BNSF Going BIG in Barstow (Updated With Commentary)

Written by William C. Vantuono, Editor-in-Chief

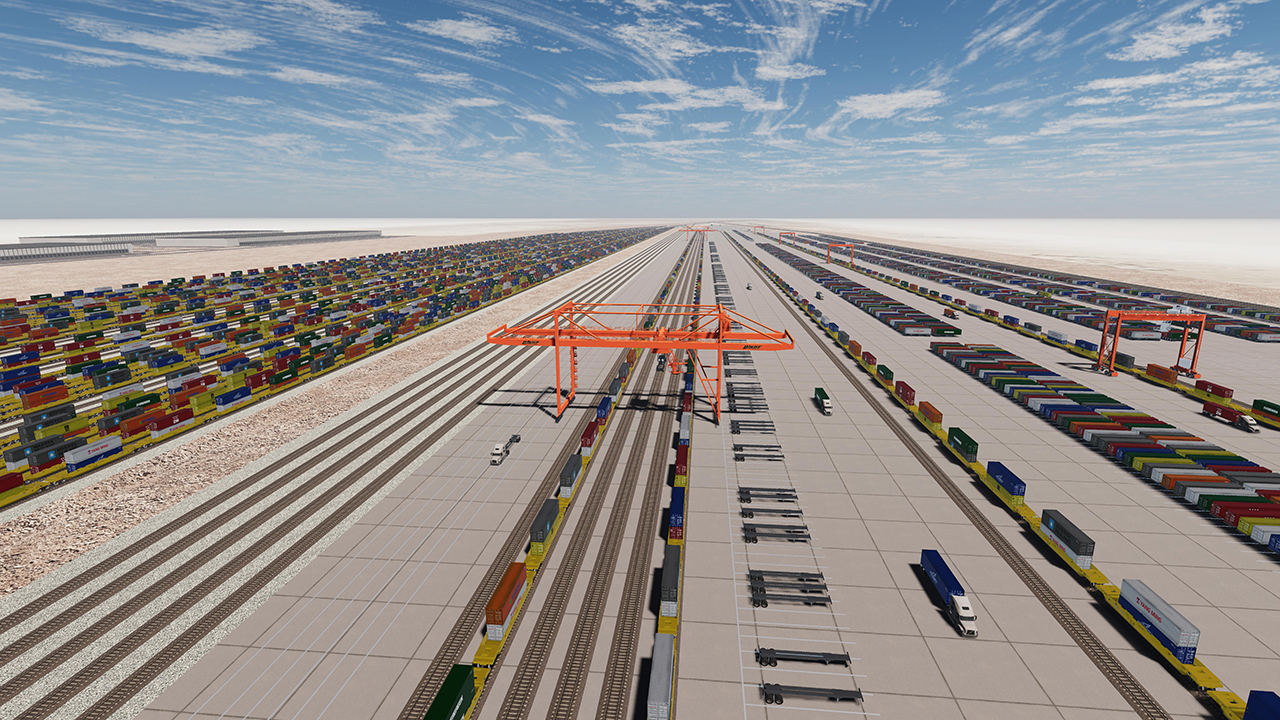

Preliminary conceptual rendering of Barstow International Gateway. BNSF illustration.

