Intermodal Briefs: POLB, ITS Logistics

Written by Marybeth Luczak, Executive Editor

Aerial view of Pier B. (Port of Long Beach Photograph)

The U.S. Department of Transportation (USDOT) awards the Port of Long Beach (POLB) $283 million for its Pier B On-Dock Rail Support Facility project. Also, ITS Logistics releases its December forecast.

POLB

POLB will receive $283 million for its Pier B On-Dock Rail Support Facility project through the USDOT’s Mega Grant Program, the Port reported Dec. 18. The $1.567 billion project is described as “the centerpiece” of POLB’s on-dock rail construction improvements.

The new facility is slated to more than double the size of the existing Pier B rail yard from 82 acres to 171 acres and more than triple the volume of on-dock rail cargo the Port can handle annually, from 1.5 million twenty-foot equivalent units (TEUs) to 4.7 million TEUs. The yard will also feature a depot for fueling and servicing up to 30 locomotives at the same time and a full-service staging area to assemble and break down trains up to 10,000 feet long. The overall project will be built in phases—starting with the rail yard’s East Expansion—with completion by 2032.

Constructing the facility involves adding more than 130,000 feet of rail, quadrupling the number of tracks from 12 to 48, widening the rail bridge over the Dominguez Channel from two to three tracks, and reconfiguring and improving nearby Pico Avenue and Pier B Street.

Construction is expected to begin in 2024. POLB on Nov. 29 announced that after 15 years of planning, it is going out to bid early next year for its first construction contract.

The existing Pier B rail facility serves as a storage and staging area for trains and is primarily used by Anacostia Rail Holding’s Pacific Harbor Line (PHL), which provides rail dispatching and switching services.

Pier B is a major junction connecting the San Pedro Bay ports complex to the Alameda Corridor and major intermodal hubs along the transcontinental rail network. Every week, an average of 90 trains either depart or arrive from the Port on their way to and from destinations across the U.S.

Currently, about 20% of cargo comes and goes through the San Pedro Bay complex via on-dock rail. The Pier B On-Dock Rail Support Facility “is critical to helping the ports boost on-dock rail use to 35%, toward achieving their larger goal of reducing greenhouse gas (GHG) emissions from port-related sources to 40% below 1990 levels by 2030 and 80% below 1990 levels by 2050,” according to POLB.

“Moving cargo by on-dock rail … is cleaner and more efficient, as it reduces truck traffic,” POLB said. “When the new [Pier B rail] facility opens, no cargo trucks will visit. Instead, smaller train segments will be brought to the facility and joined together into a full-sized train.”

POLB said it continues to seek funding partners for the Pier B project. The California State Transportation Agency (CalSTA) in July 2023 announced a grant of $158 million from the Port and Freight Infrastructure Program for it, and the federal government previously awarded almost $105 million. To date, the Port said it has secured more than $640 million in grant funding for the project.

“Moving more cargo with less environmental impact is the focal point of our approach to business,” Long Beach Harbor Commission President Bobby Olvera Jr. said. “The Pier B On-Dock Rail Support Facility, ‘America’s Green Gateway,’ will do this while easing traffic on regional roads and improving air quality. It’s also vital to help meet the environmental goals outlined in the Clean Air Action Plan.”

“This is a facility that will help move cargo more efficiently to homes and businesses across America, and from U.S. producers to overseas markets, resulting in systemwide benefits to the supply chain,” POLB CEO Mario Cordero said.

ITS Logistics

ITS Logistics on Dec. 18 reported that operations at ocean terminals throughout the US are “running at normal levels” and are expected to do so for the rest of the year; trucking capacity in 2024 is expected to “continue exiting the market and could be compounded by California’s ban on new internal combustion truck registrations for drayage”; and West Coast ports “face the possibility of significant congestion, the levels of which have not been seen in almost a year.”

