For 2022, CSX Targeting ‘Double-Digit’ Revenue, Operating Income Growth (UPDATED, Cowen)

Written by Marybeth Luczak, Executive Editor

CSX on July 20 reported that it would continue to increase its transportation headcount “to restore service and capture increasing rail volume” in 2022. It will also maintain its full-year capex target of some $2 billion. (Photograph Courtesy of CSX)

“Though volatile commodity prices and persistent inflation have added uncertainty to the economy, our efforts remain focused on adding the resources needed to deliver improvements in our network performance, lift customer satisfaction and develop new rail service solutions to drive meaningful growth over the long term,” reported James M. Foote, President and CEO of CSX, during the Class I railroad’s July 20 release of second-quarter 2022 financials, which included net earnings and volumes that were flat with the previous-year period.

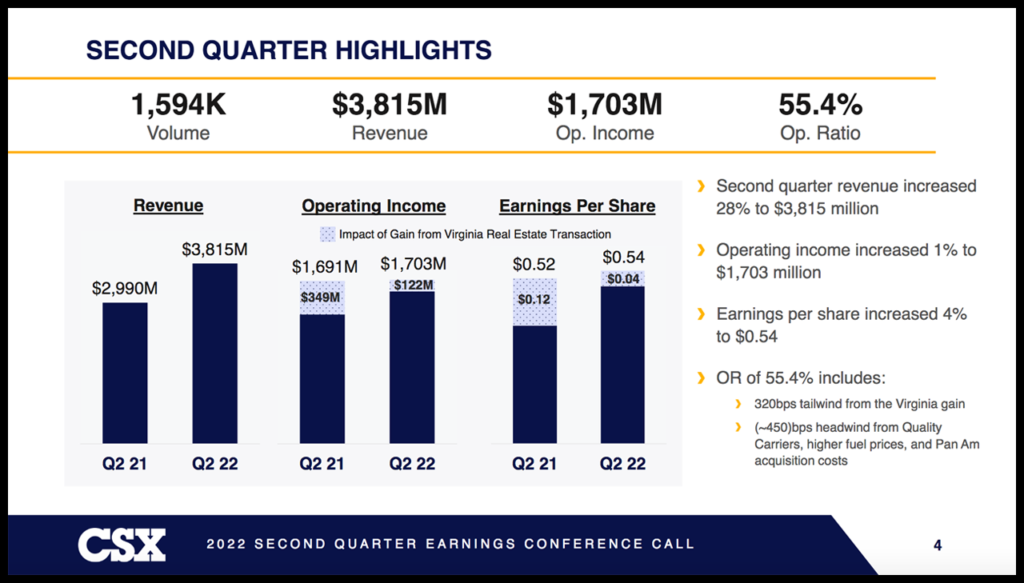

Following are highlights of CSX’s second quarter:

