UP 3Q22: ‘Positive Strides’ Despite Challenging Year (UPDATED, Cowen)

Written by Marybeth Luczak, Executive Editor

“As we close out 2022, we will maintain strong price discipline while improving efficiency and service to capitalize on the available demand,” UP Chairman, President and CEO Lance Fritz said. (Photograph Courtesy of UP)

Union Pacific (UP) “made positive strides in the third quarter to increase network fluidity and better meet customer demand,” UP Chairman, President and CEO Lance Fritz said during an Oct. 20 earnings report.

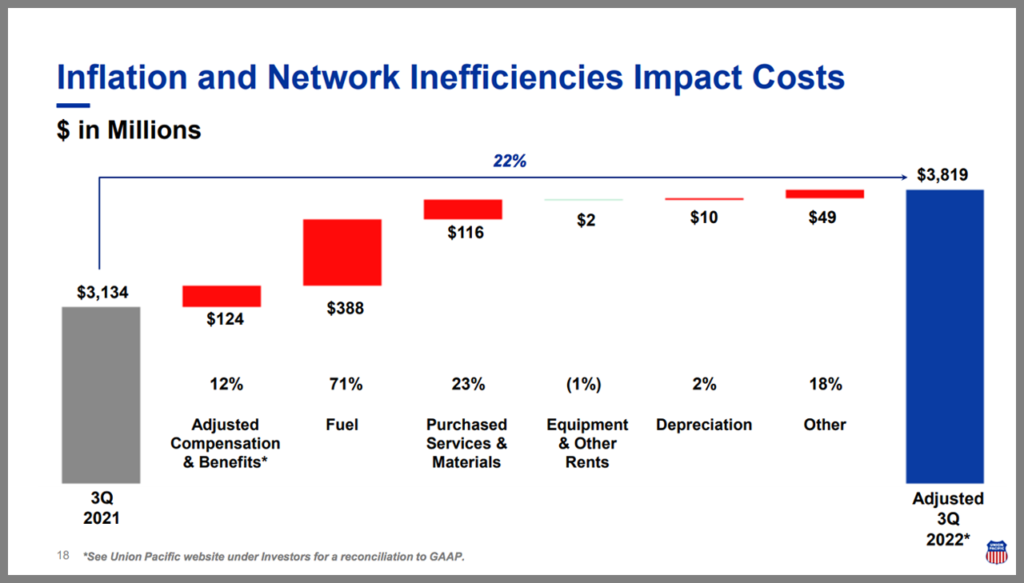

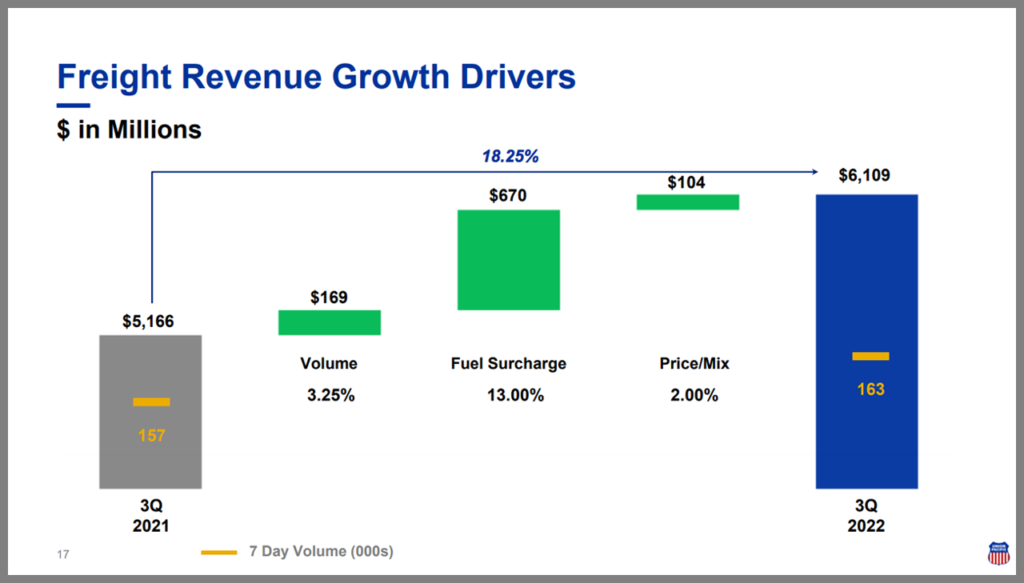

“Inflationary pressures and operational inefficiencies continued to challenge us,” he said. “We reported strong revenue and operating income growth in the quarter through increased fuel surcharge revenue [up 13% from third-quarter 2021], volume gains [up 3.25% from third-quarter 2021] and solid core pricing [price/mix up 2% from third-quarter 2021]. “As we close out 2022, we will maintain strong price discipline while improving efficiency and service to capitalize on the available demand.”

