Clean Track Ahead

Written by Robert H. Cantwell, Contributing Editor

Wabtec diesel engine rebuilds at the Fort Worth remenufacturing plant. Carolina Worrell photo

RAILWAY AGE, SEPTEMBER 2023 ISSUE: The California Air Resources Board (CARB) fired a shot across the freight rail industry’s bow to accelerate the drive to lower locomotive emissions to zero by 2035. In response, the Association of American Railroads (AAR) has filed suit against CARB. Regardless of the outcome, there is now heightened awareness of locomotive emissions. The issue isn’t going away. Instead, the economic impact to implement tighter emission regulations will be in the billions for as far as the eye can see.

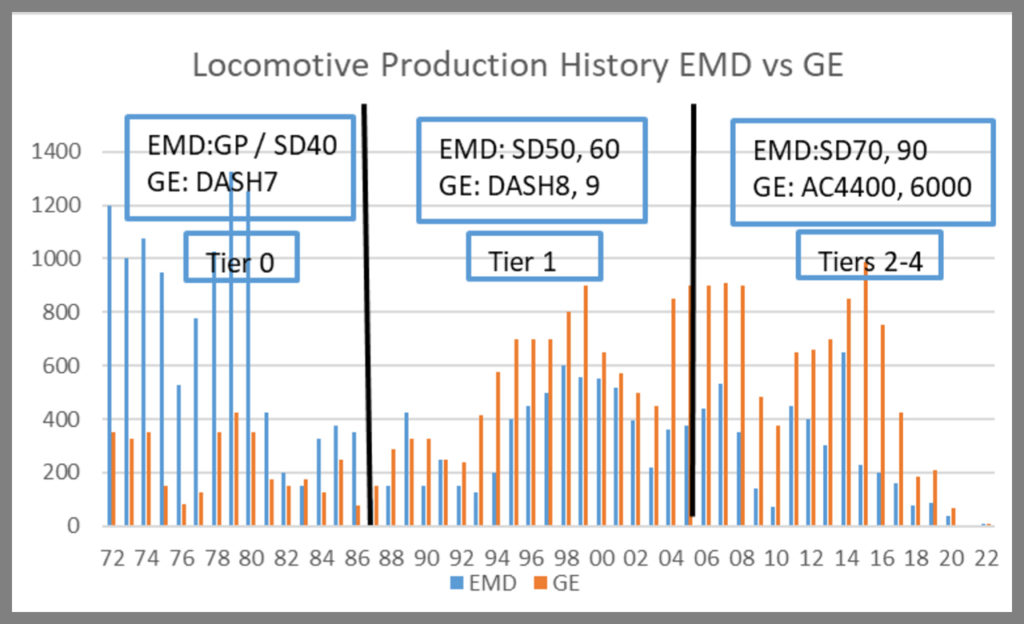

Don Graab, of Triangle Brothers Associates and previously Vice President Mechanical of Norfolk Southern, recently authored an excellent article sharing an unfortunate gloomy outlook, “New Locomotive Build Market: Non-Existent for Now?” Within the article, he highlights the two main drivers of locomotive demand: fleet replacement and traffic growth.

There will be a third driver for new locomotive demand: emissions.

On April 27, 2023, CARB issued an “In-Use” Locomotive Regulation laying out a roadmap toward zero emission locomotives in California by 2035. Highlights of the regulation:

- Establishment of a “spending account” that collects fees (taxes) commencing in 2024 on locomotives that operate in California. This will be calculated as a function of their operating use and emission levels. The funds will eventually be used to purchase new low/zero emission locomotives.

- Limit idle time to 30 minutes.

- Prohibit the use of locomotives over the age of 23 years by 2030. This is a very critical feature of the CARB regulation with far reaching impact.

- Mandating Zero Emission (ZE) locomotives to operate exclusively by 2035.

The potential impact of this regulation is likely to be very costly to the freight rail industry and may impede its ability to move freight in certain areas. Arguing that ZE locomotive technology is very much in its infancy, combined with the lack of infrastructure needed to support ZE locomotives, the industry is unlikely to meet this stringent regulation by 2035.

