Bailey, Elkins, Seyfert and Titterton: ‘Reversion to the Mean’

Written by Carolina Worrell, Senior Editor

The definition of the financial term “reversion to the mean,” according to Forbes, says that “an event that is not average will be followed by an event that is closer to the average.” That term was the general theme during the Railway Supply Institute (RSI) “Rail Collaboration to Increase Modal Share” keynote presentation, which took place on Oct. 2 at Railway Interchange 2023 in Indianapolis.

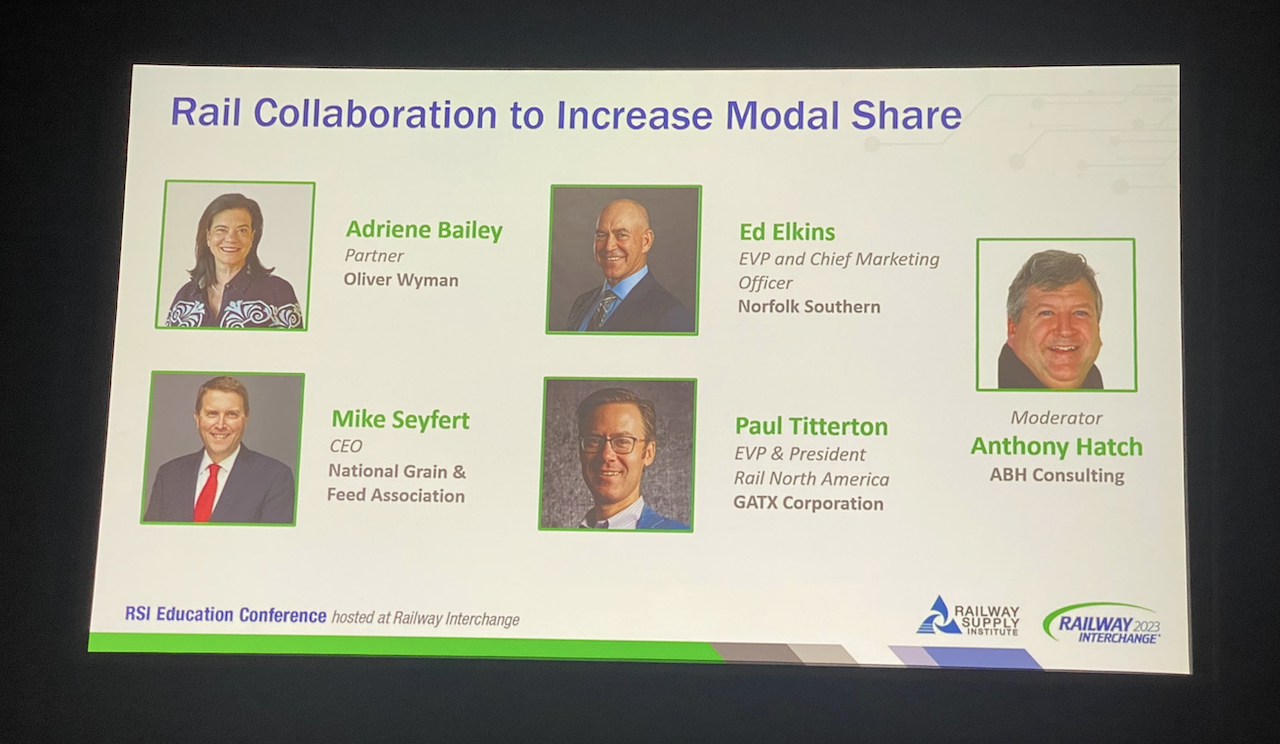

The presentation, which focused on how the supply industry can more effectively partner with the railroads to change the trend of railroads losing modal share and move more shipments to rail, included speakers Adriene Bailey, Partner, Oliver Wyman; Ed Elkins, EVP and Chief Marketing Officer, Norfolk Southern (NS); Mike Seyfert, CEO, National Grain & Feed Association; and Paul Titterton, EVP and President, Rail, NA GATX. Tony Hatch of ABH Consulting moderated the session.

“From a freight standpoint, it still feels very questionable about how fast and how much is freight going to come back,” said Bailey. “We do see in our data, a ‘reversion to the mean,’ and things are coming back to a normalized level.”

“The amount of COVID money that was out there had to do with the longevity for this industry,” added Elkins. “We’re going to see a reversion to the mean long-term. What sort of freight is going to go up the fastest? Freight that will have a choice—you can go by rail or by truck. That’s what we’re working hard on as an industry —is how do we deliver value. It must be ‘easily recognized value,’” said Elkins.

“From a shipper/receiver perspective, we’re in a much better spot than we were a year ago,” said Seyfert. “Grain is up. And, even though we’re struggling in the export market, river levels on the Mississippi are extremely low, so rail will be picking most of that up.”

“The equipment/leasing business is strong right now but it’s strong for some confounding reasons,” said Titteton. “It’s not carload demand or freight demand that’s underpinning the type of railcar market; it’s the fact that it’s gotten really expensive to build new cars (fewer new cars coming in), scrap prices have held up so older cars are leaving the fleet at an accelerated rate, and railroad velocity and dwell time has soaked up the remaining cars that are in the fleet. The fleet is tight and that means good utilization and good pricing for operating lessors, but it doesn’t really suggest that there’s a lot of freight demands that’s underpinning it.”

“We’re always happy to have a tight fleet—that’s good for our business—but I’d much rather have a tight fleet for the reason that rail demand is actually rising,” added Titterton.

Growth From the Rail Perspective

Rail volumes peaked between 2006 and 2008, according to Hatch. But even without the pandemic, which is a centralized event, there have been issues, including changing supply chains and emerging super competitors, such as Brazil.

