Are You Ready for 2024?

Written by Ron Sucik, Contributing Editor and Principal, RSE Consulting

BNSF Hobart Intermodal. BNSF photo.

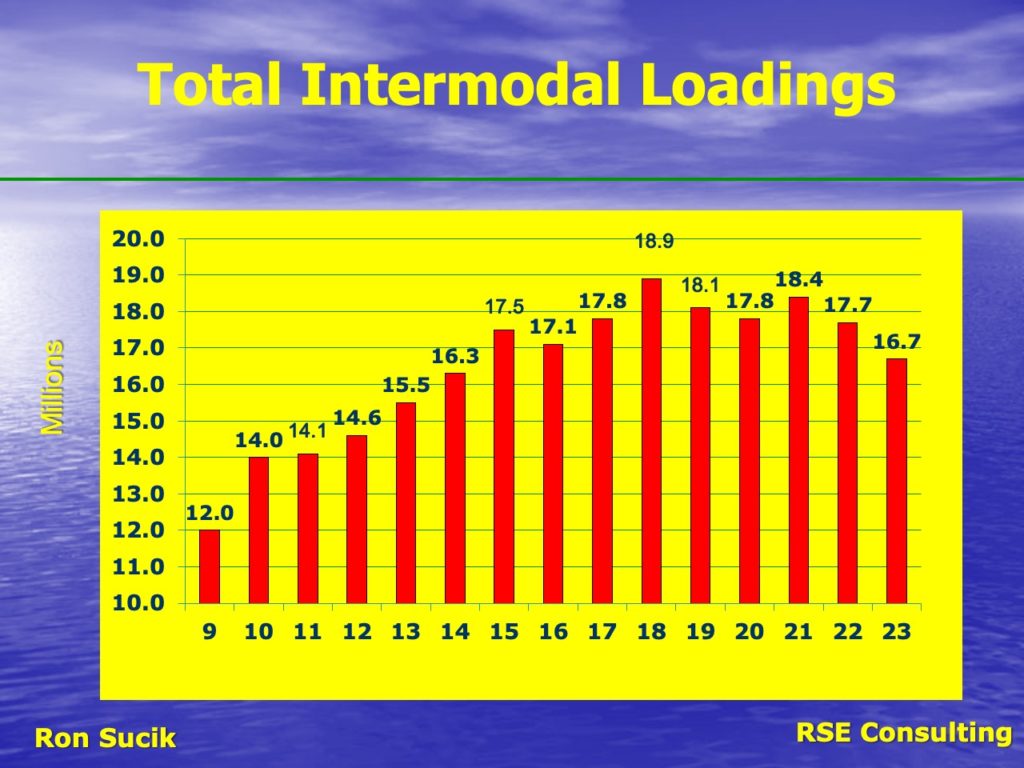

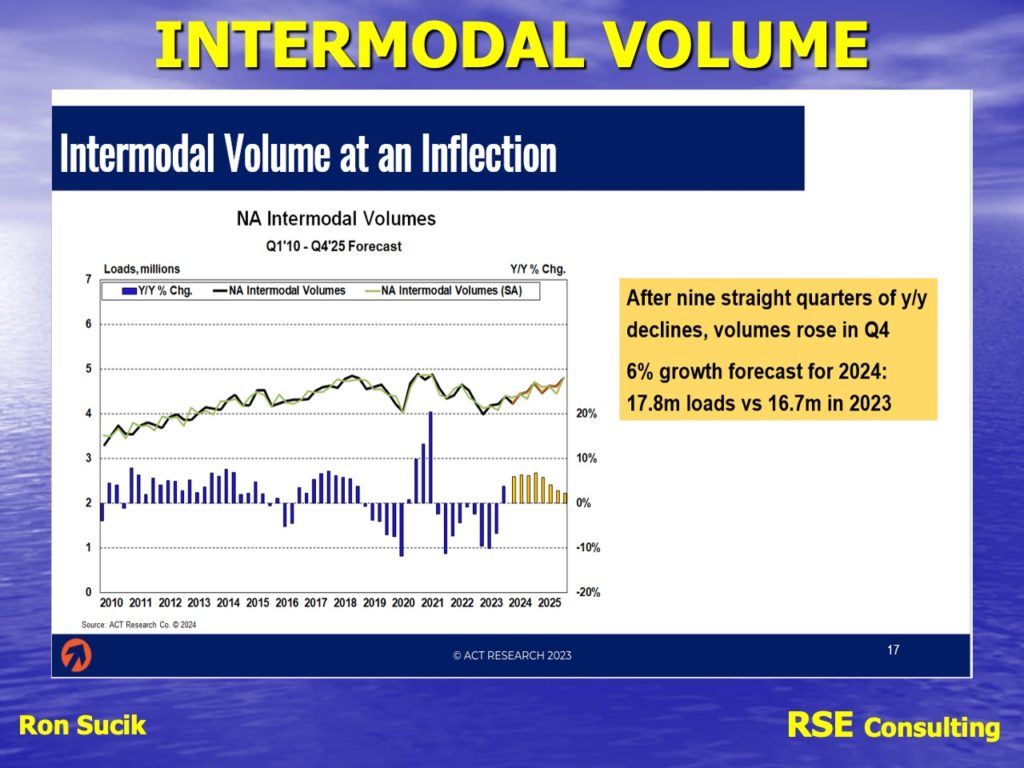

Rail Equipment Finance 2024: Does anyone remember the saying “In Like a Lion—Out Like a Lamb”? Intermodal loadings ended 2023 on a strong note and started out 2024 positive as well. The Port of LA/Long Beach (POLA) started January with near-record import numbers. Some of that can be explained.

