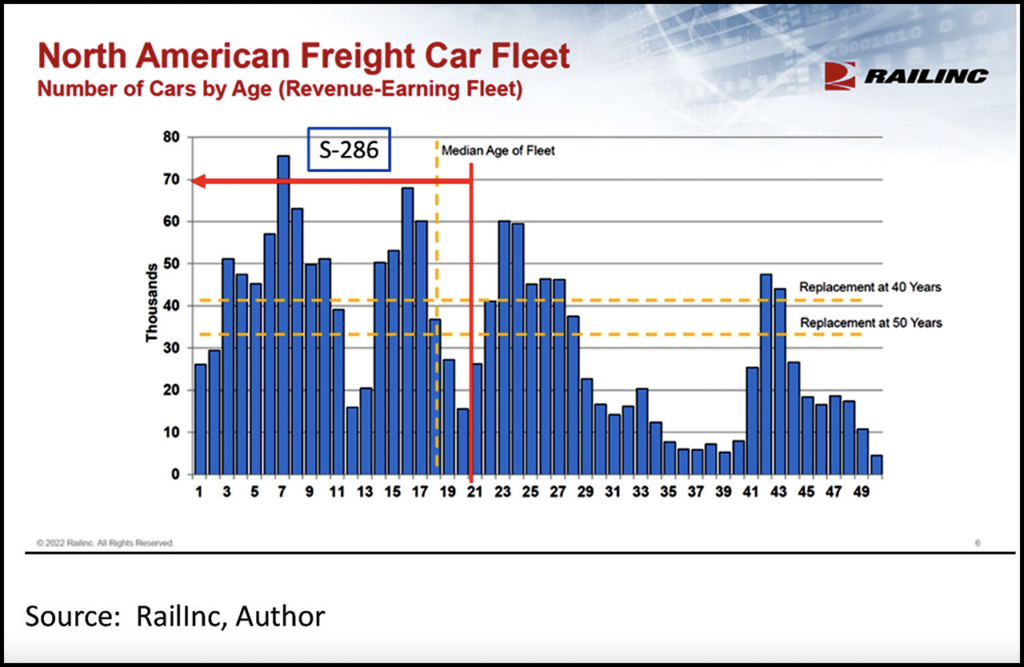

Dr. David Humphrey of Railinc produces an excellent tool for envisioning railcar demand: aging of the railcar fleet. With a much more attractive lease rate environment, far more attention is being given to fleet demographics. Older cars are being scrapped while new cars replace them.

We find ourselves in an attractive “replacement” cycle. There are no apparent spikes in a particular commodity that will drive irrational demand. Replacement demand is broad-based across a wide variety of car types. With higher interest rates, speculation will be muted as well.

However, here is a cautionary word: As the rail industry pivots to carload growth through much-improved service, railcar demand will probably increase and demand will likely reach current production capacity.

In contrast to many of my industry colleagues, I believe the railcar replacement demand is toward the higher end of Dr. Humphrey’s chart (above, 42,000 to 45,000) for these reasons:

There are more than 250,000 cars approaching their 50-year limit.

Cars produced from 1994-2004, or more than 500,000, have been loaded to 286K but weren’t adequately designed to handle these elevated loads. This led to implementation of the S-286/M-976 standards in 2004. Put another way: Do your 286K cars that were built in the 1990s still have another 20 years of life, and what are the maintenance expenses going to be to run them that long, not to mention the wear and tear they impart on the track?

To replace 750,000 cars will take 18 years at a 42,000 annual build rate. Others in the industry believe 35,000 is more realistic.

Of note, however, is the potential impact of conversions on this number. All the carbuilders have the ability to convert a stored car into a car that offers utility. Conversions appear to run around 3,000 to 4,000 annually, but aren’t included in the overall industry number. They could possibly impact new demand as an alternative to a new car.

