Insurance Market Instability Threatens the Present and Future of Commuter Rail Service

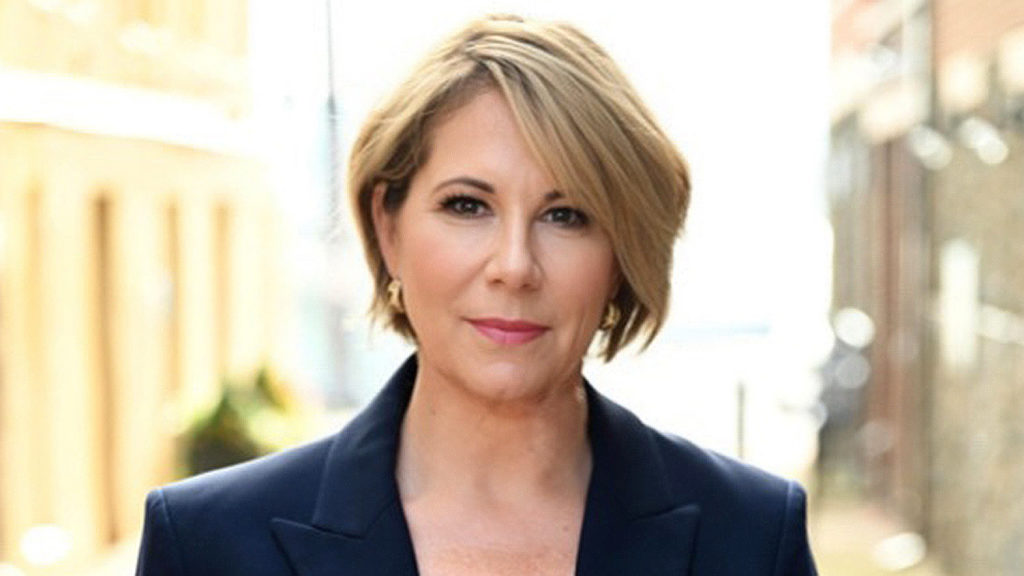

Written by KellyAnne Gallagher, CEO, Commuter Rail CoalitionIn 2021, Congress passed the Bipartisan Infrastructure Deal and made the largest Federal investment in public transit in the nation’s history. Between new investments and reauthorizations, the legislation committed $89.9 billion in public funding over a five-year period.

The spending authorized by that bill was designed to expand access to mobility, replace aging infrastructure, and reduce emissions across all modes of transportation.

But while that legislation has the potential to drive a boom in public transportation, one illogical aspect of the insurance market threatens to pull the brakes on that progress for commuter railroads.

Commuter railroads in the United States, all of which are publicly funded, are currently expected to carry up to the federal cap in excess liability insurance—$323 million per year—to do business with partners such as host railroads, contractors, and suppliers. That federal cap is adjusted every five years by applying the consumer price index; once the new number is released, commuter railroads have just 30 days to acquire the additional insurance coverage. If they fail to acquire that coverage within 30 days, they must stop running. Immediately.

This 30-day requirement is illogical, unnecessary, and it threatens the long-term stability and growth of commuter rail in America.

Extreme Requirements on Extreme Timelines

Why do commuter railroads have to carry such extreme levels of insurance coverage?

Surprisingly, those insurance levels are neither required by law, nor do they necessarily match the liability that a railroad would even be exposed to — because they’re public agencies, many commuter railroads have limited liability under the sovereign immunity provisions established in each state. The railroads themselves can’t even take steps to reduce their insurance costs — railroads that have operated for decades without an insurable claim are still forced to carry the maximum amount of insurance. Even after the commuter rail industry invested $4 billion to implement positive train control, coupled with the safety improvements we can expect to see because of the Bipartisan Infrastructure Law, there will likely be no impact on the state of play for commuter railroads in the excess liability market.

The commuter rail industry in the U.S —and by extension, the experience of every rail passenger—is held hostage by the insurance demands of third-party partners. Host railroads and PTC (Positive Train Control) system operators issue blanket requirements for excess liability insurance, forcing the commuter railroads to find this coverage on the open market.

The current 30-day implementation timeline for liability insurance takes a challenging situation and makes it a nearly impossible one. When the federal cap on excess liability insurance is increased in late 2025 or early 2026—perhaps by as much as $80 million—every commuter railroad in the country will be forced to compete as quickly as possible for coverage within a 30 day period from a dwindling number of insurance providers.

Forcing Public Money to be Spent Abroad

The U.S. insurance market doesn’t have the capacity to deploy the level of insurance required of commuter railroads, and the situation is only getting worse. No U.S. insurers offer the capacity to provide coverage beyond $32.5 million, which means railroads are forced to purchase $300 million in annual coverage from foreign markets in places such as the United Kingdom or Bermuda.

What does that mean in practice? As a result of a hardened market, commuter railroads in the United States have no choice but to take tens of millions of dollars of public money—contributed by U.S. taxpayers—and spend it outside of our borders. This is certainly not a “Buy America” program.

We are seeing many of the same factors are playing out for U.S. consumers as well. In states like California, Florida, and Louisiana, consumers are being left to deal with skyrocketing insurance costs for home and auto policies. Rising costs and shrinking profitability leads insurance companies to pull out of some markets entirely, and these overarching business decisions can then reduce the availability of coverage in other areas and drive up premiums. The next time commuter railroads must look for additional liability insurance, it’s entirely possible that they won’t be able to find it on the open market and will be forced to suspend operations.

Short-Term Fixes and Long-Term Common Sense

What can we do to resolve the threat to operations currently facing commuter railroads?

First, Congress can pass legislation extending the implementation window for excess liability insurance from 30 days to 365 days. This is a crucial correction that would provide commuter railroads with the breathing room they need to find the required insurance coverage within their annual renewal cycle; spread out demand in the market; and, crucially, allow Congress time to intercede should the market fail and commuter railroads begin ceasing operations.

But over the long term, the Federal government needs to work with commuter railroads to find common sense solutions. It doesn’t benefit anyone in this country that our commuter railroads are forced to purchase hundreds of millions of dollars in coverage from overseas providers. And the potential consequences of an insurance market collapse—which is not out of the question given the current situation with consumer insurance in some state —would be disastrous for rail service in America.

There is precedent for the Federal government to provide a backstop if the market fails. When the insurance industry was unable to meet the coverage needs of the growing nuclear energy industry in the 1950s, Congress stepped in with the Price-Anderson Nuclear Industries Indemnity Act to cover the difference. More recently, the U.S. government has stepped in to ensure the availability of terrorism risk insurance in the aftermath of the 9/11 attacks and the war in Ukraine.

One possible solution could be a federal backstop for commuter railroads in the event of a market failure; this would ensure that no transit agency must cease operations while looking for the necessary coverage. It would guarantee reliability and prevent railroads from being held hostage by forces outside of their control.

With the backing of the Bipartisan Infrastructure Law, commuter railroads in the U.S. are on the verge of driving a new era in transportation and sustainability. We need to take common sense steps to ensure that our railroads are allowed to reach their potential and fulfill the goals set out in that legislation. We can’t afford not to.

The Commuter Rail Coalition will be testifying before Congress on this topic on Wednesday, April 17. The House Subcommittee on Railroads, Pipelines, and Hazardous Materials is holding a hearing: “Getting to Work: Examining Challenges and Solutions in the Commuter Rail Industry.”