Wabtec: ‘Solid’ 4Q23, ‘Strong’ Order Pipeline (UPDATED 2/15)

Written by Marybeth Luczak, Executive Editor

(Wabtec Photograph)

“The Wabtec team delivered a strong finish to 2023 as evidenced by higher sales, margin expansion, increased earnings and improved cash flow,” President and CEO Rafael Santana said in a Feb. 14 earnings announcement. Sales were up 15.7% year-over-year, driven by Freight and Transit growth. TD Cowen offers updated insight on Feb. 15.

Santana reported that there was “[s]trong demand” for Wabtec products in North America and international markets, and with “robust international activity and a strong order pipeline, Wabtec is well-positioned to drive profitable growth in 2024 and beyond.” He noted that Wabtec’s “differentiated portfolio is aligned to solving our customers’ most pressing needs and making rail the safest and most efficient way to move people and goods across land.” Wabtec’s products and technologies, he said, “will enable us to capitalize on these trends and drive profitable growth and increase long-term shareholder value.”

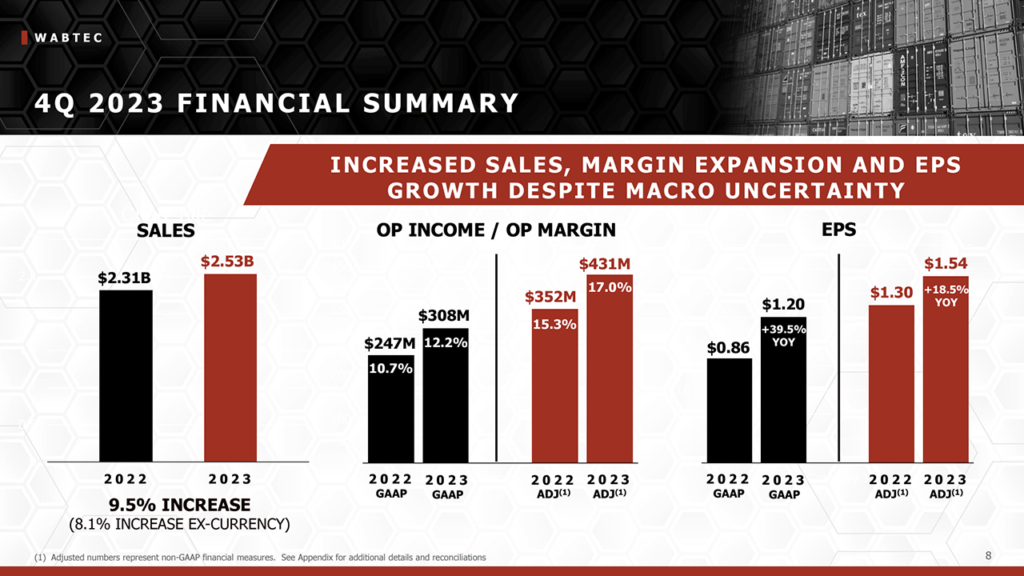

For fourth-quarter 2023, Wabtec GAAP earnings per diluted share of $1.20 were up 39.5% from fourth-quarter 2022; adjusted, they were $1.54, up 18.5% from 2022. “GAAP EPS and adjusted EPS increased from the year-ago quarter primarily due to higher sales and margin expansion, partially offset by increased interest expense,” Wabtec reported. “GAAP EPS also benefited from a gain resulting from a change of ownership interest of an assembly joint venture.”

Sales came in at $2.53 billion for fourth-quarter 2023, rising 9.5% from the same quarter in 2022 ($2.31 billion). Among the key drivers, according to Wabtec:

- Equipment: ”Higher mining sales offset by lower locomotive deliveries (second half deliveries significantly skews to the third quarter).”

- Components: “Increased demand for rail and industrial products, and L&M acquisition (4.1% year-over-year growth excluding acquisitions).”

- Digital Intelligence: “Higher demand for international PTC [Positive Train Control], on-board locomotive hardware, and digital mining products offset by lower sales in North America.”

