FreightCar America: ‘Solid Results’ for 4Q23; Randall Named New CEO

Written by Carolina Worrell, Senior Editor

FreightCar America Castaños, Mexico manufacturing facility.

FreightCar America (FCA) delivered solid results for fourth-quarter 2023 with gross profit up 62% on significant year-over-year margin expansion, President and CEO Jim Meyer said during a March 18 earnings report, also announcing that Chief Operating Officer Nick Randall, effective May 1, 2024, will succeed Meyer as President and CEO and become a member of the company’s Board of Directors.

Meyer will assume the role of Executive Chairman of the Board. William D. Gehl, the Company’s current Chairman, will remain on the Board of Directors and serve as Lead Independent Director.

For the fourth-quarter 2023 ended Dec. 31, 2023, FCA revenue came in at $126.5 million on 1,021 railcar deliveries, a decrease of 1.9% compared to revenues of $129.0 million on 1,150 railcar deliveries in fourth-quarter 2022.

Other fourth-quarter 2023 highlights:

- Gross margin of 9.6% with gross profit of $12.1 million, compared to gross margin of 3.6% with gross profit of $4.6 million in the fourth quarter of 2022.

- Net loss of ($2.9) million, or ($0.24) per share and Adjusted Net income of $2.4 million, or ($0.07) per share, accounting primarily for non-cash items associated with a $4.1 million impairment on leased railcars as well as change in fair market value of warrant liability.

- Adjusted EBITDA of $6.5 million, compared to Adjusted EBITDA of $1.2 million in the fourth quarter of 2022.

Fiscal Year 2023 Highlights

- Revenues of $358.1 million, down 1.8% year-over-year, on deliveries of 3,022 railcars, down 5.1% year-over-year.

- Gross margin of 11.7% with gross profit of $41.8 million, compared to gross margin of 7.1% with gross profit of $25.8 million in fiscal year 2022.

- Net loss of ($23.6) million, or ($1.18) per share and adjusted net loss of ($1.0) million, or ($0.39) per share, accounting for primarily non-cash items including $14.9 million loss on extinguishment of debt, $4.1 million impairment on leased railcars and $2.2 million on the change in fair market value of warrant liability.

- Adjusted EBITDA of $20.1 million, compared to Adjusted EBITDA of $8.4 million in fiscal year 2022.

“We continued to deliver both solid financial results and margin growth for 2023,” said Meyer. “Our team continues to remove cost and create efficiencies, which played heavily in our more than doubling Adjusted EBITDA in 2023 on similar volume as compared to the prior year. We did this while simultaneously completing the buildout of our state-of-the-art manufacturing campus which doubles our capacity from one year ago levels. Furthermore, we absorbed the impacts of the US-Mexico border closure in December which lowered fourth quarter deliveries and foreign exchange headwinds, which together decreased results by about $5 million. For the year, we achieved $20.1 million in Adjusted EBITDA on just 3,022 total deliveries, in a footprint now capable of producing 5,000 or more railcars per year.

“As we scale-up, we are well positioned to gain meaningful new efficiencies on more railcars in total. Although uncertainties exist around future border disruptions as well as the overall strength of the market at present, we are confident in our ability to drive additional meaningful top and bottom-line growth in 2024.”

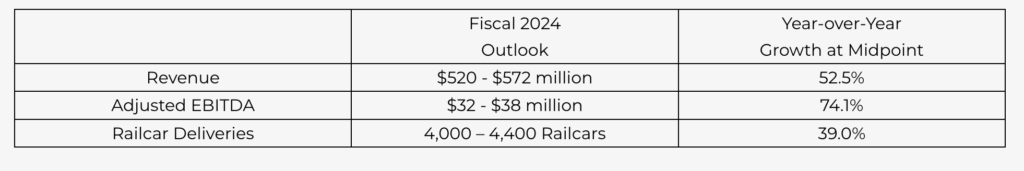

Fiscal Year 2024 Outlook

The company’s outlook for fiscal year 2024 is as follows:

“During the quarter, we continued to experience headwinds related to foreign exchange and rail service disruptions due to the border closure, which pressured our margins by limiting shipments and impacting our costs,” said FCA CFO Mike Riordan. “The team’s ability to expand Adjusted EBITDA on a per car basis despite these industry challenges underscores the value proposition of our transformation strategy as we achieved Adjusted EBITDA of $6,658 per car in the year versus $2,642 in the prior year. In addition, we are issuing our 2024 revenue guidance at $520 million – $572 million. We expect railcar deliveries to be between 4,000 and 4,400, with Adjusted EBITDA in the range of $32 million – $38 million.”

Randall, who has more than 20 years of global experience working in and leading engineering and manufacturing operations at world-class companies, joined FCA in 2023 as COO. Since joining the company, Randall has managed FCA’s operations and overseen the completion of its manufacturing campus in Castaños, Mexico.

“I am extremely pleased to announce the appointment of Nick Randall as our new President and Chief Executive Officer,” said Meyer. “Nick upholds the highest standard of operational excellence and shares the same values and vision for the Company that have guided us in recent years. Under his leadership, I am confident that the team will continue to advance our priorities and deliver a great future for our customers and shareholders.

“My role with FreightCar America will evolve as I assume the position of Executive Chairman, and I look forward to working with Nick and the rest of the Board on our strategic priorities. I also want to thank Bill Gehl for his ten years of service to-date, and especially for the dedication and expertise he brought to the Company and our Board as its Chairman,” Meyer added.

“I would like to recognize the transformative work that Jim has led at a pivotal time in the Company’s history, and I am honored by the Board’s confidence in my abilities to lead the Company going forward. I am excited by what lies ahead and look forward to working with our teams to scale the business while delivering world class products and after-sales service, and building great relationships throughout the industry,” said Randall.