TD Cowen’s 2024 Rail Preview

Written by Jason Seidl, Matt Elkott, Elliot Alper and Uday Khanapurkar, TD Cowen

“While rail bridge closures at Eagle Pass and El Paso affect approximately 45% of UP’s cross-border business, we expect the impact on overall volumes to be minimal due to quick resolution of activity,” TD Cowen analysts report. (Union Pacific Photograph)

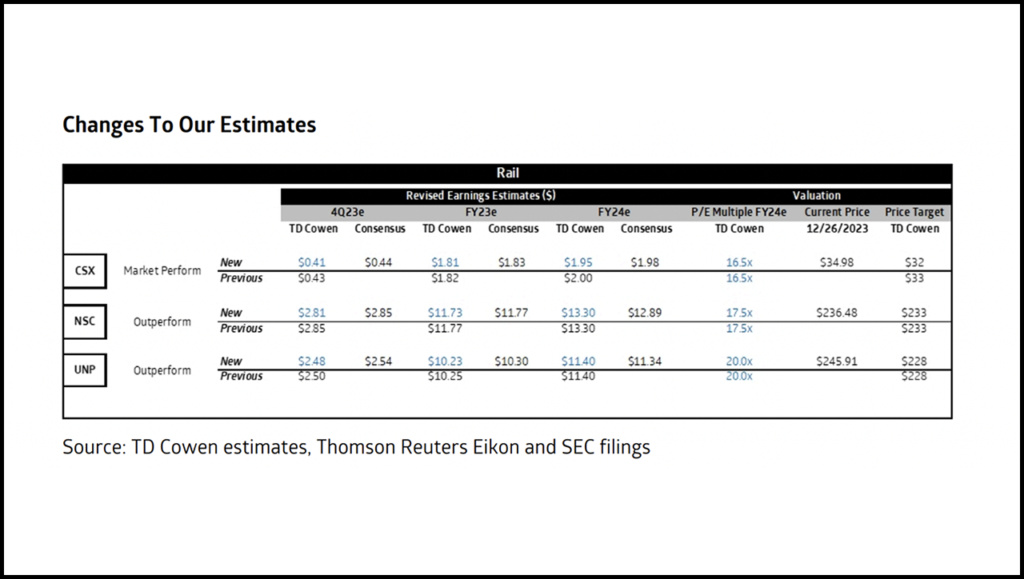

We modestly lower our fourth-quarter 2023 estimates on mix pressures that are likely to be somewhat mitigated by fuel tailwinds. Intermodal recovery comes at the price of yield given the protracted over-the-road (OTR) rate trough. A revenue per carload rebound is likely a late-2024 story, at best. First-quarter 2024 should see typical seasonal softening, which is well understood as the focus shifts to recovery. We favor Union Pacific (UP) and Norfolk Southern (NS) in 2024 on margin recovery prospects.