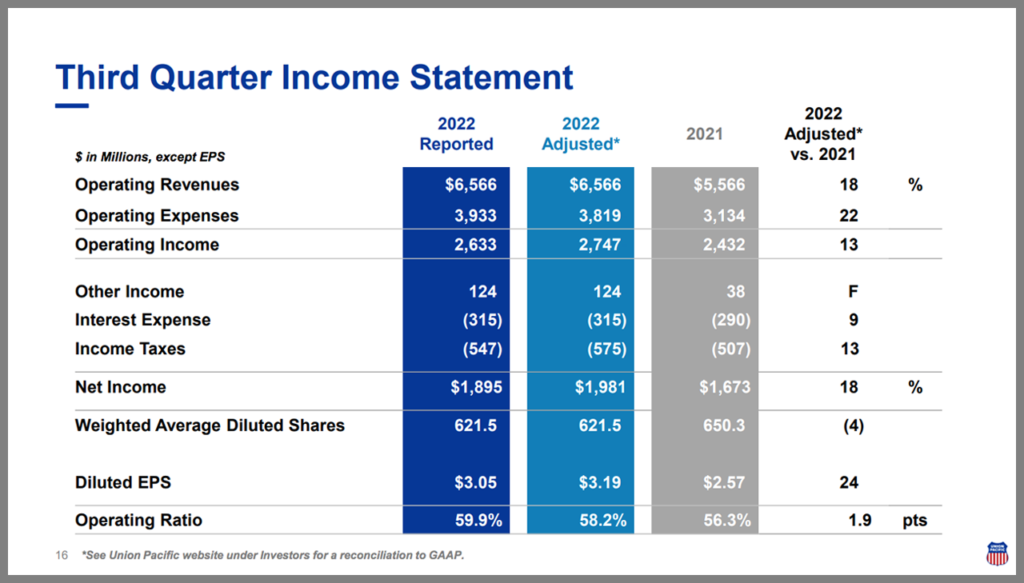

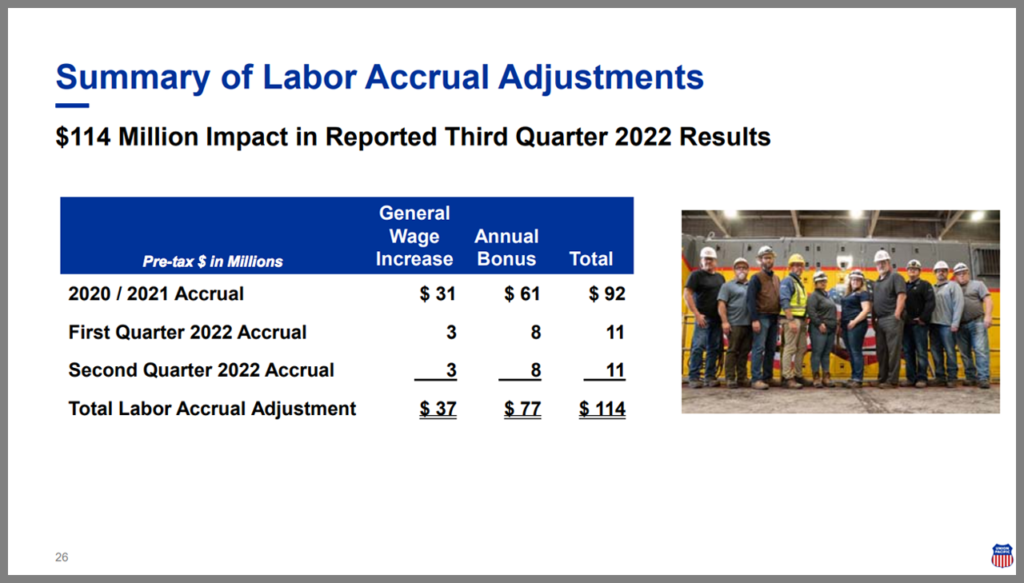

UP posted third-quarter 2022 net income of $1.895 billion (or $3.05 per diluted share), which the Class I railroad said “includes a $114 million charge for a change to prior-period accounting estimates related to new, tentative and ratified labor agreements.” Excluding the effects of that charge, adjusted third-quarter net income came in at $1.981 billion (or $3.19 per diluted share), up 18% from third-quarter 2021’s $1.673 billion (or $2.57 per diluted share).

Among the Class I railroad’s other third-quarter 2022 results:

- Operating revenue of $6.6 billion was up 18% from third-quarter 2021, “driven by higher fuel surcharge revenue, volume growth and core pricing gains,” according to UP.

- Business volumes, as measured by total revenue carloads, were up 3% from third-quarter 2022.

- Operating ratio came in at 59.9%. Excluding the previously mentioned charge, UP said the adjusted operating ratio of 58.2% deteriorated by 190 basis points. It noted “lower fuel prices positively impacted the operating ratio by 70 basis points.”

- Adjusted operating income of $2.747 billion was up 13% from the prior-year period’s $2.432 billion.