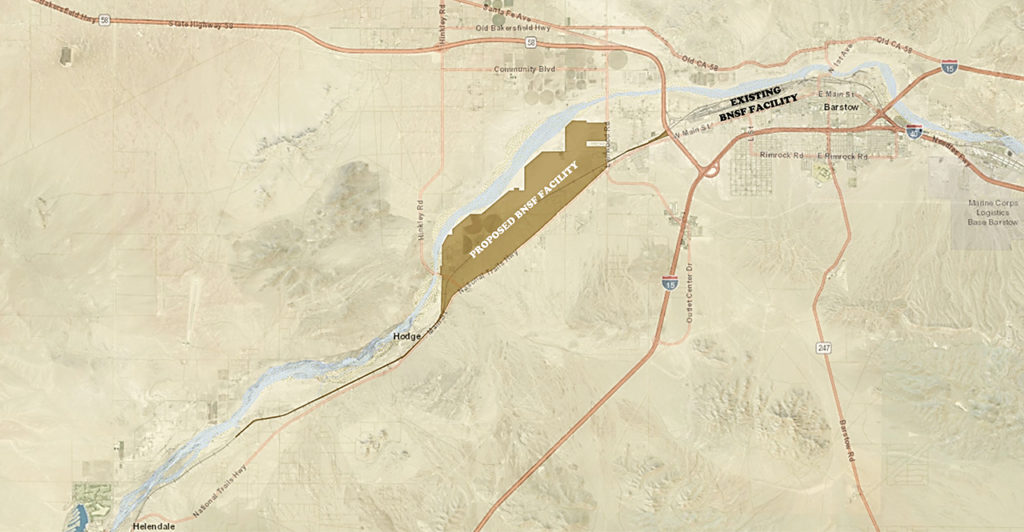

Barstow, Calif., a major hub on the BNSF Southern Transcon in San Bernardino County where the Needles, Mojave and Cajon subdivisions come together, and the location of Barstow Yard, will be the site of Barstow International Gateway, a $1.5 billion investment described as a “state-of-the-art master-planned integrated rail facility, and the first being developed by a Class I railroad.”

Barstow International Gateway (BIG) will indeed be big—huge, actually—4,500 acres, roughly 7.5 times the size of 600-acre Barstow Yard. Located on the west side of Barstow along the Cajon Subdivision, it will consist of a rail yard, intermodal facility and warehouses for transloading freight from international containers to domestic containers.

BIG “will allow the direct transfer of containers from ships at the Ports of Los Angeles and Long Beach to intermodal trains for transport through the Alameda Corridor onto the BNSF main line up to Barstow,” BNSF noted. “Once the containers reach BIG, they will be processed at the facility using clean-energy-powered cargo-handling equipment, and then staged and built into trains moving east via BNSF’s network across the nation. Westbound freight will similarly be processed at the facility to bring trains more efficiently to the ports and other California terminals.”

The Barstow International Gateway, BNSF added, “will create 20,000 direct and indirect jobs, and reduce port and highway congestion around the Ports of Los Angeles and Long Beach.” It “will not replace or become an extension of our existing Barstow Yard,” BNSF spokesperson Lena Kent told Railway Age. “BNSF is developing this facility as a private investment. It is not a P3.”

The construction schedule and opening date have not been determined.

“By allowing for more efficient transfer of cargo directly between ships and rail, the Barstow International Gateway will maximize rail and distribution efficiency regionally and across the U.S. supply chain and reduce truck traffic and freeway congestion in the Los Angeles Basin and the Inland Empire,” said BNSF President and CEO Katie Farmer. “This will play a critical role in improving fluidity throughout our rail network, moving containers off the ports quicker, and facilitating improved efficiency at our existing intermodal hubs, including those in the Midwest and Texas. The facility will also have an important positive economic impact, including the creation of new, local railroad jobs. And we appreciate the support from leaders at the state, regional and city level and look forward to building on our 140-year history in the High Desert to open the Barstow International Gateway as soon as possible.”

BNSF provided Railway Age with these details:

- The clean-energy powered cargo-handling equipment will include electric wide span cranes and electric yard trucks, which will be used to transfer containers to the on-site warehouses.

- The footprint of the project will be approximately 4,500 acres with the new intermodal facility, block swap yard and warehouses planned.