Where We Stand

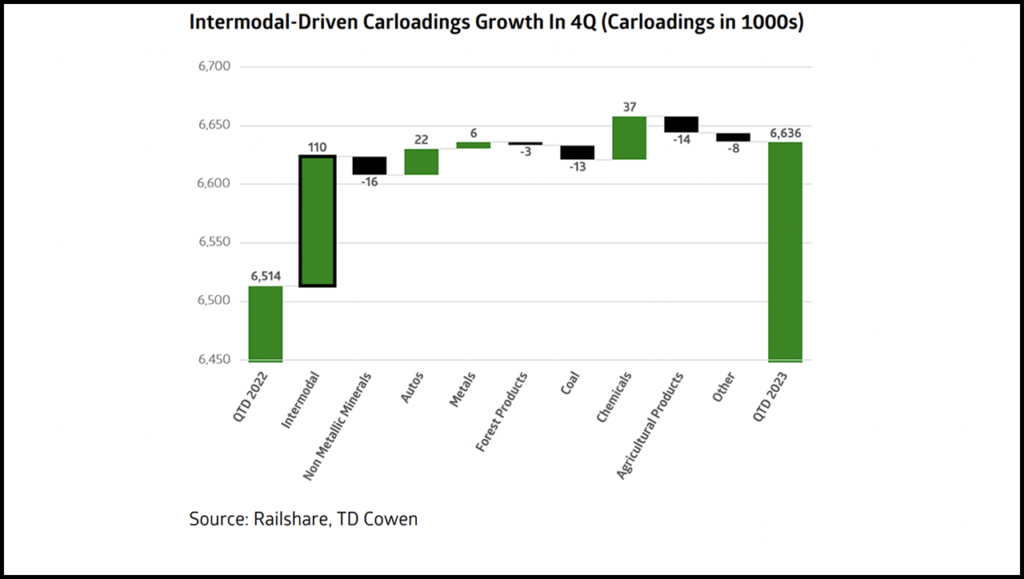

While carloadings continue to track below 2019 levels, the fourth quarter has seen a 1.9% year over year (y/y) increase in quarter-to-date (QTD) volumes driven by a notable 3.4% y/y increase in QTD intermodal volumes. Class I’s have rationalized intermodal pricing to claw back market share in our view as OTR rates continue to bounce along an elongated trough—even showing some unseasonable albeit modest deterioration in the fourth quarter. We continue to expect pressured intermodal pricing through the first half of 2024. Present intermodal volume gains are coming from international business that we note tends to have lower yields, generating some negative mix effects in the quarter.

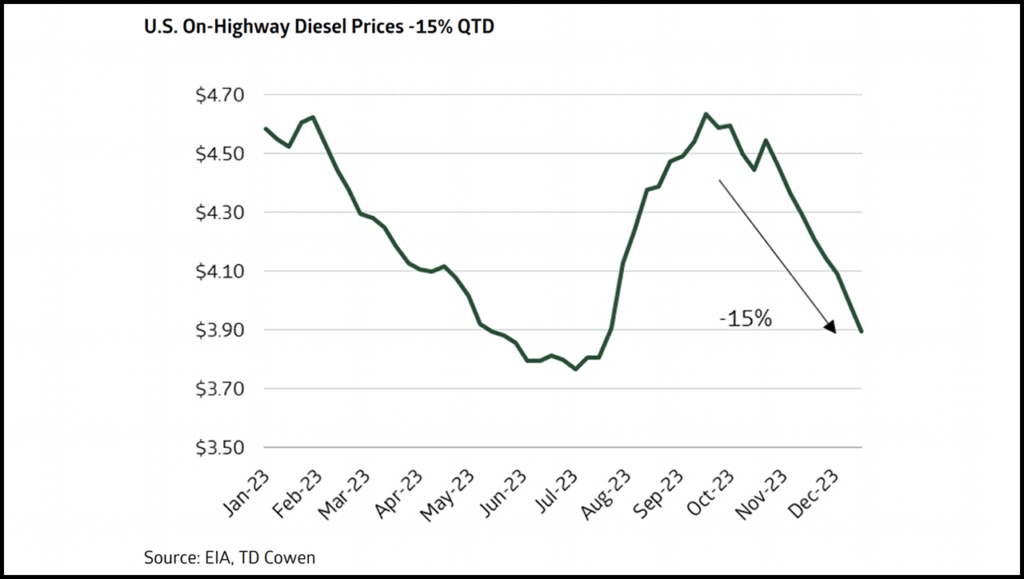

Cost pressures continue for the Class I’s on accrual costs arising out of labor deals with the unions, and intermodal volume surge should generate elevated purchased services costs. NS should see operating expenses step up in the fourth quarter (contrary to prior guidance) in our view as the eastern Class I continues to see elevated re-crew rates and associated costs in the fourth quarter following two tech outages in the previous quarter, but we expect it to revert to normal entering the new year. We see cost pressures for the group being mitigated by fuel tailwinds with diesel prices –15% QTD driving fuel expense down while surcharges are pegged at higher third-quarter levels, leading us to modestly improve fourth-quarter operating ratio (OR) estimates.