INDUSTRY CONSOLIDATION, CAPACITY RATIONALIZATION

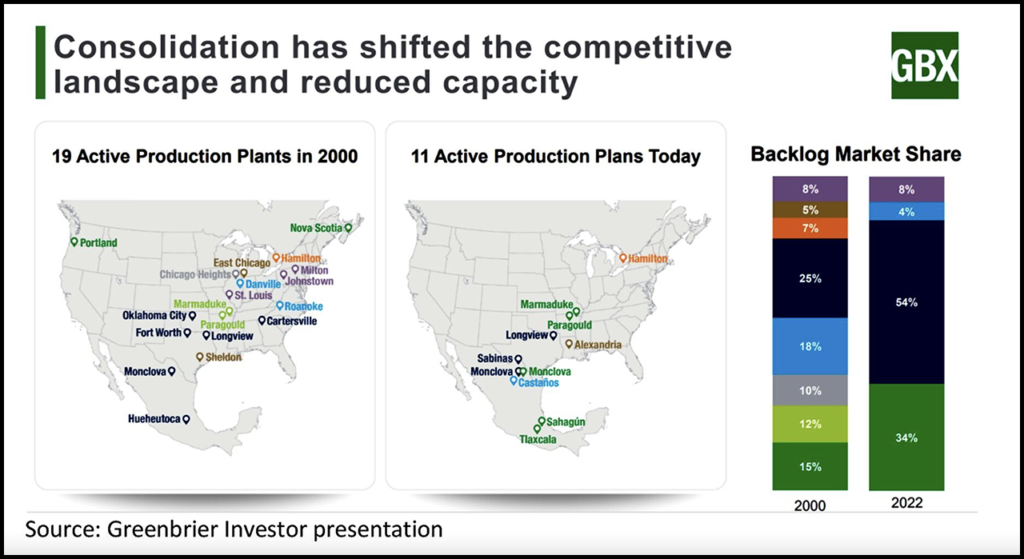

Shortly after my December 2022 article was released, The Greenbrier Companies announced the closure of its Portland, Ore., assembly facility, further reducing industry capacity. As a result, there are now 11 North American railcar assembly plants, down from 19 in 2000. As stated in my article, industry build capacity is currently estimated to be around 52,000 to 55,000 railcars annually, way down from the 80,000 built in 2015. FreightCar America has continued to ramp up capacity in its new facility in Mexico, but planned capacity is 5,000 to 6,000.

Importantly, industry capacity has reduced significantly to better match replacement demand with some marginal growth capability built in. Given the current industry and carbuilder backlogs, order books are pretty full for 2024, and lessors should be planning accordingly, like GATX did with a multi-year order from TrinityRail in 2022.

SUPPLY CHAIN IMPACTS

In 2022, the supply chain for components was tight, driven by geopolitical events and the tight labor market. While conditions have improved, there remain certain pockets of tightness, some of which are driven by the wide diversity of cars in production, boxcars in particular. Recently, the biggest supply chain challenge has been getting finished cars across the U.S./Mexico border. Border closures, especially at Eagle Pass in response to illegal immigration, have impacted the ability to deliver new cars. This is a fluid situation that may impact deliveries in 2024.

LEASE PRICE TRENDS

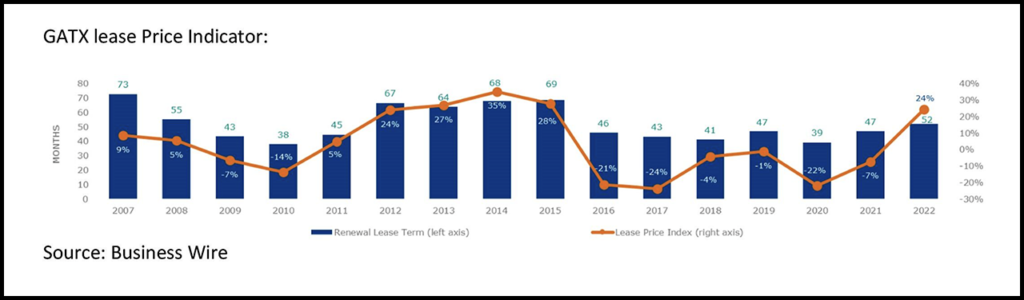

GATX’s LPI (Lease Price Indicator, above) continues to trend upward. According to company sources, “we are in the early innings of the current lease price cycle.” Ironically, higher railcar prices drive higher lease rates.

TrinityRail’s FLRD (Forward Lease Rate Differential) continues its upward trend as well: “Our forward-looking metrics continue to point toward consistent strength in lease rates, with a FLRD of 26.6% and lease fleet utilization of 98.1%,” Trinity reported in its third-quarter 2023 earnings statement.

While lease prices trend upward, they are car-type specific. Coal, flammable tank and frac sand car rates remain depressed, while most others are elevated and likely to remain so for the next couple years. Higher interest rates support higher lease rates and discourage speculation. The rapid rise in long-term rates over the past 18 months indicates that higher rates are here to stay.

CARBUILDER PERFORMANCE

The Greenbrier Companies reported deliveries of 26,000 railcars in its fiscal year that ended Oct. 31, and are projecting deliveries of 22,000 to 25,000 for its fiscal year 2024 (including 1,000 for Brazil). Importantly, Greenbrier already has the backlog to support this. The company’s gross margins on railcar sales came in at 9.3%, short of the “low double-digit” objective, but expect further improvement going forward. Greenbrier has also committed $300 million annually to expand its lease fleet.

TrinityRail’s gross margins on railcars in its most recent quarter were 5.2%, but the company said it expects “to exit the year with a segment operating margin in rail products of 8% to 9% and the full-year average of 5% to 6%, barring further substantial rail service issues at the border.” Like Greenbrier, TrinityRail’s backlog is strong going into 2024.

Greenbrier’s and TrinityRail’s march toward double-digit margins on railcar sales continues through a combination of higher prices and lower costs. FreightCar America, in contrast, reported a 14.9% margin on sales of 503 railcars in its most recent quarter. For 2023, FreightCar America is planning to deliver 3,150 to 3,300 railcars.

SUMMARY

Higher railcar prices and elevated lease rates have indeed come to pass throughout 2023, despite softer carloadings. Expect more of the same going forward into 2024 and beyond. And if carloads turn the corner in 2024, things could look even better!