- Services: “Increased sales from significantly higher modernizations deliveries (second half deliveries significantly skewed to the fourth quarter) and increased parts sales.”

- Transit: “Strong OE and aftermarket sales; sales up 9.9% on constant currency basis.”

GAAP operating margin for fourth-quarter 2023 was higher than the prior year at 12.2%; adjusted, it was higher than the prior year at 17.0%, according to Wabtec. The company said that both “benefited from higher gross margin and lower SG&A and Engineering expenses as a percentage of sales.” The company said GAAP gross margin was higher than the previous year at 30.3% and adjusted, it was higher than the previous year at 30.8%, as both “benefited from higher sales, improved price/mix and productivity.”

For full-year 2023, Wabtec reported GAAP earnings per diluted share of $4.53, up 30.9% from full-year 2022. Full-year 2023 adjusted earnings per diluted share were $5.92, up 21.8% from the prior year. Wabtec said total 2023 sales came in at $9.68 billion, up 15.8% from sales of $8.36 billion in 2022. Cash from operations was a “record high” of $1.20 billion, it said.

At Dec. 31, 2023, the 12-month backlog was $697 million higher than at Dec. 31, 2022, according to Wabtec, and the multi-year backlog was $442 billion lower than Dec. 31, 2022. The company said that “excluding foreign currency exchange,” the multi-year backlog decreased $645 billion, down 2.9%.

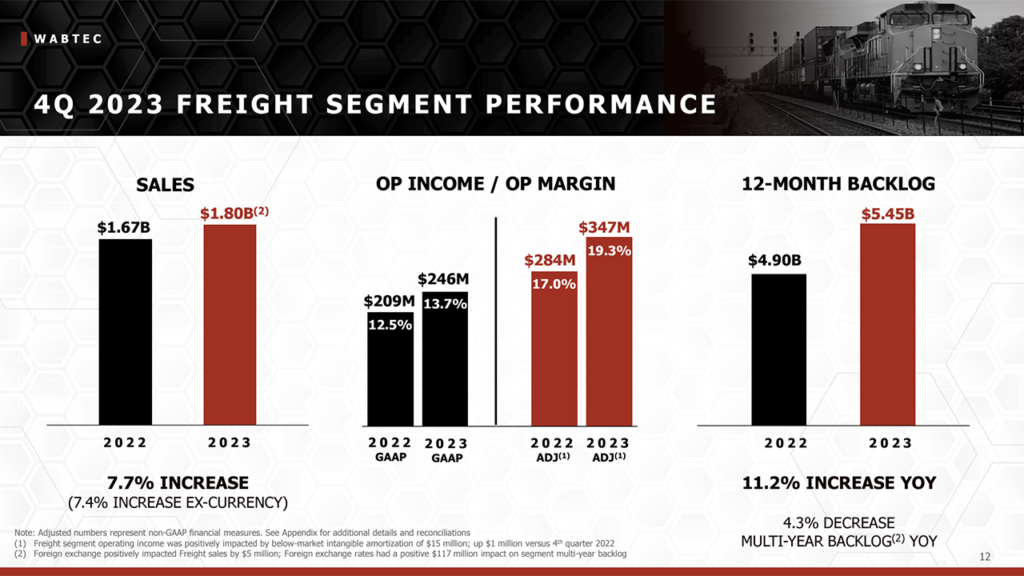

Freight segment sales for fourth-quarter 2023 were $1.80 billion, up 7.7% from $1.67 billion posted in fourth-quarter 2022. Sales were driven by double-digit growth in Services and Components, according to Wabtec, which noted that GAAP operating margin and adjusted operating margin “benefited from strong gross margin gains and lower SG&A and Engineering expenses as a percent of sales.”