CARB gets its authority to regulate locomotive emissions from a unique Memorandum of Understanding (MOU) it signed many years ago with the Southern Pacific (now Union Pacific), then headquartered in San Francisco. For now, CARB is acting alone in its drive to impose stricter locomotive emission standards, but should it capture the support of EPA or other states, watch out. The EPA and CARB have ganged up on the trucking industry for years.

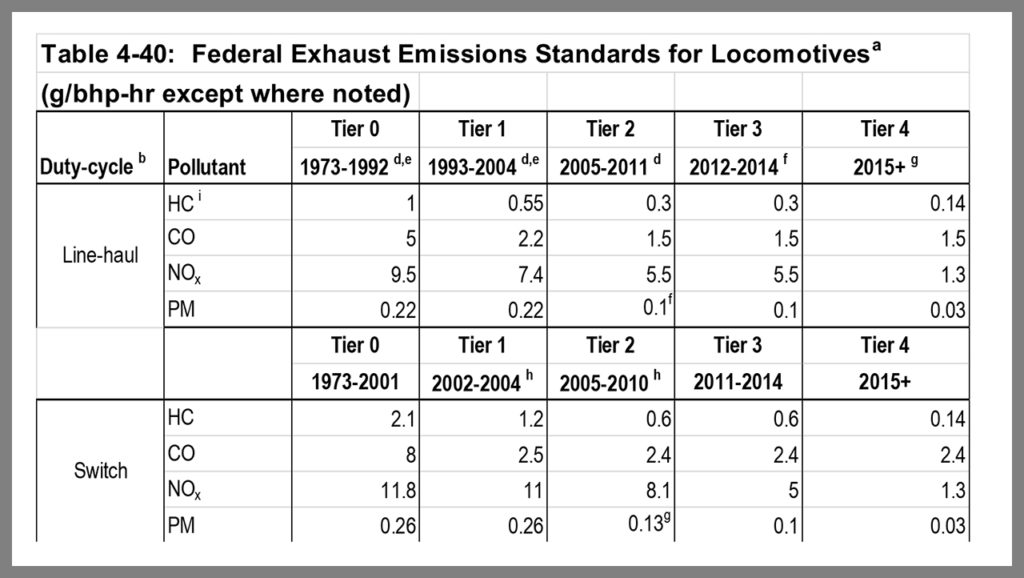

Diesel Emissions

Diesel engines fight a dual mandate: reducing carbon emissions in the struggle to reduce greenhouse gases, and reducing localized pollution (smoke and smog) through the reduction of NOx and PM (Particulate Matter). NOx and PM have been the focus of diesel emission development for the past 50 years, resulting in the development of a tiered approach to reduction. Since 1973, locomotive NOx limits have declined from 9.9 g/bhp-hour (Tier 0) in 1973 to 5.5 g/bhp-hour (Tier 3) in 2012. Tier 4 imposed a very stringent 1.3 limit. To hit this tremendous reduction requires extensive engine modification, particularly to the air intake, exhaust, cooling, and fuel delivery systems. Achieving these levels is expensive in terms of both capex and operating expense, which is one of the main reasons for the slow adoption of Tier 4 locomotives since 2015. NOx and PM dropped by almost 50% between Tiers 0 and Tier 2. Between Tier 0 and Tier 4, NOx and PM have been reduced nine-fold! Tier 0 and Tier 1 locomotives, which were produced until 2004, are indeed much dirtier than newer units.

