TD Cowen: Still Searching for Positives in Near-Term

Written by Jason Seidl, Matt Elkott, Elliot Alper and Uday Khanapurkar, TD Cowen

At TD Cowen, we are lowering our rail estimates ahead of third-quarter earnings reports to reflect a very challenged environment. Leaders in the rail and logistics market who attended our latest Railroad Happy Hour” called the current outlook “bleak,” with growing uncertainty in 2025.

Rail volumes quarter-to-date are below 2022 and 2019 (pre-COVID) levels, and labor, diesel, weather and other headwinds should lead to operating ratio (OR) pressure in the third quarter. Cautious sentiment was shared among rail management teams at our recent Transport Conference, and we look for material uplift in over-the-road (OTR) pricing before domestic intermodal can find its footing.

Where We Stand

Carloadings in the third quarter continue to reflect a very challenged environment, and rail volumes continue to track below 2019 (pre-COVID) levels. Weakness has been led by Forest Products (down 11% quarter-to-date) and Intermodal (down 7% quarter-to-date); overall volumes are down 4% so far through the third quarter.

OTR rates that continue to putter around trough levels have put material pressure on intermodal volumes and rates this year. With a notable rebound in OTR rates now likely a back-half 2024 story, we expect intermodal to continue to feel pressure into the fourth quarter, though acknowledging favorable comps.

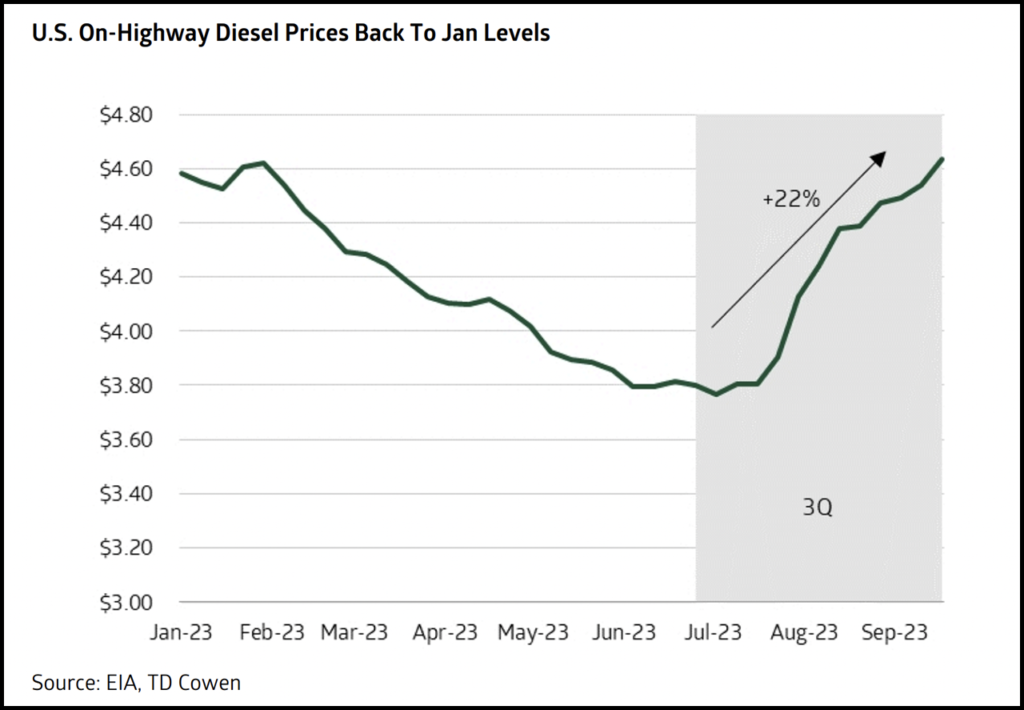

Coming out of our conference where C-level executives from three U.S. Class I railroads attended (CSX, Norfolk Southern and Union Pacific), cautious near-term sentiment is expected to weigh on third-quarter results. Weather challenges on the West Coast (Hilary) impacted UP, a tech outage for NS that is expected to come with material expenses, and diesel up 22% quarter-to-date has worked against the railroads. This all presents headwinds for OR in the third quarter, and we worsen our margin outlook for all three names.

The railroads are finally fully staffed, though material volumes have not come back onto the network; management teams at our conference doubled down on their stance of not furloughing employees (aside from UP’s very small furlough) given the economics of hiring and training, and this too will weigh on profitability in the second half.