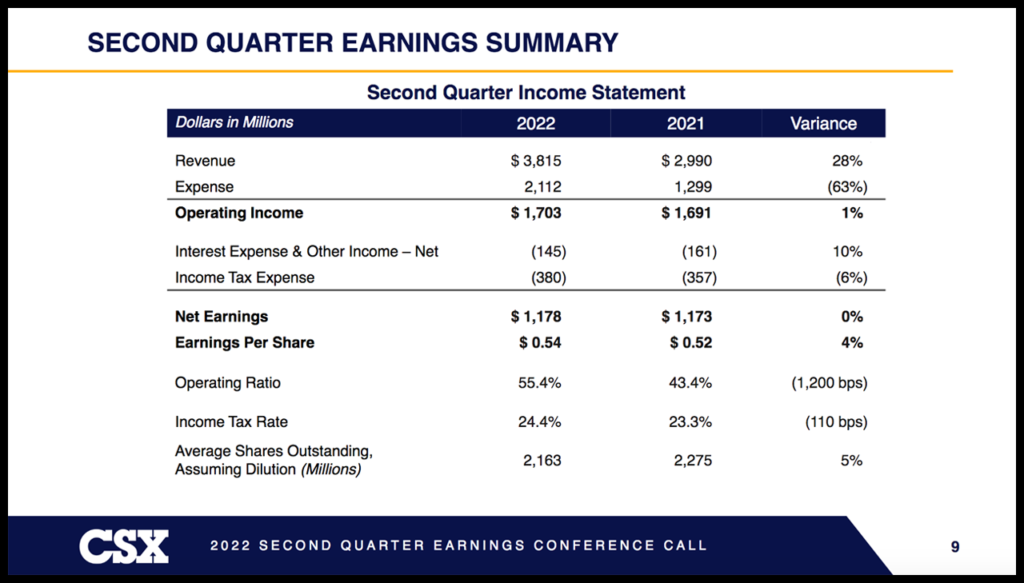

• Net earnings of $1.178 million (or $0.54 per share) were virtually flat (up 0.43%) with second-quarter 2021’s $1.173 million (or $0.52 per share).

• Operating income came in at $1.703 billion, up 1% from the same point last year ($1.691 billion).

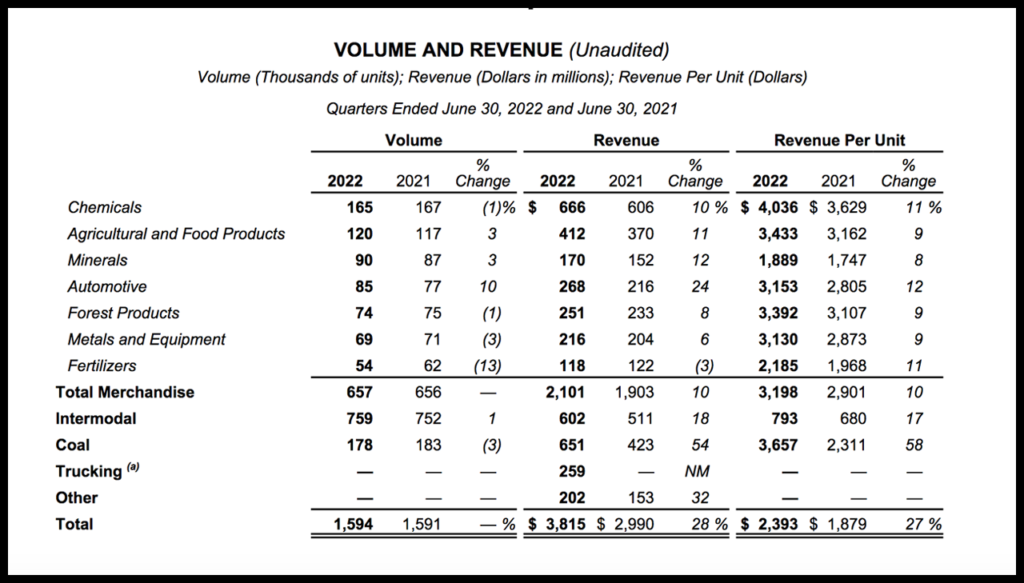

• Revenue reached $3.815 billion, rising 28% from second-quarter 2021’s $2.990 billion, “due to higher revenue in nearly all markets driven by pricing gains, fuel surcharge and the addition of Quality Carriers,” according to the Class I railroad.

• Operating ratio increased to 55.4%, which included “the effects of lower real estate gains, the acquisition of Quality Carriers and higher fuel prices,” CSX said. The OR was 43.4% in second-quarter 2021.

• Volumes reached 1,594K, virtually flat with second-quarter 2021’s 1,591K.

CSX noted that its financial results for the three months ended June 30, 2022 included $18 million of expense related to the acquisition of Pan Am Railways and a $122 million gain ($0.04 per share after-tax) from property sales recognized from the 2021 agreement with the Commonwealth of Virginia. Additionally, second-quarter 2021 results included a $349 million gain ($0.12 per share after-tax) from the same agreement.

2022 Outlook

Looking ahead, CSX reported that it is “still targeting full-year double-digit revenue and operating income growth, excluding impacts from the Virginia real estate transaction.” It said it would also continue to increase the transportation headcount “to restore service and capture increasing rail volume.” The railroad is maintaining its full-year capital expenditure target of approximately $2 billion, and said it remains “committed to returning capital to shareholders.”

The Cowen Insight: ‘Coal-Powered Beat’

“CSX kicked off rail earnings with a top/bottom-line beat powered by strong coal pricing and stable volumes despite continued fluidity challenges,” reported Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “We model volume growth in the second half as service improves, a normalization in coal benchmarks and the final payment of its Virginia deal. We model earnings growth of approximately 8% excluding gains and lower our PT to $37 due to a more conservative view of CSX’s multiple.”

