Wabtec: ‘Strong’ 4Q22 Results, Full-Year Backlog Grows

Written by Marybeth Luczak, Executive Editor

(Photograph Courtesy of Wabtec)

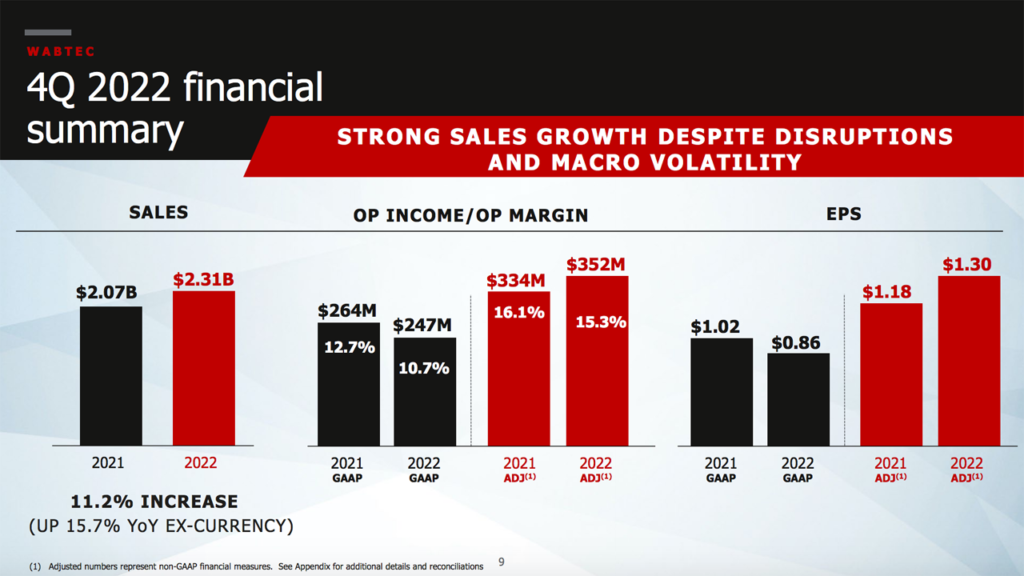

Wabtec “finished a strong 2022 as evidenced by higher sales, margin expansion and increased earnings,” said President and CEO Rafael Santana, who noted during a Feb. 15 earnings report that the company was able to deliver “despite a volatile environment that included significant headwinds from the impact of Russia sanctions, negative foreign currency exchange, supply chain constraints and higher input costs.”

For fourth-quarter 2022, Wabtec GAAP earnings per diluted share of $0.86 were down 15.7% from the prior-year period; adjusted, they were $1.30, up 10.2% from the prior-year period. “GAAP EPS declined due to higher restructuring costs related to the Integration 2.0 program,” Wabtec reported. “Adjusted EPS increased from the year-ago quarter primarily due to higher sales and disciplined cost management.”

Sales came in at $2.31 billion for the three-months ended Dec. 31, 2022, rising 11.2% from the $2.07 billion posted in the same quarter in 2021. On a constant currency basis, consolidated sales were up 15.7%, the company said. Among the key drivers, according to Wabtec:

- Equipment: “Significantly higher international locomotives sales.”

- Components: “Higher due to improving OE railcar build and increased railcars in operation.”

- Digital Electronics: “Higher demand for on-board locomotive products, software upgrades and acquisitions of Beena Vision and ARINC (22% year-over-year growth excluding acquisitions).”

- Services: “Larger active locomotive fleet and higher sales of MODs [modernizations].”

- Transit: “Decreased as a result of unfavorable foreign currency exchange … sales up 9.3% on constant currency basis.”

GAAP operating margin for fourth-quarter 2022 was down 2.0 percentage points, which Wabtec attributed to “higher restructuring costs.” Adjusted operating margin was lower, it said, “due to unfavorable sales mix and increased technology spend in the quarter.”

At Dec. 31, 2022, the multi-year backlog was $272 million higher than at Dec. 31, 2021, and “excluding unfavorable foreign currency exchange,” it was up $680 million (or 3.1%), according to the Wabtec.