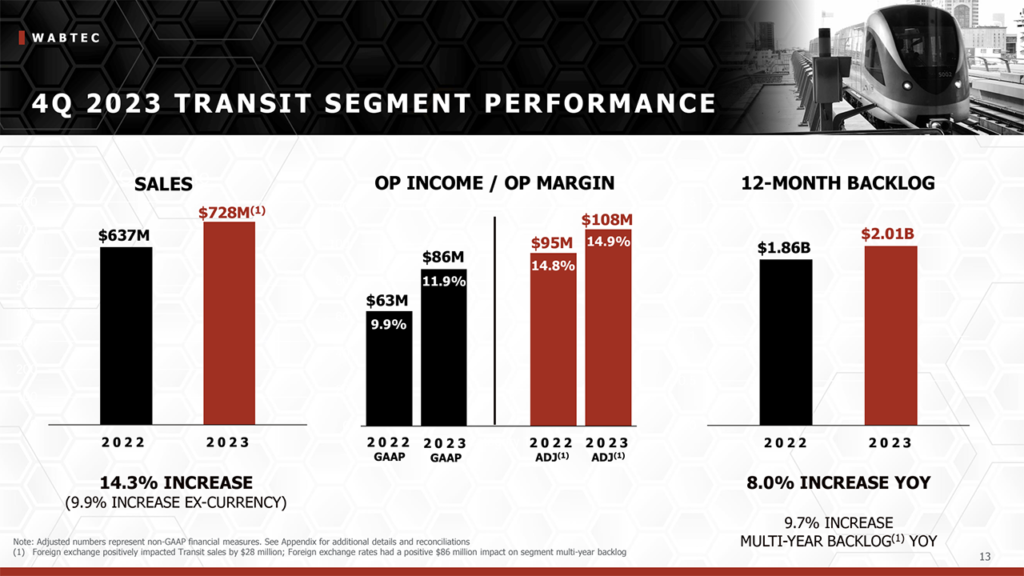

Transit segment sales for fourth-quarter 2023 came in at $728 million, a 14.3% increase from the $637 million posted in the same quarter in 2022. Wabtec attributed this to “to strong OE and aftermarket sales.” Additionally, GAAP and adjusted operating margins were up “as a result of higher sales and savings related to Integration 2.0, partially offset by unfavorable product mix,” the company reported. “GAAP operating margin also benefited from lower year-over-year restructuring expense.”

2024 Outlook

Wabtec issued its 2024 financial guidance, with sales expected to be in the range of $10.05 billion to $10.35 billion, and adjusted earnings per diluted share to be in the range of $6.50 to $6.90. For full year 2024, Wabtec said it expects “strong” cash flow generation, with operating cash flow conversion of greater than 90%.

“We remain committed to our capital deployment strategy to maximize shareholder returns,” Rafael Santana said. “We invested for future growth, executed on two strategic acquisitions and returned over $530 million to shareholders through share repurchases and dividends. And based on our strong performance in 2023 and confidence in the future, our Board of Directors recently reauthorized our stock buyback program to refresh the amount available to $1.0 billion and approved a 17.6% increase in our quarterly dividend.”

Wabtec also reported that it would exit “various low margin product lines,” noting that “[p]runing will improve focus and profitability while reducing manufacturing complexity.” It said divestitures “represent approximately $110 million of 2023 low margin revenues,” with “[r]oughly 50/50 split between Freight and Transit segments.” The company said to “[e]xpect net exit charges of approximately $85 million in predominantly noncash asset write downs.” It noted that a “$28 million non-cash charge booked in 4Q23 GAAP results.”

The Wabtec website provides more earnings details.

