Greenbrier 4Q23: ‘Driving Operational Improvements, Realizing Margin Enhancement’

Written by Carolina Worrell, Senior Editor

“During the fiscal year, Greenbrier met the evolving needs of our customers to maintain our market-leading position. At the same time, we advanced our strategy to drive operational improvements and realize margin enhancement,” said Greenbrier President and CEO Lorie L. Tekorius during a report on fourth-quarter 2023 and full year financials.

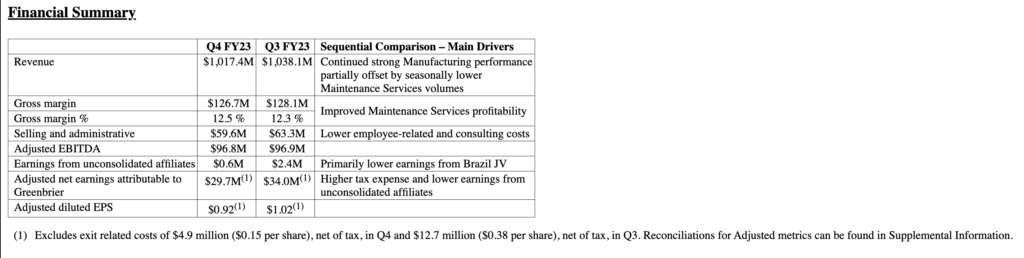

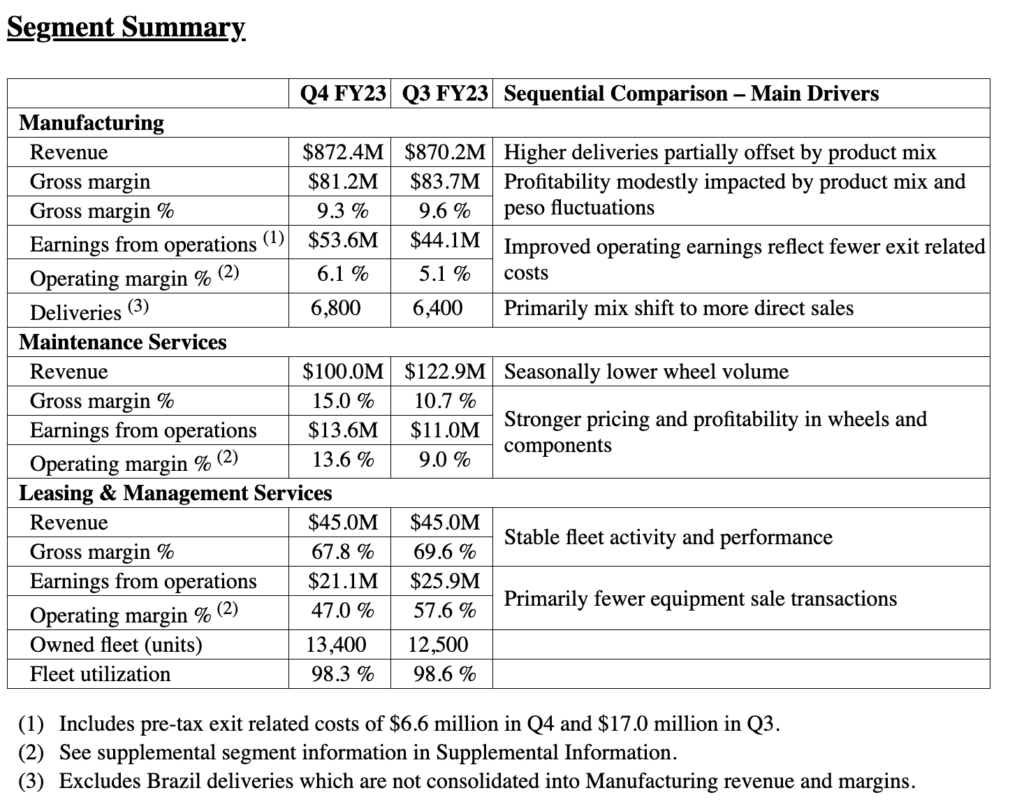

Greenbrier’s fiscal fourth-quarter 2023 financial results (the company begins its fiscal year on Oct. 1 of the prior year) include a high lease fleet utilization of 98% on a 13,400-unit fleet and new railcar orders for 15,300 units valued at $1.9 billion. Order activity, Greenbrier says, highlights the company’s “strong lease origination capabilities balanced with its direct sales expertise.” As of Aug. 31, Greenbrier’s backlog was 30,900 units with an estimated value of $3.8 billion.

