STB Approves CSX-Pan Am Combination

Written by Railway Age Staff

All five Surface Transportation Board members on April 14 signed off on CSX’s proposal to acquire Pan Am Systems, Inc., and its short line railroad subsidiaries, effective May 14.

The decision came in under the wire: At the end of 2021, when STB scheduled the Jan. 13-14, 2022 public hearing on the combination, it said the hearing would “be considered the close of the record (depending on whether the hearing is one or two days long). In accordance with 49 C.F.R. § 1180.4(e)(3), the Board’s [merger] decision would be issued no later than 90 days after the close of the record.” April 14 is 90 days.

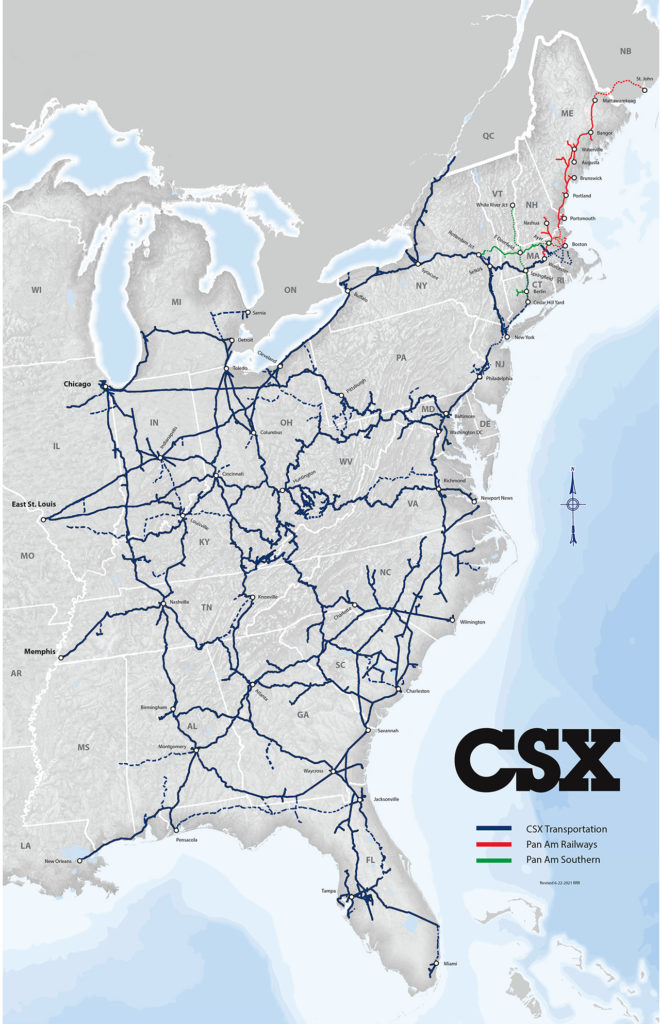

Acquiring Pan Am will expand CSX’s reach in Connecticut, New York and Massachusetts, while adding Vermont, New Hampshire and Maine to its existing 23-state network. Pan Am, headquartered in North Billerica, Mass., owns and operates a nearly 1,200-mile rail network across New England and has a partial interest in the more-than 600-mile Pan Am Southern, jointly owned with Norfolk Southern (NS; see map below).

The STB explained in its April 14 decision (download below) that it “approves, subject to conditions, the application by CSX … to acquire control of seven rail carriers owned by Pan Am Systems, Inc., and Pan Am Railways, Inc., and to merge six of those railroads into … [CSX]. The Board also approves six related transactions, allowing Norfolk Southern Railway Company to acquire trackage rights over certain lines of four other railroads [CSX, Providence & Worcester Railroad Company (a subsidiary of Genesee & Wyoming), Boston & Maine, and Pan Am Southern; these trackage rights agreements would create a new route for NS to move intermodal and automobile trains from Voorheesville in eastern New York State to Ayer]; allowing Pittsburg & Shawmut Railroad, LLC d/b/a Berkshire & Eastern Railroad [a subsidiary of G&W], to replace Springfield Terminal [an affiliate of Pan Am Railways] as the operator of Pan Am Southern LLC; and allowing SMS Rail Lines of New York, LLC, to discontinue service and terminate its lease of a rail line between Delanson, N.Y., and Voorheesville, N.Y.”

