TD Cowen 1Q24 Earnings Preview

Written by Jason Seidl, Matt Elkott, Elliot Alper and Uday Khanapurkar, TD Cowen

Norfolk Southern Lamberts Point Terminal Pier 6. NS photo.

We adjust our models as we head into Q124 earnings–a slow start to the year due to harsh weather was followed with a rebound and U.S. carloadings turning positive YTD, led by intermodal growth. Panelists on Suds With Seidl (“Railroad Happy Hour”) spoke to improved rail service in 2024. The activist battle heats up at NSC and the tragic collapse of the Baltimore bridge has forced CSX and NSC to start rerouting freight.

Where We Stand

Severe weather led to a soft start to rail carloadings in 2024 (which was widely discussed during 4Q calls in January), though carloadings have picked up since and are now up 2.5% YTD. Intermodal carloadings lead the group at 8.6% growth in the U.S. through the third week of March. Non-metallic Minerals and Products is the largest decliner, down 8.8% YTD. BNSF is seeing the largest carloadings growth so far this year at 5.6%, led by intermodal at 18.7%. Despite the welcomed rebound, volumes are still 4.1%% below 2019 levels. The U.S. Class I’s look for a lever for top line growth as freight rates have broadly declined and rails work to improve service to win business back onto the network.

Panelists on our recent Railroad Happy Hour spoke to chemicals, paper and bulk segments rebounding (or, at the very least, finally finding a bottom) after having a soft 2023. Our energy panelist has seen downward pressure on demand with natural gas prices sitting at multiyear lows. His outlook remains fairly bleak as wells are coming offline and crews are sitting idle. Two panelists highlighted that NSC is addressing some challenges in the Northeast and going after some new business (waste), which it hasn’t showed in the past.

While intermodal carloadings have seen strong growth YTD, IM carriers at conferences have pointed to a very challenging start to the bid season, and we expect intermodal rates to remain under pressure, especially given the lack of inflection in the OTR rate market. We expect IM rates to take another step downwards through bid season and will likely not see a pricing rebound until 2025. We note that import data has been strong in February; loaded imports at the Port of LA were up 64% in February (primarily due to easier comps). LA/LB (which accounts for 40% of U.S. imports) has seen 12% growth in February vs. February 2019. An intermodal and drayage carrier on our recent Trucking Happy Hour is seeing a modest shift from the East to West Coast ports, which we have previously noted, though Class I’s we have caught up with have not called out any material shifts.

1Q Rail Shipper Survey

Activist Fight Heats Up at NSC

Ancora and NSC have exchanged a steady flow of public messaging ahead of their shareholder meeting scheduled for May 9. Recently, NSC announced the strategic hire of John Orr, in exchange for: (1) $25MM cash, and (2) several operational concessions. NSC updated 2H OR guidance that is better than consensus forecasts, and long-term guidance that is 140bps better than previous LT outlook, at a minimum. The sub-60% OR target was topped by Ancora shortly thereafter, who stated they could see an OR of 57% within three years. Ancora reaffirmed its management strategy (Barber and Boychuk), and at this point in the process, we take long-term targets with a grain of salt. We ultimately think that Ancora’s demands are not an “all or nothing” proposition and believe the most likely outcome of the proxy fight will be a deal that meets somewhere in the middle. We look for the opinion of ISS as an upcoming catalyst, which we expect to be in late April.

Baltimore Bridge

The tragic collapse of the Francis Scott Key bridge off the Port of Baltimore has resulted in a pause on vessel traffic into the Port. While the Port is one of the country’s smaller ports (20th largest in the country) with ~560K import TEUs done in 2023 vs LA/LB’s 4.4MM, it is one of the top ports for certain autos and export coal. CSX is the main rail network in the region and the Class I has informed customers of delays in coal shipments. Rerouting freight is already under way, which may result in regional impacts though they should not be a material impact to the overall economy. CSX and NSC stated that they are adding a new dedicated route to move diverted freight into the Port of New York and New Jersey. NSC now expects between $50MM-$100MM in lost revenues from the Baltimore bridge collapse in Q2.