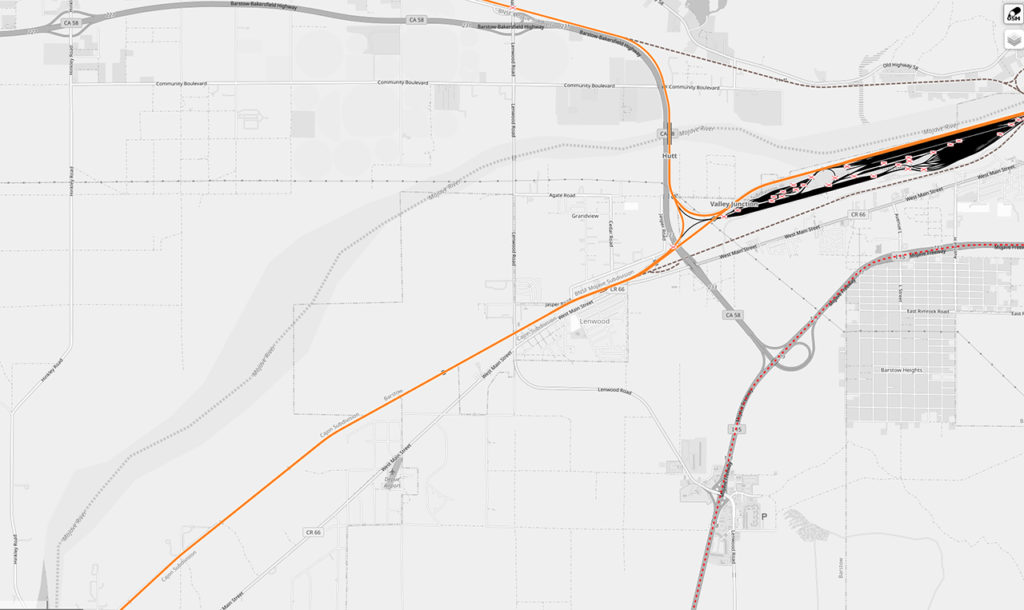

- The bulk of the facility will be centered within the approximately 4.5-mile-long corridor between Hinkley Rd. and Lenwood Rd.

- The block swap yard will feature numerous 16,000- and 10,000-foot tracks, and the longer tracks will be used to assemble or disassemble longer trains using the shorter 10,000-foot tracks.

- The intermodal facility will feature multiple sets of 10,000-foot- tracks, as well as several sets of 10,000-foot support tracks.

- Up to 10,000 parking stalls will be provided to support the intermodal facility operation—about 300 acres of new parking area.

- The new intermodal facility will have an Automated Gate System (AGS) to expedite operations and reduce truck idling.

