For Greenbrier 1Q24, ‘Strong Performance’

Written by Marybeth Luczak, Executive Editor

(Greenbrier Photograph)

The Greenbrier Companies’ new railcar backlog “remains robust,” said President and CEO Lorie Tekorius during a report on the manufacturer’s first fiscal quarter ended Nov. 30, 2023. “Our backlog, combined with programmatic railcar rebuilding activity not included in backlog, provides clear revenue visibility into 2025.” She added that Greenbrier’s “disciplined construction of our leased railcar fleet and increasing lease rates make doubling our high-margin recurring revenue an achievable goal in the years ahead.”

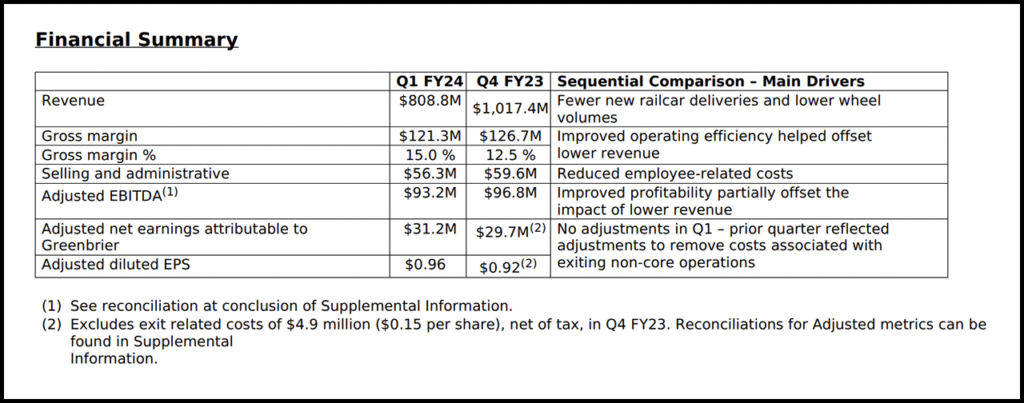

“Strong performance in the first quarter across all our operating segments demonstrates continued progress toward achieving the targets established in our multi-year strategy,” Tekorius summed up Jan. 5. “Aggregate gross margin of 15% in the quarter is a key indicator of success.”

Following are highlights of Greenbrier’s first fiscal quarter 2024:

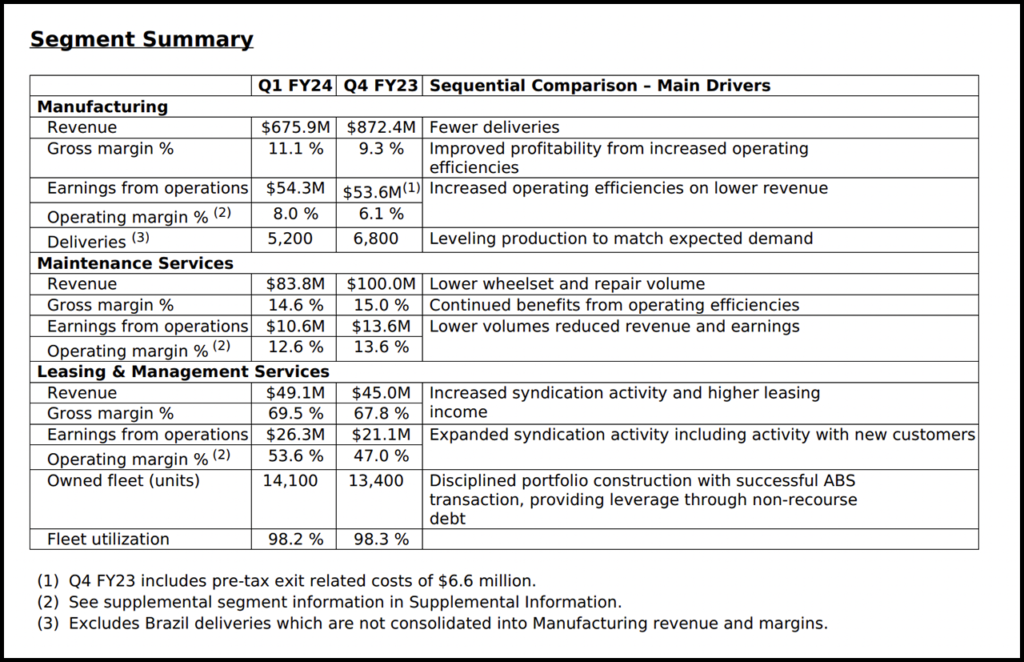

- Grew lease fleet by 700 units to 14,100 units and maintained fleet utilization of 98%.

- Received new railcar orders for 5,100 units valued at nearly $710 million and delivered 5,700 units, resulting in new railcar backlog of 29,700 units with an estimated value of $3.8 billion.

- Net earnings attributable to Greenbrier for the quarter came in at $31 million, or $0.96 per diluted share, on revenue of $809 million.

- Adjusted EBITDA for the quarter was $93 million, or 11.5% of revenue.

