FreightCar America Posts ‘Impressive’ 2Q23 (UPDATED, TD Cowen Insight)

Written by Carolina Worrell, Senior Editor

FreightCar America Castaños, Mexico manufacturing facility.

“FreightCar America (FCA) finished an impressive quarter, with revenues up 56% year-over-year and gross margins of 14.6%,” said President and CEO Jim Meyer during an Aug. 7 earnings report that also announced the addition of Nick Randall as the company’s first COO.

“These results were fueled by our steadfast commitments to achieving the highest levels of customer satisfaction and operational excellence, and building a world-class manufacturing campus in Castaños, Mexico,” Meyer continued. “The multi-year project to construct the campus is scheduled to be completed this August, after which we will have four production lines available and even more opportunities to differentiate ourselves within the industry.”

“Consistent with our commitments, we announced the addition of Nick Randall as FCA’s first COO during the quarter,” said Meyer, who will retire this year. “Nick brings a wealth of experience and will be a great asset as we continue to lay the groundwork for our future. Lastly, we completed the previously announced financing transaction during the quarter to replace our term loans with a preferred share offering. This transaction further strengthened our balance sheet and provides us with additional flexibility as we focus on the future and growth.”

Second-Quarter 2023 Results

For the six months ended June 3, 2023, FCR revenue came in at $88.6 million on deliveries of 760 railcars, representing a 56% jump from second-quarter 2022’s $56.8 million on deliveries of 468 railcars.

Other second-quarter 2023 highlights:

- Gross margin of 14.6% with gross profit of $13.0 million, compared to gross margin of 11.6% with gross profit of $6.6 million in the second quarter of 2022.

- Net loss of ($18.9) million, or ($0.73) per share and Adjusted Net income of $2.7 million, or $0.02 per share, accounting primarily for non-cash items associated with the loss on debt extinguishment and change in fair market value of warrant liability.

- Adjusted EBITDA of $8.0 million, compared to Adjusted EBITDA of $2.3 million in the second quarter of 2022.

- Railcar orders of 381 in the second quarter and 2,341 for the first half of the year, with quarter-end backlog totaling 3,288 railcars for an aggregate value of approximately $382 million.

- FY23 Adjusted EBITDA guidance raised to $18 – $22 million from prior guidance of $15 – $20 million.

Fiscal Year 2023 Outlook

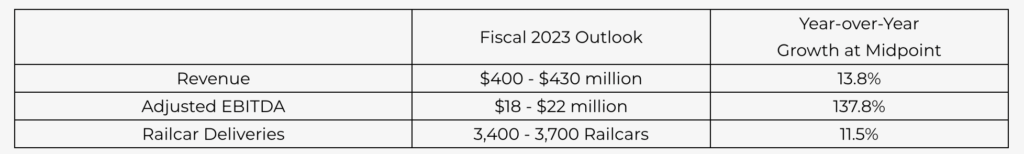

FCA has raised its outlook for FY23 as follows:

“Market demand for our railcars remains strong,” said FCR CFO Mike Riordan. “While new orders were lower than anticipated for the quarter, this was primarily a function of timing. With our order backlog fully booked for 2023, we are raising our previously stated full year Adjusted EBITDA guidance range from between $15 million and $20 million to between $18 million and $22 million. Despite foreign currency headwinds alongside the broader macro environment, we are making great progress in improving our margins. Increased profitability combined with our robust backlog and a stronger balance sheet, FCA is positioned to execute as we head into the second half of the fiscal year and beyond.”

TD Cowen: “Notable Progress Continues”

FreightCar America (NYSE: RAIL) “delivered its first adjusted quarterly net gain since 1Q17 and beat our consensus expectations,” reported OEM Transportation Analyst Matt Elkott. “This represents the second consecutive quarter of markedly improved results and reduced noise. The solid YTD performance could portend a better hold on execution in future periods as a result of the company’s operational plan of the last couple of years.

“Adjusted 2Q23 EPS of $0.02 was the first net gain for the company in six years. While the re-emergence of profitability is unlikely to be linear (we’re projecting a net loss in 3Q23, followed by net gains in 4Q23 and FY24), the YTD improvement in execution is encouraging. The industry’s gradual manufacturing recovery coupled with RAIL’s expanding capacity of up to 5,000 railcars annually should position the company well in the coming years.

“Management maintained its 2023 production and revenue guidance but raised EBITDA to $18-22MM, from the previous range of $15-20MM. Orders in the quarter dropped to 381 units from 1,960 units in 1Q, but this appears to have been largely due to the choppiness inherent in railcar order activity as opposed to a material slowing in demand. Inquiry activity remains solid.

“The company’s manufacturing lines are largely full for the remainder of the year, and we are modeling for a 6% increase in deliveries in 2024.

“We’re fine-tuning our 2023 EPS estimate to a loss of $0.14, from a loss of $0.27. Our 2024 EPS estimate of $0.30 and $5.00 price target remain unchanged.

“We’re encouraged by the progress but remain on the sidelines as we continue to assess RAIL’s risk-reward profile and monitor the sustainability of the execution improvement as well as industry and macro variables. As far as industry-wide risks, what we currently view as the chief near-to-intermediate concern is the combination of improving rail service and stubbornly weak rail freight volumes.”