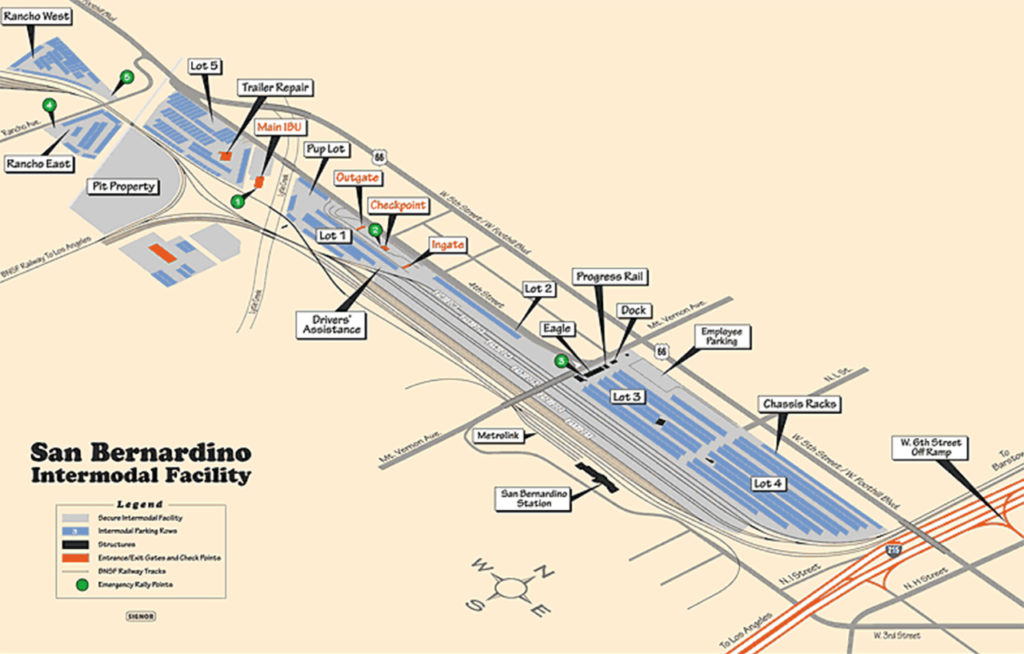

In the interim, BNSF is making improvements to the existing San Bernardino Intermodal Facility at Barstow Yard, which opened in July 2019. In June, the San Bernardino City Council voted to certify the Final Environmental Impact Report for BNSF’s “gap closure project,” which will add approximately 4.3 miles of new fourth main track in two segments along the current BNSF corridor from the BNSF overpass at State Street/University Parkway to the intermodal facility, located at 1535 W. 4th Street. BNSF’s $3.55 billion capital investment plan for 2022 allocated $283 million to projects in California, including the San Bernardino Intermodal Facility, which opened . The gap closure project is slated for completion in 2024.

BNSF invested $27 million building the container-only San Bernardino Intermodal Facility. The railroad currently has the largest market share in intermodal freight traffic among Class I’s, and built this facility to relieve congestion at its other Southern California terminals along the Southern Transcon, such as Hobart Yard in Los Angeles. Barstow is on the California highway network at the junction of Interstate 15 (north-south) with Interstate 40 and State Route 58 (east-west).

“The significance of BNSF’s investment to improve the supply chain here in California cannot be overstated. Rail plays a critical role in moving goods safely and efficiently, while reducing emissions due to congestion in many of our high-traffic corridors,” said Governor’s Office of Business and Economic Development Deputy Director, Sustainable Freight and Supply Chain Development Trelynd Bradley. “Projects like BNSF’s will work to strengthen our inland local economies, such as that of Barstow in San Bernardino County. We look forward to continuing to work with projects like these, as well as others, to drive transformative investments that will enhance and elevate California’s supply chain ecosystem for a more efficient and resilient tomorrow.”

“BNSF’s planned Barstow International Gateway will improve cargo velocity through our port and reduce truck traffic on our freeways,” said Port of Los Angeles Executive Director Gene Seroka. “This project will help ensure that goods moving through the San Pedro Bay will get to consumers, businesses and manufacturers with speed and reliability.”

“The Port of Long Beach welcomes BNSF’s planned Barstow International Gateway in the high desert,” said Port of Long Beach Executive Director Mario Cordero. “This project will help improve supply chain fluidity, reduce environmental impacts and enhance the competitiveness of California and the nation’s largest port complex.”

“The County of San Bernardino plays a critical role in supporting the movement of goods to the rest of the country,” added San Bernardino County Supervisor for the Third District Dawn Rowe. “Barstow International Gateway will be essential for modeling new and efficient ways to address supply chain issues that have impacted everyone over the past several years.”

“This facility will bring thousands of jobs to Barstow, while increasing equity, opportunity and the economic competitiveness of the high desert,” noted Barstow City Manager Willie A. Hopkins, Jr. “BNSF has been an important part of our city since its inception, and on this 75th anniversary, we are proud to partner with them to ensure our success in the future.”

Download FAQs:

COMMENTARY

Railway Age Contributing Editor Jim Blaze:

The Barstow area is a logical location for BNSF. But is it the optimal location for California manufacturers, distributors, logisticians and State of California consumers? That is not vetted in the BNSF promo literature. Scale in volume per year? Not yet announced. And competition from other possible private-vs.-public California sites are also in the wind.

Challenges ahead include developing environmentally balanced drayage services, and the question of short-haul intermodal train operations as cost centers vs. high profit long-distance train centers for BNSF.

The overall BNSF-announced scale (size and capital dollars) dwarfs most recent intermodal projects as Class I rail carrier projects like that those inland yard sites located on CSX in Rocky Mount, N.C. or in inland areas of Georgia.

