New U.S.-Mexico Trade Corridor Eyed

Written by Marybeth Luczak, Executive Editor

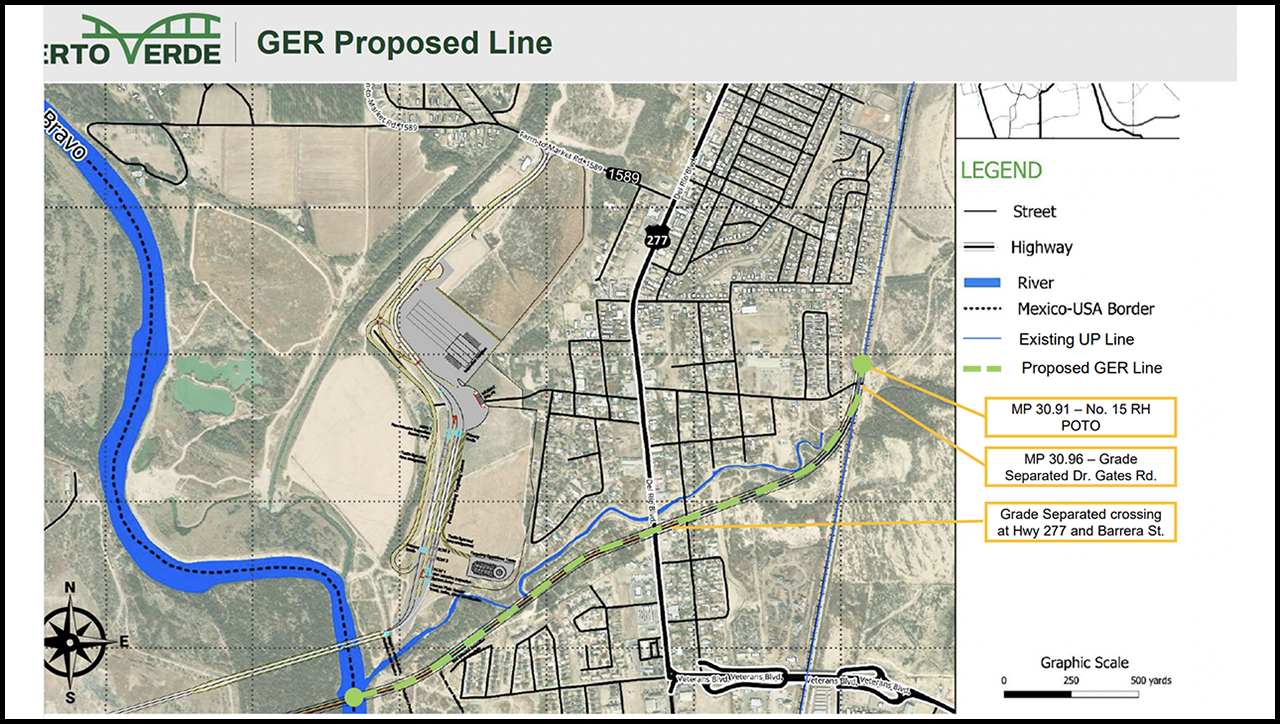

A map of Green Eagle Railroad LLC’s proposed 1.335-mile common carrier rail line in Maverick County, Tex., extending from the southern border of the United States and connecting to Union Pacific (UP) at approximately milepost 31 on the Eagle Pass Subdivision. The line is part of parent company PVH’s proposed trade corridor for freight and commercial motor vehicles extending into Mexico. (GER Map)

Green Eagle Railroad LLC (GER), a non-carrier subsidiary of Texas-based Puerto Verde Holdings (PVH), is seeking Surface Transportation Board (STB) approval to construct some 1.335 miles of new common carrier rail line in Maverick County, Tex., extending from the southern border of the United States and connecting to Union Pacific (UP) at approximately milepost 31 on the Eagle Pass Subdivision. GER, which also seeks operating authority, reported that it is developing the proposed line as an element of PVH’s proposed Puerto Verde Global Trade Bridge, which would “create a new trade corridor for freight rail and Commercial Motor Vehicles (‘CMV’) extending from the City of Eagle Pass to the U.S./Mexico border and then approximately 17.79 miles into the Mexican State of Coahuila.”