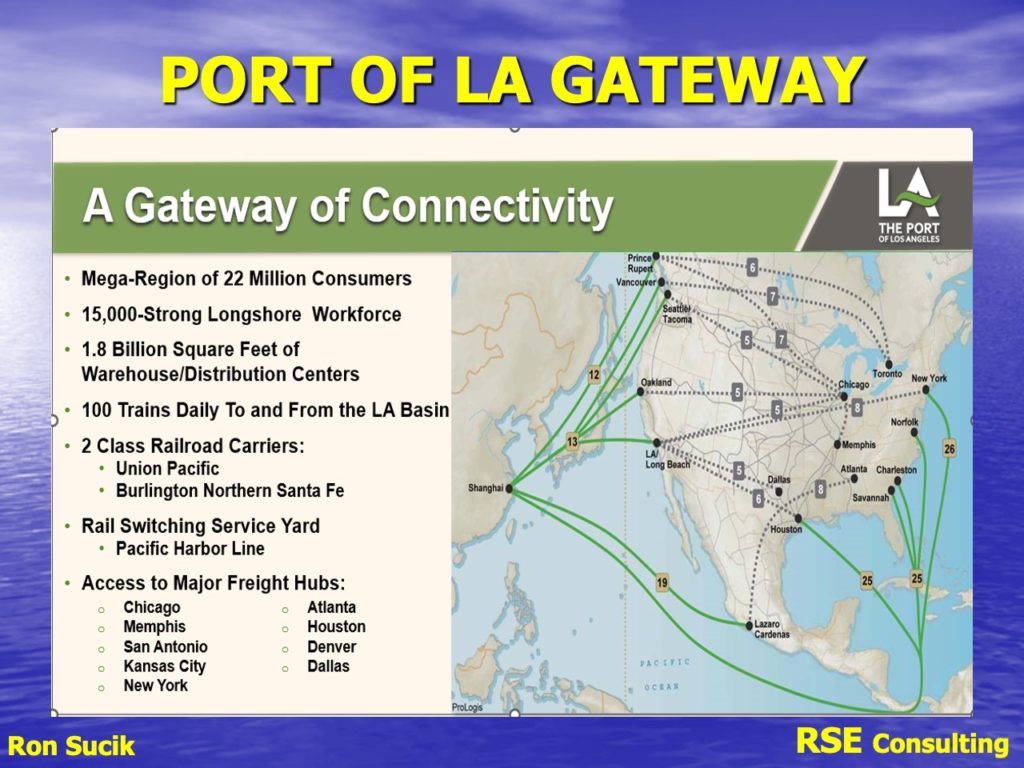

Contrary to most predictions, 2023 Intermodal loadings once again retracted until the very end of the year. Just to put the San Pedro Port Complex into perspective, here is a slide my friends at POLA gave me. You can see the time differences from Asia to various North American points via Prince Rupert, Pacific Northwest, Pacific Southwest or all-water through the Panama Canal to the East Coast. And there is a cost associated with the East Coast move.

