CP 4Q22: ‘Well Positioned to Execute a Historic Year’ in 2023 (Updated, Cowen)

Written by Carolina Worrell, Senior Editor“We finished the year with the people, capacity and resources in place to meet the needs of our customers today and are well-positioned to make history in 2023,” Canadian Pacific (CP) President and CEO Keith Creel reported Jan. 31 during the railroad’s quarterly earnings announcement.

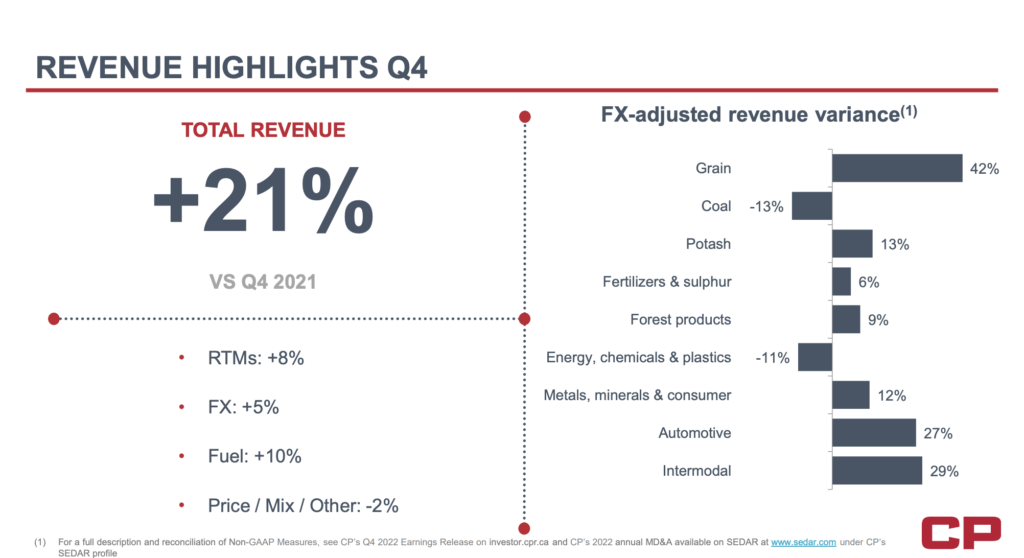

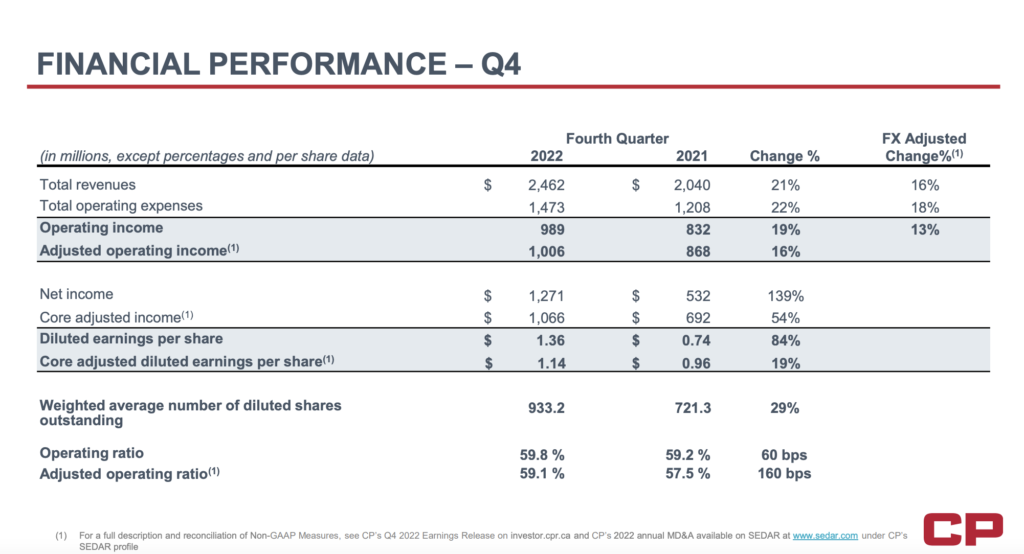

Revenues of C$2.46 billion increased 21% from C$2.04 billion in fourth-quarter 2021. The railroad’s operating ratio (OR) came in at 59.8%, improving by 60 basis points (bps); and adjusted OR came in at 59.1%, an increase of 160 bps, CP reported.

