Greenbrier Ups Delivery, Revenue Guidance for 2023

Written by Marybeth Luczak, Executive Editor

(The Greenbrier Companies Photograph)

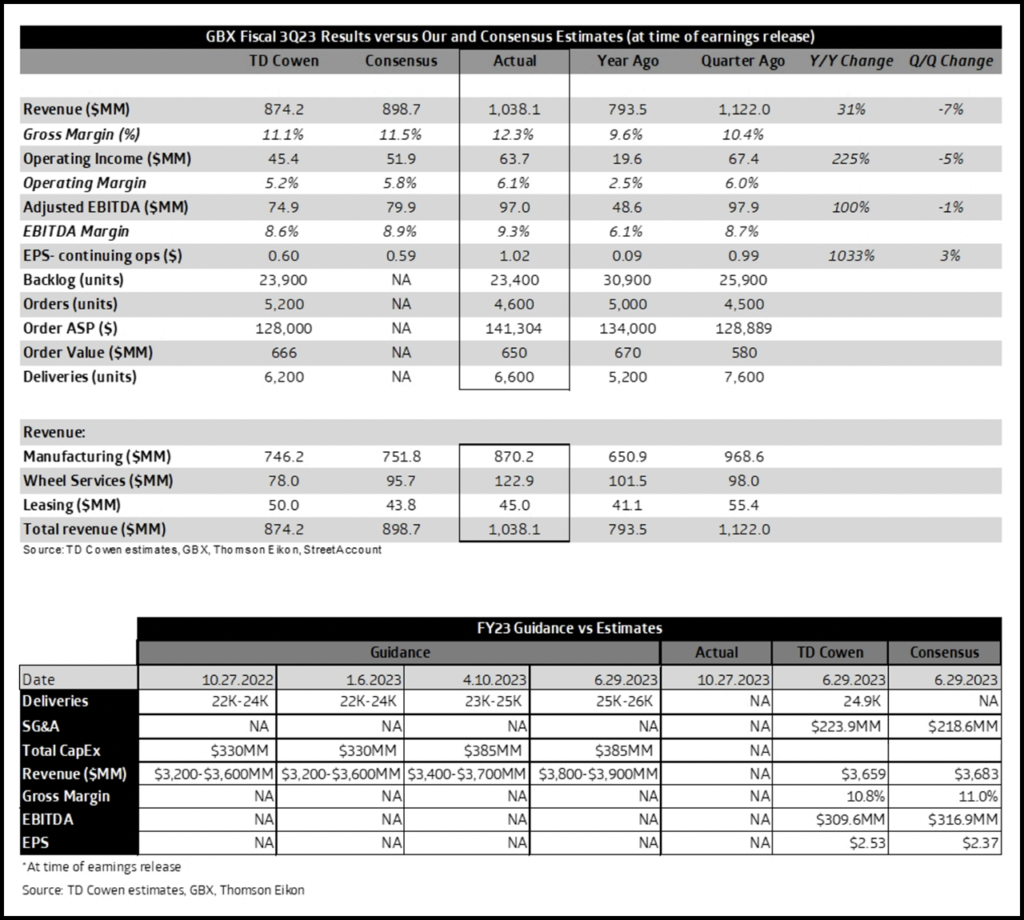

The Greenbrier Companies’ third fiscal quarter, ending May 31, 2023, “reflects continued operating momentum and strong commercial activity,” President and CEO Lorie L. Tekorius said June 29 during the Oregon-based railcar manufacturer’s financial report. The company also raised its delivery and revenue guidance for the year, and announced that Canadian Pacific Kansas City (CPKC) advisor Patrick J. Ottensmeyer has joined its Board of Directors. TD Cowen offers insight.

“Our results demonstrated the early impact of operational initiatives described during our Investor Day in April,” Tekorius said of Greenbrier’s third fiscal quarter. “In particular, certain manufacturing efficiencies were achieved ahead of plan, and we expect further improvement. Our new railcar backlog provides strong revenue visibility and further confidence as we execute our strategic plan. We are excited as we embark on our multi-year strategy, including a substantial lease fleet investment. This will maximize Greenbrier’s financial performance during periods of strong market demand and stabilize performance at higher levels when demand is less favorable.”