I met with the POLA Marketing people and a couple of LA transloaders. Both ports had significant surges of imports during January. In fact, for POLA, January was the second-highest volume in history and the fifth consecutive Y/Y increase following 13 months of decline in cargo. Both Port Commissioners attributed this to a replenishment of inventories ahead of the usual Lunar New Year production slowdown.

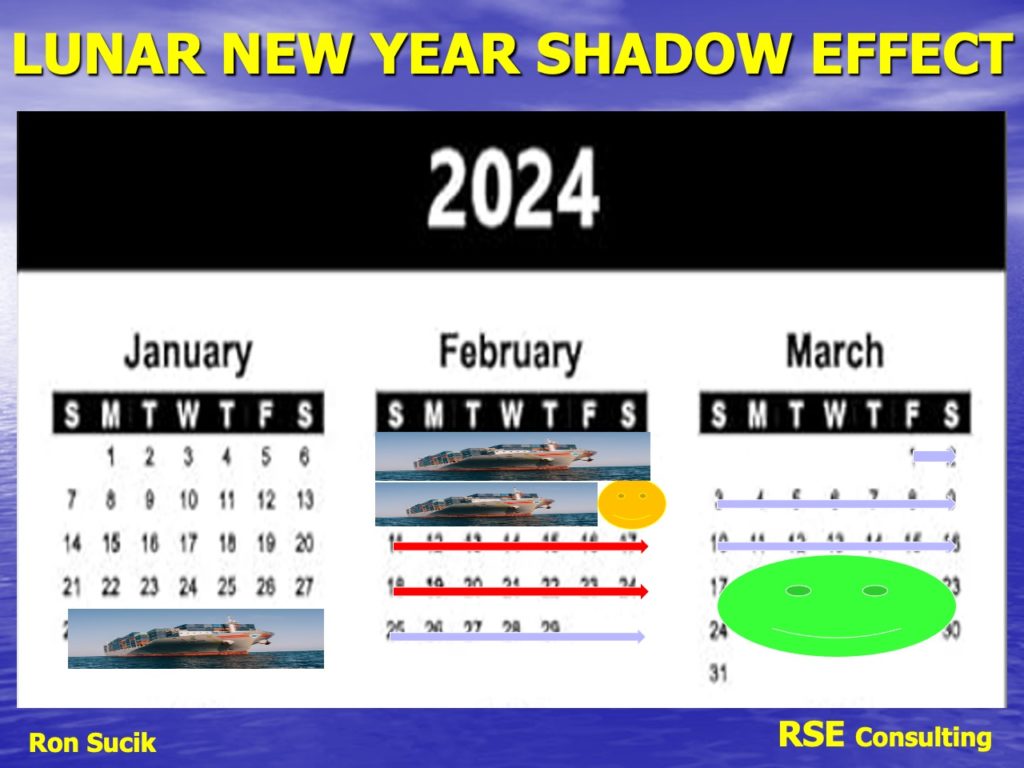

A few years back, I coined the phrase “Lunar New Year Shadow Effect” as it related to the volume of import containers coming from Asia and for the most part China. As a refresher, think of the Lunar New Year date. Realize that on that date the largest human migration in the world takes place as most Chinese laborers travel back to their home villages for the holiday and the manufacturing plants shut down for two weeks.

The result is that U.S. importers will order their early year products in front of that date to assure placement in time for demand. A flurry of containers are loaded prior to the shutdown date and loaded on eastbound container ships that can be on the West Coast in 13 days.

Those of us that watch intermodal rail loadings usually see this surge in the Y/Y numbers up to and following the Lunar New Year Date for about two weeks. Then just as suddenly, the numbers will drop as those last ships that were loaded Eastbound have arrived on the West Coast and sailings decline while the manufacturing is shut down for the two weeks.

Once the manufacturing starts up again and ships are loaded, come East and are unloaded at the West Coast ports, the numbers will pick up again. Keep in mind that since the Lunar New Year Date changes every year. these Y/Y loading comparisons can vary those totals considerably.

