NS 1Q24 Prelim Results Reflect East Palestine Settlement (Updated Following NYSE Close)

Written by William C. Vantuono, Editor-in-Chief

““Norfolk Southern is becoming a more productive and efficient railroad. There is still work to be done to achieve industry-competitive margins and our target of a sub-60% adjusted operating ratio in 3-4 years and we are taking all the right steps to deliver on our promise.” – President and CEO Alan Shaw

Norfolk Southern on April 9, 2024, released preliminary 1Q24 results that include the impact of a $600 million “agreement in principle” to resolve a consolidated class action lawsuit relating to the East Palestine derailment. The preliminary numbers, released simultaneously with the settlement announcement, come 15 days ahead of the company’s April 24 first-quarter earnings call, and one month before the May 9 shareholder’s meeting in which a proxy vote prompted by activist investor Ancora Holdings is scheduled.

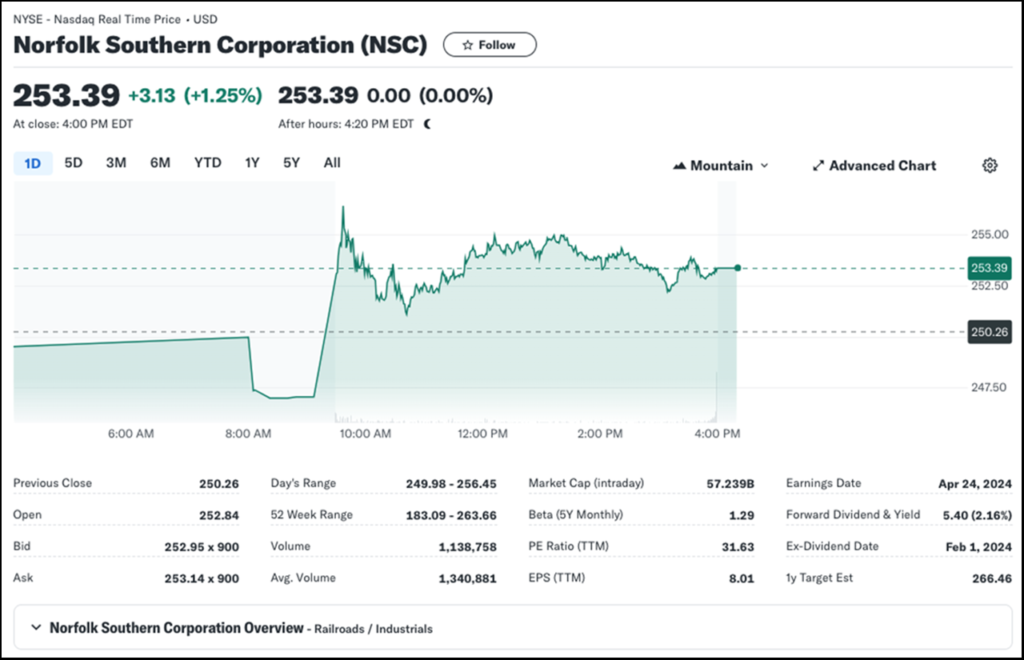

The announcements did not negatively impact NS share price. After closing the previous day at $250.26, NS shares opened on the New York Stock Exchange at $252.84 and closed at $253.39, for a modest 1.25% gain.

NS’s preliminary GAAP results also include charges associated with its “involuntary and voluntary separation programs that will eliminate management positions, as well as costs associated with the recruitment of a new Chief Operating Officer, expenses associated with shareholder matters, and a deferred tax adjustment.”

