Hopes For a Second-Half Rebound

Written by David Nahass, Financial Editor

All photos: Bruce Kelly

GUIDE TO EQUIPMENT LEASING, RAILWAY AGE JUNE 2023 ISSUE: Summertime is fast approaching. With the COVID-19 pandemic “officially” over, it is time to turn attention to different matters, such as the immanent defaulting of the U.S. debt or the threat of a moderate to severe El Niño to develop in the summer and fall of 2023 with a significant probability of extending into the winter of 2024. The El Niño pattern brings a host of domestic and global weather challenges. On the plus side, El Niño is generally not correlated to a high-risk Gulf and Atlantic hurricane season.

Like many things in life, El Niño is a risk and reward proposition. The potential global impact of a severe El Niño is estimated to be more than US$3 trillion over the next five years (according to a study by NOAA). On the other hand, according to NOAA, in the U.S. in 2021, there were 20 separate billion-dollar weather and climate disasters. The total cost for these events was $145 billion. The estimate for the economic impact of weather and climate disasters in 2022 is $165 billion.

The “benefit” to the hurricane zone from Texas to Florida and up the East Coast of the U.S. may be a fraction of the global impact of El Niño, and the total impact to the U.S. would be reflected globally and domestically in different ways. One dramatic impact could be potential of West Coast flooding if another one or two years of severe winters (and subsequent potential flooding) were to occur.

But readers of the Railway Age Guide to Equipment Leasing didn’t come for weather forecasting. The railcar lease market has continued the upward pressure on lease rates and tautness in availability. We are now entering (if one counts back to the early days of the COVID-19 pandemic) almost three full years of sequential increases in lease rates. As any industry veteran will tell you, what makes this current cycle different from previous cycles of increasing lease rates on railcars is two separate and impactful points.

One is the long duration of the current cycle, and that this current cycle, even in the face of a potential recession, does not show any signs of near-term abatement. Two is that railcar manufacturing has always been a boom/bust series of events that built the supply to satiate the need in the moment of demand. However, in this current cycle, railcar manufacturing has maintained an austerity.

Call it labor, call it materials, call it decreases in total industry-wide production capacity, or call it supply chain difficulties, all these factors have contributed to what feels like a secular change in the railcar manufacturing marketplace. Among other factors, this new, lower production cycle is causing cyclical rental cycle stability.

In previous cycles, lessor owners and end users (shippers) would have demanded more production, more components and more deliveries. The call for more, still heard in the alleys and byways from those that use and deploy rail assets for fun and profit, remains unanswered.

This cycle is further driven by ongoing (seemingly never-ending) challenges to utilization associated with poor railroad service and ongoing hiring issues being faced by the railroads. Raise your hand if you cringed when the railroads indicated a hiring pause in the face of a potential recession!

While this may or may not be the new normal, it is certainly different. But wait—several questions remain. First, is there an imminent recession that is unavoidable? In March, as the first quarter was coming to a close, the signs were flashing red. Logistics companies (e.g. J.B. Hunt) were harbingering a failed freight rebound amid a massive inventory glut; intermodal loadings YOY for the first 20 weeks of 2023 are down 11%. Consumer sentiment has been bending to the negative, as there has been a clear scaling back on purchases in an uber-inflationary environment. It’s a negative fact pattern. True to this new normal, where everything is just different than it may have been in the past, news suggesting the inventory glut is being burned through at a faster rate than expected has recently bubbled to the surface. Hopes for a second-half of the year rebound might actually have some modest merit.

Second, who is the primary beneficiary of this new austerity? It feels a bit like El Niño (see the tie in?) where a few might be benefitting, while the larger population seems to be excluded from receiving equal benefit. Carry that thought a bit further. Many lessors of railcars have been the beneficiary of increasing lease rates. Contrarily, it is difficult to find an end-user of cars that would suggest higher lease rates and higher interest rates provide them any benefit.