A game changer for California, its seaports and the broad overall California inland market of shippers and consumers? Possibly. But there is complexity and some site efficiency competition. Let’s quickly discuss the intermodal market dynamics and the geographic alternatives to this Barstow site.

For example, a closer examination suggests that this BNSF concept plan might not be the best location for shippers or even for the California environment. Why not? The answer involves a complex business model trade-off between cheap remote desert land vs. much higher real estate land values closer to the actual market demand places.

This location is somewhat remote from deliveries/pickups. There will likely be added-length trucking drayage expenses in order to deliver the container intermodal goods to/from first-mile and last-mile actual California customers. There seems to have been a BNSF balance sheet ROI decision that lowers the buy-in development costs against a possible long-term variable drayage length cost that will hit the intermodal income statement. Is that drayage distribution well understood here?

For example, remote desert land near western Barstow or in the Mojave Desert (in case of another site location) might require an initial land purchase price of $5K to $15K per acre. That contrasts with an intermodal terminal acreage in the suburban California Central Valley that arguably might have an opportunity land value priced in the $20k to $200k range per acre—maybe higher, above $300k an acre? The economics is that these near-to-market locations have much shorter truck drayage costs between the inland rail yards and the beneficial cargo shippers. A possible new yard in the Bakersfield area is right on top of the Central Valley markets—relatively short distribution driving, far fewer local added truck miles, and less highway congestion. A site near Barstow requires a 110-mile or longer (each way) drayage truck run just to reach the lower area of the Central Valley. That’s not environmentally friendly. This conceptual approach at Barstow might prudently be examined, depending upon the market. If it’s mainly a parking lot for containers, then that site might be excellent.

Thinking strategically, my long intermodal rail/port career extends back to my University of Chicago graduate school days, where professors encouraged me to challenge conventional market/operations views. I later had insider discussion seats for intermodal at a State DOT (Illinois), an MPO (Chicago CATS), at the federal level (USRA), then at Conrail. Based upon that work, and work with multiple ports and carriers, here’s my reaction to locational siting challenges for California rail intermodal.

BNSF hasn’t yet disclosed how this Barstow site fits. Things to consider:

Short-haul intermodal rail earns the big carrier like BNSF and Union Pacific a relatively small profit margin, arguably less than around 15%. In contrast, long-distance intermodal between Los Angeles and Chicago/Joliet might earn a 35% or higher profit margin. That’s a real choice dilemma for financial officers and shareholders. Would BNSF innovate with a switch to short hauls? And is this the correct plan?

Train access is the priority for a large rail company, but not necessarily the first priority for a market-based location site plan.

There is the development plan’s total capex budget, and its land cost vs. site preparation timeline and costs. If the $1.5 billion is spread out over 13 to 15 years, that’s probably manageable. It’s less realistic if expensed out over three years with an assumed short pay-back expectation. We haven’t seen the plan’s timeline yet.

Railroads like to have development control, but with minimized project risks. So, what are the shared risks among the participating joint venture partners near western Barstow vs. a complete risk package that BNSF might have accepted here? And what is each party’s leadership role?

What’s the market target? Is it cargo distribution with integrated semi-manufacturing value-added local employment? If so, then the land value locations offered by urban sites like Bakersfield might produce superior total returns.

For example, one recently announced site named Rosedale Ranch, in Kern County, provides excellent access to “markets,” at a cost. This option involves conversion of up to 1,600 acres of assembled single ownership land northwest of Bakersfield in the heavily populated and growing Central Valley. But with competing land use options across residential and industrial/commercial demands, market prices are significantly higher.

Beyond the aforementioned more-efficient drayage logistics of highway infrastructure, Bakersfield is closer to the final market demand points. That’s always been stressed as critical in economics classes and case studies.

Unlike the two competitive desert railroad sites, the Bakersfield location is within the Central Valley region with more than 7 million people. That ranks the local valley as the equivalent of being one of the top 15 states in the nation. As for growth prospects, eight of California’s twelve fastest growing counties are located within the Central Valley.

