POLB Selects Iteris to Complete Multimodal Transportation Study

The Port of Long Beach (POLB) has awarded “technology ecosystem for smart mobility infrastructure” Iteris, Inc. a $900,000 contract for an 18-month multimodal transportation study.

The Port of Long Beach (POLB) has awarded “technology ecosystem for smart mobility infrastructure” Iteris, Inc. a $900,000 contract for an 18-month multimodal transportation study.

Over the past two decades, the Port of Long Beach (POLB) has completed 10 major projects valued at more than $500 million to modernize its rail network for speeding cargo in and

The Freight Logistics Optimizations Works (FLOW) platform is now publishing data on inland freight hubs, including rail terminal and warehouse end destination data, that will provide an “enhanced view” of future container import volumes and traffic, the U.S. Department of Transportation (USDOT) reported March 20, the second anniversary of the platform’s launch to provide an integrated view of supply chain conditions in the United States and to help users forecast how current capacity and throughput will fare against future demand.

The Port of Long Beach (POLB) and the Port of Los Angeles report an increase of trade in February.

Trade moving through the ports of Los Angeles and Long Beach rose in January as retailers stocked up ahead of the Lunar New Year, when east Asian factories typically close for up to two weeks.

Chicago-based Anacostia Rail Holdings (ARH) on Jan. 31 released two new reports examining the feasibility and benefits of rail service operating to an inland port for intermodal containers destined within 150 miles

The U.S. Department of Transportation (USDOT) is distributing $4.9 billion to 37 nationwide projects through the FY 2023-24 Mega (National Infrastructure Project Assistance) and INFRA (Infrastructure for Rebuilding America) grant programs. Twelve rail-related projects will receive a total of $1.6 billion; the Pier B project at the Port of Long Beach and the Louisiana International Terminal project at the Port of New Orleans are among the winners.

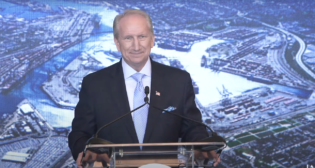

Port of Long Beach (POLB) CEO Mario Cordero on Jan. 17 gave a “State of the Port” address, highlighting rail facility modernization and air quality improvement efforts that will continue through 2024, as well as 2023’s cargo volume statistics.

Port of Los Angeles Executive Director Gene Seroka outlines plans for 2024 in his “State of the Port” address. Also, Trigon Pacific Terminals Ltd. (Trigon) initiates the regulatory review process for its planned Canadian LPG export project.

AITX appoints Tina Beckberger as Chief Commercial Officer. Also, Earl Adams, Jr., joins Hogan Lovells’ Transportation Practice as a Global Regulatory & IPMT partner; Jodi Heath joins the Indiana Rail Road Company (INRD) as Vice President, Business Development; the Port of Long Beach (POLB) appoints two division directors; Sound Transit considers Goran Sparrman for interim CEO; and the League of Railway Women (LRW) names MxV Rail President and CEO Kari Gonzales the 2023 Railway Woman of the Year.