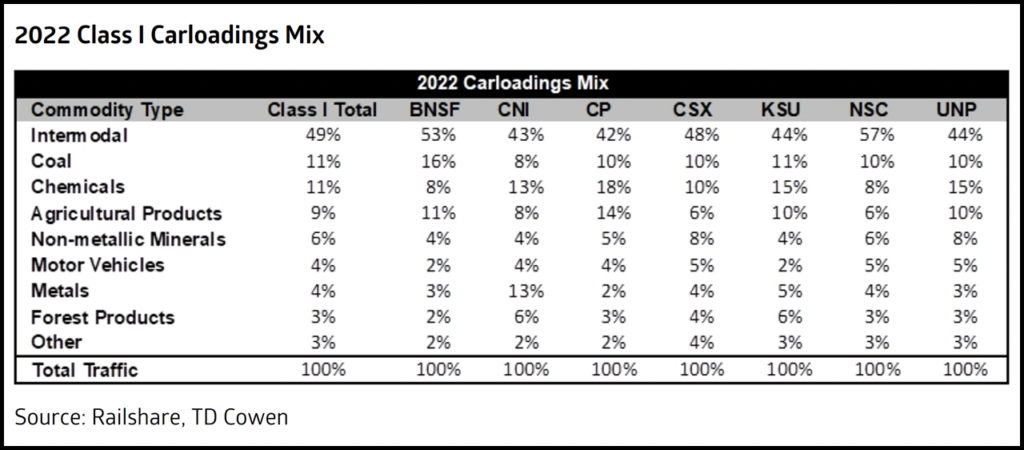

We remain skeptical of a fourth-quarter volume rebound, with management consensus pointing to another muted peak season. (Investors should note it is muted despite easy year-over-year comps.) One tailwind is the U.S. Department of Agriculture expects the 2023 crop season should be the second largest in history; agricultural products represent 9% of total Class I carloadings.

Auto Strike

Starting Sept. 15, approximately 13,000 United Auto Workers (UAW) went on strike at three auto plants (Ford, GM, Stellantis) after auto companies did not meet a deal with the union by the deal expiration late Sept. 14. New reports suggest that additional plants in the U.S. may go on strike Sept. 22 if material progress is not made in negotiations. The bottom line is that auto carloadings only account for 4% of total volumes on the rail network, so we believe there to be little financial impact for the Class I’s, assuming the strike does not last for a prolonged period. A protracted strike, however, could negatively impact the group given auto traffic is up 13% in 2023.

The Big 3 auto makers are 30%-40% of auto volumes on the NS network, and approximately 50% of auto volumes on the CSX network. The chart above shows 2022 carloadings volume by segment, highlighting insignificant volumes associated with the strike, under the assumption that there will be resolution in a relatively timely manner.