TD Cowen Insight, Feb. 14

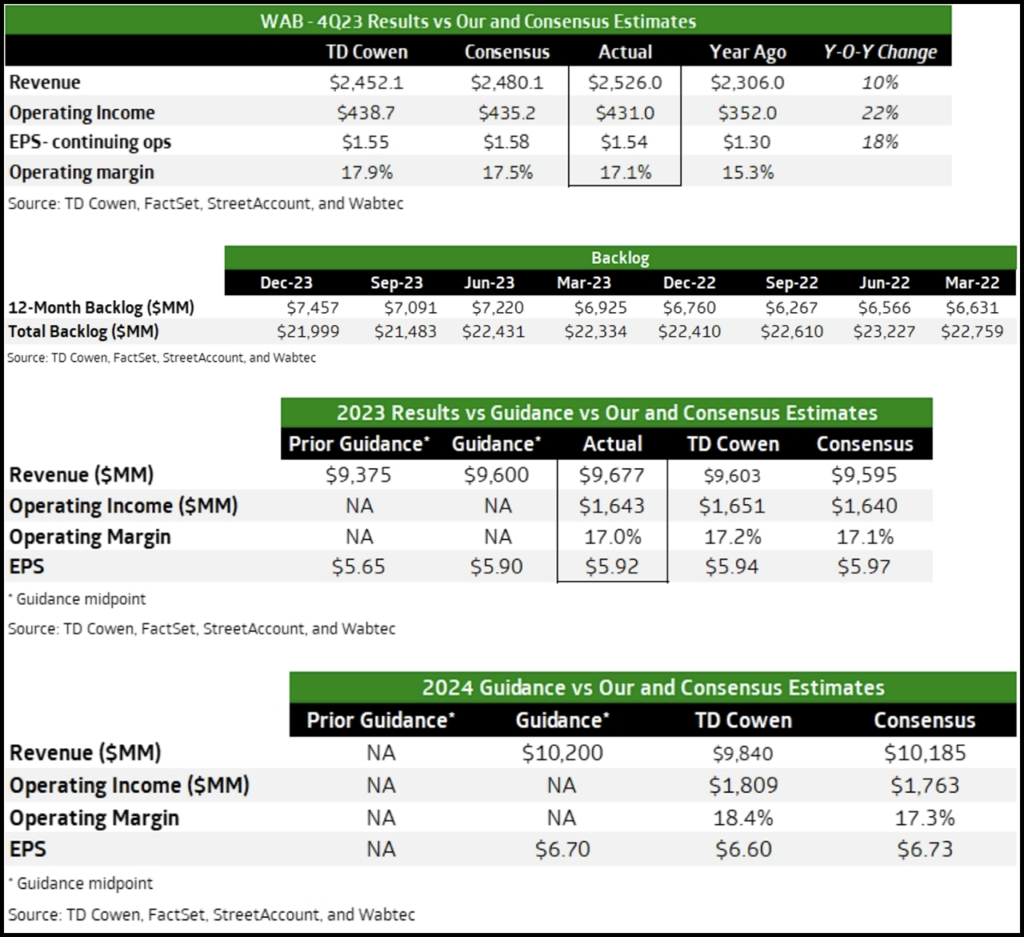

“Wabtec delivered a solid quarter despite a slight EPS miss in 4Q23 and FY24 guidance midpoint just shy of consensus,” TD Cowen Transportation OEM Analyst Matt Elkott said on Feb. 14. “Backlog remains strong, with sequential increases in both 12-month and total backlog on the freight and transit sides. In 4Q23, the $92 million organic freight revenue contribution to year-over-year growth was below the $312 million in 3Q23 and the lowest number in two years—something to keep an eye on.”

Key TD Cowen takeaways:

- “The total backlog remains strong, increasing 2.4% sequentially. The 12-month backlog increased 5.2% sequentially. 12-month backlog in 4Q23 was up 10.3% year-over-year while the total backlog in 4Q23 was down 2% year-over-year and down 2.9% year-over-year excluding unfavorable foreign currency exchange.

- “4Q23 adjusted EPS of $1.54 compared to our estimate of $1.55 and consensus of $1.58. Adjusted operating income of $431 million compared to our and consensus estimates of $439 million and $435 million, respectively.

- “The company guided FY24 EPS in the range $6.50 to $6.90, with a $6.70 midpoint compared to our estimate of $6.60 and consensus of $6.73. Revenue is expected to be $10,050 million to $10,350 million, with a $10,200 million midpoint, compared to our estimate of $9,840 million and consensus of $10,185 million.