Neither GER nor PVH currently own or operate any other rail lines, according to GER, which on Dec. 14 submitted to the STB a petition for an exemption from the prior approval requirements of 49 U.S.C. §10901 for construction of the Texas line (download below).

The components of the Puerto Verde Global Trade Bridge corridor include the proposed 1.335-mile Texas line; the GER rail line in Mexico connecting to Ferrocarril Mexicano, S.A. de C.V. (Ferromex) at the Ferromex Rio Escondido rail yard; a new CMV roadway running parallel to the railroad tracks in the U.S. and Mexico; a new bridge crossing the Rio Grande River with two spans to carry the railroad tracks and the CMV roadway; and customs inspection facilities, according to the GER petition filing. GER reported that Ruben Garibay, owner and chairman of PVH and founder and majority owner of trucking logistics carrier Select Dedicated Solutions, “controls a large majority of the land on the U.S. side of the border that will be required to build the Proposed Line and other infrastructure that is proposed as part of the Puerto Verde Global Trade Bridge corridor.” GER said that in Mexico, “the State of Coahuila is pledging to assign the approximately 18-mile long and 80-meter-wide existing right-of-way known as Libramiento Norte for the proposed trade corridor for CMV and rail use.”

GER told the STB that the purpose of building and operating the proposed 1.335-mile line is “to develop an economically viable solution to meet the needs for border infrastructure improvements that will increase safety and facilitate crucial binational trade between the United States and Mexico.”

GER said the existing border crossing in the City of Eagle Pass is the second busiest rail crossing between the U.S. and Mexico. It noted that currently rail traffic crosses the U.S./Mexican border at Eagle Pass via a single-tracked bridge belonging to UP on the U.S. side and owned by the Mexican federal government with rail operations concessioned to Ferromex on the Mexican side of the border; BNSF also operates on the line via trackage rights. Additionally, GER said, the current Eagle Pass Port of Entry rail bridge “is situated within the congested areas of the City of Eagle Pass, and Piedras Negras, Coahuila” and traverses nine at-grade rail crossings in the City of Eagle Pass and 16 at-grade crossings in Piedras Negras.

The Texas Department of Transportation (TXDOT) in 2021 released the Texas-Mexico Border Transportation Master Plan (BTMP) “to analyze capacity at the Texas/Mexican border and provide recommendations to ease congestion,” according to GER. “Currently, trade via rail and CMV provides a total of ‘$15.2 billion in GDP ($5.3 billion in the U.S. and $10.0 billion in Mexico),’” GER reported, noting that “BTMP found that Eagle Pass northbound rail traffic grew from 61,600 railcars in 1996 to 336,500 rail cars in 2019. It projects that by 2050, northbound rail traffic will increase to an estimated 943,700 rail cars per year.”

GER said that the BTMP “cited challenges at all of the Texas/Mexican rail crossings including the Eagle Pass Port of Entry,” and “notes that each of the rail border crossings are single tracked, which prevents ‘simultaneous two-way operations and creating bottlenecks as trains queue in both directions.’” Specific to the Eagle Pass Port of Entry rail crossing, GER said that the BTMP “identified ‘[l]imited train speeds and limited freight capacity due to [a] need for improved infrastructure and expanded track.’”

While TXDOT released the BTMP in 2021, “challenges continue,” reported GER, noting that “[m]ost recently, security issues at the Eagle Pass rail crossing resulted in a temporary cessation of rail service for cross border rail traffic,” forcing BNSF and UP to embargo service.

“The infrastructure needs are not limited to the rail corridor; the current commercial motor vehicle border crossing is also under strain,” GER said. “The BTMP sounds a warning that ‘[c]ontinued growth of population, trade, and personal travel demand has outpaced investments in border-wide multimodal transportation infrastructure’ along the Texas/Mexico border. As a result, border crossing times and congestion has increased. The BTMP states that ‘[w]ithout border infrastructure improvements, border crossing times will escalate to unmanageable levels putting at risk the economic competitiveness of trade between the U.S. and Mexico’ and the result will be that trade ‘could move to other countries, resulting in fewer jobs and lower incomes’ in the U.S. and Mexico … BTMP finds, the ‘negative impact to US GDP caused by delays to the movement of goods through Eagle Pass is projected to increase from $2.1M in 2019 to $3.7B in 2050.’”