Another often overlooked caveat that will stimulate intermodal loading numbers is what the IPI (Inland Point Intact) rate the railroads will charge. Back when I was gathering information for a Trade Flow Study, the Alameda Corridor was about to become operational. An acquaintance, Jim Mucci who worked for Pacer at the time, told me it didn’t matter what improvements were made to the logistics system, it was what the railroads charged for the IPI rate that determines the transload numbers. I was told by my transloader friends that presently the railroads have a very favorable IPI rate and it has encouraged more ISO (International Container) traffic to skip the transload and to move on the rails.

In other words, when the IPI rate is favorable, shippers are more likely to ship their containers “inland intact” without processing a transload in LALB. Remember that the cubic capacity of 10 ISO Containers is equivalent to 7 53-foot domestic containers. That could mean a 30% increase in rail container loads. Keep in mind these are not the Walmart, Target or Home Depot retailers but often the smaller shippers like Harbor Freight.

I don’t have the advantage of unlimited resources or access to all the financial forecasting information that is out there. Thankfully I am able to share conversations with people like Bascome Majors, Tony Hatch and Jim Blaze. But I do have a lot of friends in various occupations who often have interesting comments about the economy.

We have a very close friend in Phoenix, Johnny, a West Point Graduate who worked for the NSA and whose brother worked for Barry Goldwater. Upon returning to Phoenix, he opened up Healthwaves, which comes to you for your company’s physicals, bloodwork, inoculations etc. We talk often to discuss military policies and the economy. Johnny just told me their-five year lease expires at the end of 2025 and they have been informed their per-square-foot rate is going up from $0.94 to $2.00. That is a 100% increase in rent!

Healthwaves is in Tempe, which is a very central and favorable location. And with all the people moving to Phoenix a very desirable location. I asked Johnny that if rental demand is so high what can he do about the increase? He said you either downsize, which he cannot do as he has a small staff to start with. Or he could relocate to a less desirable location, and face the costs of moving all the equipment and supplies. He mentioned that two companies have already moved out of his industrial complex to less favorable locations.

Healthwaves is a niche business and is experiencing inflationary increases for incidentals like drugs and supplies They range from 25% to the 100% for rent. Johnny recognizes that the increases are not the same as an ordinary business, but he commented that a close friend is the accountant for PetSmart and told him he noticed both in his personal purchases as he finished remodeling his house and in various products at their stores the inflationary rate appears to be closer to 10% than 5%. The bottom line for Healthwaves or Pet Smart is they will have to increase their prices to meet their higher expenses.

This made me curious, so I called another friend who is in the Phoenix industrial real estate market. He confirmed that Healthwaves is between a rock and a hard place, as almost all of the new industrial construction in the Phoenix area is at 10,000 to 15,000 square-foot locations, much larger in size and usually located west of town near Surprise, Ariz. I also checked with my son’s girlfriend, who manages real estate properties in the Chicago area. Their prices have gone up 22.5%. Another friend who owns trailer parks in Florida held the line during COVID but is increasing rates 7.5% on existing occupancies while new occupancies are double-digit increases.

I have a hunting buddy who works for Iloca in Aurora, Ill. Iloca sells and leases new trailers. He said in 2022 the OEMs built the second highest number of trailers in history. Iloca ordered 400 in 2022 followed by 600 in 2023. Then the freight recession hit, and he witnessed the highest number of bankruptcies in 7 years, and multiple orders were cancelled. Trailer sales dropped 13.5% Y/Y. They had to offer up 300 of the 600 trailers to the lease fleet. No trailers were ordered in 2024. As food prices rose, people cut back on perishable products and the reefer fleet was suddenly surplus. Iloca offered up most of their new reefers for sale at less than cost just to get them off inventory.

Kenny Veith of ACT told me 2023 was an all-time record high in tractor sales. The private fleets bought up more market share and brought traffic in-house for fear of not having a large enough vocational fleet to handle their products to market. Then the freight recession hit at the end of 2022 going into 2023. Truck sales usually lag behind the freight cycle by about a year, so expect truck sales to drop in 2024.

Next, I checked in with my neighbor, who manages one of the Grocery Markets on the south side suburbs of Chicago, and my son-in-law, who operates Bilbo’s, a pizza place in Kalamazoo, Mich. I was already feeling higher food costs, both in the store and at restaurants. My grocery store manager said it is difficult to put a hard number on Y/Y increases because prices can vacillate so much depending on what is in season or if supply is high on a certain product. But he did say that, in general terms, some product prices have increased substantially while others are increasing less because of supply promotions. The aggregate increase Y/Y of all his shelf products would come in over 10%. When was the last time you bought a dozen eggs for $0.99 or a pound of butter for less than $3.00?

