CN Receiving Next-Gen Ore Jennies (Updated)

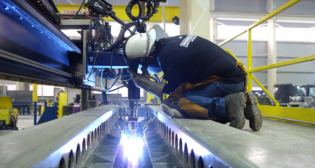

CN is taking delivery on 600 new 1,150-cubic-foot iron ore hopper cars, colloquially called “jennies,” from FreightCar America. The new equipment, described as “a significant upgrade to CN’s fleet,” incorporates materials from