We anticipate volumes will soften in-line with seasonality heading into first-quarter 2024 and see tepid ex-intermodal carload growth for the group in the year (barring NS, which should lap derailment and tech outage headwinds this year). Given the uncertain macro-backdrop, we do not believe the volume outlook given by the carriers on fourth-quarter earnings calls will be strong. That said, Class I’s appear well positioned for intermodal volume growth in 2024 given increased staffing levels, though material top-line uplift hinges on OTR rate recovery and is likely a late 2024 story at best.

Estimate Changes and Stock Takeaways

We adjust our fourth-quarter estimates down slightly on mix-driven top-line pressure, partially mitigated by fuel tailwinds. Typical seasonal volume softening is expected heading into the new year and is well understood.

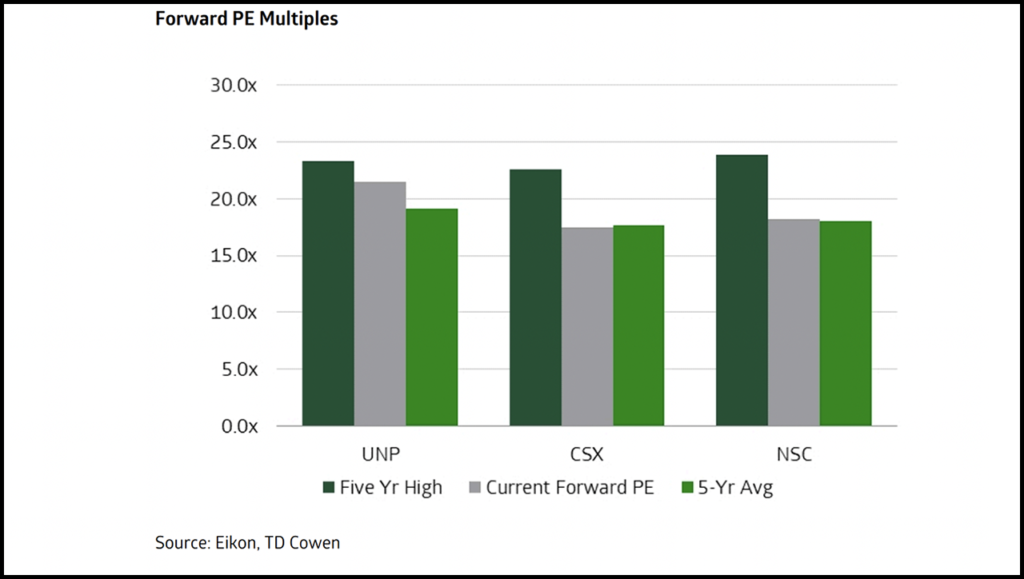

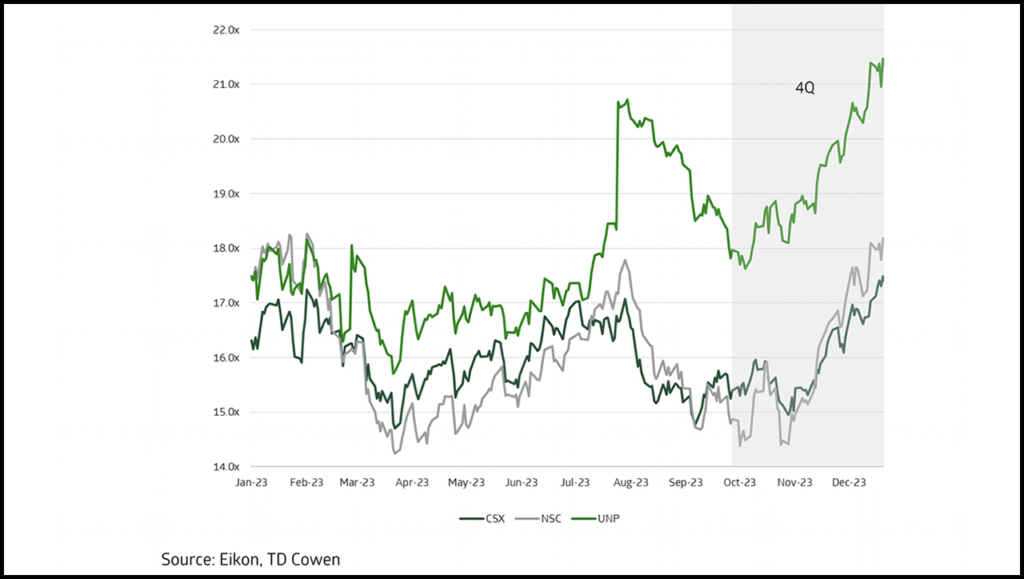

We again leave multiples for the Class I’s intact. We see the railroads’ fortunes dependent on an intermodal rate recovery that is likely a late 2024/early 2025 story, while acknowledging that investor interest in the Class I’s is trending higher as the focus turns to the other side of this freight recession.

For 2024, we remain constructive on UP as *CEO Jim Vena’s operating plan, reminiscent of PSR (Precision Scheduled Railroading), should drive efficiency improvements, as well as on NS with the eastern Class I lapping derailment and tech-related service issues. Indeed, long-term investors are looking at the railroads as the group has spent all of 2023 with a pricing vs. rail inflation differential at a 20-year bottom. As contracts roll over and trucking prices recover, we believe this relationship will begin to favor the railroads more.

Fuel Dipped as Sharply as it Spiked

Following a rapid spike in the third quarter, on-highway diesel prices reversed course once again dropping –15% QTD, nearing early third-quarter lows. Lower diesel prices should be a slight tailwind for the fourth-quarter Class I earnings due to the four-to-six-week lag in fuel surcharge revenues, which should tick up sequentially (though still down y/y). Volume growth in the fourth quarter has been primarily intermodal-driven and fuel surcharge lags on this business tends to be low. Y/Y intermodal volume comparisons remain favorable until Week 36 in early third-quarter 2024.