My son-in-law says in 2023, dairy and meat started to go up in price while produce went down due to good crop production (but coincidently, bacon was inexpensive). Suddenly in January, 2024 dairy and meat start dropping and produce got expensive. Expensive produce can be explained by the season. But meat and dairy becomes puzzling.

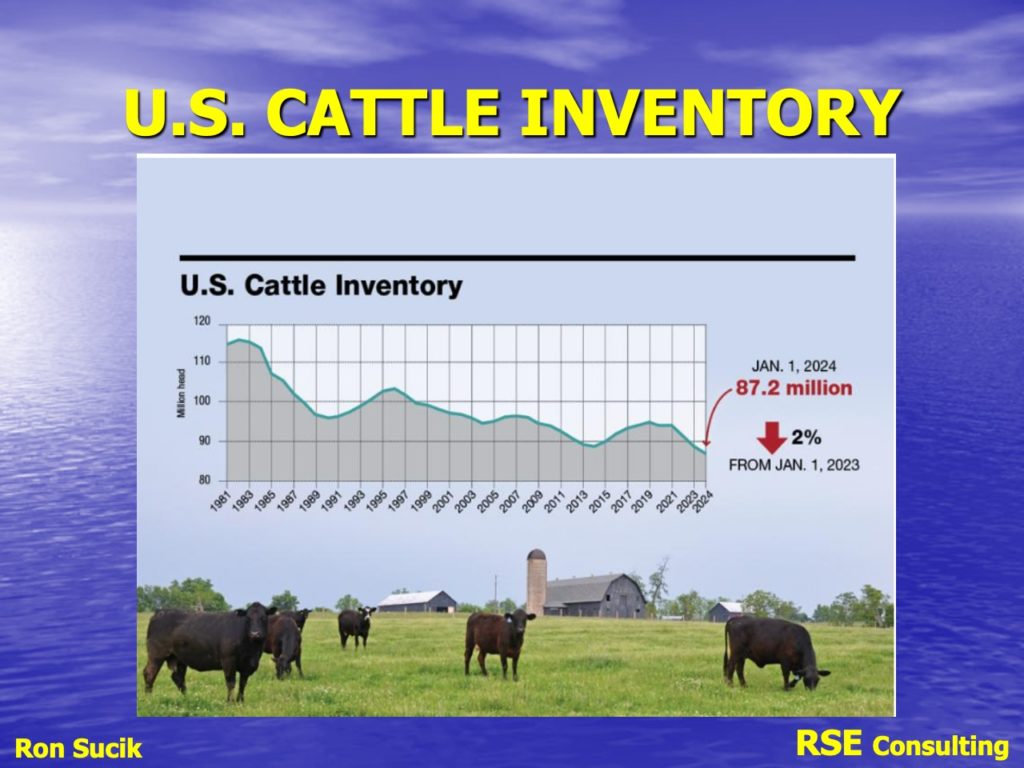

At my local Jewel Grocery Store, pork babyback ribs are buy one and get two free. Now, we know they raise the price of the one, but still why are they doing that? Supply is high. And porterhouse steak is on sale for $8.99 a pound, my old Costco price a couple summers ago. So I am confused how meat can suddenly be so affordable at this time while inflation is attacking everything else—unless someone is downsizing their fleet and there is a surplus of meat in the marketplace.

So, I talk to a rancher friend in South Dakota for his perspective on cattle raising. I would like to see a comparison of the U.S. human population with the cattle population. Unless a significant number of people are going vegan, I would be worried where a good steak was going to come from in the future. But my rancher friend told me that through breeding, the cows are yielding much more meat than back in the day. But he will only make $300 per heifer he sells. Unless you already own enough land to on which to graze your cattle you cannot afford to raise beef. For a family to earn more than $70,000, you need to raise at least 300 cattle—but you can probably not afford to purchase new machinery or equipment, and replacement parts to repair have gone way up. Small cattle ranchers have been getting out of the business.

Could these examples possibly be like the canary in the coal mine? Healthwaves is going to have to raise prices to meet a new lease arrangement. People renting in Chicago and Florida will have less disposable income after rental increases. Trailer and truck manufacturers will cut back production while the market comes back into balance. My daughter and son-in-law will have to raise the price of their pizzas to cover increased costs. My grocery chain manager will have to raise food prices and run fewer loss leaders to attract sales. And if it wasn’t for the fact my rancher friends own or manage a couple of thousand acres rather than hundreds, they couldn’t make it either.

