UP and Soroban: CN Déjà Vu All Over Again

Written by William C. Vantuono, Editor-in-Chief

Just when you thought things were getting really interesting in the railroad industry, along comes another hedge fund trying to grab hold of a Class I, turn it upside down and shake it violently, hoping current leadership falls out (perhaps drifting away on a platinum parachute).

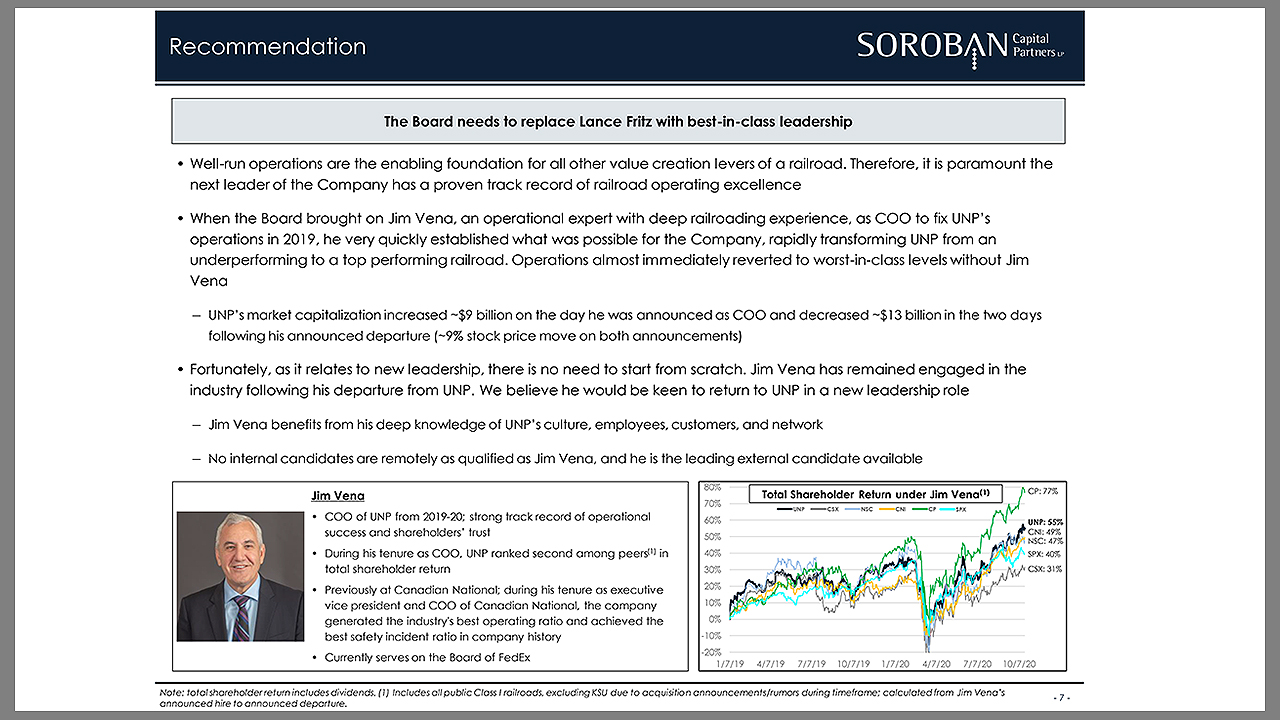

This latest Wall Street-induced drama has strong shades of hedge fund TCI’s cancelled bid to take over CN in 2021 and replace then-CEO JJ Ruest with former CN and Union Pacific COO Jim Vena, 63, during the Canadian Pacific vs. CN battle to acquire Kansas City Southern (which CN lost). This time it’s Soroban Capital Partners, which in a 43-page presentation to UP’s board of directors (download below) said Vena should replace Chairman, President and CEO Lance Fritz immediately. UP countered by revealing an “active leadership succession planning process” that has been under way since March 2022.

This battle, however, is a bit different than the CN saga. Soroban says, at least for now, it’s not looking for a proxy fight. It merely wants to send Fritz, 59, packing and replace him with Vena. Let the games begin.

“Following discussions between the Board and Mr. Fritz regarding the path for identifying Union Pacific’s next CEO, in March 2022 the Board engaged a leading outside consultant and subsequently formed a task force of directors composed of each of the Board committee chairs in November 2022,” UP said in a Feb. 26 announcement. “The Board is seeking a CEO with a strong track record of success and expertise across safety, operational excellence, enhancing and driving customer service, innovation, employee culture and sustainability. The Board is focusing the process on highly qualified candidates both within the industry and adjacent industries to identify a CEO capable of leading the company for a long-term tenure. The Board expects to name a successor who will assume the position in 2023.”

UP added it “has considered shareholder input and will continue to do so. The Board has been actively engaging with Soroban Capital Partners since 2017. In recent conversations, Soroban indicated it intended to move discussions to a public level. The Board decided it is in the best interests of all shareholders to provide a public update on its ongoing succession process and expected timing.”