Among Bakersfield’s SWOT ((strengths, weaknesses, opportunities, and threats) characteristics is that it has a nearby labor force. That’s critical, given the current U.S. demographic working age shortage. There is also an available large trucker population that could rapidly redeploy toward drayage.

The Rosedale Ranch project site (for intermodal or for selected rail carload business industrial park use), now being discussed with possible users/investors, is already benefiting from a short permit approval process and nearby access to utilities and a water supply—both, like labor, critical components. Close to 800 acres of shovel-ready land are now permitted and available at this location, with capabilities to deliver 1,600 acres within a very short time period into 2023. That’s a noticeable execution timeline.

Any future rail served plants and warehouses in this central California location are within a four-hour drive to 44 million people to the north and south.

Kern County has approved the establishment of a yet another California inland port site located in the middle of the Mojave Desert. Mojave Inland Port is a modest-size 410-acre container site that could receive cargo by rail from congested ports in Los Angeles and Long Beach. Houston-based Pioneer Partners will develop this site on a tract at the southeast corner of Highways 14 and 58, a few miles north of Edwards Air Force Base and the desert town of Mojave. The long-term annual capacity is possibly in the range of one million containers. The developers estimate that the Mojave Inland Port will handle as many as 3,600 trucks per day, operating around the clock. The rail connection is Union Pacific.

I’d expect that the California ports, the State of California, various policy agencies, and ocean carrier and shipper/receiver logisticians would have some metrics to offer in the discussion.

Chris Rooney, Vanness Company:

BNSF is usually top notch in on-the-ground planning. Everyone is trying to solve the LA/Long Beach to elsewhere puzzle, and there are some holes nearer to the ports that need attention but are not within BNSF’s control, namely, the train staging at the ports and the spaghetti bowl at the north end of the Alameda Corridor.

Historically, the big three for distribution, stripping, stuffing and light processing have been Ontario, Riverside and San Bernardino, where every square foot is spoken for. Some 70 miles east is Barstow on I-15, which basically co-occupies the rail alignment over Cajon. There, it appears BNSF want to recycle some/all of the massive operationally oriented division points yard.

Lingering questions: How do you drag the center of gravity that is Ontario-Riverside- San Bernardino 70 miles east to Barstow? Do you propose two centers of gravity, or maybe arguably three, if other ports and East Los Angeles are taken into account?

Larry Gross, Gross Transportation Consulting:

When mature, this facility will put a lot of economic pressure on the existing transload infrastructure further west in the Inland Empire. Presumably (speculation on my part), shuttle trains will operate from on-dock railyards at the port directly into this new facility. There, the containers will be shuffled, with some going directly into trains for movement further east, while others will be grounded for movement to adjacent transload facilities. In the latter case, 80-plus miles of drayage will be eliminated: port to Inland Empire transload (marine chassis) and transload to San Bernadino (domestic chassis).

Elimination of most of the cost of 80 Southern California dray miles will improve the economics of transloading and further tip the balance in its favor vs. IPI. The new facility will eventually dominate the long-haul transload market, but the existing facilities will remain to serve the more localized markets such as Phoenix, Salt Lake City and so forth. In these cases, the transload will be from ISO container into truck.

Pressure on the Pacific Harbor Line will be reduced, as the need to assemble long-haul trains with multiple blocks will be shifted to Barstow.

Of course, Barstow is also at a strategic point in the BNSF system where the line for Northern California (Stockton, etc.) joins the main east-west Transcon route. This facility will provide a transload option for Oakland/ Northern California traffic in both directions that currently largely does not exist. With Oakland having a more robust export business, this creates the possibility for “reverse transloads,” wherein the domestic container moves westbound with export cargo and the load is then moved into a ISO box for movement to either L.A. or Oakland for export.

Any comparison to North Baltimore is imperfect for two reasons: North Baltimore did not have any transload associated with it, and was a pure classification facility with local business clearly an afterthought. Also, the Barstow facility has many more eastward low-cost rail miles to work with, so total cost structure will be very different.