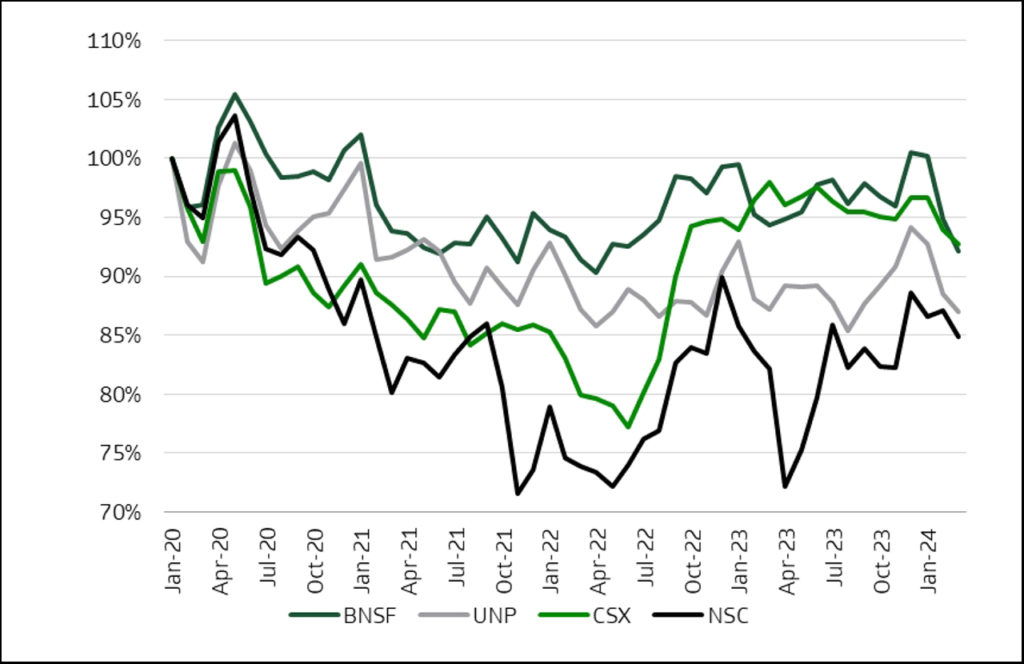

Rail Service

Short lines at our recent Railroad Happy Hour acknowledged that improved service on the rail network has supported volumes in 1Q and average train speed for the Class I’s indicates that harsh weather had a relatively muted impact on service. Through 1Q, CSX retained the top spot for velocity (a lead that emerged mid 2022) followed by UNP and lastly NSC, which has seen velocity recover, lapping derailment and tech issues, but still lags peers. UNP noted recently that its internal service metrics on the intermodal network have reached a level where customers do not complain about service. Early 2Q could see short-term pressure on CSX and NSC car velocity on account of the Baltimore bridge accident as volumes reroute (likely to NY/NJ, Norfolk) affecting scheduling in the near term.

We see sustained service levels as a positive for the Class I’s long-term ability to price ahead of inflation as bids proceed this year (~50%-60% of the rails’ book is repriced in a year, primarily in 4Q and 1Q) although conversion-related volume benefits are likely to materialize beyond 1H. T&E headcount for the U.S. Class I’s grew 4.4% y/y in 2023 and at a higher clip than the ~3% y/y growth in QTD, thus bringing headcount up double digits over 2022 levels. This indicates that Class I’s are adequately resourced to maintain and even improve service levels going forward, absent shocks. On our Rail Shippers’ Survey, 45% of participants indicated that service needs to remain robust for two consecutive quarters for OTR conversion to occur, while 21% cited a full year of improvement needed. In the near term, cheap TL rates could keep some service-sensitive shippers in the TL market (where service tends to be highly on time and consistent).

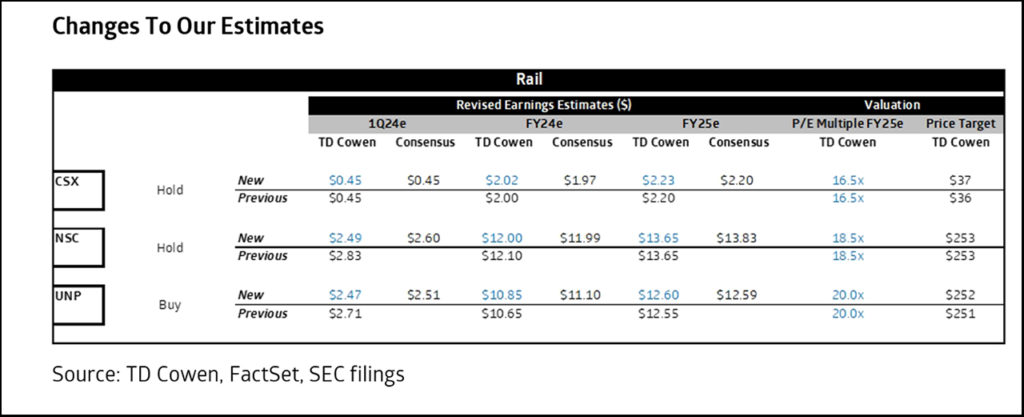

NSC announced preliminary 1Q results on April 9, and the company expects 1Q adjusted EPS of $2.49, below the consensus figure of $2.60. We note that consensus estimates were likely to come down as analysts fine-tune estimates ahead of earnings to a range similar to the prelim $2.49. Adjusted OR of 69.9% was in line with management’s previous margin commentary on Q1. NSC will incur a $600MM settlement charge (which they will GAAP out) in Q1 due to the East Palestine derailment in 2023. We note this settlement is higher than previous significant derailments that involved fatalities (while East Palestine did not have any fatalities). The charge will be a drag to GAAP earnings of $2.26 in Q1.