The Year of Rail: Making Cargo Connections

Written by Port of Long Beach Corporate Communications

Union Pacific has partnered with Duncan and Son Lines, a family-owned logistics firm based in the greater Phoenix metropolitan area, to provide drayage services between the its Phoenix Intermodal Terminal and nearby distribution centers. (Caption and Photograph Courtesy of POLB)

Over the past two decades, the Port of Long Beach (POLB) has completed 10 major projects valued at more than $500 million to modernize its rail network for speeding cargo in and out of the Port. Four more projects are in design or under construction, including major segments of the centerpiece of the Port’s new rail infrastructure, the Pier B On-Dock Rail Support Facility. The $1.56 billion program will serve as the Port’s hub for staging and assembling trains to further boost the velocity of imports and exports riding the rails to and from markets nationwide.

As the Port looks to break ground this summer on the first phase of Pier B, Union Pacific (UP) and BNSF have moved forward with their own projects to enhance freight rail service in the Southwest and the intercontinental network. Key regional projects that will expand these networks are UP’s Phoenix Intermodal Terminal and BNSF’s Barstow International Gateway (BIG).

“The rail network works best when all segments are optimized,” said Long Beach Harbor Commission President Bobby Olvera Jr. “We’re proud of what we’re doing at the Port to improve our rail network to move more cargo by rail and we’re excited about the investment Union Pacific and BNSF are making to increase efficiencies down the line.”

Port CEO Mario Cordero highlighted the Phoenix and Barstow rail projects Jan. 17 during his 2024 State of the Port address. Under the banner theme, The Year of Rail, Cordero talked about the systemwide benefits of the UP and BNSF improvements and how they will strengthen West Coast competitiveness, advance the Port’s efficiency goals that include moving 35% of cargo by on-dock rail, and reduce carbon emissions by shifting more containers to rail.

“The Class I projects position our customers to reap the full benefits of all our work to enhance rail service through the Port and across the nation,” Cordero said. “These type of fluid, reliable connections that we and our partners offer are the essence of a world-class supply chain.”

Phoenix Intermodal Terminal

Opened Feb. 1, the Phoenix Intermodal Terminal is the first-of-its-kind rail service between the San Pedro Bay ports and Phoenix. With a population of more than 5 million, Phoenix ranks as the 10th-largest metropolitan area in the nation, according to U.S. Census population trends reported in 2023.

The new service responds to both the economic and environmental market demand for moving more cargo by rail between the two locations and has the capacity to handle tens of thousands of international shipping containers, said Reed Janousek, Assistant Vice President of UP’s Premium Intermodal group. Phoenix is located more than 350 miles east of the Southern California ports, a distance previously considered too costly for rail and traditionally covered by trucking.

“There is absolutely an opportunity for transporting imports by rail to the growing consumer market in Phoenix,” Janousek said. “Rail also allows you to increase the weight capacity, which makes it more advantageous for exports.” Arizona’s top commodities are agricultural products, such as hay and alfalfa, and raw materials, such as minerals and metals.

UP opened the facility a mere 45 days after the railroad announced the project. The work involved repurposing and upgrading an underutilized Union Pacific rail yard and adding a new ramp and lift equipment for transferring international containers between well cars and chassis. The timing allows UP to market the new facility ahead of May 1, the date by which annual global shipping service contracts and rate agreements are typically finalized.

The quick turnaround also reflects UP’s strategy of launching the service and expanding it as business grows. “As Long Beach and Los Angeles continue to invest in infrastructure and attract more freight to the West Coast, it increases our confidence in expanding inland options for our customers,” Janousek said.

In addition to price, speed and reliability, cargo owners also want options that reduce their carbon footprint. UP estimates its new rail service connecting the San Pedro Bay ports directly to Phoenix will reduce traffic congestion on Southern California’s roadways and eliminate more than 25,000 metric tons of greenhouse gases annually.

UPs Phoenix-bound cargo will come directly from on-dock rail yards, as well as the near-dock Intermodal Container Transfer Facility operated by UP. The railroad has partnered with Duncan and Son Lines, a family-owned logistics firm based in the greater Phoenix metropolitan area, to provide drayage services between the new facility and distribution centers, warehouses, retail customers or its own container yard in the region.

In the past, the cost of moving containers to Phoenix has been less expensive by truck, but the equation is changing, said Keith Jones, Vice President of Sales for Duncan and Son Lines’ parent company DSL Logistics Inc. “With rapidly increasing costs for trucks, drivers, fuel, et cetera, as well as CARB requirements, the cost of trucking has become very similar to rail.”

