Hydrogen: Hope or Hype?

Written by Don Graab, Triangle Brothers & Associates LLC

RAILWAY AGE JULY 2023 ISSUE: With the absence of orders for new locomotives, it is easy to conclude railroad executives are not thinking about new purchases. This is probably wrong. What is keeping railroad managers pondering locomotives are their Environmental, Social and Governance (ESG) goals. Drafted in 2019 by all Class I carriers, these ESG goals weigh heavily in current discussions. For locomotives, the focus is on “E” for Environmental.

With a few exceptions, such as highway vehicles, almost all railroad emissions come from locomotives. Unlike earlier, the focus is no longer on oxides of nitrogen (NOx) or Particulate Matter (PM) but on carbon dioxide (CO2) emissions. Often called “Green House Gases” (GHG), is the principal component, but methane and NOx are also present. CO2 emitted by diesel locomotives is directly proportional to fuel usage.

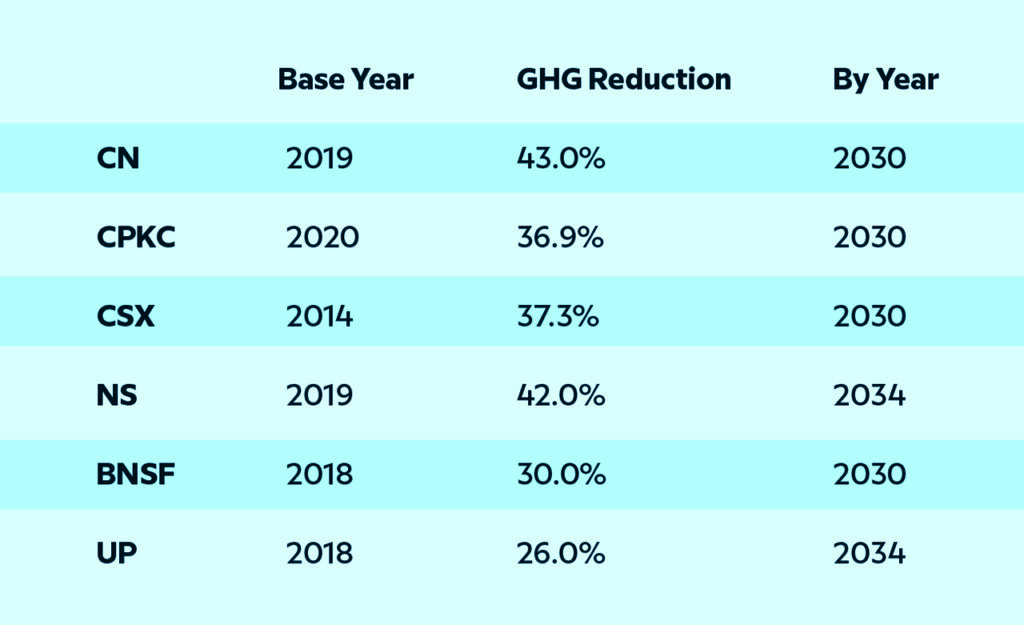

Due to their impact on warming the earth’s atmosphere and the world emphasis on reducing GHG, all Class I’s announced GHG reduction goals in 2019. Outside corporate boardrooms, little is known about how these goals were developed other than the Association of American Railroads (AAR) reports that they are Science Based Target initiatives (SBTi). The table below reflects GHG reduction goals for each major railroad:

These metrics are calculated based on total fuel consumption and are more complex than this chart reveals in that they include GHG emissions from Scope 2 (purchased electricity) and Scope 3 (purchased materials). Further, the six railroads used two different metrics to measure GHGs. CN, CPKC, CSX and NS calculate GHGs based on metric tons of CO2 per MGT (million gross ton-miles), whereas BNSF and UP estimate GHGs based on MMTs (million metric tons) of CO2, an absolute number not prorated for tonnage. This has the peculiar effect of making the metrics more positive for BNSF and UP as traffic levels decrease. The industry’s historical gains in fuel efficiency have averaged about 1% per year for more than a decade. These GHG reduction goals are quite aggressive.

