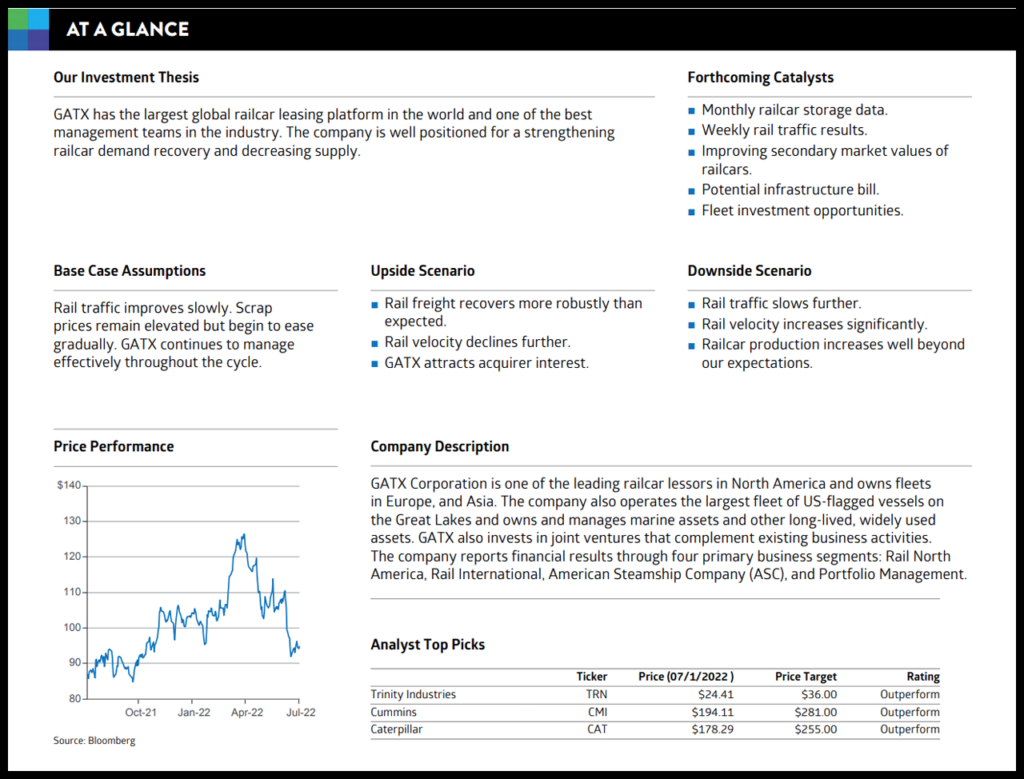

Cowen: GATX ‘Improving Return Dynamics’

Written by Matt Elkott, Transportation OEM Analyst, TD Cowen

Matt Elkott

GATX has taken advantage of low interest rates over the past few years to improve its debt profile, which is currently 90% fixed, with an average maturity of 10 years. Meanwhile, spot lease rates are expected to continue their seven-quarter run of sequential growth. This should lead to progressively higher returns for the company, which is now likely to focus on locking into much higher lease terms.

Cowen and Company on June 29 hosted investor meetings with GATX CEO Bob Lyons, who took over company leadership on April 22; Chief Financial Officer Tom Ellman; and Investor Relations Director Shari Hellerman. Following are our key takeways.