Class 8 Truck Emissions

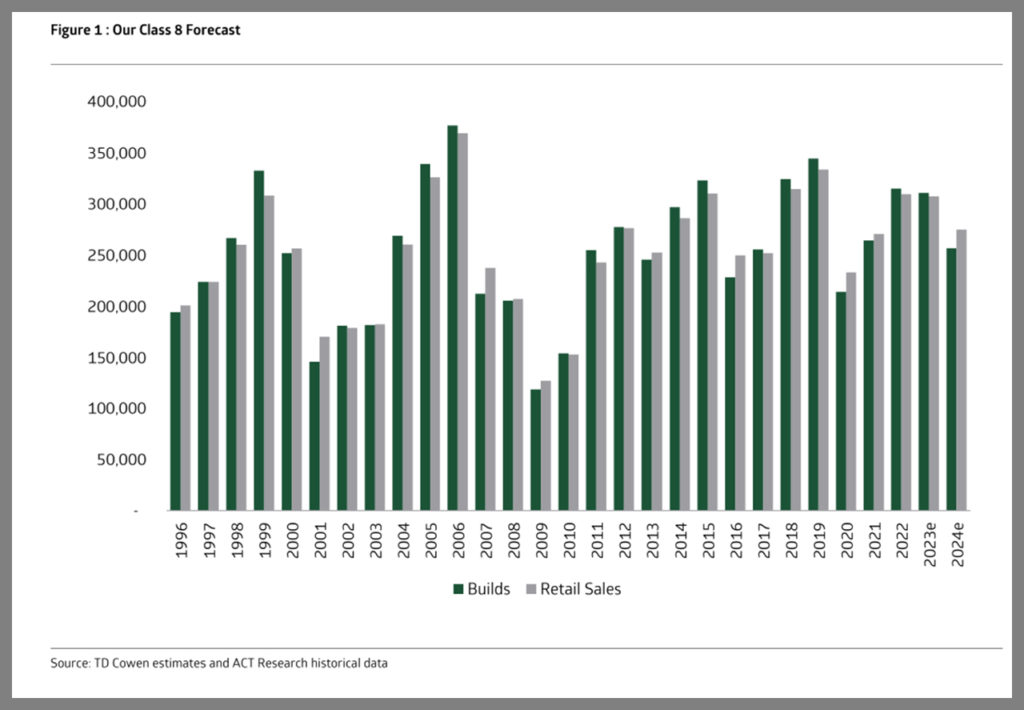

Locomotive engines are not alone in the drive to reduce NOx and PM. The Class 8 trucking industry has been subjected to similar, in fact more stringent, emission limits. The EPA on Dec. 20, 2022 finalized what it called “the strongest-ever national clean air standards to cut smog- and soot-forming emissions from heavy-duty trucks beginning with model year 2027.” EPA projects that by 2045, this final rule will reduce NOx emissions from the in-use fleet of heavy-duty trucks by almost 50%. As a result of this new regulation, there is a mad dash to purchase trucks under existing regulations–despite slowing freight demand. This is what happens when the EPA gets involved and should serve as a warning to the rail industry.

New Locomotive Demand

Since the enactment of Tier 4 in 2015, only about 1,200 units have been built, with more than 1,000 of these Wabtec units. Developing Tier 4 locomotives has been a long, expensive journey with little payback to date. In fact, Caterpillar, parent company of Progress Rail/EMD, took a $935 million write-down at the end of fiscal year 2022 on its rail business in large part due to the slow adoption of Tier 4 locomotives. With CARB regulations, or a derivative thereof, this may change quickly.

23-Year-Old Locomotives

The 23-year-old mandate by 2030 as outlined by CARB coincides with the imposition of Tier 2 requirements in 2005. In other words, no locomotive will be able to operate in California without complying with Tier 2 beyond 2030, but ultimately banned by 2035 if the regulation holds. Since 2005, there have been more than 15,000 locomotives delivered meeting Tier 2, the majority GE/Wabtec.

Tier 1 Modified Units

Modifying older Tier 1 locomotives has proven to be good business, particularly for Wabtec. These upgrades offer the following advantages:

- Up to 25% better fuel consumption, resulting in lower overall emissions, through better fuel systems and microprocessor train control.

- Conversion from DC to AC power, resulting in up to 50% greater tractive effort at slow speeds.

- Anticipated reliability improvements of

up to 40%.

While such upgrades don’t offer the same NOx and PM reduction as Tier 2+, they are an improvement over prevailing Tier 1 standards. Furthermore, they extend the useful life of a locomotive an additional 10-15 years at significantly lower upfront cost.

