Intermodal Briefs: ITS Logistics, Port of Long Beach

Written by Carolina Worrell, Senior Editor

ITS Logistics releases its August forecast. Also, cargo volume dips in July at Port of Long Beach (POLB).

ITS Logistics

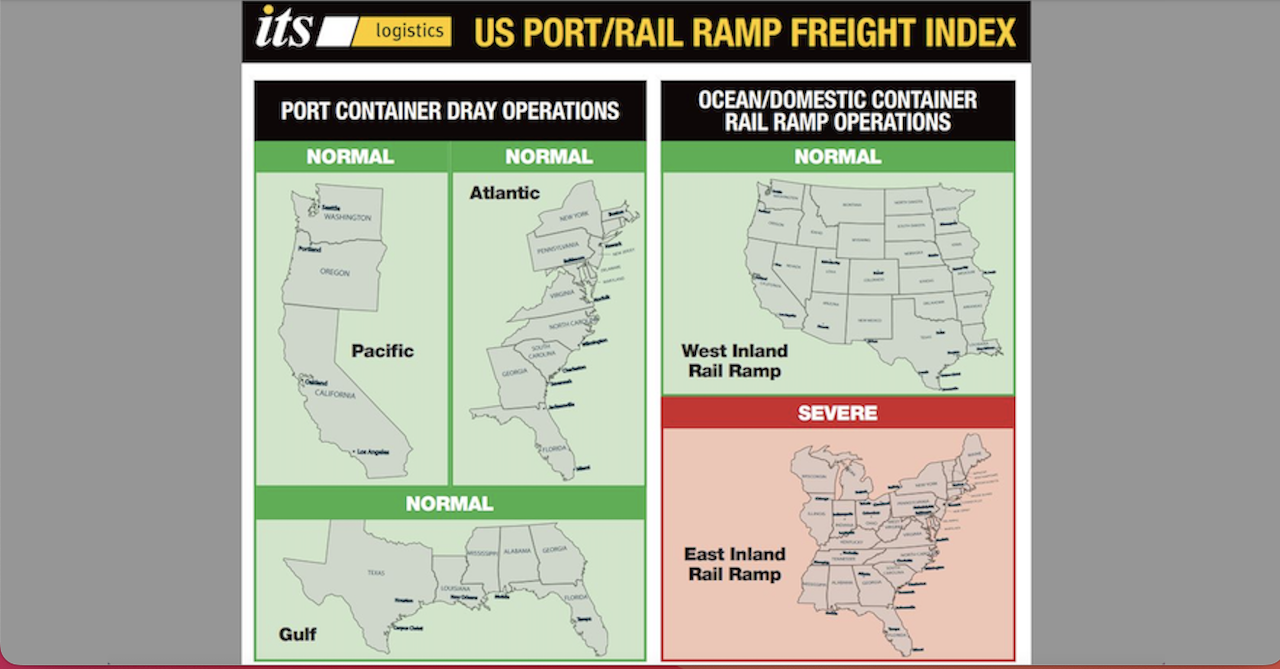

ITS Logistics on Aug. 15 issued the August ITS Logistics US Port/Rail Ramp Freight Index, forecasting port container and dray operations for the Pacific, Atlantic and Gulf regions. The 3PL (third-party logistics) firm based in Reno, Nev., said the index reveals that “because of the recently resolved British Columbia labor issues, congestion and delays are manifesting at Chicago and other Midwest rail ramps.” Additionally, ITS Logistics forecasted that there is an increased likelihood that trucking capacity will start exiting the market at an alarmingly high rate.

“There are side effects still being felt from the labor disruption in Western Canada, specifically at the Eastern Region rail ramps in Chicago and the Midwest,” said Paul Brashier, Vice President of Drayage and Intermodal for ITS Logistics. “As weeks of affected IPI container volume finally begin to make its way via rail from Vancouver and Prince Rupert to Chicago and other Midwest ramps, congestion and delays are occurring at those locations. For most of August, these ramps will experience a lack of ocean container chassis availability and significant congestion causing an increased likelihood of storage and detention charges.”

As the industry attempts to adjust to the aftermath of the latest events in supply chain disruption, ITS Logistics says it is also monitoring trucking capacity. Current trends show an increased likelihood that capacity will start exiting the market at an alarmingly high rate, the 3PL firm said. According to the current analysis of trucking rates versus carrier operating costs and profitability with the recent increases in fuel, it appears that many small to medium size trucking companies will be operating at a loss unless rates increase.

“Current forecasts show rates for trucking to start increasing around Lunar New Year 2024, as regular container volumes should return for that period. This will occur for the first time in almost two years, as shipper and BCO inventory levels should normalize for the first time since the pandemic,” continued Brashier.

Brashier suggests that during the congestion, companies should avoid booking low-inventory or high-demand SKUs to the ramps of the Midwest via IPI. Instead that inventory should be transloaded and then moved inland by way of truckload or intermodal. Furthermore, as the freight sector of the industry experiences a slower season as of now, shippers should take time to properly vet the overall fiscal health of trucking providers. “As shippers start to review current RFPs (Requests for Proposals) and issue awards, select a trucking partner that provides more value than the least expensive rate,” Brashier said. “Honoring RFP rates for the duration of the contract, fiscal health, solid visibility software, and operational excellence should also be considered during this process.”

Port of Long Beach

Trade dipped at POLB in July “due to adjusted trade routes, full warehouses and a shift in consumer spending to travel, entertainment and other experiences,” the Port announced on Aug. 15.

According to POLB, dockworkers and terminal operators moved 578,249 twenty-foot equivalent units (TEUs) last month, down 26.4% from July 2022, which was the Port’s busiest July on record. Imports declined 27.9% to 271,086 TEUs, while exports decreased 17.6% to 90,134 TEUs. Empty containers moving through the Port were down 27.7% to 217,030 TEUs.

The Port has moved 4,310,925 TEUs during the first seven months of 2023, down 25.6% from the same period last year. Cargo flows are now closer to pre-pandemic levels when POLB moved 4.3 million TEUs through the first seven months of 2019.

“I am confident we will see our numbers improve as we work with industry partners to rebuild our market share,” said POLB CEO Mario Cordero. “Looking ahead in the near term however, we anticipate a modest ‘peak season’ for shipping as consumers spend a little less this year on back-to-school supplies and gifts through the holiday season.”

“Our facilities, longshore labor, marine terminal operators and all of our industry partners continue to make this the premier gateway for trans-Pacific goods movement,” said Long Beach Harbor Commission President Bobby Olvera Jr. “We are ready for a rebound in cargo volume based on our ability to move cargo reliably, quickly and sustainably.”