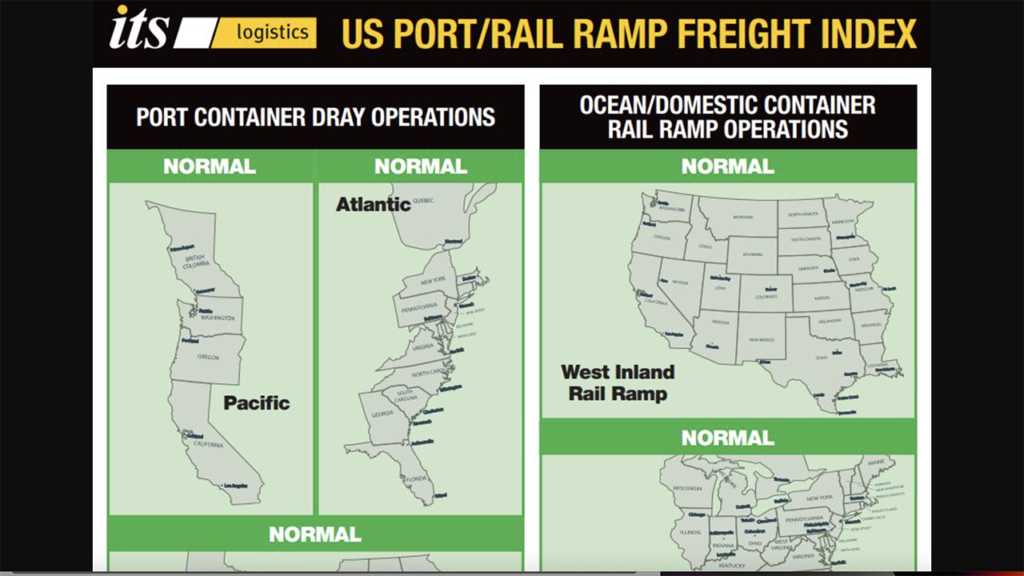

The findings come from the December edition of the ITS Logistics US Port/Rail Ramp Freight Index. The Nevada-based third-party logistics (3PL) firm releases the index each month, forecasting port container and dray operations for the Pacific, Atlantic and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions.

“Today’s lower inventory levels could equal a more pronounced Lunar New Year peak than we saw in 2023,” said Paul Brashier, Vice President of Drayage and Intermodal for ITS Logistics, which provides drayage and intermodal services in 22 coastal ports and 30 rail ramps throughout North America. “Combine that with transpacific volumes being diverted from the East Coast as shippers avoid both the Panama and Suez Canal and it could quickly cause significant congestion.”

Exiting capacity in the market could worsen congestion and increase rates, according to the 3PL firm. “ACF Drayage Truck Requirements in California ban any new registration of internal combustion trucks, which is expected to have a chilling effect on capacity and potentially drive more of it out of the market,” it reported. Additionally, there is the potential for ILA labor unrest at the East and Gulf Coast ports, “which could drive even more volume to West Coast ports and increase the chances of disruption.”

“ILA labor negotiations will be ongoing up until September,” Brashier said. “If labor unrest occurs and more volume is driven west, it will be interesting to see if the West Coast ports and infrastructure is prepared to handle that surge in volume as capacity exits the market.”

U.S. ports handled 2,099,408 twenty-foot equivalent units of imports in November, according to ITS Logistics; this was 9% less than in October 2023, but volumes increased by up to 7.4% vs. November 2022. “Despite supply chain challenges, imports from January to November are up 4% vs. the same period in 2019, supporting the fact that imports have continued to outpace pre-COVID levels,” the 3Pl firm reported. “The data found in this month’s index reveals demand spikes in November and early December for Savannah, New York/New Jersey, Los Angeles/Long Beach, Dallas, and Chicago.”

According to ITS Logistics, as the Panama Canal continues to experience congestion for non-containerized cargo due to water levels and additional charges on containerized goods, “navigating the canal may cause some inflationary pressure.” Additionally, it said, “several shippers have chosen to avoid the Suez Canal completely in response to an increased number of drone attacks in the Red Sea and Gulf of Aden. Vessels navigating the Suez Canal should soon see increased insurance costs, which is likely to create additional inflationary pressure as well, posing the potential risk of vessels avoiding the canal altogether.”