Consolidation Breeds Volatility

Written by David Nahass, Financial Editor

FINANCIAL EDGE, RAILWAY AGE, MARCH 2024 ISSUE: Most rail professionals don’t devote time to ocean freight rates or shipping industry consolidation.

Sure, there was plenty to discuss when the water outside the Port of Long Beach turned into the world’s most expensive parking lot. (Apologies to Harry Reid International Airport, but 882 private jets at the Swiftie-enhanced Super Bowl LVIII party can’t compete with 109 container ships.) Rail industry professionals are mostly concerned with what happens when the containers on those ships get hooked up to a locomotive.

During the past seven or so years there has been consolidation in ocean freight shipping. A crowded field of competitive shipping companies has seen consolidation from roughly 20 into the hands of six to eight.

Governments and executive branches flitter between a laisse-faire approach to consolidation in a specific industry and wanting to protect consumers from the potential market impact when too much market share is consolidated in limited suppliers. All one must do is watch the European Union and Federal Trade Commission look for ways to grab Google by the horns as if it were all that difficult to download a Firefox browser or to select a DuckDuckGo search engine. Usually, big fines are paid and imperceptible changes are made.

As a result of these mergers, ocean-borne freight rate pricing power, while still responding to the supply and demand pressures of the global economy, is significantly consolidated in the hands of this particular group of companies. Let’s call them “Oceans 8.”

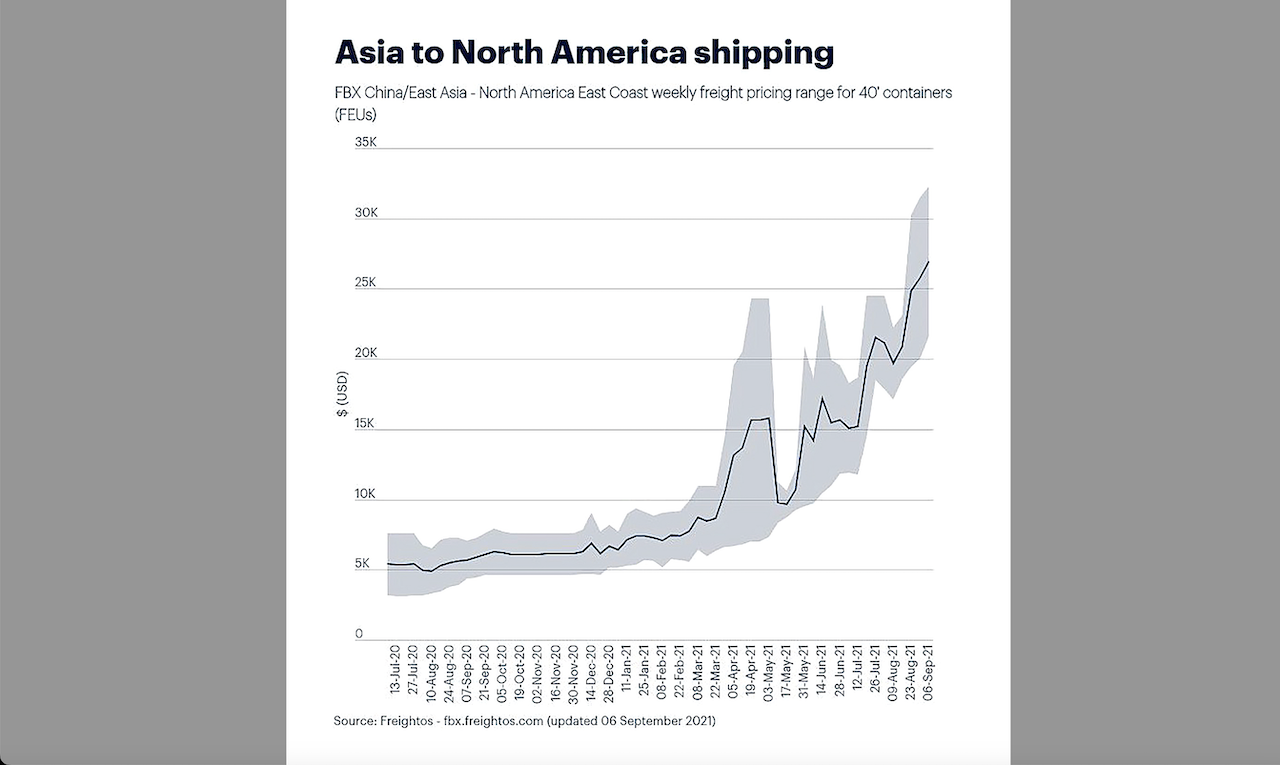

Jefferson Clay, Vice President of Sales for Cargo Services, Inc. (who also outlined the shipping industry consolidation history), described the volatility and pricing power of rates before, during and after consolidation. Clay notes that the pre-pandemic freight rate for a 40-foot box from Shanghai to Long Beach was roughly $1,200. Early in the pandemic, that rate fell to $800. Post-COVID hibernation, the rate rose astronomically to above $20,000, according to The Wall Street Journal and Reuters. January 2024 rates were $1,500, but the Red Sea crisis and Lunar New Year have pushed those rates to $3,000.

To subvert Federal Maritime Commission rules, the Oceans 8, Clay notes, formed collusive alliances to increase rates. As no racketeering ring is perfect (like The Sopranos), global economic softness creates a circumstance where price collusion doesn’t always mean high profits. Even today, the Oceans 8 can’t agree on whether ship capacity is under- or over-supplied.

Why the discussion on freight rates and shipping companies? After all, this is Railway Age, not Marine Log. The connection to Clay came from a rail industry veteran who suggested that railcar manufacturing was in the same place as the shipping market following consolidation.

The suggestion is that consolidation of most manufacturing (for a high economic barrier of entry business; e.g., railcar manufacturing and international shipping) into the hands of a couple of companies allowed for two (heretofore uncommon) paths in the new railcar market: manufacturing caps and price control.

The Federal Reserve tracks a producer price index (PPI) for rolling stock, railcar parts and maintenance-of-way equipment. This PPI starts to increase at a higher clip after the consolidating impact of the 2019 sale of the American Railcar Industries manufacturing assets to The Greenbrier Companies.

This does not mean that the business of railcar building is immune to the forces of economics. The ARCI (American Railway Car Institute) number for 4Q23 orders was an incredibly low 4,164 (that’s only 16,656 annualized). But as the railcar industry has built just below the rate of replacement for the past four years, a low order number is more worrisome than the anomaly of 16,194 in 2Q23.

In the October 2023 Railway Age “Financial Desk Book,” the concept of supply inelasticity related to railcar manufacturing was introduced. This is another angle on the same theme. If the Fed Railcar PPI is compared to the index that tracks the price of moving a 40-foot box from Shanghai to Long Beach, there is a clear increase in volatility that follows shipping company consolidation.

From the consumer perspective (and this is the point), when price starts to disconnect from demand, the market changes. While it is not a guarantee that this happens in the railcar manufacturing space, it feels like the potential is there. When all the other salient factors that have been impacting railcar pricing (supply chain, commodities, labor, etc.) become less impactful or less volatile parts of the landscape, supplier consolidation will still mean something.

Got questions? Set them free at [email protected].

![Balsa 91 transits the Fort McHenry Channel [Key Bridge Response 2024 Unified Command photo by U.S. Army Corps of Engineers Visual Information Specialist Christopher Rosario]](https://www.railwayage.com/wp-content/uploads/2024/04/Balsa91-315x168.jpg)