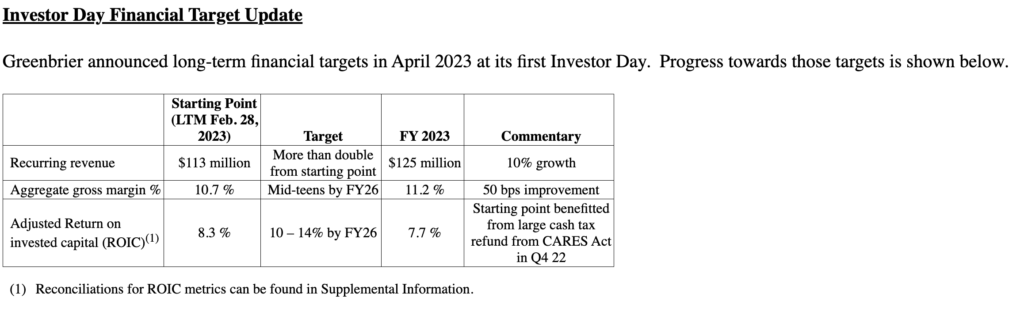

“Importantly, we delivered an outstanding commercial performance against a dynamic economic backdrop throughout the year,” Tekorius added. “Greenbrier enters fiscal 2024 with our largest backlog value in almost eight years. This provides excellent near-term revenue visibility and further confidence in our strategy. As we continue to execute the strategic plan we shared at our Investor Day in April, we expect to improve performance in fiscal 2024. Deployed capital will enhance operational efficiencies and grow our lease fleet as we ambitiously pursue our goal to increase recurring revenue.”

Among Greenbrier’s other fourth-quarter 2023 and full year highlights:

- Fourth quarter deliveries of 7,000 units and full year deliveries of 26,000 units.

- Net earnings attributable to Greenbrier for the quarter were $25 million, or $0.77 per diluted share, on revenue of $1 billion. Results include $5 million, or $0.15 per share, net of tax, of exit related costs associated with our ongoing capacity rationalization initiative.

- For the quarter, Adjusted net earnings attributable to Greenbrier of $30 million or $0.92 per diluted share.

- Fiscal 2023 Net earnings attributable to Greenbrier were $63 million, or $1.89 per diluted share, on record revenue of $3.9 billion. Results include $37 million, or $1.08 per share, net of tax, of exit related costs associated with capacity rationalization.

- For the year, Adjusted net earnings attributable to Greenbrier of $99 million or $2.97 per diluted share.

- Adjusted EBITDA for the quarter was $97 million, or 9.5% of revenue and was $340 million, or 8.6% of revenue for the year.

- Repurchased 0.2 million shares for nearly $8 million in the quarter and 1.9 million shares for $57 million (at an average price of $29 / share) for the full year. $46 million remaining under current share repurchase program.

- Board declared a quarterly dividend of $0.30 per share, payable on November 29, 2023, to shareholders of record as of November 8, 2023, representing Greenbrier’s 38th consecutive quarterly dividend.

Based on current trends and production schedules, Greenbrier says it expects the following in fiscal 2024:

- Deliveries of 22,500 – 25,000 units, including approximately 1,000 units in Brazil.

- Revenue of $3.4 – $3.7 billion.

- Capital expenditures of approximately $190 million in Manufacturing and $15 million in Maintenance Services.

- Gross leasing investment of approximately $335 million in Leasing & Management Services which includes 2024 capital expenditures and transfers of railcars into the lease fleet that were produced onto the balance sheet in 2023.

- Proceeds from equipment sales are expected to be approximately $80 million.

“We have devoted a portion of our flexible manufacturing footprint to large railcar refurbishment programs for multiple customers that are accretive to earnings although not included in deliveries. Additionally, our insourcing initiative utilizes space previously used for new railcar production capacity,” reported Greenbrier.

More details can be found through Greenbrier’s Financial page.

TD COWEN INSIGHT: ‘Results and Guidance a Little Light’

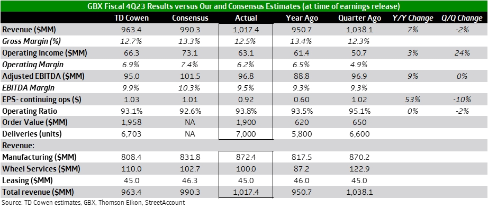

“Revenue was a beat; GM, EBITDA, and EPS were a mild miss, although below-the-line items had somewhat of an unfavorable impact relative to our estimate. FY24 delivery and revenue guidance a little light, although refurbishments which are not included in deliveries should add some EPS accretion. Progress ongoing on long-term targets from investor day,” reported OEM Transportation Analyst Matt Elkott. “The shares could see pressure today.”

TD Cowen’s Key Takeaways:

- “FY23 deliveries were 26K units compared to our estimate of 25.7K units.

- “FY24 delivery guidance midpoint is 23.75K units (see range in table below) vs our estimate of 26.3K units and FY24 revenue guidance midpoint is $3,550 MM (down 10% y/y) vs our estimate of $4,020 MM (up 2% y/y).

- “GBX indicated that it devoted a portion of its flexible manufacturing footprint to large railcar refurbishment programs for multiple customers that are accretive to earnings although not included in deliveries. Additionally, the company noted that its in-sourcing initiative utilizes space previously used for new railcar production capacity.

- “GBX noted FY24 capital expenditures are expected to be $335 MM in Leasing & Management Services, $190 MM in Manufacturing and $15 MM in Maintenance Services.”