GER told the STB that the Puerto Verde Global Trade Bridge’s purpose “is to resolve the rail and CMV congestion, reduce cross border wait times, route rail traffic and CMV traffic around the urban centers of the City of Eagle Pass and Piedras Negras, thereby eliminating the at-grade crossings and the associated environmental and community burdens, and increase security.” Additionally, the new trade corridor “will directly link the industrial areas of Mexico with the United States providing economic opportunity in Maverick County and the State of Coahuila,” GER said.

The proposed 1.335-mile line in the U.S., GER reported, “serves the specific purpose of connecting the Mexican segment of the GER rail line to the interstate railroad system in the United States bypassing the nine at-grade rail crossings in the City of Eagle Pass.”

Proposed Texas Rail Line: Construction, Operations

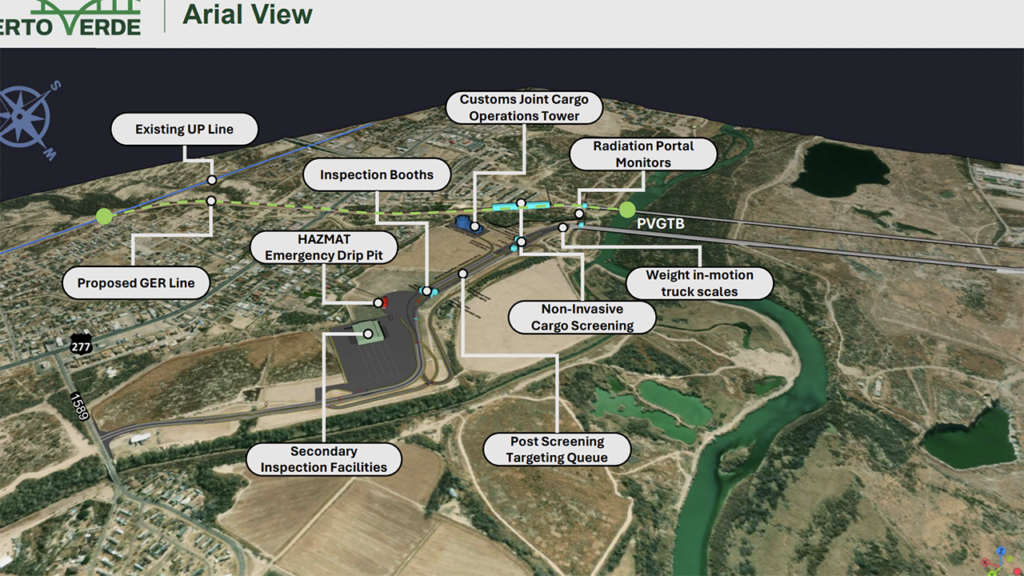

GER told the STB that it intends to construct and operate in Maverick County, Tex, a “double-tracked corridor with no at-grade crossings extending from the interchange point with UPRR [Union Pacific/UP] at approximately UPRR milepost 31 on the Eagle Pass Subdivision near the UPRR Clark’s Park yard extending 1.335 miles southwest and ‘terminating’ at the U.S./Mexican border on a newly constructed bridge that crosses the Rio Grande River. Further, GER would build infrastructure along the Proposed Line for U.S. and Mexican customs operations to include a customs control tower located between the Proposed Line and the CMV, providing for combined multi-modal cargo inspection.”

The remainder of the line, which GER noted was not the subject of the STB petition, would extend south approximately 17.79 miles into Piedras Negras, Coahuila, Mexico to connect with Ferromex at the Ferromex Rio Escondido rail yard. That portion of the GER line, it said, would be “single track with passing tracks and a sufficiently wide right-of-way to double track the line if customer demand warrants it.” Together, the two line segments would form a 19.12-mile corridor.

GER said that it “is planning to construct the Proposed Line [in Texas] and the Mexican portion of the line to be a secure rail corridor encompassing the entire route between U.S. and Mexico rail switchyards.” The corridor on both sides of the border would be “fully fenced, monitored, and patrolled by security personnel.” GER reported proposing “to provide the Mexican National Customs Agency and the U.S. Customs and Border Protection with scanners and portal radiation monitoring to provide non-intrusive inspections of all rail cars crossing the border.”