“After considering the full record in the proceeding, the Board found that CSX’s control of Pan Am and subsequent merger of six of Pan Am’s subsidiary railroads into CSX, subject to the voluntary commitments and settlement agreements to which the applicants have agreed, would not likely cause a substantial lessening of competition or create a monopoly or restraint of trade,” STB said. “Additionally, the Board found that any anticompetitive effects that might be caused by the transaction, in the unlikely event they were to occur, would be outweighed by the public interest in meeting significant transportation needs. Accordingly, the Board approved the transaction, subject to the conditions that CSX requested to be imposed as part of the agency’s approval.”

STB found several benefits flowing from the transaction:

• “[M]uch-needed capital investments in the Pan Am network, as well as more consistent maintenance.”

• “[S]hippers would have additional marketing opportunities and more efficient single-line service.”

• “CSX would have the opportunity to better compete for traffic moving via long-haul trucking.”

• “[F]uel efficiency and lower emissions resulting from CSX’s use of newer line-haul and switching locomotives, compared with Pan Am’s locomotives.”

In Aug. 26, 2021 comments filed with the STB, the United States Department of Justice (USDOJ) took issue with many aspects of the proposed CSX-Pan Am merger, citing President Biden’s July 9, 20021 Executive Order, “Promoting Competition in the American Economy.”

In its April 14 decision, STB pointed out, for example, that the “evidence in the record suggests that NSR [Norfolk Southern] will have both the ability and the incentive to prevent CSX from taking actions that would impair PAS [Pan Am Southern]”; the Canadian Pacific settlement agreement with CSX and NS “also provides assurances that the Merger Transaction and Related Transactions will not ultimately undermine the PAS routes as a competitive option”; and the “Board finds that the arrangement between CSX, NSR, and B&E, under which B&E would have independent rate-setting authority, will be sufficient to ensure that PAS rates are not set in an anticompetitive manner.” Additionally, the “Board finds that the [CSX] open gateway commitment is vital to ensuring that the PAR System remains a competitive option, as it will allow other carriers that connect with the PAR System to continue offering competitive interline rates. Under this commitment, CSX has agreed to waive its right under the Board’s ‘Bottleneck Cases’ to quote only long-haul rates, even when interline routes are possible.”

With specific regard to PAS, the Board said that “the Merger Transaction, subject to the additional commitments and settlement agreements that CSX has requested be imposed as conditions to the overall Merger Transaction, would not likely cause a substantial lessening of competition or create a monopoly or restraint of trade; as such, there is no need for the Board to consider USDOJ’s proposal that CSX be forced to divest the 50% ownership interest in PAS it will acquire through the transaction. Moreover, the Board is not persuaded that divestiture would provide a superior alternative to both the more narrowly tailored commitments made by CSX and the other railroads here, which are targeted to address specific competitive concerns, and the Board’s continued oversight. Were the Board to require divestiture to address concerns over CSX’s half-ownership of PAS or GWI’s control of both NECR and PAS, the Board would essentially revise the entire structure of the Merger Transaction and Related Transactions, an approach that does not appear warranted here given the specific commitments and the Board’s oversight. In particular, the Board regards NSR’s acquisition of trackage rights for intermodal/automotive traffic over the Southern Route as a procompetitive aspect of the proposed transaction because it could enable NSR to provide single-line service to Ayer at a lower cost. It is not clear that that those trackage rights would remain part of any restructured transaction that included a required divestiture, assuming the transaction proceeded at all. There are also lingering questions about the feasibility of divestiture as a remedy here, including whether an appropriate buyer could be located, whether an appropriate operator could be identified, and whether the alternative operator/buyer would have sufficient resources and incentives to preserve PAS as an effective alternative to CSX’s Southern Route … [T]he Merger Transaction is likely to result in important public benefits in the New England region. On balance, the Board concludes that these benefits are more likely achieved through the transaction as currently structured, with commitments, than through an uncertain divestiture requirement with unpredictable outcomes that could have potentially weakened PAS as a viable alternative.”