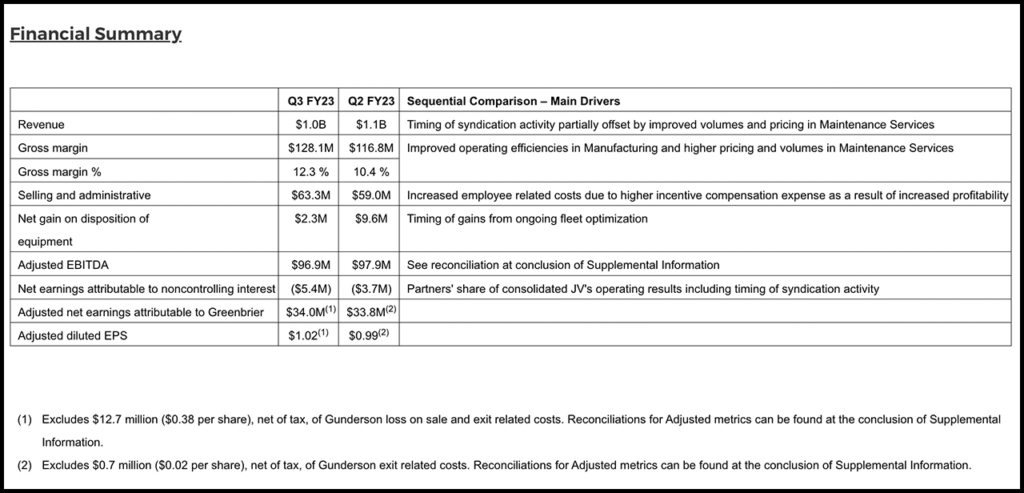

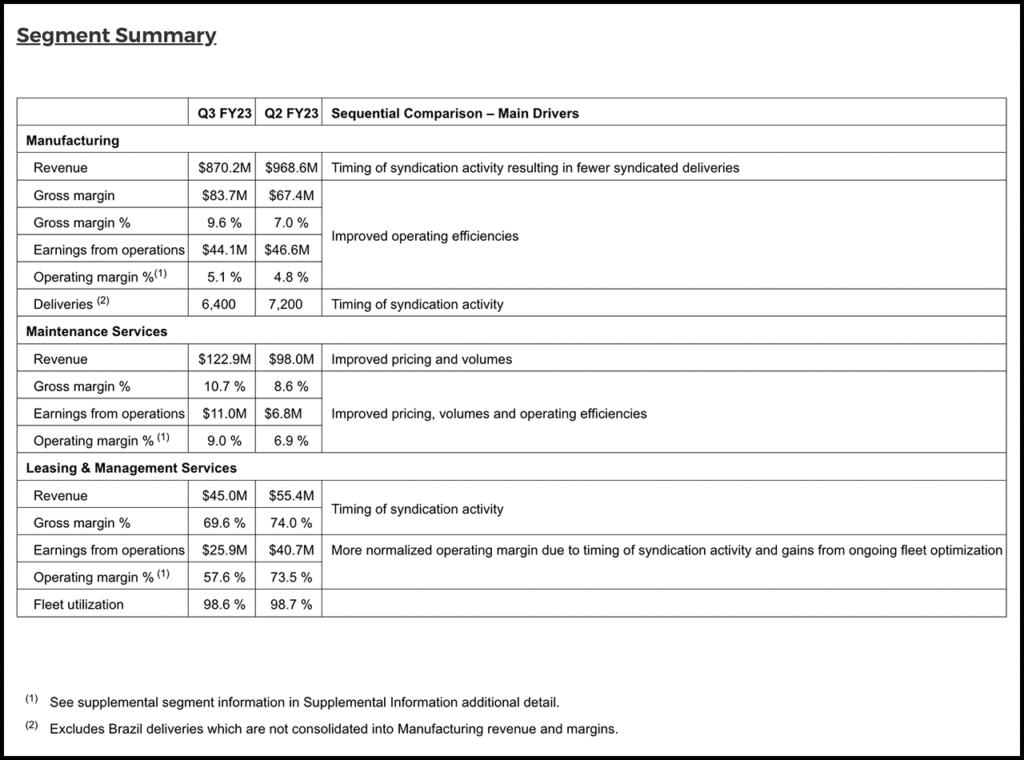

Following are Greenbrier’s third fiscal quarter 2023 highlights:

- New railcar orders came in at 4,600 units (valued at $650 million) and deliveries were 6,600 units. According to the company, after quarter-end it received orders for 7,900 units valued at $975 million.

- New railcar backlog as of May 31, 2023, was 23,400 units with an estimated value of $2.9 billion, which Greenbrier said “excludes orders received subsequent to the end of the quarter and railcar conversion backlog of 1,000 units.”

- Quarter-end liquidity was “strong” at $665 million, the company said, and included $321 million in cash and $344 million of available borrowing capacity.

- Net earnings came in at $27 million and net earnings attributable to Greenbrier were $21 million, or $0.64 per diluted share. The company said the results include a $13 million ($0.38 per share), net of tax, loss related to the sale and exit of Gunderson Marine.

- Adjusted net earnings attributable to Greenbrier were $34 million or $1.02 per diluted share.

- Revenue came in at $1.0 billion, operating cash flow at $98 million, and adjusted EBITDA at $97 million.

- Greenbrier said it repurchased 1.2 million shares of stock for $32 million; $54 million remaining under current share repurchase program.