- “Wabtec noted freight segment sales for the fourth quarter were up 7.7%, driven by double-digit growth in Services and Components. Adjusted operating margin benefited from strong gross margin gains and lower SG&A and Engineering expenses as a percent of sales.

- “Wabtec noted transit segment sales for the fourth quarter were up 14.3% due to strong OE and aftermarket sales. Adjusted operating margins were up as a result of higher sales and savings related to Integration 2.0, partially offset by unfavorable product mix.

- “We note that, in 4Q23, the organic freight revenue contribution to year-over-year growth of $92 million was below the $312 million in 3Q23 and the lowest number in two years—something to keep an eye on.”

TD Cowen Insight Update, Feb. 15

“We’re fine-tuning our ’24 EPS estimate to $6.85 from $6.60,” Matt Elkott reported on Feb. 15. “Our PT is now $130 based on our new ’24 EPS estimate and an unchanged 19x multiple. Wabtec continues to be a high-quality company with favorable long term growth prospects, but we remain concerned about the NA rail environment challenges we detailed in our July report, Downgrade to Market Perform: Continues to Impress but Risks Underappreciated.

“We continue to believe Wabtec is well positioned in the long term as it enjoys an enviable competitive position as the larger part of a near-duopoly in the relatively high-barriers to-entry locomotive manufacturing market and one of two large participants in the legacy component space, beyond which the market is fragmented and ripe for more consolidation. Execution has improved significantly under the current management, and the long-cycle nature of the business has also helped. What we continue to view as the key intermediate-term risk to Wabtec is improving rail service, which could be a headwind to equipment demand this year, without such a service improvement resulting in more volume coming to

rail as long as end-market demand remains weak.

“One sign of this dynamic could be the difference between Wabtec’s 2023 year-end backlog growth (up 10.3% from year-end 2022) and the revenue guidance midpoint up only 5% for 2024. Difficult revenue comps explain some of it (revenue up a strong 16% in 2023), but it’s possible management is also expecting orders for same-year delivery to be lower than orders for same-year delivery last year. (The 2022 year-end backlog was up 7.8% year-over-year, and Wabtec did 16% revenue growth in 2023).

“We also note that, in 4Q23, the organic freight revenue contribution to year-over-year growth of $92 million was below the $312 million in 3Q23 and the lowest number in two years.

“The total backlog remains strong, increasing 2.4% sequentially. The 12-month backlog increased 5.2% sequentially. Twelve-month backlog in 4Q23 was up 10.3% year-over-year while the total backlog in 4Q23 was down 2% year-over-year and down 2.9% year-over-year excluding unfavorable foreign currency exchange.

“4Q23 adjusted EPS of $1.54 compared to our estimate of $1.55 and consensus of $1.58. Adjusted operating income of $431 million compared to our and consensus estimates of $439 million and $435 million, respectively.

“The company guided FY24 EPS in the range $6.50 to $6.90, with a $6.70 midpoint compared to our estimate of $6.60 at the time of the earnings release and consensus of $6.73. Revenue is expected to be $10,050 million to $10,350 million, with a $10,200 million midpoint, compared to our estimate of $9,840 million (at the time of the earnings release) and consensus of $10,185 MM.”

In related developments, CSX recently extended its AC4400 modernization program with Wabtec to give the remaining 200-plus locomotives in its 460-plus unit fleet improved fuel efficiency, reliability, utilization and tractive effort. Additionally, Wabtec last month reported landing a $157 million brake system order from the Mobility Business of Siemens India Private Limited for Indian Railways’ new line of 1,200 electric locomotives for freight service. The company also announced last year that it was entering the rapidly growing railcar telematics market, with an agreement with Netherlands-based Intermodal Telematics B.V. (IMT) under which Wabtec’s Digital Intelligence Group will create a platform integrating IMT technology.

Wabtec is slated to lay off 94 workers with the closure of its Wilmerding, Pa., plant, this summer.