“In a year of changing conditions and challenges, in order to support the broader economy and prepare for our proposed combination, we executed one of the largest hiring plans and capital investment programs in our company’s history,” Creel (Railway Age’s 2021 Railroader of the Year and, with Kansas City Southern President and CEO Pat Ottensmeyer, 2022 Co-Railroader of the Year) said.

Among other fourth-quarter highlights:

- Volumes, as measured in revenue ton-miles, increased 8%.

- Reported diluted EPS increased to C$1.36, from C$0.74 in fourth-quarter 2021.

- Core adjusted diluted EPS increased to $1.14, from C$0.96 in fourth-quarter 2021.

For the full year, revenues increased 10% to C$8.81 billion from C$8.0 billion in 2021; OR increased 230 bps to 62.2%; adjusted OR increased 380 bps to 61.4%.

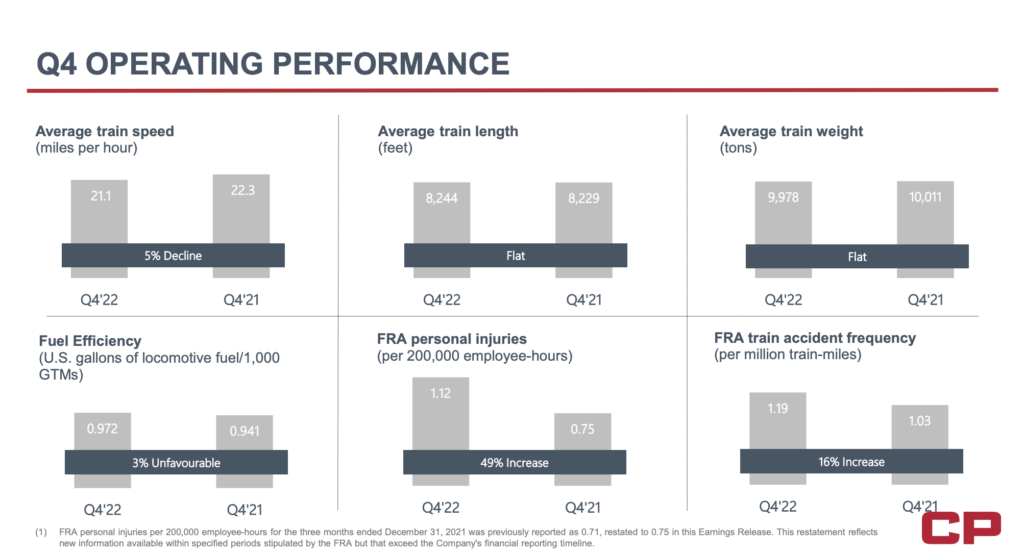

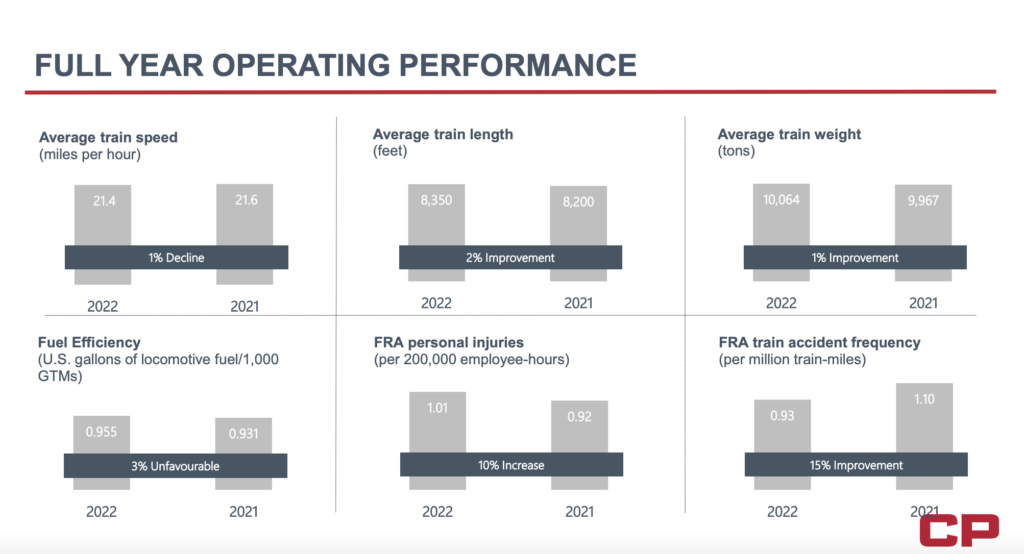

Additionally, CP’s Federal Railroad Administration (FRA)-reportable train accident frequency in 2022 declined15% to 0.93 compared to 1.10 in 2021—the lowest among the Class I’s for the 17th consecutive year, the railroad reported.

Among other full-year 2022 highlights:

- Generated $2.7 billion in free cash, an increase of 52%

- Reported diluted EPS decreased to C$3.77 from C$4.18.

- Core adjusted diluted EPS1 was flat compared to 2021 at C$3.77.

“We remain focused on our Precision Scheduled Railroading model and fundamentals of efficiency and strong service to our customers as we await a decision by the U.S. Surface Transportation Board (STB) on our proposed combination with Kansas City Southern (KCS), which we anticipate occurring later this quarter,” said Creel. The STB on Jan. 27 released the transaction’s Final Environmental Impact Statement.

Cowen Insight: “Bulks Leading the Way for Unification Year”

“The CP/KCS merger appears to be on track, with management highlighting progress without getting ahead of its skis; we would expect a verdict hopefully in 1Q,” said Cowen Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “The two companies did a southbound temperature-controlled test shipment that took approximately three days, which is about on par with the highway alternative, a significant potential opportunity for the company and shippers (particularly in the auto industry). Management also highlighted significant amounts of northbound Mexican traffic opportunities.