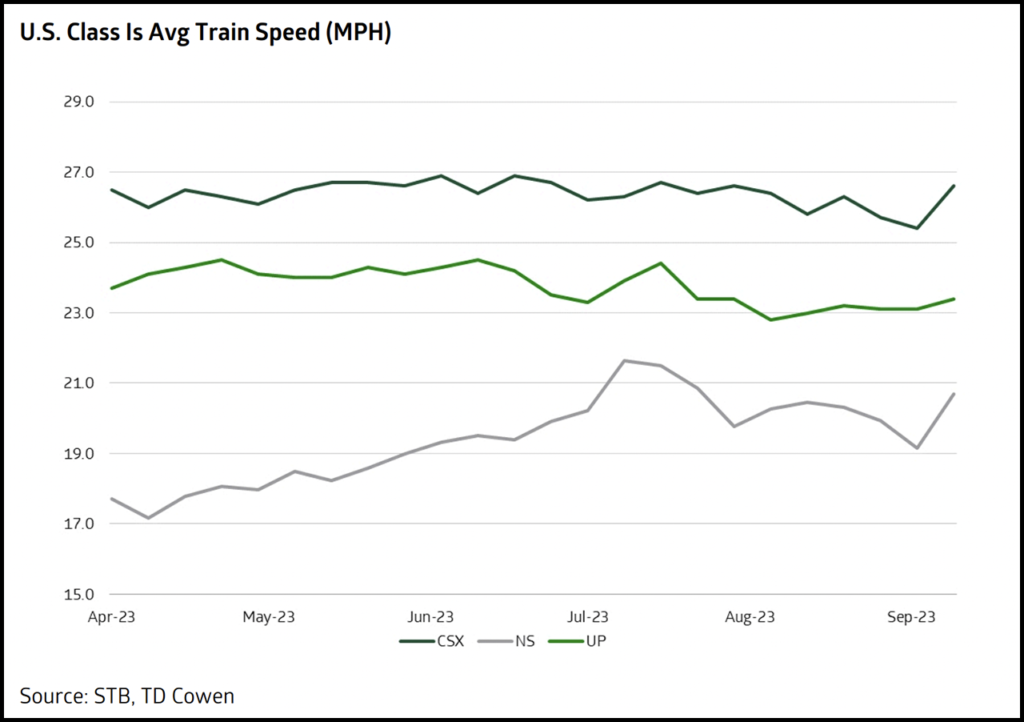

Service Faced Snags in 3Q23, Though Remains Improved Y/Y

Class I railroad service remains materially improved over the last year but faced some challenges from inclement weather in the quarter. Service quality on the CSX network remains robust.

The UP network faced a brief snag in California following hurricane Hilary as repairs were required at an important bridge. Service at the bridge was restored promptly.

While NS has largely resolved service issues related to the East Palestine, Ohio, derailment, a tech outage in late August impacted operations for a 12-hour period, which hit service consistency and added costs. NS had previously called out $40 million-$50 million of service costs slated to leave the system in the third quarter, though this take out has likely been pushed out into the fourth quarter.

Fuel Spiked Up in Q3, Up 22% QTD

After slipping through most of 2023, on-highway diesel prices reversed course sharply in the third quarter and are now hovering back near levels seen at the start of the year. Quarter-to-date diesel price per gallon is up 22%. This increase in fuel prices should be a significant headwind to third-quarter railroad earnings. Fuel surcharges lag behind rising fuel expenses by a four-to-six-week period in nearly every end market barring intermodal (for which lags have been trending lower). Fuel headwinds should be greatest in the third quarter and then moderate in the fourth quarter as surcharges materialize absent any further unexpected shocks to fuel prices through the second half.

Reciprocal Switching

The Surface Transportation Board (STB) earlier this month introduced a new reciprocal switching rule proposal linking eligibility to service metrics including trip plan compliance, transit times and local service. As we wrote in our previous note, we believe the new rules are materially less onerous than envisioned in the 2016 proposed rules. On average, the Class I’s service metrics tend to exceed the stipulated minimum requirements though we note that there is considerable variation in service metrics across shippers in the network. The rulemaking process is still in the early stages with a comment period open until late November, and we will continue to track developments. In general, what we see thus far is much better than we had initially feared.