My point is the existing inflationary rate seems to be more like 10%, and this all trickles down to the basic consumer one way or another. With the high debt ratio and less disposable funds, I feel uncomfortable that consumers can sustain the demand to drive intermodal loadings up very high. I believe the driving factors are certainly there for positive numbers and it should certainly be easy enough to beat 2023’s soft numbers, but I will hold my breath until well into second quarter before I would feel comfortable with any high numbers. But this is an election year, so anything can happen.

Let’s take a look at a few more positive thoughts from the supply chain leaders and their side of the business.

- Dario Ambrosini, CMO of Propel Software, believes Mexico has reached an inflection point on high value-added manufacturing capabilities for industries such as aerospace, medical devices, automotive, consumer products and textiles.

- Demetri Venetis, President Freight Forwarding at RXO, believes that nearshoring is not only a trend but also a long term strategy.

- Chris Pickett, COO of Flock Freight, is quoted as saying the strategy from Just-In-Time to Just-In-Case supply chains will prove to have been short-lived and we are going back to Just-In-The-Nick-Of-Time.

- The research team at warehouse developer Prologis believes the global freight recession will reverse, demonstrated by double-digit growth in port and truck traffic. Prologis believes that import volume at POLA & LB will exceed pre-pandemic levels. This will cause even more demand for Southern California logistics real estate, sending rates up from the already sky-high levels. This is making that less expensive land around Barstow and Phoenix even more attractive for inland intermodal yards. And I would be remiss if I didn’t mention something about Barstow or Phoenix. We know BNSF is projecting Barstow International Gateway operational in 2028, but I don’t have a hard timeline on the UP at Phoenix.

J.B. Hunt is purchasing 15,500 containers from Walmart. I have a couple of thoughts on this. Both Jason Hilsenbeck from Load Match and Jim Blaze believe that Walmart realized it is much more difficult to operate an intermodal container fleet than a trailer fleet and opted to get out. The problem is these containers are not designed to match the JBH chassis and are either going to be considered surplus and sold, or as some of the shippers and chassis operators at RILA (Retail Industry Leaders Association) suggested, they will be modified.

Hilsenbeck and I think this is a stretch, and given the surplus number of 53-foot domestic containers out there it is unlikely to happen, and more likely as he suggested, they might be sold on the open market. One result might be increased intermodal movement, given the pricing JBH gets with BNSF. Only time will tell on that game.

As for what was talked about at RILA, there were lots of concerns about consumer disposable income. Food purchases are the big issue as high costs eat into other potential retail sales. They’re still seeing somewhat robust purchases, but nothing frivolous. You have to buy a new water heater or dishwasher if they break, but you might not buy new furniture at this time. For example, fashion seems to be holding its own but furniture is hurting and you can follow the money on that back to interest rates and housing.

Retailers believe 2024 and 2025 will still be slow unless there is some sort of stimulus in 2024 because of the election year. I’m focusing on 2026 to be growth year.

Steamship companies will not wholesale their rates because of the global issues, and because of logistic issues their ships will continue to try to keep some sort of balance between the West Coast and East Coast. There is about a $1,200 difference in rates East Coast over West Coast. It would have to get to about the $2,000 difference to drive traffic away from the East Coast to the West Coast.

As Director, Market Development at TTX, Ron Sucik established relationships in the industry that include members of the railroads, steamship lines, port authorities, transloaders, 3PLs, motor carriers, intermodal marketing companies, retail industry and real estate development companies. Ron is recognized as having a significant understanding of the trends of trade flows into North America and the affect they have on the rail industry. He is often called upon for his perspective of emerging issues. Ron’s prior experience at Burlington Northern gave him an understanding of the basic operational aspects of the rail side of the intermodal industry as well. He holds a Bachelor of Science in Business Administration and an MBA with emphasis on Marketing from Illinois Benedictine University. Ron remains active within the transportation community as a consultant. He was a major contributor to the CIGMA International Freight Study at the Tioga Group, and continues to make presentations on the issues and trends in the intermodal industry. Ron and his wife Robin live in Naperville, Ill.