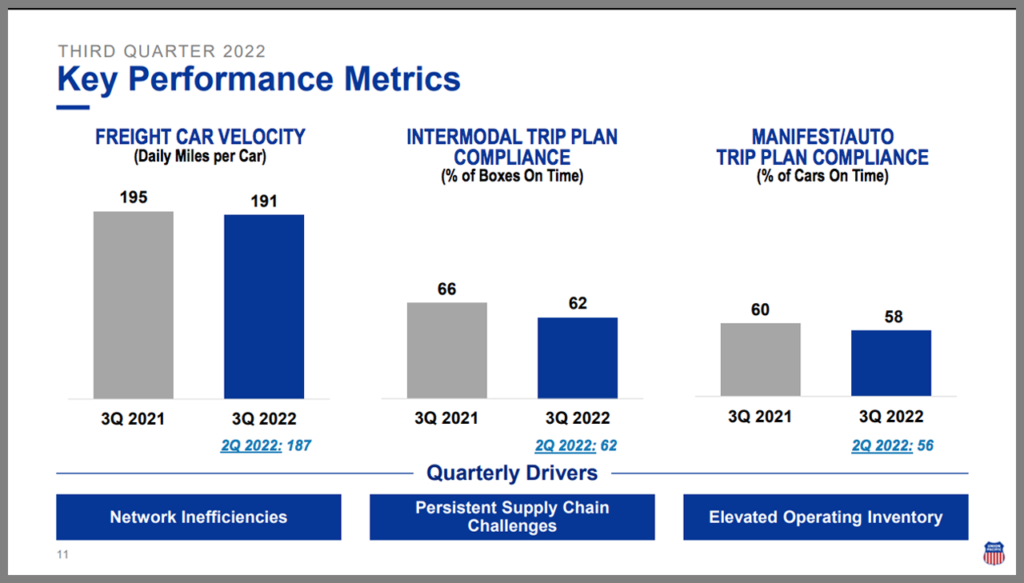

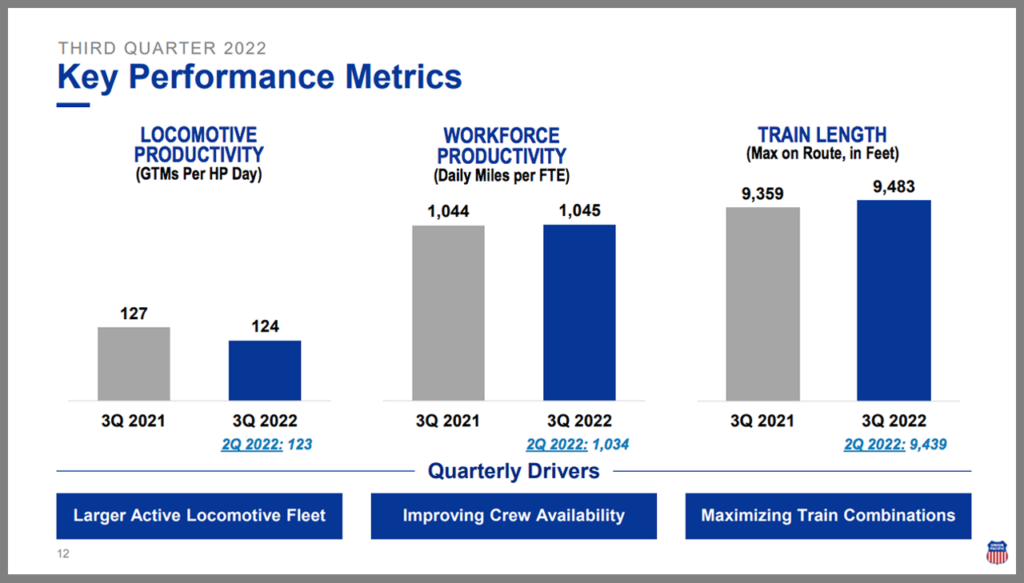

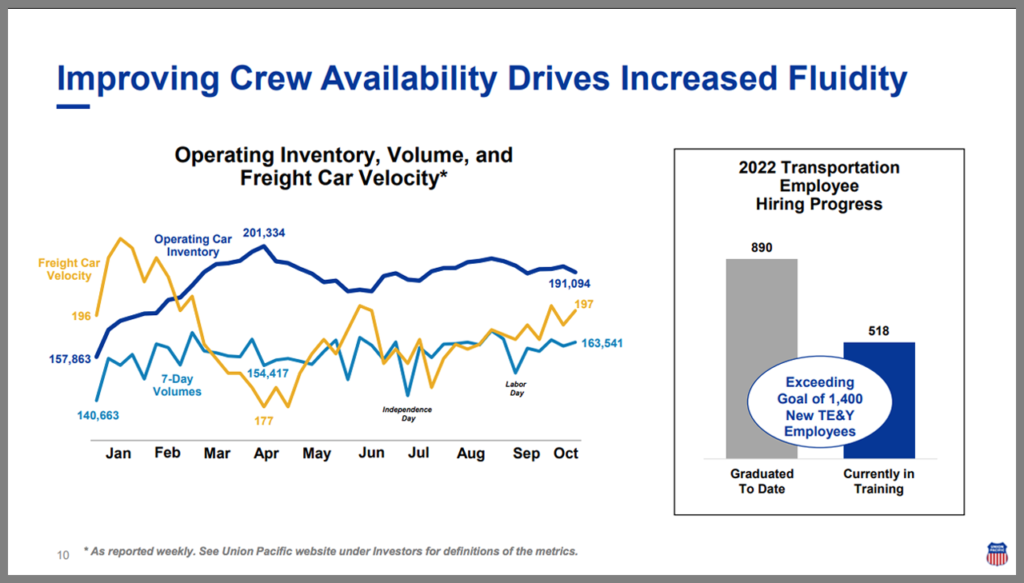

In terms of operating performance, UP reported a 2% decline in both quarterly freight car velocity (191 daily miles per car) and locomotive productivity (124 gross ton-miles/GTMs per horsepower day) from third-quarter 2021. Average maximum train length increased 1% to 9,483 feet. Additionally, quarterly workforce productivity of 1,045 car miles per employee was flat with third-quarter 2021, and the fuel consumption rate of 1.056 (measured in gallons of fuel per thousand GTMs) improved 1%. UP said its year-to-date reportable personal injury rate improved 20% to 0.80 per 200,000 employee-hours compared with 1.00 for year-to-date 2021.

2022 Outlook

Reflecting a “challenging year,” UP said it updated its full-year carload growth to approximately 3%, reported operating ratio to around 60% and capital spending to $3.4 billion. It affirmed “pricing gains in excess of inflation dollars.”

The Cowen Insight: ‘Is 3rd Time a Charm? ’23 Outlook Revised Down Again’

“UP again revised its financial outlook lower as rail congestion continues and inflationary costs pile up; we believe margins will stay under pressure,” reported Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “UP continues to believe in its ability to price above cost inflation and is expected to show improved network fluidity in the coming year. Price target to $204.”