In “moving discussions to a public level,” Soroban, which holds a ~$1.6 billion stake in UP, pulled no punches excoriating Fritz and portraying Vena as a savior who will deliver “~$18 EPS and ~$400 stock price by 2025” at UP. Under Fritz, a 22-year UP veteran who assumed the CEO post in 2015, “UP has repeatedly and significantly failed to reach its potential,” Soroban said. Borrowing from TCI’s now-closed CN playbook, Soroban said UP “has the best rail franchise in North America. Despite this, under current leadership, UP has been the worst–performing Class I railroad, ranking the worst in every key railroad operating metric: safety, volume growth, revenue growth, cost management, EBIT growth, and total shareholder return. Key constituents have understandably lost confidence in Lance Fritz’s ability to lead the company. Shareholder returns have been the worst in the industry.”

There’s much more: “Employees are disgruntled: Among all S&P 500 companies, UP is rated by employees as the worst place to work and has the lowest employee CEO approval rating (ranked 500th out of 500 in both). The company is not delivering on its commitment to customers, and the Surface Transportation Board has singled out UP as providing the worst service among the Class I railroads. The U.S. economy needs an efficient rail network to flourish, as railroads are the lifeblood of the U.S. economy. UP, one of the largest and most interconnected transportation assets, has the most inefficient rail network, which has exacerbated the U.S. supply chain crisis. The environment is negatively impacted, as UP is not fulfilling its potential as a decarbonization enabler. Lance Fritz has continually failed to meet the annual incentive compensation targets set by the Board. Simply put, UP is not reaching its potential as North America’s best Class I railroad. Management’s poor track record results in the company not reaching its full earnings power and trading at a meaningful discount to its Canadian railroad peers and other high-quality industrial companies, thus significantly impairing shareholder value creation.”

“Shareholder value creation.” If I had a dollar for every time I heard that phrase, I could retire. In any case, Soroban’s criticisms are a contradiction in terms. If Union Pacific is “North America’s best Class I railroad,” how can it be as miserable a company, “the worst-performing Class I railroad,” as the hedge fund says it is? Doesn’t make much sense, does it? (And by the way, what is a “decarbonization enabler”? A ten-syllable phrase for “green”? Another example of euphemistic language, like calling used cars “previously owned transportation.”)

Another a contradiction in terms: Soroban said UP’s Board “needs to hold Lance Fritz accountable for UP’s failures and replace him,” but that “ultimately, the need to replace Lance Fritz is not personal but about elevating the interests of the company and its key constituents above those of management. UP deserves better leadership.” Sounds rather personal to me, don’t you think? Trust me, almost everything is personal. Lance Fritz would have to have skin as thick as an alligator not to be insulted. He doesn’t deserve to be publicly crucified.

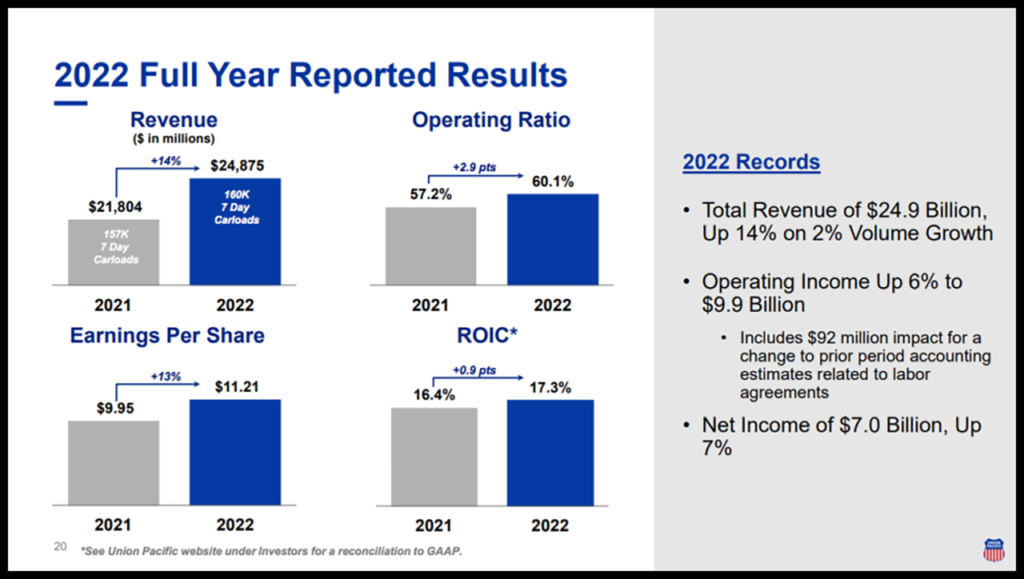

Take a look at UP’s 2022 results. For full-year 2022, the railroad reported operating revenue of $24.9 billion, an increase of 14% over 2021 “driven by higher fuel surcharge revenue, core pricing gains and volume growth.” Business volumes grew 2%. The railroad said its 60.1% reported operating ratio deteriorated 290 basis points from 2021. “Higher fuel prices negatively impacted the operating ratio by 20 basis points and the prior period adjustment related to new labor agreements added 30 basis points to [the] operating ratio.” Operating income for 2022 came in at $9.9 billion, a 6% rise over 2021.