“What are the new business opportunities? How do we get back the share that we shouldn’t have lost (as an industry) and then where do we go from there?,” Hatch asked the panelists.

“The way GATX thinks about the world of railcar shipments is we try to get rid of a lot of noise when we think about the numbers,” said Titterton. “We tend to get rid of a lot of grain because it’s a naturally rail friendly commodity and there are going to be reasons it goes up or down that may or may not have anything to do with rail service. Likewise, we tend to get rid of energy related commodities, such as crude, as well as coal, which is in secular decline, and we come back to what GATX calls ‘core carloads.’

“Carloads that can shift on and off the network that are modally competitive. That’s how we judge the core health of the business from a demand standpoint. When rail is working, that is where there is a real proposition value for the shipper. Right now, the opportunities in that core carload space include shippers that are concerned with their carbon footprint and carload rail is an opportunity for that.

“Folks like NS and folks like Ed are focusing on putting a service product together to meet that need and if we can work together I think it’s a real opportunity there to grow some demand for rail freight,” said Titterton.

“The export competitiveness, as mentioned, we are way off on that right now, especially in Brazil and China,” said Seyfert. “We’re seeing significant infrastructure investments in Brazil in terms of roads, ports and rail. That competition isn’t going away,” he said. Questions to consider, Seyfert adds, include: “What’s going to happen on the export side? What’s going to happen with some of the crushed volume being proposed? And on the ethynyl side, what is the aviation fuel going to look like?”

There will be a lot of questions over the next few years, but, from a shipper viewpoint, rail is in a much better place this year than it was a year ago,” said Seyfert.

“There are a few macro trends going on,” said Elkins. “Specifically in the Southeast U.S., including reliable, available energy supply and infrastructure and whether you can connect that with an actively engaged and able workforce.

We’re seeing more nonresidential construction right now and that bodes very well for the U.S. economy and links those factories with the rest of the world, so I am very optimistic for the long-term about the prospects for the U.S., which does two things well—it produces calories and BTUs—both of which are important for the rest of the world, especially the free world.

“We think we’re seeing some version of onshoring; it’s not reshoring because it’s not the same things that left a long time ago. But it’s more advanced manufacturing and that’s critically important to understand, such as the EV battery supply chain, which has seen about $70 billion worth of investment in the last couple of months. About 30% of that has landed on NS. That’s just one facet of the supply chain that’s being built out.

“There’s a real minority of freight that changes ownership. What we’re [the industry] focused on is how do we deliver that simplicity with the economics and efficiency of rail,” said Elkins.

“There are some big disruptions in certain industries and we’re just at the tip of the spear of what’s going to happen, said Bailey. “Having rail be very intentional about bringing as much of that back to the network is super important.”

Regarding Hatch’s two main questions, “How do we get the freight that’s left back? And what’s on the horizon that we can get that we’ve never had before?”, Bailey responded as follows:

“We need to figure out how to a run a reliable service product on the railroad and completely redo the customer experience and make it delightful to work with a railroad—all of which is fixable,” said Bailey. “We see some of the Class I’s, and NS has certainly been out foot forward on this, really embracing the idea of reliability and customer centricity to deliver a product that has the right kind of value prompt to get the freight that has a choice back.”

“We think there’s three areas that deserve attention [to get the freight that we don’t have yet],” said Bailey. This includes interline services, intentionally bringing the freight infrastructure to the railroads, and the idea of short haul, especially in the intermodal space, which has about 14% of the total truck market intermodal share, according to Bailey.

“If you were to look at lengths of haul over 1,000 miles, the intermodal shares of those markets that are servable by two railroad intermodal terminals, is over 35%,” according to Bailey. “If you were to look again, of those lengths that are over 1,000 miles, that are servable by intermodal and only run on a single line railroad, that market share is over 60%. We have a ton of the freight that is running long haul on one railroad, which also speaks to the issue that the railroads need to figure out how to get the interline services to work because we can go after a lot of freight there.

“But when we get down into the short haul territory, whether its single line or interline, we’re only capturing about 20-25% of the freight that’s running over 500 miles of less than 1,000. There is a lot of opportunity there, if we can get the equation right, to go after that and get into the new markets. There’s less opportunity in some of those longer haul markets to take incremental share for a variety of reasons.”

Sustainability

“Our research says that we are not yet at the point where at scale customers are willing to pay more and suffer worse service to get a carbon benefit,” said Bailey, who added that we are “headed toward a future that will have an equivalence of propulsion that is green across all of it.”

“We have a window here where it is better to move on the rail. We believe there are societal benefits that go way beyond carbon to put more stuff on rail. There’s no reason why it’s a bad idea to put more on rail, but the product must be there, Bailey added.

“The table stakes are you come to the table with reliable, resilient service,” said Elkins. “If you don’t have that table space, it’s hard to make the sell on anything else. There’s s a lot of value that we can deliver through sustainability, but we must make people trust that we’re going to keep their factory running first. We must have reliable service over long periods of time.”

“What we really like is carload service, particularly from dock to dock, because that’s the stickiest and done right is the most energy efficient way to move freight,” said Titterton. “The customers that we talk to are those that can potentially shift not from truck to intermodal but the opportunity to go rail direct in the carload network, such as beverage shippers.”

Service

Next, Hatch asked the panel the following questions: “Where is service now? Where do you think it’s going to be? And what will it take to get you to have some of those wins?”

“We have come off the lows,” said Titterton, speaking from the small role that GATX plays as a shipper.

“The industry as a whole is distinctly better, such as in the first- and last-mile category, which is the focus. Our direct experience is that it’s more consistent now than it was a year or two ago. It feels much more like it’s in a mean reversion phase than a new era of things being fundamentally different right now,” Titterton.