As railroads think about meeting these goals, their thoughts turn to alternative fuels. Not all alternative fuels require a leap in technology. We can group alternative fuels into two categories, the first of which are biodiesel and renewable diesel (also called HVO, Hydrotreated Vegetable Oil), both of which can be implemented now. The second category is hydrogen, which is viewed as the long-term fuel of choice.

Biodiesel and renewable diesel are produced from a variety of animal and agricultural products like plant oil, animal fats and recycled cooking oil using slightly different processes. Limited volumes of biodiesel are blended with standard diesel. Engine builders are getting comfortable with higher percentages of biodiesel in locomotive fuel and have now approved 20% blends of biodiesel. Locomotives can operate on 100% renewable diesel fuel today.

There are pros and cons to both fuels. Biodiesel fuel generation produces its own carbon footprint. Compared to conventional diesel, depending on seasonality, state incentives and its evolving supply chain, Biodiesel costs more, has a lower energy content per unit volume, a shorter shelf life if not handled or stored appropriately, and is inclined to plug engine fuel filters in cold weather.

Renewable diesel requires no blending but does require the addition of lubricant. While production is increasing, the demand for renewable diesel (particularly from California) is strong, causing it to cost more than biodiesel. It is possible the airline industry, which has few alternative fuel choices, may consume all the renewable diesel produced in North America. Both these fuels could greatly aid the railroads in meeting their GHG reduction goals, but how this will play out before and after 2030 remains to be seen.

The long-term fuel solution, hydrogen, has many appealing qualities. Hydrogen burns clean in internal combustion engines (ICE), emitting only water. The fuel injection systems for natural gas can be adapted to hydrogen. Thanks to dual injection systems, we can expect ICEs to be capable of running on hydrogen or diesel. A locomotive that consumes all the available hydrogen before reaching its destination experiences a hydrogen fuel injection problem and could switch to diesel fuel.

Hydrogen is the most common element in our world, and there are multiple ways to make pure hydrogen. The most common way is an extraction method using natural gas. This steam-methane “reforming” process emits substantial amounts of carbon dioxide (CO2) and is called “grey” hydrogen. A second way is to use water and split hydrogen molecules off from oxygen (H2O) in a process called electrolysis. This requires large amounts of electricity. Ideally, this electricity comes from hydroelectric plants, solar panels or wind turbines, creating “green” hydrogen because no CO2 is released for production. Unfortunately, the supply of green hydrogen is limited by the power produced from dams, solar panels and wind turbines. “Blue” hydrogen is produced from fossil fuels, where CO2 is stored or repurposed. “Brown” or “black” hydrogen is extracted from coal using gasification.

There are two ways to power hydrogen vehicles. We have already mentioned the first method, burning hydrogen in ICEs. The second approach uses HFCs (hydrogen fuel cells), where a chemical reaction occurs between hydrogen and oxygen from the air to produce electricity. HFCs are physically stacked and electrically connected to provide current to batteries. These batteries assure a steady flow of power. HFCs have advantages over ICEs. They have fewer components and no moving parts. They do not emit trace elements of lubricating oil, nor do they create NOx from combustion.

Canadian Pacific Kansas City continues to work with partner Ballard developing an HFC locomotive, but the work is progressing slowly. Progress Rail, Wabtec and Cummins are also pursuing HFC technology but have yet to assemble a locomotive. The limitation of fuel cells today is “power density.” Today’s modern, Tier 4, 12-cylinder engines pack a powerful punch in the space they are provided on a locomotive platform. This power density has yet to be duplicated by HFCs. Even the largest locomotive frames will not accommodate a 4,500-hp fuel cell.

Hydrogen got a huge boost from the 2021 Infrastructure Investment and Jobs Act (IIJA). Major corporations like Chevron, Exxon, British Petroleum and even universities collaborated in submitting 79 concept papers to the Department of Energy for six to ten Hydrogen Hubs (a locale where hydrogen is produced, consumed and, if necessary, sequestered) for which the U.S. government is providing $7 billion in funding.

Problematic with hydrogen:

- H2 is a very small molecule. Hydrogen is the Houdini of gas molecules; it can escape from most forms of containment.