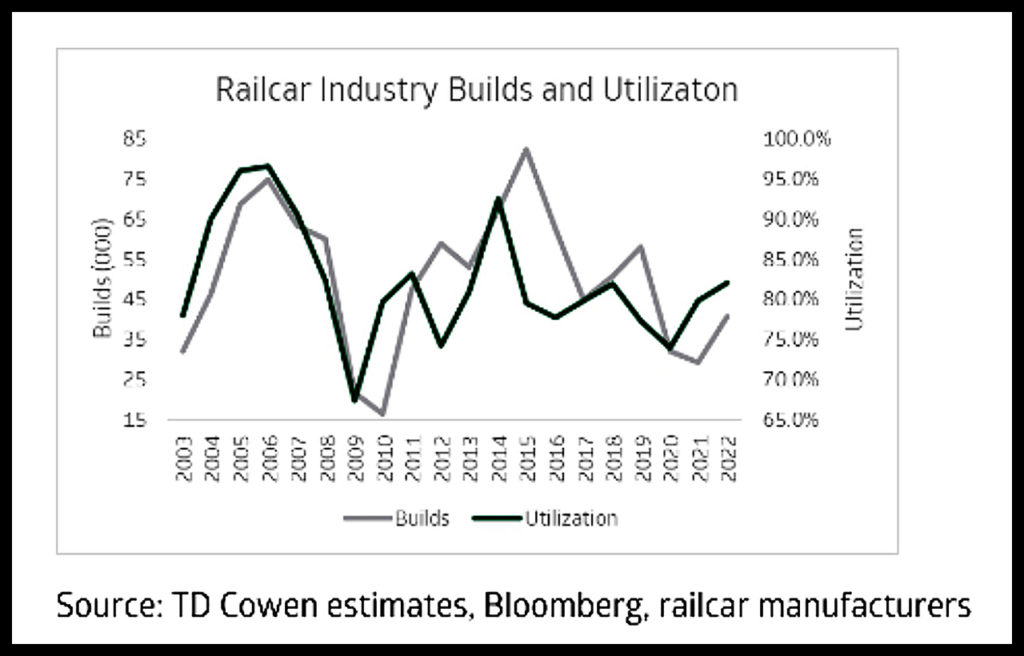

This is where things get interesting. There are, more or less, five primary competing interests in the world of moving freight by rail (and they often overlap). Railroad, manufacturer, car owner, car user and component supplier. Of these parties, car owners stand to receive the greatest benefit from increasing lease rates. See chart, below, courtesy of Matt Elkott, TD Cowen Machinery and Transportation OEM analyst (and frequent Railway Age contributor), which layers railcar utilization over railcar deliveries. See how utilization precedes a runup in manufacturing. See further how utilization has been running ahead of production since, you guessed it, the time when lease rates started to rise. Need a cherry on top? In 2020, when the utilization percentage started to rise, there were almost 600,000 cars in storage. Today there are fewer than 300,000.

With new car prices being so stratospheric, one might feel that the OEMs are making bank on their new lower volume austerity. The choice to increase net profits over generally improving gross revenue is one of the factors behind today’s perception of railroad ambivalence about growing their franchise. It represents, to the casual observer (though this does not imply veracity on any level), the foundational mindset of PSR: Earn more money with fewerpeople, fewer cars, fewer locomotives, etc.

Recently, the Wall Street Journal highlighted that Wall St’s focus on margin/profit over revenue was leading retailers to make it harder for consumers to execute item returns for free. The key takeaway from the reporting? “The move to reduce returns is part of a sea change in retailing that is giving priority to profits over growth.”

It would seem then that rail is a leading indicator, a trendsetter one might say, in leading the Wall Street community in an occasionally elusive chase to improve profits rather than to increase revenues. In speaking with Elkott on the WSJ article, he had a similar thought, noting, “It may not be far-fetched to think of a clamp down on returns as the retail industry’s version of PSR: an effort to expand margins at the expense of the service offering and the top line, at least initially.”

The problem is that, for railcar OEMs, it just isn’t true, even at today’s lofty railcar pricing. Railcar OEM margins have been compressed for some time, since passing through increased profit margin during a period of rapidly increasing feedstock and personnel expenses is challenging. Companies are going to need railcars just like people are going to need clothes (though most clothes don’t last 50 years). The question is, where is the flex point between price, demand and satisfying one’s investors?

This is an equally interesting question relative to the railroads. If the railroads survive regulatory scrutiny and can choose only high-margin business, that could, Elkott notes, “translate to a net reduction in freight market volumes, but it could improve freight network fluidity. Both are potential mild headwinds to equipment demand.”

The conclusion is that, for the current rental market and those reaping benefits from it, the path forward is not clear. If there is a tilt to recession and freight levels decline, system velocity could free up cars and soften demand for new builds. If demand for cars continues and new car production stays at historically reasonable levels, owning railcars might be the best long-term investment. Viscerally however, it feels that to make that new price paradigm stick, inflation must continue at current levels.

That seems somewhat far-fetched, even if, for the moment, other countries are forecasting inflation to have a tighter grip on their economy. See the U.K.’s recent indication of inflation staying above 5% for the remainder of 2023. It’s unclear that a bet against the U.S. economy (for rising inflation) sounds smart right now. Carl Icahn might suggest that following Warren Buffet’s advice to not bet against the U.S. economy is the better play.

Higher lease rates continue to support high secondary market values on many used car classes. It is interesting to note, however, that recent, call it consolidation in the railcar lessor space has led to a kind of “wealth gap” or death of the middle class in leasing. There are, based on most recent data, six companies with operating fleets of more than 80,000 railcars, three companies with fleets of more than 30,000 and fewer than 80,000, and then a large handful of those with fewer than 30,000.