Tier 2, 3, 4 Retrofit Units

Since 2000, there have been several efforts to retrofit older Tier 0 and 1 locomotives with modern T2, 3 and 4 engines. Engines from Cummins, MTU, Deutz and Caterpillar, all certified to higher emission regulations, have been installed in limited quantities, primarily in lower horsepower applications. This may prove to be a good alternative for switching and short line applications, especially when needing to shut down engines frequently. This also serves as a bridge between existing T 0-1 units to battery-electric units, particularly in urban areas.

March Toward ZE

Despite the slow adoption of Tier 4, leading to anemic deliveries and subpar returns for builders, they have plowed ahead in their development of ZE locomotives. Both Wabtec and Progress Rail/EMD are developing a portfolio of battery powered units, covering switcher, commuter and line haul heavy freight. Wabtec is advancing development of hydrogen powered locomotives, as is CPKC and developmental partner CSX. All of this comes with a very high price tag and long lead times.

Further exasperating adoption of ZE battery locomotives is the infrastructure necessary to support them. A nationwide charging network is needed. Charging one locomotive is equivalent to charging 81 Tesla automobiles.

Hydrogen powered locomotives, the “other ZE alternative,” is challenged as well. Mike Iden of Tier 5 Locomotive LLC, and Contributing Editor for Railway Age, recently authored an article on the overall efficiency of hydrogen and the associated cost of production and transmission, which is well worth the read. Don Graab also weighed in on the hurdles for hydrogen powered locomotives. Like battery locomotives, facilities for hydrogen production and transmission and fueling stations are necessary. In the case of green hydrogen (hydrogen produced from all renewable energy), neither the cost nor capacity are in place to make an impact on rail emissions. While there are several hydrogen fuel cell suppliers, all are in the early stages of production. And few if any are profitable at this point. Massive amounts of capital will be required for these companies to scale up production to make a dent with hydrogen powered locomotives.

Perhaps the biggest hurdle toward adopting ZE locomotives is the integration of entirely new technologies. Typically, new technologies undergo Reliability Growth Testing before widespread adoption can occur. RGT requires years of testing, product refinement, infrastructure buildout, and training. Simply delivering a fleet of battery or hydrogen powered locomotives does not ensure success and immediate adoption.

Potential Economic Impact

Should the entire industry be mandated to operate only Tier 2+ locomotives by 2030, it is anticipated that more than 1,000 new Tier 4 and modernized Tier 2+ locomotives will be needed annually. This translates into a price tag of $3-$4 billion per year indefinitely, or almost 30% of annual railroad capital expenditures. Adding the cost of battery and hydrogen locomotives, along with their associated support infrastructure, could double this number, approaching 60-70% of current railroad capex

Summary

Like all negotiations, each party starts with demands and expectations on the extremes, and ultimately end up somewhere near the middle. If the AAR fights back too hard, it may be perceived as anti-clean air. In the case of CARB vs. the AAR, expect certain elements to prevail, like faster adoption of Tier 4 locomotives and accelerated obsolescence of Tier 0 and non-modified Tier 1 units. I expect diesel locomotives will be around a lot longer than CARB envisions, otherwise the U.S. economy could be significantly impacted. This is evidenced by the slower-than-expected adoption of electric vehicles. Despite enormous investment during the past 12 years, EVs represent only 7% of current auto sales in the U.S., most of that coming from Tesla. Frustratingly, EV penetration has only been realized through massive government subsidies. Will those same stimuli be available for ZE locomotives?

From the AAR fact sheet: “U.S. freight railroads, on average, move one ton of freight nearly 500 miles per gallon of fuel. On average, railroads are three to four times more fuel efficient than trucks.” Yet we continue to lose market share. The fuel efficiency argument doesn’t pack the same punch it once did. Modern trucks are gaining steadily. We now need to focus on the overall value proposition—fuel efficiency, service, timeliness, cost—and drive down the rail industry’s impact on GHG emissions along with localized NOx and PM. That means utilizing far more clean/cleaner diesel locomotives longer. Delaying the implementation of Tier 4 locomotives signals that U.S. railroads have not prioritized emissions, and potentially invites further backlash from CARB and the EPA, something we don’t wish for.