Business Update, Outlook for Fiscal Year 2023

Based on current trends and production schedules, Greenbrier said it has updated its guidance for fiscal year 2023. It expects deliveries of 25,000-26,000 units, including approximately 1,000 units in Greenbrier-Maxion (Brazil); this is up from 23,000-25,000 units, including approximately 1,000 units in Greenbrier-Maxion (Brazil), which it estimated in April, during its second fiscal quarter 2023 report. Revenue of $3.8 billion to $3.9 billion is now anticipated for 2023, up from the $3.4 billion-$3.7 billion estimated in April. Additionally, Greenbrier said capital expenditures of $280 million are expected in Leasing & Management Services, of $90 million in Manufacturing, and of $15 million in Maintenance Services; proceeds of equipment sales are $76 million; and the consolidated gross margin percentage of the low double-digits is unchanged.

The company noted that during Investor Day, it unveiled long-term financial targets including: growth +100% in annual recurring revenue from its Leasing & Management Services segment; aggregate gross margin in the mid-teens by fiscal 2026; and return on invested capital of between 10% and 14% by fiscal 2026.

More details can be found through Greenbrier’s Financial webpage.

Ottensmeyer Joins Greenbrier Board

Greenbrier also reported that Patrick J. Ottensmeyer has been elected to its Board of Directors. Ottensmeyer was previously President and CEO of Kansas City Southern (KCS), which on April 14 merged with Canadian Pacific (CP) to form CPKC, becoming the first single-line, transnational railway connecting Canada, the U.S. and Mexico. He is serving as an advisor to CPKC President and CEO Keith Creel (formerly CP President and CEO) through the remainder of 2023. Both are former Railway Age Railroaders of the Year, sharing the honor in 2022 and independently honored in 2020 (Ottensmeyer) and 2021 (Creel). This year, Ottensmeyer received the NARS Edward R. Hamberger Lifetime Achievement Award, and in 2022 he was the recipient of Ingram’s Executive of the Year Award.

Ottensmeyer is the U.S. Chairman of the U.S. Chamber of Commerce’s U.S.-Mexico Economic Council (USMXECO), presiding over the U.S.-Mexico CEO Dialogue, which occurs twice annually, and overseeing the Council’s agenda of engagement with public- and private-sector leaders in the U.S. and Mexico “to strengthen bilateral commercial ties,” Greenbrier noted. “As leader of the U.S.-Mexico CEO Dialogue, Ottensmeyer was instrumental in representing business interests during the formation of the United States-Mexico-Canada Agreement (USMCA) from 2017-2020,” according to Greenbrier.

Ottensmeyer is also Co-Chair of the Brookings Institute USMCA Initiative and serves as Chair of the Truman Library Institute.

“Pat’s experience in operating international businesses with strong regulatory oversight will be invaluable to Greenbrier,” Greenbrier Board Chair Thomas Fargo said. “In addition to his unique experience leading a company that connects the entire North American economy, he is committed to continuous improvement and collaboration. Pat’s leadership role in the CPKC merger demonstrates his vision for economic growth and supply chain integration. Through CPKC, Pat helped create the first fully integrated rail freight route spanning all three nations of North America. The Board is confident he will provide important perspectives as we continue to execute our strategy, drive profitability and enhance value for all Greenbrier shareholders.”

“As a thoughtful and influential leader, Pat has brought growth and innovation to the rail industry’s most complex challenges, including deep involvement during the creation of the USMCA,” Lorie Tekorius said. “His leadership in U.S.-Mexico trade relations is unmatched, with decades of experience leading in both business environments. With more than 10,000 of our employees based in the United States and Mexico, we will value his insights into our business which relies heavily on effective management of trade and labor issues between the U.S. and Mexico. Greenbrier is fortunate to have Pat join our Board of Directors.”

Cowen Insight: ‘Impressive Executive Produces Banner Quarter for Our 2023 Smidcap Pick’

“GBX [Greenbrier] reported an impressive all-around beat to our and consensus estimates and raised guidance,” TD Cowen Transportation OEM Analyst and Vice President Equity Research Matt Elkott reported June 29. “Deliveries and gross margin exceeded expectations. While orders were somewhat below our estimate, after quarter-end, GBX received orders for a strong 7,900 units. FY23 delivery and revenue guidance are above our projections. We have higher confidence in our above-consensus FY23 and FY24 EPS estimates.

“The results affirm our favorable view into the print: see our June 16 selection of GBX as our best Smidcap pick Best Smidcap Ideas: Well Positioned For Manufacturing Ramp and our June 23 Machinery Weekly & Industrial Heatmap for broader positioning. The decisive all-around beat occurred despite lower gains on sales, lower earnings from unconsolidated affiliates, and higher interest and foreign exchange expense than we had modeled. GBX increased the quarterly dividend by 11% to $0.30. The shares should outperform significantly.”