![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)

RailState: Canadian Railroads ‘Close to Matching Volumes Seen Before B.C. Ports Strike’

Written by Carolina Worrell, Senior Editor

In the month since the end of the main strike period at the B.C. Ports, Canadian railroads are “close to matching volumes seen before the strike,” reported real-time network visibility provider RailState, which independently tracks all freight movements across Canada.

“There has been a significant widespread increase in train volume aimed at clearing backlogs caused by the strike,” announced RailState in its recent report, “Canadian Rail Network Update – Recovering After the BC Ports Strike.”

“We’re constantly monitoring volume movements across the rail network in Canada, and it appears that rail traffic is returning to status quo,” said RailState Co-Founder and Chief Commercial Officer John Schmitter. “We haven’t seen a big increase in volume, and an expectation that the railroads have unused capacity sitting around that can quickly be brought on line to clear what’s built up isn’t reasonable. The decreased volume seen in July will take a long time to resolve or it is lost for good.”

Port of Vancouver

Total train traffic through the Port of Vancouver is in line with pre-strike traffic, according to RailState. Train volume on CN increased over the June average in early August, which would help clear some of the backlog. This increased volume, however, has not been sustained.

Prince of Port Rupert

Traffic through Prince Rupert increased significantly in the week after the strike and has now settled to the pre-strike average, according to the report.

Intermodal

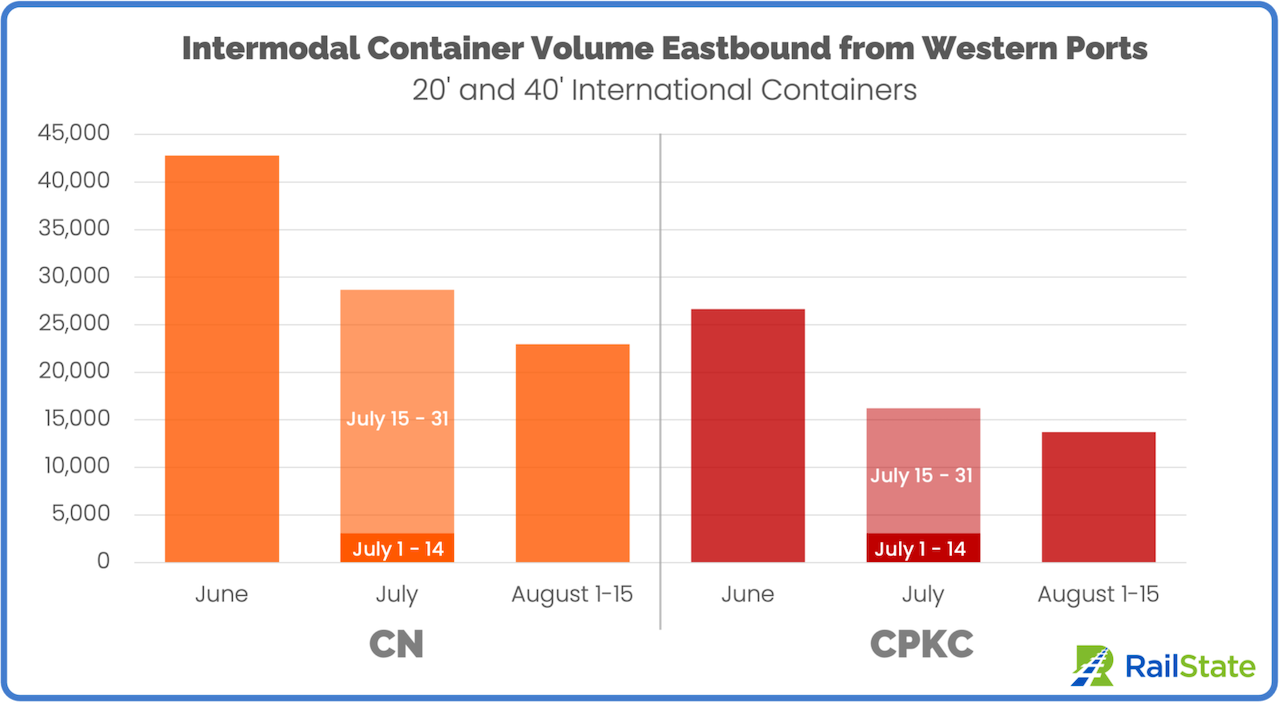

CN moved quickly to clear the container backlog at the western ports. In less than a week from the end of the strike, CN was close to matching the average daily volume before the strike.

And within two weeks, CN increased intermodal traffic to above the historic average and has maintained that elevated volume into August. CN is moving 103 more containers per day than in June (7.2% increase), which is about one extra intermodal train every other day.

Canadian Pacific Kansas City (CPKC) increased intermodal volume more slowly than CN. Since late July, CPKC has hovered right around the average daily volume they moved in June. August average daily volume is 3.1% higher than pre-strike volume.

Commodity Flows

Coal

CN saw an increase in coal traffic during the strike partly due to some producers diverting trains to Prince Rupert instead of to Port of Vancouver and using Neptune Terminals, which was shut down during the strike, according to RailState.

The average daily rate for coal export carloads on CN through the first half of August is down 22.4% from July and still down 12.3% from June volumes.

CPKC lost coal traffic during the strike and has now returned to pre-strike volumes. Export carloads on CPKC are in line with volumes moved during June, with just a modest difference of a 2.4% higher daily average rate in August so far.

CPKC’s lost volumes are largely due to the shutdown at Neptune terminals and Westshore terminals being unable to handle all the volume that would typically move through the Port of Vancouver, according to the report.

Seven coal trains originating in southeast BC were shipped to Prince Rupert, which remained open during the strike.

“RailState is the only data source that identified these diverted trains and the route taken from southeast BC to the Port of Prince Rupert,” the company said. No coal unit trains moved on this route in the previous year or since the end of the main strike period on July 14.

Grain

Grain exports increased during the strike and have now fallen.

Grain continued to move during the work stoppage because of Clause 87.7 of the Canada Labour Code, which states that longshore workers must continue to “ensure the tie-up, let-go and loading of grain vessels at licensed terminal and transfer elevators, and the movement of the grain vessels in and out of a port.” Decreased traffic on the network made it advantageous to increase exports during the strike.

Average daily grain export volume in August remains lower than volumes moved before the strike. Volume on CN is down 13.1% compared to June and volume on CPKC is down 20.5%.

“We expect this lower volume to be short-lived as the annual grain harvest is starting,” said RailState.

Potash

Potash exports decreased significantly during the work stoppage and have not recovered like other commodities, according to RailState. Daily average volume is down 43.2% from June volumes on CN, and down 15.2% on CPKC. There are a couple factors impacting the drop in Potash exports, according to RailState. One is the lower potash volumes compared to other commodities. One additional train movement in a week could significantly change the volumes seen so far in August. More importantly, RailState says, “a major potash producer has curtailed production in response to general demand.”

Further Reading:

- ILWU Canada Accepts B.C. Ports Deal Brokered After Minister Steps In

- B.C. Ports Labor Dispute Drags On

- B.C. Port Strike Resumes as Union Walks Away From Tentative Deal

- B.C. Port Strike: Tentative Settlement Agreed