- Hydrogen embrittles conventional pipe. The suitability of pipelines for distributing hydrogen is a big unanswered question, one the European Union is pursuing.

- Hydrogen is highly flammable.

- Hydrogen gas has very low energy density. To achieve reasonable energy, hydrogen must be compressed to 10,000 PSI. One tender will be necessary for each locomotive.

- Demand from other industrial sectors such as steel and fertilizer continue to grow.

- Hydrogen is expensive—at least for now.

With hydrogen as a viable fuel for ICEs, HFC development under way and hydrogen hubs in our future, what is needed to get railroads ready for this promising fuel? In a word, infrastructure. This can be broken down into three categories: tenders, distribution and fueling. Let’s begin with tenders:

- Nothing with hydrogen is likely to occur without tenders. Our society has enjoyed the energy density of gasoline and diesel fuel in that the range of many ICE highway vehicles is 500 miles. The good news is railroads know how to specify tenders. Through the AAR’s Locomotive Committee, tender specifications have been written in recent years, first for LNG (liquified natural gas) and then for CNG (compressed natural gas). In fact, a Technical Advisory Group (TAG) is in place for this purpose. This TAG can use the proven process for involving railroads, the Federal Railroad Administration (FRA), locomotive builders, suppliers and technical experts to provide a safe, consensus-based hydrogen tender specification.

- Distribution of hydrogen is a sticky problem. The IIJA does not address distribution. If pipeline distribution isn’t practical, railroads may have to install hydrolyzer systems to produce hydrogen locally at refueling depots or default to trucks (or tank cars) for transportation. Some people are suggesting distribution of hydrogen by rail. Further investigation into hydrogen distribution is needed. This merits AAR involvement through MxV Rail (formerly TTCI) or an engineering consultant.

- Fueling presents challenges. Fueling stations will need equipment capable of compressing hydrogen up to 10,000 PSI. Such compressors exist today; however, they will require electricity and capex. At each fueling facility, there will need to be piping to convey the hydrogen gas to the tenders. And finally, there will need to be hydrogen fueling nozzles that connect to the tenders. The good news is hydrogen refueling rates can be comparable to conventional diesel fuel.

Looking at railroad ESG goals, it is not clear there is a viable path to achieving them. Railroads consume more than 4 billion gallons of diesel fuel per year. Availability of biodiesel and renewable diesel being produced at the scale required to meet the railroads’ requirements is questionable. Nor will all the problems surrounding hydrogen be solved by 2030. Yet short of electrification, hydrogen is the only vision of how railroads will achieve zero emissions. If hydrogen is to arrive in a timely fashion, here is what must happen:

- Engine builders must complete their hydrogen fuel injection systems and progress engine testing.

- AAR must expedite the tender specification. Prototype tenders must be built and evaluated. A successful tender design could be the segue for approved hydrogen tank cars.

- AAR must take the lead in the design and construction of fueling stations, which will likely include hydrolyzers, compressors, pressure vessels for storage, piping and fuel nozzles.

- The industry must ramp up in preparation for hydrogen fuel before HFC locomotives arrive by introducing hydrogen with ICEs. This strategy affords time to work out the tender, distribution and fueling issues. Dealing simultaneously with new HFC locomotives, hydrogen tenders and fueling is a recipe for trouble, intensifying the capital requirements.

Railroads need to push the advancement of both hydrogen ICEs and HFC locomotives now. For locomotives with Internal Combustion Engines, this should not require ordering new units. Pursuing hydrogen ICE locomotives will reduce GHG emissions earlier with or without the successful introduction of HFC locomotives. This approach allows more time to develop the hydrogen infrastructure while avoiding dependency on so many technology projects converging successfully at the right time. This approach smooths out the need for capital in the future.

There is no obvious industry drive to make hydrogen a viable fuel. Granted, the goal is to be carbon-neutral by 2050, but the most recent fuel conversion, from steam to diesel, took two decades, and time is already short for railroads operating in California.

In closing, note that there are few new ideas. Did you know that a Welsh judge named Sir William Robert Grove invented the hydrogen fuel cell in 1839? Further, NASA’s Gemini and Apollo spacecraft of the 1960s used hydrogen fuel cell technology for the on-board production of electricity and water.