Shipper Survey Indicates ‘Significant Concern’ Over NS Takeover Attempt

Written by William C. Vantuono, Editor-in-Chief

Norfolk Southern photo.

Little Rock, Ark.-based analyst Stephens Inc. on April 4 released the results of a survey, Rail Shipper Survey on the Activist Campaign at NSC, conducted with Norfolk Southern shippers that indicates a “consensus view” that they are “supportive of the current NSC plan and fearful the activist [Ancora] plan would result in a deterioration in service.” Questions related to CSX were included.

The report, whose results were collected through Survey Monkey (which was used for “distribution of questions and anonymous collection of results”), was compiled by Analyst Justin Long and Associates Brady Lierz and Collin Nieman. The analysts noted that they believe the responses “are largely driven by past disruptions during the expedited implementation of PSR, and to be fair, this activist campaign is being proposed as a multi-year operational change (vs. a ‘quick fix’). However, rail shippers are skeptical at this time.”

Stephens said it conducted the survey “as a timely exercise, given the increasing level of activity/commentary from both parties* ahead of the May 9 shareholder vote (scheduled for May 9) … We estimate the respondents collectively manage ~$25 billion of annual transportation spend.” At the same time, Stephens disclosed (as required by federal law) that it “maintains a market in the common stock” of both Norfolk Southern Corp. and CSX Corp. as of the date of the report, “may act as principal in these transactions, and expects to receive or intends to seek compensation for investment banking services from [both railroads] in the next three months.”

“The vast majority of shippers participating in our survey support NSC’s strategic plan, with 86% choosing this approach over the activist plan (the remaining 14% were indifferent),” Stephens reported. “We believe this is partially being driven by memories of prior activist campaigns at Class I railroads, some of which involved service disruptions during the implementation of PSR. And while the activists have stated a priority of its leadership slate is delivering dependable, high-quality service to customers (at committed levels), the initial response from most shippers has been skepticism.”

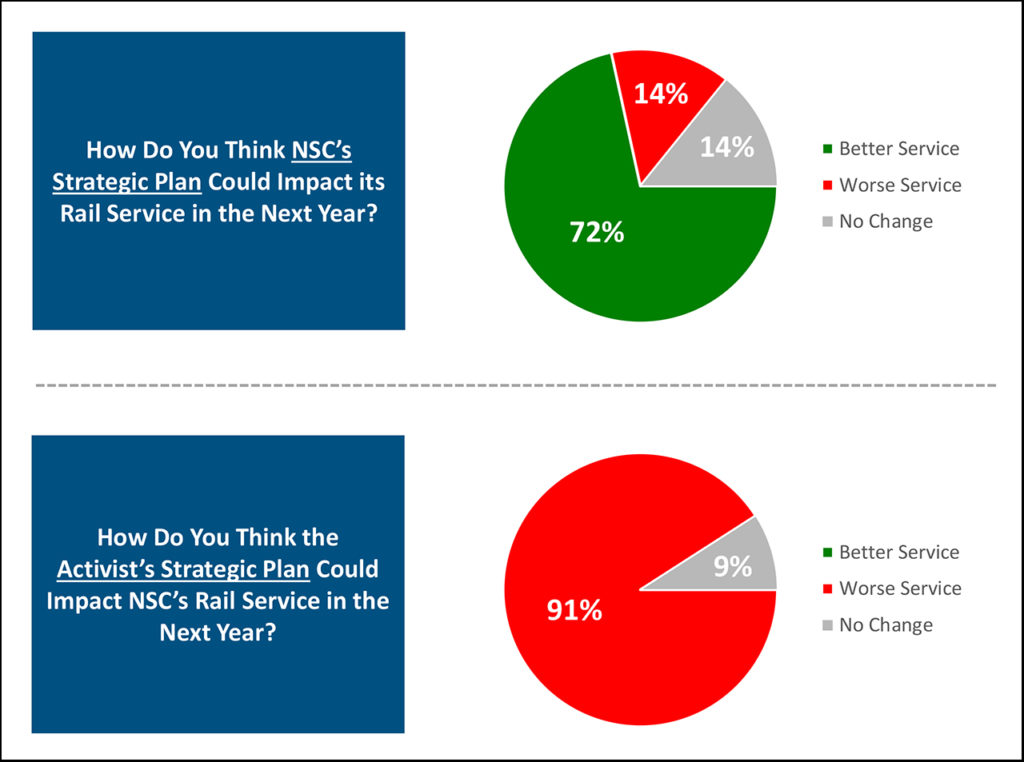

When questioned about the potential impact to rail service from the two proposed strategic plans, 72% of respondents “believe NSC’s plan would result in better service in the next year, while 91% of respondents believe the activist’s plan would result in worse service in the next year,” Stephens said. “And while we do not think there has been much share shift due to this activist campaign at this time, if NSC loses the shareholder vote, 80% of respondents said they would shift some freight to CSX and/or truck. The outcome of this activist campaign will ultimately be in the hands of shareholders, and we continue to see the opportunity for meaningful service/productivity improvement with or without activist involvement. But based on this survey, we think shippers are initially skeptical of the activist plan based on scars from the past. So if the activists prevail, we think turning this sentiment will need to be a top priority in the initial 6 to 12 months of the transition.”

Stephens also published examples of “other commentary” from the surveyed shippers:

- “We have seen solid improvement with NS service over the past two years, for both carload and intermodal. After reviewing the plan by the activist, I am convinced it is a short-term attempt to squeeze cash out of the NS network.”

- “I am mildly concerned with John Orr replacing Paul Duncan as COO and hope he does not bring [PSR] that has not helped our service on [other networks].”

- “Short term cost cutting by the activists will result in a lower level of service.”

- “If the activists win again, it will be another Class I railroad that will implement the Hunter Harrison model. That model simply proved that the customer doesn’t really matter when most shippers only have one rail option.”

- “NS service has been lagging other railroads, particularly in the Southeast. They could use some PSR methodology in operations, but I hope the PSR philosophy does not bleed over into Sales and Marketing.”

- “I have been through this with the other railroads, and it is a complete disaster. Rates go up. Service goes down.”

- “[S]ignificant concern for an activist takeover focused on short-term shareholder returns and less about strong support for current NS strategy or performance.”

- “Railroads need to build some resiliency into their operations.”

- “The NS has been doing a really nice job of balancing cost and service. If the activist moves forward, it will be bad for everyone except for a few profiteers.”

*Editor’s Commentary: The “activity/commentary” from the Ancora side has included what I see as hateful, inappropriate, mostly personal and wholly unnecessary attacks directed at NS CEO Alan Shaw and COO John Orr. – William C. Vantuono