As previously announced, Greenbrier noted that it issued $179 million of asset-backed securities with 6.5% blended interest rate to support its leasing business. “The offering received the first ‘AA’ debt rating of an asset backed security offering within the freight rail asset class,” the company said.

2024 Outlook

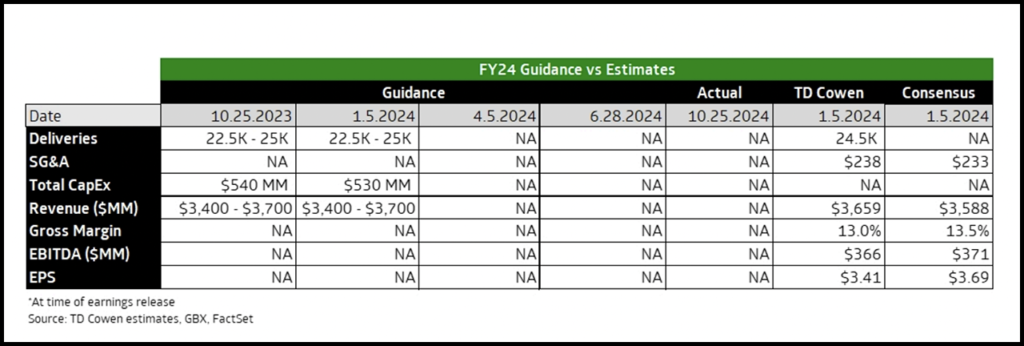

Based on current trends and production schedules, Greenbrier said it expects the following performance in fiscal 2024:

- Deliveries of 22,500-25,000 units, including approximately 1,000 units in Brazil.

- Revenue of $3.4 billion-$3.7 billion.

- Capital expenditures of approximately $165 million in Manufacturing and $15 million in Maintenance Services.

- Gross leasing investment of approximately $350 million in Leasing & Management Services. According to the company, this includes 2024 capital expenditures and transfers of railcars into the lease fleet that were produced and held on the balance sheet in 2023.

- Proceeds from equipment sales are expected to be approximately $85 million.

More earnings report details can be found on the Greenbrier website.

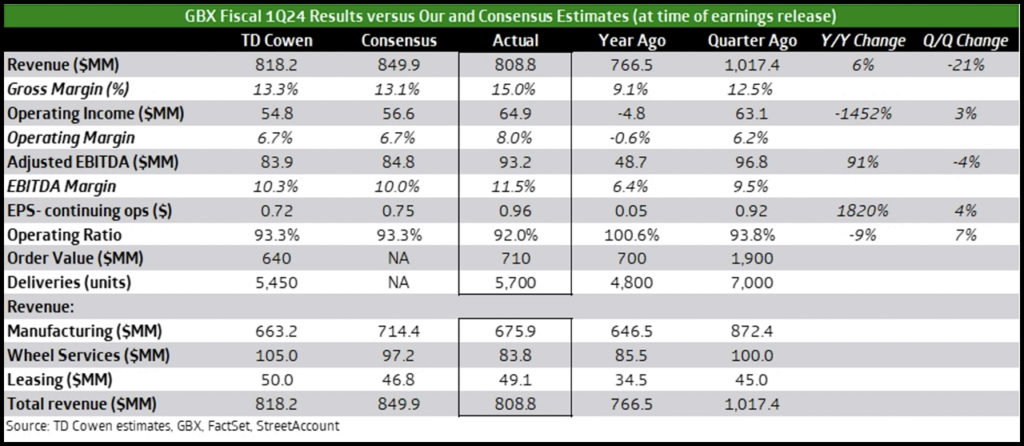

TD Cowen Insight: Strong Quarter, FY24 Guidance Unchanged

“Revenue was a miss but GM, EBITDA and EPS beat us as well as the Street,” TD Cowen Transportation OEM Analyst and Vice President Equity Research Matt Elkott reported Jan. 5. “Deliveries in the quarter were solid at 5,700 units (vs. our estimate of 5,450), and new railcar orders were 5,100 units (vs. our estimate of 5,000). FY24 guidance was largely unchanged with a decrease in manufacturing CapEx. Shares should outperform today.”

TD Cowen Key Takeaways:

- “EPS came in at $0.96, well above our and consensus estimates of $0.72 and $0.75, respectively. Relative to our model, items below the operating income line contributed a net benefit of approximately $0.03 per share.

- “FY24 delivery guidance midpoint was unchanged at 23.75K units (see range in table below) vs. our estimate of 24.5K units, and FY24 revenue guidance midpoint was unchanged as well at $3,550 MM (down 10% y/y) vs our estimate of $3,659 MM (down 7% y/y) and consensus of $3,588 MM (down 9% y/y).

- “FY24 capital expenditures are now expected to be $350 MM in Leasing & Management Services, $165 MM in Manufacturing and $15 MM in Maintenance Services (previously, in the 4Q23 release the company noted FY24 capital expenditures were expected to be $335 MM in Leasing & Management Services, $190 MM in Manufacturing and $15 MM in Maintenance Services).”