Estimate Changes

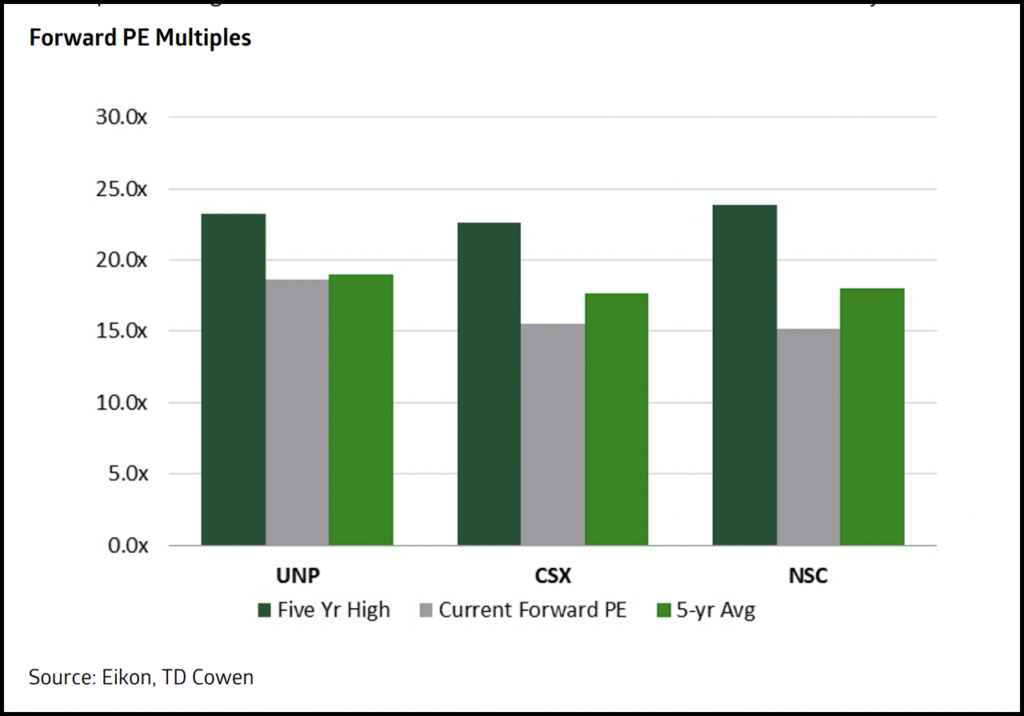

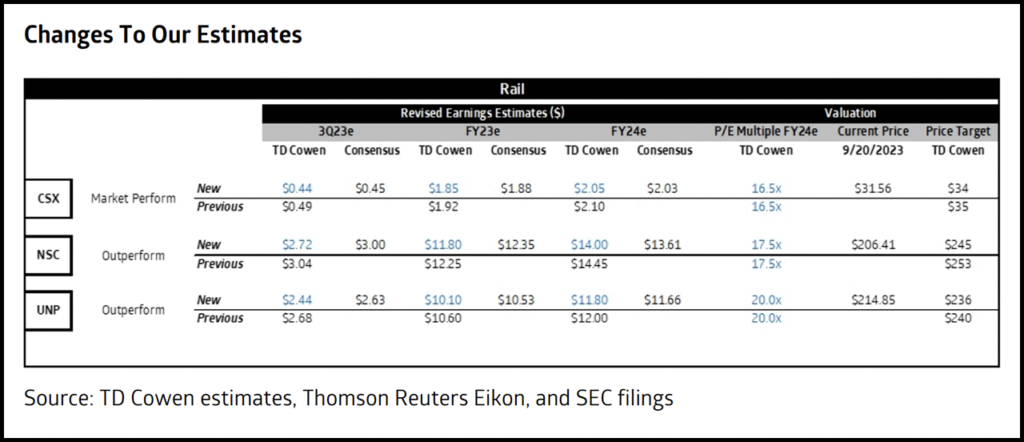

We adjust third-quarter estimates downward on continued demand side weakness, service hiccups and the unexpected resurgence of fuel headwinds. Peak season expectations are mixed at best and signs of delayed TL market recovery continues to drag on domestic intermodal.

We leave multiples for the Class I’s intact as we wait to see how adjustments to the railroads’ operating plans shake out as we exit the current freight recession.

‘Railroad Happy Hour’ Report

At TD Cowen’s latest “Railroad Happy Hour,” leaders in the rail and logistics market struck a very somber tone for the fourth quarter and peak season. Intermodal markets remain challenged and IMCs are setting low expectations into peak. Commentary is potentially a near-term negative for U.S. railroads, freight forwarders, and IMCs such as J.B. Hunt and the Hub Group.

Key Takeaways:

- The current market outlook was very weak, and panelists do not expect a peak season. The consensus among panelists was that things are not looking promising for the fourth quarter, and peak season has not taken any material form. The railroads normally roll out peak season surcharges that they have not seen yet because of the light volume environment. One panelist shared a recent conversation with a large IMC who did not have good things to say about the fourth quarter—intermodal outlook remained bleak. Fuel is also beginning to factor into shippers decisions, with a $3,000 cross-country shipment now adding a $1,500 fuel surcharge. One positive note was the fall corn crop is expected to be a record (as we have previously written) that should support some ag shipments in the back half of the year. One logistics panelist does not believe there will be any freight uptick in 2024 and is looking to Chinese New Year of 2025 for a turnaround (this is the most negative commentary we have heard thus far among industry contacts).

- The Less than Container (LCL) market is very weak and is disconnected from the Full Container Load market (they are usually strongly correlated). Our IMC panelist estimates that ocean rates on the Shanghai to Long Beach lane would have to double (to approximately $5,000) for shippers to find value in shipping via LCL instead of booking full containers. This should be a near-term negative for ocean forwarders.

- Panelists confirmed our belief that new service-linked reciprocal switching rules are significantly less burdensome than prior proposed rules. The Class I’s should achieve the minimum service requirements with relative ease. Short line panelists highlighted that Class I’s could also outsource low service operations to them to avoid switching.

- The Federal Railroad Administration is reportedly pursuing safety inquiries quite aggressively following recent hazmat incidents. At this stage, safety-related regulations are not expected to generate capex impacts for the Class I’s, though we note that the regulatory environment certainly still appears fraught with some potential issues as we look into the future.

- Industrial development inquiries continue to hold strong. One panelist noted that a number of plastics and chemicals shippers are exploring options to be directly served, but highlighted that it is uncertain at this stage whether the rail network possesses sufficient locomotives and crew resourcing to satisfy this demand. Commentary indicates that consistent high-quality rail service will be necessary for Class I’s to capitalize on industrial development trends. We also note that industrial development is a long-term story, likely generating gains in 2025 and beyond.