“4Q22 EPS was above our and Street expectations, despite some hiccups (weather, coal outage). Formal guidance was not given, but we see favorable segment commentary as CP leans into its outperforming Bulk business (40% of biz) and pending approval of its KCS merger that is slated to link the North American supply chain. Our price target moves to US$88 as we roll our model forward. We reiterate Outperform on our top rail pick.

“CP posted adjusted diluted EPS of C$1.14 in 4Q22, above our C$1.05 CAD estimate and C$1.06 consensus figure. The adjusted. OR worsened 160bps in 4Q22, with the full year OR at 61.4% compared to 57.6% in 2021. Revenues grew 21% in 4Q22, with a 5% FX (foreign Exchange) tailwind and 10% fuel surcharge recovery bump.

“Carloads grew 9% in the quarter, driven by a blockbuster grain crop (top five in Canadian history) that led to 24% volume growth, partially offset by a 16% decline in coal volumes, which was due to a longer than anticipated plant outage that caused more than 100 trainloads to be lost. Automotive carloads increased 11% as the auto parts shortage is starting to see material improvement, as well as new Ford business; there is a lot more inventory replenishment to do as car dealerships continue to restock in 2023.

“CP ended the year with a 3.8x leverage ratio, well above its 2.5x target. Management suggested that it will work to get leverage down to the high 2xs by the end of 2023 and should get back to its 2.5x target by 2024. CP repaid more than $1.6 billion in debt in 2022 using FCF (free cash flow) of $2.7 billion in 2022 and KCS dividends. Core capex levels are expected to be on par with 2022 levels, and we expect debt pay-down to be a priority over any buybacks in 2023.

“While management didn’t give formal financial guidance, we came away from the call increasingly optimistic on CP’s potential growth, excluding macro uncertainties. CP’s Bulk business unit, which accounts for 40% of its total book, is expected to see double-digit growth this year. The pricing environment continues to be strong, with high single-digit growth suggested on the call. This pricing strength was sequentially higher and will be needed to combat a higher cost environment.”