UP’s 2022 capital program totaled $3.4 billion. That’s the number that really matters in this long-term, capital- and labor-intensive heavy industry we call “railroading.”

Let’s put things in perspective. Yes, UP’s 2022 operating ratio of 60.1% was 290 bps over 2021’s 57.2%, but in my humble opinion, 60.1% is pretty darned good. By comparison, BNSF’s 2022 OR was 68%. Just goes to show you that a sub-60% OR really doesn’t matter. We don’t see Warren Buffet and Charlie Munger banging their heads against the wall, do we? “The cult of OR,” as analyst Tony Hatch calls it, is just that: a cult. And lots of people, investors included, have been led off the edge of a cliff by cult leaders.

Care for another perspective? Here’s Railway Age Contributing Editor Jim Blaze, who delights in being a “contrarian”:

“The announcement requesting UP leadership change doesn’t suggest how the change is going to execute the suggested operational improvements. That has to be a series of day-to-day operating tradeoffs. What would the top three, as an example, be? And how would each change the predicted operating margin (or operating ratio) profitability vs. safety, free cash flow, and the projected dividend payout? Right now, it’s sort of ‘faith and vagueness’ pitch. Is this one-person mission leader change the cult of Jim Vena hero worship?

“The UP announcement ignores the fact that a large portion of the existing Board obviously supported the Fritz-led initiatives. Why would they simply now abandon their loyalty? After all, they just likely reaffirmed the UP action plan for 2023 back in November/December. So why the rush to change? Why not wait and see if the announced Norfolk Southern changes work first? If so, then adapt quickly.

“Finally, let’s remember how previous outside board raids like that for CSX prior to 2017 turned out. As I recall, it didn’t. There were lots of assertions and presentations, but no fundamental change until Hunter Harrison showed up with his change management PSR approach. I’m not taking a pro or con UP change stand. I’m just asking questions.”

Railway Age Capitol Hill Contributing Editor has a different take: “Lance Fritz’s persistent eyeglass twirling while being grilled in December by Surface Transportation Board members probing UP service failures smacked of him already formulating an exit strategy and certainly not being fully engaged, despite the gravity of the formal hearing. His seeming disinterest certainly didn’t escape those attending the hearing and others watching via live streaming—or, presumably, the five quite serious STB members. How, one might wonder, would Fritz—or any CEO—respond to an underling sitting before them in a formal setting and casually twirling their eyeglasses while being quizzed about a workplace faux pas that was affecting the stock price?”

It seems to me that UP is trying to call Soroban’s bluff, just like CN did—successfully—with TCI, eventually installing Tracy Robinson as CEO (the second woman to run a Class I after Katie Farmer, our 2022 Railroader of the Year). “The Board is grateful to Lance for his unwavering leadership, dedication and oversight in driving our company forward over the past eight years as CEO,” said Michael McCarthy, Lead Independent Director of the Board. “Lance created an environment that has allowed Union Pacific to make a measurable impact with our customers, communities and employees alike. He has capably led our company during a time of significant challenge and change, positioning Union Pacific to deliver long-term sustainable value for shareholders and customers. We are immensely grateful to have Lance’s continuing leadership and support and know he will ensure a smooth transition.”

As for Lance Fritz, he has taken the high road:

“It is my honor and privilege to serve this great company. I am proud of our team and all we have built together. I’ve always said that our fundamentals for long-term success are powered by our people—our best-in-class employees and the passion they have for our customers and communities. Union Pacific has embarked on a transformative journey that will result in stronger, more consistent service for our customers, with enhanced earnings growth and value creation for our shareholders (there’s that term again!). Union Pacific has been my home for 22 years, and I am confident that now is the right time for Union Pacific’s next leader to take the helm. I look forward to working with the Board as we identify our next CEO to lead the company into the future.”

Who that will be is anyone’s guess. It could be Jim Vena, someone at UP, or someone from outside the industry we’ve never heard of, as what happened at CSX. Joe Hinrichs, who came from Ford Motor Company to lead CSX, has gotten off to a good start with a few refreshing changes, like instituting paid sick leave for unionized workers, and working out (with Norfolk Southern) a deal with Amtrak to get a few passenger trains running between New Orleans and Mobile, after a year of legal battles and endless, stultifying STB hearings.

I’ll conclude with one of my favorite non-sensical Sir Humphrey Appleby (Yes Prime Minister) pronouncements, this one on management: “The traditional allocation of responsibilities has always been so determined as to liberate the incumbent from the administrative minutiae by devolving the managerial functions to those whose experience and qualifications have better formed them for the performance of such humble offices, thereby releasing their overlord for the more onerous duties and profound deliberations, which are the inevitable concomitant of their exalted position.”