Additionally, GER proposes to utilize “international crews, thereby forgoing the current practice of crew changes at the border.”

“Currently, GER projects that it could develop its own cross border traffic,” it told the STB. “PVH intends to develop a new rail served industrial park in Mexico—Puerto Verde Nava—abutting the Ferromex Rio Escondido Yard in Mexico. GER sees an opportunity to ship aggregate because local aggregate shippers in Coahuila do not currently have access to rail. GER also envisions developing local U.S. traffic at a to-be-constructed industrial park—Puerto Verde North,” which it said would be located to the north of UP’s Clark’s Park Yard and to the south of BNSF’s Ryan’s Ruin Yard.

“Although holding out to serve local cross border rail traffic is a GER goal,” the company said, “the primary purpose for the Proposed Line is to resolve the cross-border trade issues identified by the BTMP, improve security, and route rail traffic away from the congested areas and at-grade rail crossings in the City of Eagle Pass and Piedras Negras.” To do this, GER told the STB that it “is seeking to enter into agreements with BNSF and UPRR for those carriers to shift their cross-border traffic to the Proposed Line for them to take advantage of the fluid cross border trade corridor that PVH intends to construct.” GER said it has discussed its Texas line and greater PVH Puerto Verde Global Trade Bridge proposals with UP and BNSF, and “to date, GER has been pleased with the reception its proposal has received from both railroads. If GER is able to attract BNSF and UPRR to route their traffic over the Proposed Line, GER anticipates that it will serve 15-18 trains per day based on the current traffic flow.” GER added that “[i]f UPRR and BNSF are agreeable, GER proposes to offer freight service between the Ferromex Rio Escondido Yard and the UPRR Clark’s Park Yard and between the Ferromex Rio Escondido Yard and the BNSF Ryan’s Ruin Yard. Accessing BNSF’s Ryan’s Ruin Yard with GER trains would require a trackage rights agreement with UPRR. Failing a trackage rights agreement, GER and BNSF may explore alternative arrangements that would allow BNSF to utilize the Proposed Line.” GER said that it expects to haul similar commodities as those that are currently crossing through the Eagle Pass Port of Entry; in 2022, it said, the leading U.S. exports to Mexico included soybeans, passenger vehicles, miscellaneous iron and steel articles, and corn and the leading imports into the U.S. included commercial vehicles, beer, and passenger vehicles.

Puerto Verde Global Trade Bridge Corridor

“PVH selected the trade corridor based on regional plans to reroute commercial traffic out of the urban centers of the City of Eagle Pass and Piedras Negras,” GER told the STB. “Located to the north of both cities, the new trade corridor (to include the Proposed Line [in Texas], the Mexican segment of the rail line, and the new CMV roadway) would bypass the densely populated areas of these cities alleviating the burdens of commercial traffic on residents. The current proposed alignment allows for realization of Piedras Negras’ Master Plan to route commercial rail and CMV traffic to the north of the city and of Maverick County’s plans for a new CMV international crossing to the north of Eagle Pass.”

Construction of a new trade corridor like PVH’s proposed Puerto Verde Global Trade Bridge requires coordination and approvals from various federal, state, and local agencies in the U.S. and Mexico, including the STB. GER reported that PVH in October submitted a Presidential Permit Application for State Department approval of the Puerto Verde Global Trade Bridge; Maverick County, Tex., was its public entity sponsor. In support of that application, PVH included an economic impact study of the Puerto Verde Global Trade Bridge corridor and letters of support from U.S. and Mexican supporters of the proposed trade corridor, such as U.S. Sens. Ted Cruz (R-Tex.) and John Cornyn (R-Tex.); the U.S. congressman for Eagle Pass, Rep. Tony Gonzales; Texas Transportation Commission Chairman Bruce Bugg; and Texas State Reps. Eddie Morales and Ryan Guillen. Also required, GER said, will be “some level of authorization or agency approval” from the State of Texas Bridge Permit program, Customs and Border Protection/General Services Administration, the International Boundary Water Commission, the United States Coast Guard, the Army Corps of Engineers, and Maverick County.