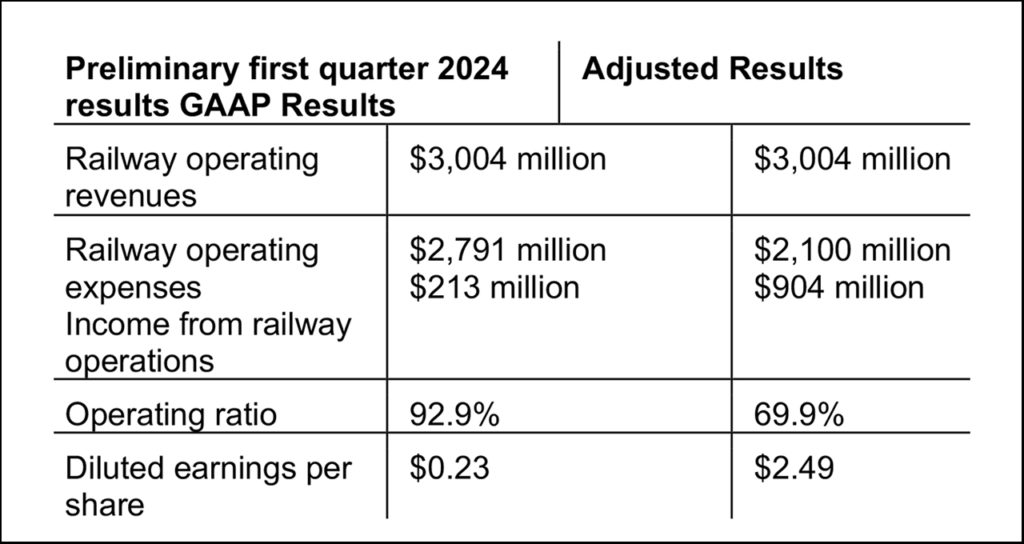

Collectively, these expenses increased railway operating expenses by $691 million to $2.8 billion (reducing income from railway operations by the same figure to $213 million); increased operating ratio by 2,300 basis points to 92.9%; and reduced diluted earnings per share by $2.26, to $0.23, compared to preliminary adjusted results. Non-GAAP preliminary adjusted results include railway operating expenses of $2.1 billion; income from railway operations of $904 million; an OR of 69.9%, and diluted EPS of $2.49. Both sets of calculations are based on preliminary railway operating revenues of $3 billion.

NS said it is “reaffirming its full-year 2024 adjusted operating ratio guidance improvement, including a 400-plus basis points OR improvement in the second half,” and provided a progress update on “actions to close its margin gap with peers.”

Volumes grew 4% in the quarter, but revenues dropped 4% “due to RPU (revenue per user) headwinds primarily from lower fuel surcharge and the continuation of adverse mix along the patterns we experienced in 4Q23,” NS said. “Additionally, lower Intermodal storage fees, persistent pressure in Domestic Intermodal RPU from over-capacity in the domestic truck market, and lower seaborne coal prices were headwinds to RPU in the quarter. While there were also adverse mix impacts within Merchandise, our laser focus on strong core pricing, supported by considerably improved service, helped deliver all-time quarterly records for revenue less fuel and revenue per unit less fuel in our Merchandise markets.”

“In the first quarter, we delivered an adjusted operating ratio in line with our guidance, which called for a seasonal increase of 100-200 basis points sequentially from the fourth quarter,” said NS President and Chief Executive Officer Alan H. Shaw. “We achieved this result despite macroeconomic challenges and the continued impact of our revenue mix being weighted towards lower-rated traffic, including international intermodal, which continues to be a significant driver of volume growth. We are encouraged that our non-GAAP margin improved each month throughout the quarter. Looking ahead, we have strong momentum in our effort to achieve a full year 100-150 [OR] basis points improvement, including 400-plus basis points of year-over-year improvement in the second half of the year.

“Norfolk Southern is becoming a more productive and efficient railroad. There is still work to be done to achieve industry-competitive margins and our target of a sub-60% adjusted operating ratio in three to four years, and we are taking all the right steps to deliver on our promise. Our recently appointed Chief Operating Officer, John Orr, is executing Precision Scheduled Railroading principles and accelerating our operational improvements, which are already yielding positive results. We are moving with urgency, and we are confident in our ability to achieve our near- and long-term operating and financial targets.”

NS added that it, in response to the March 26 Francis Scott Key Bridge collapse in Baltimore, it “is taking proactive steps to mitigate supply chain disruptions and ensure uninterrupted service for customers. Leveraging ours extensive franchise footprint and strategic partnerships with ocean carriers, short line railroads, East Coast ports and other transportation providers, we are collaborating with customers of all commodity types. Already, we’ve launched a new dedicated service to facilitate the flow of freight between the Elizabeth Marine Terminal at the Port of New York and New Jersey and the Seagirt Marine Terminal in Baltimore. Despite ongoing mitigation efforts, and depending on the duration of the port outage, we expect there to be a $50 to $100 million impact on revenue in the second quarter.”