Founded in 1934, Duncan and Son Lines has its own fleet of 500 trucks and 3,000 intermodal chassis. Having specialized in serving the San Pedro Bay ports for more than 30 years, the company is one of the largest drayage providers with the cleanest fleet calling at the port complex.

This allows Duncan and Son Lines to meet shippers’ increased focus on sustainability in any market, Jones added. “The oldest truck in our fleet is four years old and we custom spec our trucks with the most CARB-friendly components. Currently, we are finalizing the onboarding of 70 zero-emissions trucks. We have also purchased electric charging stations in Southern California.”

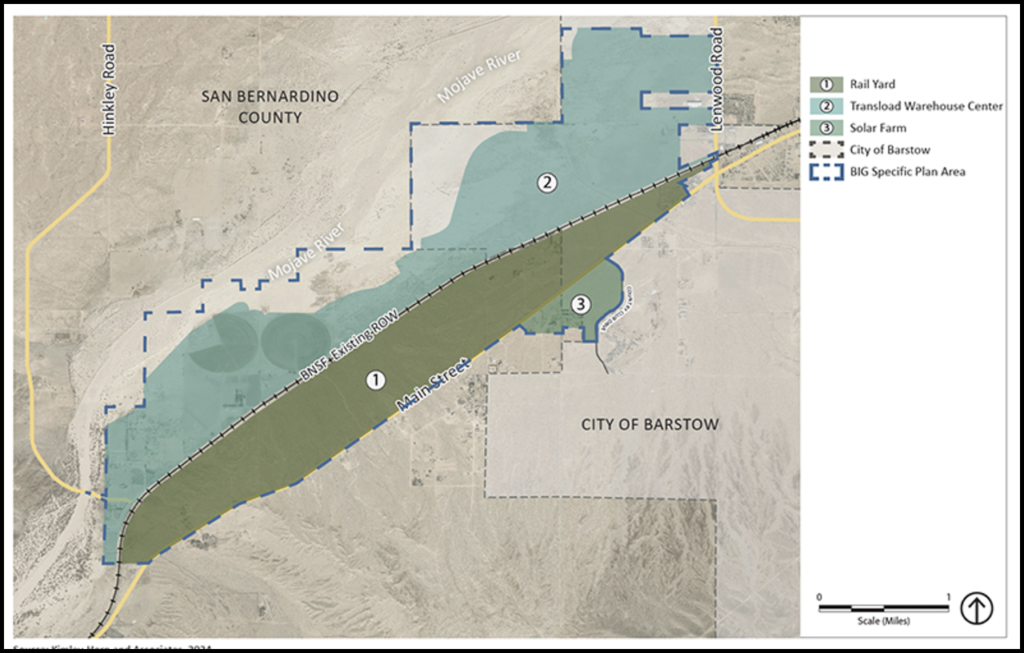

Barstow International Gateway

BNSF is proposing a new 4,500-acre master-planned rail facility proposed for the desert city of Barstow, nearly 135 miles northeast of the San Pedro Bay ports complex. The $1.5 billion project calls for a state-of-the-art rail yard and intermodal facility for processing both eastbound containers destined for inland U.S. markets and westbound containers destined for markets overseas.

The full-service rail yard includes a new component: multiple onsite warehouses for transloading to streamline moving cargo between international and domestic containers.

“The facility, when complete, will evolve beyond the traditional model of an intermodal facility and create something that can better serve and improve the fluidity of the West Coast ports,” said BNSF CEO Katie Farmer, in her video message included in the Jan. 17 State of the Port address. Industry benefits include a lower-cost rail move to an inland transloading facility and shorter dwell times for containers on marine container terminals, she added.

BIG is projected to support about 3,000 union jobs over three years during construction. Long-term economic benefits include an estimated 20,000 direct and indirect jobs in the High Desert communities of southeastern California, the largest portion of the Mojave Desert. The region includes most of San Bernardino and portions of Los Angeles, Kern and Inyo counties.

Key sustainability elements include a solar farm that would generate clean energy to supplement its onsite electricity needs, including powering electric hostlers for moving containers from the facility’s intermodal ramp to its transloading warehouses.