Key Cowen Takeaways:

• “2Q adjusted EPS came in at $0.54, above our $0.49 estimate and the consensus figure at $0.47. Adjusted operating ratio of 58.1% came in below our forecast of 57.1% and excludes a 320 bps tailwind from Virginia real estate sales and a 50 bps headwind from Pan Am acquisition costs (we note that a lag in fuel surcharge recovery also hurt the quarter). An additional $125MM in Virginia sales gains is expected to materialize in the fourth quarter, per management.

• “CSX posted 28% top-line growth in the second quarter even as volumes remained flat on a year-over-year basis on account of continued pricing growth and fuel surcharges. Coal yields led the charge, growing at a rapid clip of 58.2% in the second quarter. On the pricing side, management remained somewhat optimistic on growth in the second half, while guiding a step down in coal benchmarks back to first-quarter levels, suggesting a normalization in what has been a significant tailwind over previous quarters.

• “Volume stability was aided by a turnaround in automotive carload growth of 10.4% on a year-over-year basis with management indicating that alleviation in semiconductor shortages will bolster automotive carload growth into the second half. Management expressed confidence that velocity improvements will translate into volume growth in intermodal, boxcars and coal, and reiterated expectations to see volume growth in excess of GDP. We were encouraged by management’s positive tone on the demand side as it reiterated second-half growth opportunities across industrial segments. We continue to expect second-half volumes to outpace first-half volumes as supply chain constraints ease and model as such.

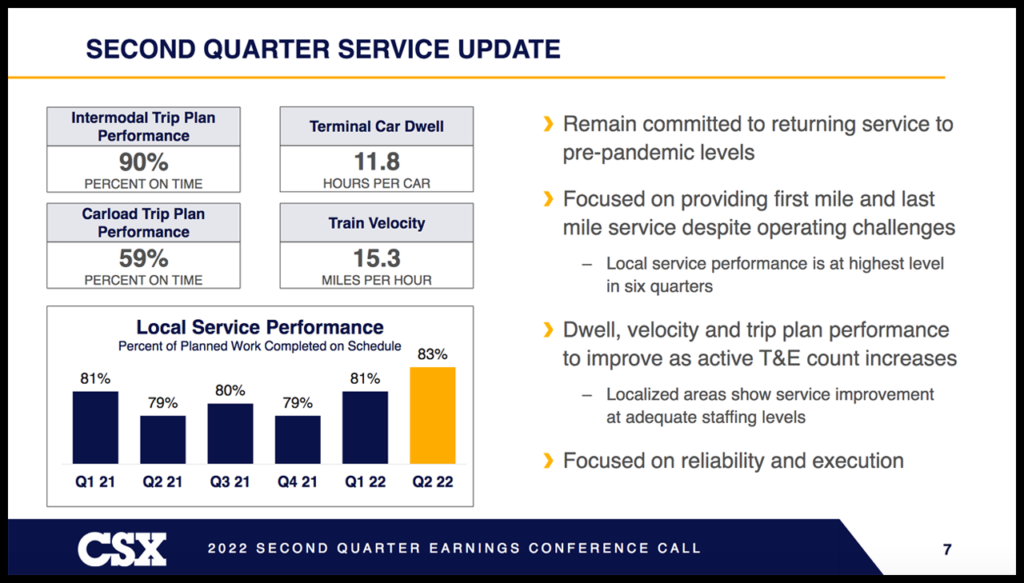

• “Labor challenges were discussed at length with management confident of achieving CSX’s 7,000 active T&E workers target by the third quarter despite high attrition subduing headcount growth. CSX added approximately 500 trainees on average in the second quarter with active T&E expected to increase throughout the second half. Operational metrics improved for the second quarter in a row as 83% of planned work was completed on schedule, a post-pandemic high. Management expects service to improve further in the second half with employee availability reverting to baseline levels of 85% as vacations back off in September.

• “We raise our 2022 and 2023 EPS estimates to $1.95 and $2.00, respectively. Acknowledging potential economic softening, we lower our P/E multiple to the 3-year historical average at 18.5x. With our new 2023 EPS estimate, this sends the price target to $37 from $39. Reiterate Market Perform.”