While there is plenty of liquidity chasing new opportunities for investment, today’s high lease rates cannot often support a new investor’s desire to enter the market or an existing investor’s desire to grow through acquisition. It also suggests that scale doesn’t lead to increases in margin. One only has to observe GATX’s “trust the process” ideology to see that consistency play out over the long term.

Will end users find ways to use cars for longer to avoid paying new car prices and higher lease rates? Will they look to control costs by entering into more structured financing vehicles or through more direct purchases? That also remains to be seen.

The other notable news item parked next to the one on tightening retail return policies: An article highlighting the $600MM in corporate stock buyback programs YTD. To quote a recent note from Tony Hatch about an 18% increase in big truck rig-related fatalities, “I haven’t seen the date for the scheduled Congressional hearings—have you?”

Around The Market

The lease market continues to show stability at the higher price levels that have been in place for a while. The mix of softened railcar deliveries, higher interest rates and railcar service issues continues to favor lessors, who continue to press the advantage on lease rates, length of term and on lease terms and conditions. As noted above, the current environment shows no signs of abatement.

Here’s what is happening around the market:

Covered Hoppers for Grain: Hate to repeat last year’s note, but “Wow, just wow!” Lease rates on grain hoppers continue to show incredible strength and an almost non-existent inventory of available cars. Jumbo hoppers larger than 5,100cf are leasing for high $600s to low $700s full service (FS) with term lengths of greater than 5 years (there are higher numbers. In what might be the biggest 90s throwback ever, 4,750cf hoppers are in the high $400s FS for 3-5 years, with numbers reaching into the $500s. Hurtful.

Covered Hoppers for Sand and Cement: Ongoing strength in this market continues to support higher lease rates but without any additional improvements from 2022 levels. While stored inventory continues to decrease, there are still cars in storage, and that is collaring the upside in this market. Some spot rates continue to flex into the mid to high $200s FS. While rates can go higher depending on who is footing the freight and the return expenses, there are a fair number of deals also being done at rates in a lower range, especially if the term is short.

Covered Hoppers for Plastics: Inventory on these cars is generally nonexistent as well. And, with new car prices in the low $120,000s or higher and higher interest rates, these hoppers are at high rates. For 6,200cf cars, new(er) cars are being quoted above $850 FS, and that is with some term on them. That rate is made more significant as the maintenance on these cars is lower than on most car types. Inventory on the smaller 5,800cf cars is also on fumes, with rates in the low $500s FS.

PD Hoppers: This market generally doesn’t get overbuilt, so when service slows, rates tend to increase. For the smaller 5,125cf car, expect rates in the high $600s to low $700s, and for the jumbo, more modern 5,660cf car, think low to mid $800s. Most of these cars are leased FS.

Mill Gondolas: This market had been ambling along and then recently exploded with newer 286 GRL six-foot side gons jumping up to the high $600s FS for five years. Older 263 GRL cars are staying in the mid $400s. There is some new building in this segment. Probably a decent investment for the long term.

Boxcars: 50-foot and 60-foot plate F boxcars are in demand, and rates have remined at high levels. Expect numbers in the mid to high $600s FS for both sizes, and limited availability of cars for lease.

Coal Cars: Coal loadings are up slightly from last year, and this is after a fairly mild winter. There are suggestions of long-term low-price stability for the natural gas market (Henry Hub is at $2.50 after hitting $2.00 in April, per MMBTU) that could impact demand, but at the moment it has not created much of a drag. Rates continue to be high here. Looking for a gondola? You’re easily in the mid $400s FS if you have the car already. New lessees are going to be more than $500 FS for 5 years. Look for higher numbers as terms shorten. Rapid-discharge hoppers have rates that are running from $50 to $75 per car per month higher.

Tank Cars: Lots of chatter here on what the fate of this market will be after the East Palestine derailment. There is little talk about design changes, but an acceleration of the May 2025 and May 2029 regulatory threshold for Packing Group I and all additional flammables (dates respective) is still on the table. Tanks continue to show strength in all segments, even with weakness generally in chemicals loadings (down 5.3% YOY). Food grade tanks have risen into the high $800s (or even low $900s) depending on age, FS with term. Pressure cars for propane and butane (112J340s) are in the low to mid $600s with term. 23,000-gallon and 25,000-gallon 117J tanks are also in short supply, and rates are in the high $800s to low $900s. Tanks for crude have also been active with limited availability, and rates in the high $700s for used cars. For new cars, don’t expect anything that starts lower than $900. In the retrofit market (117Rs), FS lease rates are into the high $700s and low $800s. Plain vanilla DOT111As are floundering a bit, now that the May 2023 ethanol deadline has passed. With high maintenance and recertification costs, lessors are going to think long and hard about the decision to keep these cars working or to just cut and run. Right now, this is a “take what you can get” market.

Aggregate Cars: Continued infrastructure demand keeps this market at strong levels. Newer 286K GRL cars continue to show strength into the mid to high $600s FS. This market is not expected to change much in the near term.