Reciprocal Switching: Not Quite Done

Written by Dr. William Huneke, Consulting Economist

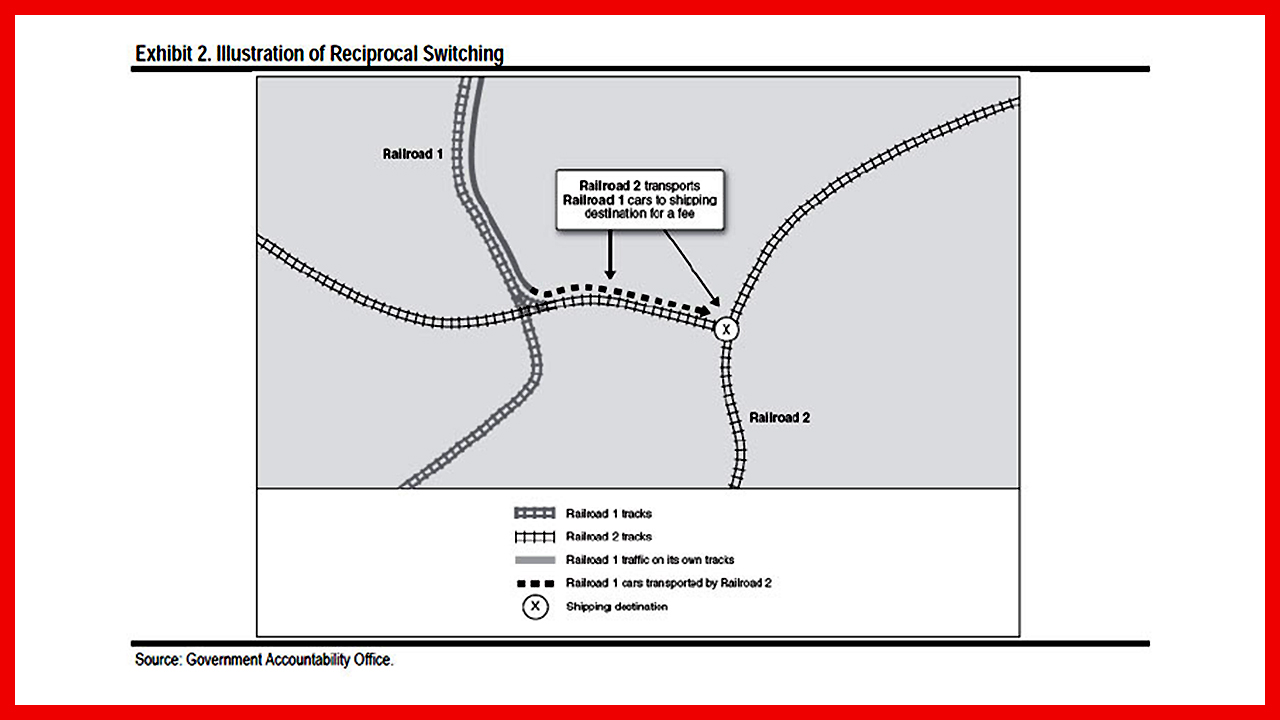

The STB has issued its decision in Ex Parte 711 (Sub No. 2). When it issued its proposed rule in October, I wrote that I thought this was an appropriate next step: to focus on service issues. Many, including Board Member Robert Primus and my colleague Frank Wilner, lamented that the STB had lost an opportunity by not moving to specify how Reciprocal Switching might be used to address competitive issues.

I still think the STB is correct to have limited its focus to service. The agency needs to monitor how a Reciprocal Switching order would affect the rail network and do this in a limited fashion. It would be a horrible outcome if an STB Reciprocal Switching order designed to improve service caused a further service deterioration because of unforeseen impacts. If the STB had put a Reciprocal Switching option in place to remedy a service issue while making it also available for addressing competitive issues, it might have become difficult to unwind a subsequent service problem.

Now that the STB has acted, an important issue will be: who will go first. I remember how elated the STB staff felt when the agency issued small-rate-case guidelines almost 20 years ago, but then the letdown as no cases were filed in the immediate aftermath or for a while after that. That was deflating. This rulemaking will not be finished until the first case or cases are filed. Then we will be able to see if the rulemaking effort has been worthwhile.

In retrospect regarding the small-case rulemaking, I fear potential litigants often seem reluctant to file the initial case if there is no track record of precedents. Feeding that concern in this instance is that the STB has given the carriers a number of possible defenses. These also increase uncertainty about how a possible case might unfold.

Potential litigants might be encouraged by reports that the STB might share summarizing the data it will be collecting. Unfortunately, that collection will not be starting right away. You see, the STB’s decision says: “That data must now be submitted using a standardized template to be developed [emphasis added] by the agency.” (Decision, p. 5.) That is disappointing. The agency has been collecting service data during the service crisis, so I would have thought it would by now have had a sense of the type of data it wanted.

Another concern I have is the fee set for Reciprocal Switching. The STB wants the carriers to reach agreement without recourse to the STB. The agency also states, “The Board has consistently viewed it as appropriate to set Reciprocal Switching fees based on the direct cost of providing service and not include any lost profits from lost line-haul service …” What will the agency do if the railroads include such “lost profits”?

Moreover, the STB also writes that if the carriers fail to reach an agreement on fees, “it is appropriate to determine the compensation methodology on a case-by-case basis because the relevant circumstances in a particular case might warrant the use of one methodology over the other.” (Decision, p. 93.) This adds to uncertainty that might limit potential litigants’ interest in filing a case because they will not if they will be better off if they win.

If the STB steps in and starts setting fees, will these be precedential for a future Reciprocal Switching order to address a competitive issue? Board Member Primus’s concurrence suggests he would like to have Reciprocal Switching available to inject more competition into the rail industry. Any rulemaking for this purpose would have to consider how the fees are set because the STB would have to set them.

If and when the STB starts looking at the fee question, it will come to face-to-face with revenue adequacy concerns because there will most likely be “lost profits.” This will be an issue in any future rulemaking regarding competition. That will make such a rulemaking more complex, another reason the STB was wise to limit the current rulemaking to service.

With Chairman Marty Oberman’s May 10 retirement, the STB may be constrained from taking on another big rulemaking. He received well-deserved accolades for being a consensus builder. Whoever becomes chair will need to reach across party lines. This probably means nothing major happens until after the 2024 election.

In the meantime, the STB will get a chance to collect data and share reports from that data. That would be good. Maybe someone will bring a service case. I am not sanguine of that happening anytime soon—at least not until we see another service crisis.

Dr. William Huneke is the former Director and Chief Economist at the Surface Transportation Board. He has more than 40 years’ experience in economics, transportation, railroad regulatory policy, management consulting, business analysis and teaching in the commercial and government sectors. He provides economic consulting on regulatory and arbitration matters. At the STB, Dr. Huneke led the Board’s analytical work and oversaw the collection of economic and financial data. Since leaving the STB, he has provided economic and litigation support to Class I railroads and other private-sector clients. He worked with the OECD (Organisation for Economic Co-operation and Development) to advise the Mexican government on its future rail regulatory policy. He represented the United States at an OECD conference on railroad industry structure. His private-sector experience included executive and management positions at UUNET, Freddie Mac and the Association of American Railroads. Dr. Huneke has taught graduate business courses at the University of Maryland, Robert H. Smith School of Business. He holds a doctorate from the University of Virginia and a B.A. from Swarthmore College.