Mexico-US Rail Bridge Closures Impact Should Be Minimal

Customs and Border Protection resumed operations at Eagle Pass and El Paso crossings following an approximately five-day closure in response to migrant inflows. While rail bridge closures at Eagle Pass and El Paso affect approximately 45% of UP’s cross-border business, we expect the impact on overall volumes to be minimal due to quick resolution of activity. The two entry points see large shipments of autos and beverages (beer).

Class I’s remain confident on cross-border intermodal offerings noting that new services are not only operating on truck-like delivery times but also recording 90%-95% on-time performance. We are encouraged to see cross-border intermodal service quality remain robust through the fourth-quarter surge in international volumes.

Protracted Tensions at Suez, Issues at Panama Canal Could Benefit West Coast Ports

Ocean carriers have been forced to restrict passage through the Suez Canal in response to attacks by Houthi militants in Yemen. Restrictions on ship sizes passing through the Panama Canal that were applied in late August also remain in place due to low water levels. With these restrictions in place, both the Suez and Panama arteries are now permitting limited throughfare. While it is too early to tell if geopolitical tensions will remain elevated for a protracted period of time given naval operations presently under way, international trade flow could shift to transpacific lanes benefiting the West Coast ports volumes (Los Angeles and Long Beach, Calif., in particular) in that event. Shippers are already in the process of moving previously diverted freight back to the West with Los Angeles and Long Beach inbound TEUs (twenty-foot equivalent units) +25% and +37% y/y in November, respectively. We note to investors that effects of volume diversions should be offset by the countervailing benefit of increased length of haul.