Greenbrier Reports ‘Strong Momentum’ in 2Q24, Updates Guidance

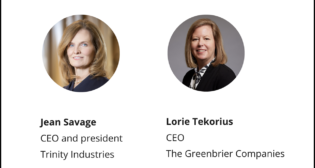

The Greenbrier Companies’ achieved consolidated gross margin “in the mid-teens for the second consecutive quarter as strong momentum continued across our business,” said President and CEO Lorie L. Tekorius, during a report on