Key Cowen Takeaways:

• “UP reported third-quarter adjusted EPS of $3.19, which excluded a $114MM impact to the third quarter relating to labor accruals. Adjusted operating ratio (OR) in the quarter was 58.2%, missing our forecast by approximately 200 bps, and was 190 bps worse than third-quarter 2021. Management attributed the margin pressure (labor accruals was already backed out of this) to high inflation and network inefficiencies. Decreasing fuel prices and the two-month lag in fuel surcharge favorably affected OR by 70 bps and added $0.37 to the bottom line.

• “Third-quarter volumes increased 3% year-over-year (y/y) as rail service continues to inhibit volume growth, slower than UP anticipated when it revised its guidance for the second time in the June quarter. Coal and renewables grew 5% reflecting energy strength and new contract wins, and industrial volumes grew 4% with both chemicals/plastics and metals/minerals leading the group. Domestic intermodal declined 3% due to softening consumer demand and a 16% decline in parcel shipments; we believe domestic intermodal volumes and pricing may be challenged given OTR rates and the well-documented inventory pile up. International intermodal volumes were +4% and management stated it is seeing the percentage of traffic on the West Coast tick upward, as more freight may be shifting back from East to West (this, of course is coming after the Port of New York and New Jersey overtook Los Angeles/Long Beach for the largest U.S. container port title).

• “UP addressed the lengthy labor negotiation process and provided a breakout of the labor accrual adjustments, which were largely in line with the PEB recommendation, while not including the $1,000 bonus payments. There is clearly some more negotiating to do with the unions, given the quick rejection from BMWD and four other unions that are out for ratification votes, and do see a scenario, albeit unlikely, that there is a rail strike in November. Regardless, wage pressures in 2023 will likely have a negative impact on OR next year all other things being equal.

• “UP revised its full-year financial outlook lower (the third time the company has done so in ’22), bringing volume growth assumptions to +3% for 2022, down from 4%-5%, citing network fluidity that clearly has limited the rails ability to capture volume growth; we model modestly below management’s guidance given UP’s inability to achieve its volume targets this year, while monitoring our rail-share data that puts UP volumes +5.0% quarter-to-date. Management revised its OR guidance to approximately 60% (non-adjusted OR) which does include the $114 million in labor accruals and assumes continued labor inflation in the fourth quarter.

• “We maintain our 2022 EPS estimate of $11.70 while lowering our 2023 EPS estimate to $12.00. Continuing to use our 17x multiple and our new EPS estimate, our price target goes to $204. Reiterate Outperform.”