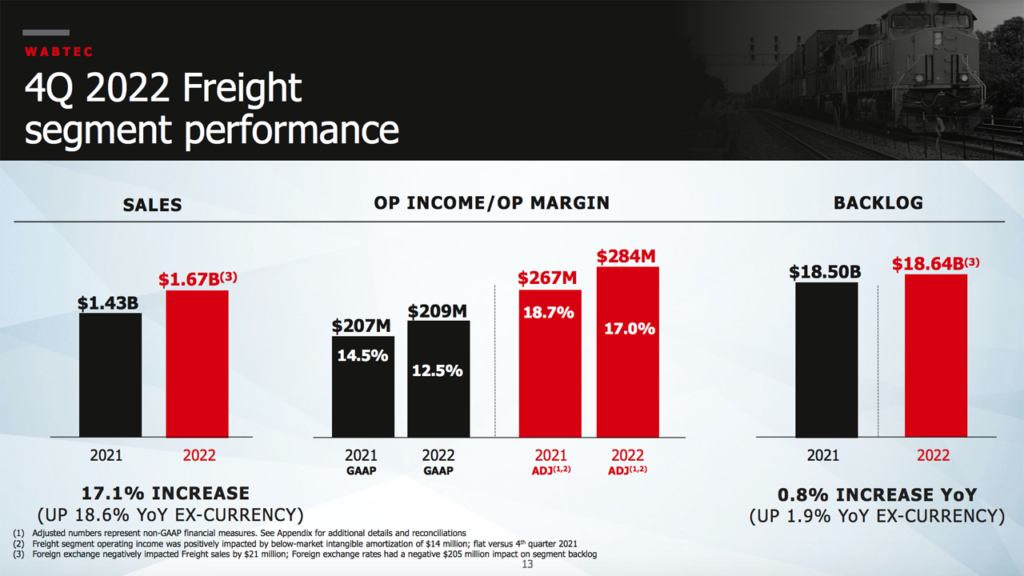

Freight segment sales for fourth-quarter 2022 were $1.67 billion, up 17.1% from $1.43 billion posted in fourth-quarter 2021. Sales, Wabtec reported, were “up across all product groups, with very strong growth in Digital Electronics, Services, and Equipment. On a constant currency basis, sales were up 18.6%. GAAP operating margins and adjusted operating margin were lower as a result of unfavorable mix and increased technology spend during the quarter, partially offset by operational efficiencies and disciplined cost management.”

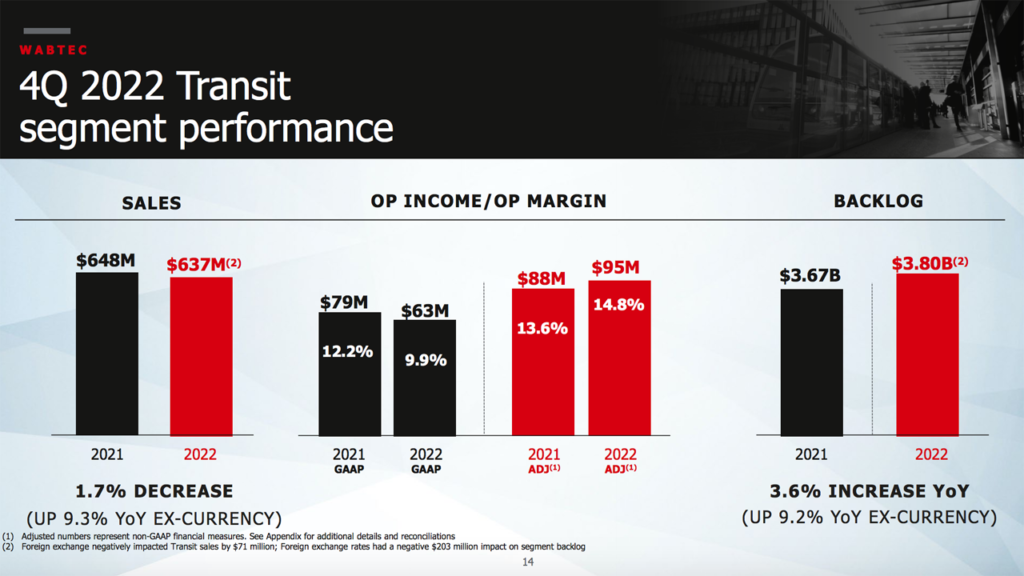

Transit segment sales for fourth-quarter 2022 came in at $637 million, a 1.7% decrease from the $648 million posted in the same quarter in 2021. Wabtec attributed this to “unfavorable foreign currency exchange.” It noted that on a constant currency basis, sales were up 9.3%. Additionally, GAAP operating margin was down “as a result of higher restructuring costs, while adjusted operating margin benefited from increased productivity and a strong cost discipline,” according to the company.

2023 Outlook

Wabtec reported anticipating 2023 sales to be in a range of $8.7 billion to $9.0 billion, and adjusted earnings per diluted share to be in a range of $5.15 to $5.55.

For full year 2023, Wabtec said it “expects strong cash flow generation with operating cash flow conversion greater than 90%.”

“Looking ahead, Wabtec enters 2023 with momentum across the business and is well-positioned to drive profitable growth as the team continues to deliver for our customers and shareholders,” Santana said. “Our differentiated portfolio of products and technologies, expansive global installed base, and multi-year backlog position us to remain highly resilient in an increasingly dynamic and challenging macro environment.”

The Wabtec website provides more earnings details.

The Cowen Insight

“Solid results consisted of a revenue and EPS beat,” Cowen and Company Transportation Equipment Analyst Matt Elkott reported. “Operating margin was a bit lighter than expectations due to unfavorable mix and higher technology spend. Guidance midpoint is just $0.07 below consensus. Backlog declined very slightly sequentially due to freight, partially offset by higher transit. The 12-month backlog rose a bit sequentially, driven by both freight and transit.”

Key Cowen Takeaways:

- “The results are solid but affirm our largely cautious view into the print. Our constructive overall view remains intact.

- “The fourth-quarter 2022 adjusted EPS of $1.30 beat our and the consensus estimates of $1.29 and $1.28, respectively. Adjusted operating income of $352.8 million compared to our and consensus estimates of $353.7 million and $351.6 million, respectively.

- “The company guided for EPS of $5.15 to $5.55, with a $5.35 midpoint (Consensus $5.42, Cowen $5.65). It guided for revenue of $8,700 million to $9,000 million, with an $8,850 million midpoint (Consensus $8,693 million, Cowen $8,965 million).

- “The backlog declined very slightly sequentially due to freight, partially offset by higher transit. The 12-month backlog rose a bit sequentially driven by both freight and transit. (The third-quarter 2022 backlog had declined slightly sequentially but saw solid year-over-year growth, up $0.77 billion; $1.52 billion on a constant currency basis. The second-quarter 2022 backlog had reflected the Union Pacific modernization order, which is worth north of $1 billion, announced on July 27.)”