BIG’s size also positions it to significantly reduce truck trips and congestion on Southern California roadways. In addition to enhancing cargo fluidity, the ports estimate that each train that hauls containers from on-dock rail yards to their destination can replace up to 750 truck trips.

Like all major development projects in California, BIG is subject to the California Environmental Quality Act (CEQA), which requires a comprehensive study of potential environmental impacts. BIG is currently at the front end of the process. The lead agency, the City of Barstow, issued its Notice of Preparation (NOP) of a Draft Environmental Impact Report (EIR) in mid-February.

The draft EIR will address both the proposed project and an update to the city’s general plan. The document is expected to be released in in the first quarter of 2025 and will undergo additional public review. The current timeline calls for the Barstow City Council to vote on the final EIR by the end of 2025.

The Unknown Factor

BNSF’s goal is to begin construction immediately after a final EIR is approved and open BIG in 2028. But whether BIG moves forward may hinge on a new rule by the California Air Resources Board (CARB), the In-Use Locomotive Regulation. The rule requires rail operators to contribute to an account to fund cleaner locomotive technologies and limits engine idling to 30 minutes. It also requires all switch, industrial and passenger locomotives built in 2030 or later to operate in zero-emissions mode while in California. The compliance date for freight line haul locomotives is 2035. The regulation offers operators flexibility for meeting deadlines and extensions in cases of technology challenges or emergencies, subject to CARB approval.

The federal Clean Air Act allows California to develop state regulations that are stricter than their national equivalent, but the state must obtain authorization from the U.S. Environmental Protection Agency to enforce them. EPA is currently reviewing the In-Use Locomotive Regulation. The process includes taking public comment on the rule through April 22, after which EPA reviews the comments and determines whether the requirements for obtaining authorization have been met.

CARB approved the regulation in April 2023 and projects it will contribute to the largest reduction of nitrogen oxides toward meeting California’s 2037 air quality standards and also reduce diesel particulate matter. The state air regulatory agency says the rule will prevent 3,200 premature deaths and 1,500 emergency room visits and hospitalizations, resulting in a $32 billion in health savings from 2030 to 2050.

The Association of American Railroads (AAR) estimates the cost of compliance at $800 million per year per Class I railroad starting in 2026. For BNSF, the sum is equivalent to 25% of its total annual capital plan. AAR describes the rule’s mandated investments and technology requirements as “completely unworkable” for freight rail operators in California. If EPA authorizes the rule, it could be duplicated nationwide and increase costs across the intercontinental rail network, put some short lines out of business, and weaken the supply chain and the U.S. economy, AAR says.

CARB says operators can start working toward the health benefits with the technology that is available now. BNSF says the regulation jeopardizes BIG’s future.

“It makes it impossible for us to complete our CEQA analysis on BIG because we have to model the type of equipment for which there is no proven zero-emissions technology,” said BNSF’s General Director of Public Affairs Lena Kent.

Trade Trends and Fundamentals

Phoenix Intermodal Terminal and BIG are projects that are part of multibillion-dollar capital investment programs both Class I railroads are making to improve the efficiency, safety and sustainability of their operations and equipment. Given current real-world uncertainties that favor moving cargo through the San Pedro Bay ports and the West Coast supply chain, Phoenix Intermodal Terminal and BIG are especially timely.

Conflict in the Middle East is disrupting cargo sailing through the Red Sea; drought associated with climate change has exposed limitations of the Panama Canal route; and the six-year contract between East Coast longshore workers and ocean carriers and terminal operators expires Sept. 31 during the peak shipping season. On the West Coast, the labor contract between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) was finalized in 2023 and extends through July 1, 2028.

All of the above favors more cargo moving through West Coast ports, which is already happening, said Jonathon Gold, Vice President of Supply Chain and Customers Policy at the National Retail Federation. This includes recouping discretionary cargo that had shifted to other ports during the lengthy negotiations of the new ILWU/PMA contract, he said. “In general, BCOs are looking for anything that builds more operational flexibility into the supply chain. Anything that provides more fluidity through the ports and down the line is important for shippers.”

NRF represents the nation’s largest private-sector industry that contributes $5.3 trillion to the U.S. gross domestic product. At a time when cargo owners are negotiating annual shipping contracts, their priorities are cost, reliability, velocity and sustainability.

Resiliency is also a critical factor in their decision-making, Gold said. “There is always some kind of disruption in the supply chain, and shippers need resiliency built into the system to mitigate what comes next. It all comes down to optionality and resiliency.”