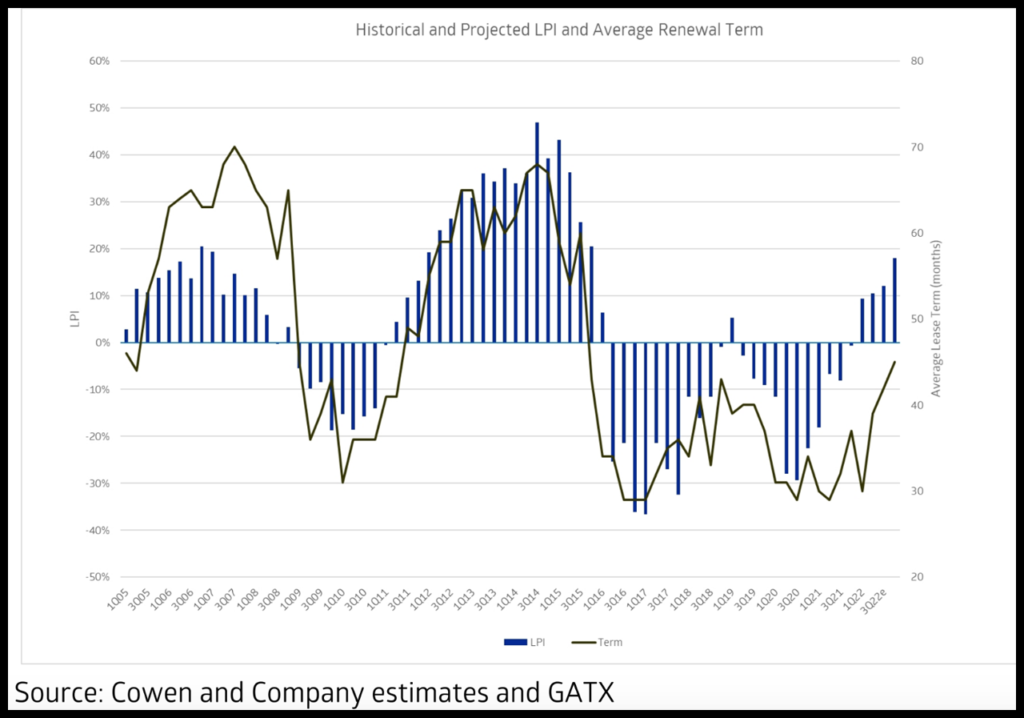

• We remain confident in our 2022 EPS estimate of $5.90, which is above consensus of $5.67. After steadily rising from $5.04 in early July 2021 to $5.96 on June 9, 2022, consensus has dropped to $5.67. This recent decrease may be a result of worsening macro sentiment, but we believe there is an under-appreciated disconnect between the broader economy and fundamentals specific to GATX and the railcar industry. GATX took advantage of the low interest rates of the past few years to improve its debt profile, which is currently 90% fixed, with an average maturity of 10 years. Meanwhile, we expect spot lease rates to continue their seven-quarter run of sequential growth, driven by continued favorable dynamics, especially on the supply side. This should lead to progressively higher returns for the company, which is now likely to focus on locking into much higher lease terms than the 30-month average at the end of first-quarter 2022. For many cars that come off lease now, GATX will likely start term discussions in the five-to-seven year range. This should lead to steady increases in average term over the next several quarters. We are expecting average terms of 39 months, 42 months, and 45 months in the second, third, and fourth quarters, respectively. Historically, the average lease term has reached as high as approximately 70 months, but we do not expect this to occur in this cycle.

• We see progressively better returns over the next several quarters due to maturities (average of 10 years) on the roughly 90% of debt that is fixed being well in excess of the average lease term of around three years. This is critical in an environment where we expect spot lease rates to continue their seven-quarter run of sequential growth. Industry scrap rates have been in the 40,000-50,000 car range in the last three years, above the more normal level of approximately 30,000 units. Scrapping should remain elevated this year, although closer to the low end of the 40,000-50,000 car range, with the deceleration partly attributable to limited scrapyard capacity. This, along with two below-replacement production years for the industry in 2020 and 2021 (just above replacement this year) and our expectation of gradual improvements in rail traffic, should keep the lease rate momentum going. Railcar industry fleet utilization has improved from a bleak 68% in mid-2020 to roughly 82% today and inching toward the mid-80s, which we would view as near full utilization. As we noted in our first-quarter 2022 GATX earnings note, we believe GATX is likely to raise guidance when it reports on the second quarter later this month.

• We’ve long-maintained that further scaling up by GATX could yield benefits not only for the lessor itself, but also for a wide range of industry stakeholders. GATX is widely regarded as one of the best operating lessors. But North America’s largest lessors are financial institutions. Leasing is not their core business. Their asset acquisitions are not informed by direct knowledge of the industry; they are limited as to how much they can provide to their customers directly in line of service throughout the lease term, and they have less extensive customer networks. What all of this typically leads to is an ineffectively managed fleet, with suboptimal utilization (the utilization gap between operating and financial owners can exceed 10 percentage points). As such, any transfer of assets from financial institutions to operating lessors could be a win for most stakeholders. The banks would offload non-core assets; the operating lessors would scale up and unlock further value from the fleet; and the customers could receive better service. It all seems to make sense. So why hasn’t it happened?

• The answer is simply valuation. It is widely known in the industry that the Wells Fargo fleet (the largest in North America) has been for sale at times over the past few years. GATX has likely bid for it unsuccessfully in the past; some financial institutions may have done the same. A transaction like this would be a game-changer for GATX—more than doubling its fleet. The company would likely work hard to secure financing if they deemed the valuation compelling. But that’s a big “if.” Given some suboptimal parts of the fleet, we believe GATX would seek a discount to book value—not as deep today as it would have sought two years ago, but still a discount. For Wells Fargo, it is hard to imagine a better time to sell the fleet given how strong the secondary market is. As the railcar manufacturing up-cycle begins in earnest in the second-half of 2022 and lasts at least through 2023 based on our projections, the new unit additions should begin to temper secondary market valuations.

Review of 1Q22 Results

• The secondary-market strength caused a majority of GATX’s anticipated 2022 remarketing income to occur in the first quarter. That was the main driver of the big earnings beat. While strong secondary-market sales likely mean that the company’s unchanged full–year guidance looks even more conservative than it did previously, it’s not dramatically more conservative, in our opinion. Yes, the first-quarter result does give us even more confidence in our remarketing income assumption (above GATX’s original guidance), but the company’s fleet right now is nearly optimal in quality and utilization. Any additional large sales could mean that the company would have to tap into the secondary market or the manufacturers to replace in order to continue to satisfy customer demand, maintain good customer relations, and maintain solid lease revenue levels.

• In first-quarter 2022, adjusted EPS was $2.34, well above our and consensus estimates of $1.37 and $1.39, respectively. This beat was aided by the fact that most of the company’s anticipated remarketing income for the year occurred in the first quarter. Relative to our model assumptions, remarketing income added $0.96 to adjusted earnings. Adjusting for this, EPS would have been $1.38, a penny above our estimate and a penny below consensus.

• Revenue was $316.6 million—below our and consensus estimates of $323.8 million and $322.8 million, respectively. LPI was 9.3%—better than our estimate of 5.0% and fourth-quarter 2021’s –0.7%. Average renewal term was 30 months—below our estimate of 38 months and fourth-quarter 2021’s 37.

• GATX said that its spot lease rates posted a quarterly sequential increase in the first quarter: mid-to-high teens. This is a big acceleration from the mid-to-high-single-digit increases it had gotten in the six quarters prior to the first quarter. The big increases are for freight cars (as opposed to tank cars).