STB noted that “the Merger Transaction also involves a number of lines on which Amtrak passenger service and MBTA commuter rail service is provided. Accordingly, Amtrak and MBTA (along with MassDOT) request that certain conditions be imposed on the Merger Transaction that they claim are needed to ensure that these passenger and commuter services are protected … Specifically, Amtrak operates the Vermonter, Valley Flyer, Springfield to New Haven (i.e., the Hartford Line), Downeaster, Adirondack, Ethan Allen, and Lake Shore Limited services. MBTA operates its Fitchburg Line, Haverhill Line, and Lowell Line commuter services. Connecticut Department of Transportation, in conjunction with CTrail and Amtrak, operates a commuter service between Springfield and New Haven. Finally, the Metropolitan Transportation Authority, through its operating agency Metro-North Railroad, operates commuter service between Waterbury, Conn., and Bridgeport, Conn.”

The decision discusses the transaction’s impact on passenger services and the conditions that have been imposed on pp. 22-32.

Next Steps

STB wrote in its decision that “as a condition of approval, the Board will establish a five-year oversight period so that it may monitor the effectiveness of the various conditions. … The Board finds that an initial five-year duration is appropriate, so that the oversight period will cover the implementation phase and two years following full implementation of operating and infrastructure improvements. At the end of the five-year oversight period, the Board may elect to extend its oversight for an additional period if conditions warrant.”

Petitions for reconsideration of STB’s decision must be filed by May 4, 2022. Requests for stay must be filed by May 4, 2022.

STB, Merger Partners’ Reaction

“After a searching review of the well-developed record in this proceeding, which included a two-day public hearing before the full Board, the Board concluded that this transaction satisfies the statutory criteria based on CSX’s representations to the Board,” STB Chairman Martin J. Oberman said. “I look forward to improvements in the rail network with respect to reliable service and competitive transportation options in New England and beyond.”

“CSX is pleased that the STB approved the proposed acquisition of Pan Am and has recognized the significant benefits this transaction will bring to shippers and other New England stakeholders,” said President and CEO James M. Foote. “We look forward to integrating Pan Am, their employees and the rail-served industries of the Northeast into CSX and to working in partnership with connecting railroads to provide exceptional supply chain solutions to New England and beyond.”

David A. Fink, President of Pan Am Railways said: “This much anticipated decision paves the way for an exciting new chapter for Pan Am customers and our employees as we begin our transition to the CSX team.”

“Adding Pan Am to our network will extend the reach of our service to a wider customer base over an expanded territory, creating new efficiencies and market prospects for customers to capitalize on a robust pipeline of growth opportunities to move freight to, from and within New England,” CSX noted. “With this transaction, New England will benefit from CSX’s track record as a leader in environmental performance. CSX will operate Pan Am with a more reliable and more fuel-efficient fleet, significantly reducing fuel consumption and improving rail’s environmental footprint in the region. Passenger and commuter carriers in New England will benefit as the company is committed to maintaining or improving existing passenger service that operates on Pan Am. CSX has a long-standing history of working cooperatively with Amtrak and other passenger rail partners as evidenced by the significant improvement in contractual on-time performance with Amtrak since CSX has implemented its new operating model.”

Background

STB on July 30, 2021 accepted for consideration CSX’s amended and re-filed merger application. (The original merger application was rejected as “incomplete” because it did not “include all the information necessary for purposes of a ‘significant’ transaction under the Board’s regulations.”) STB on Dec. 10, 2021 affirmed that an environmental and historic review of the proposed combination was not required, and set a public hearing schedule for Jan. 13-14.

There were letters filed with the STB for and against the combination. For details, read: “CSX/Pan Am Merger: Pros and Cons” ; “DOJ Picks Apart CSX-Pan Am Transaction” ; “CSX Acquisition of Pan Am: Improved New England Rail Service Makes It Commendable” ; and “CSX: Pan Am Merger Application Moves Forward, Support Builds.”