For U.S. Rail Traffic, 2023 Ends on a High Note

Written by Marybeth Luczak, Executive Editor

(BNSF Photograph)

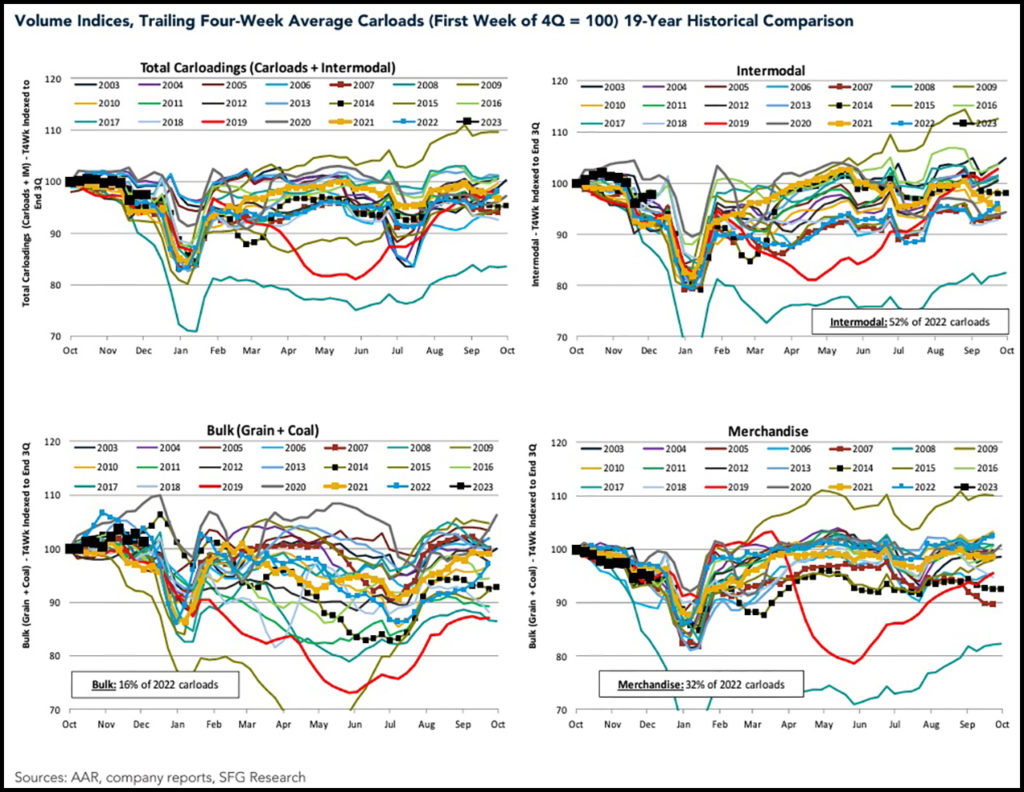

The fourth quarter was “the best quarter of 2023 for U.S. rail volumes on a year-over-year basis,” AAR Senior Vice President John T. Gray reported Jan. 2. “It appears that intense rail efforts to improve service quality are paying off. Railroads are hopeful that gains in the fourth quarter will carry over into the first quarter of 2024 and beyond.”

Total U.S. rail carloads were up 2.0% in fourth-quarter 2023 over the same quarter in 2022, while U.S. intermodal was up 5.5%, according to Gray, who provided the results in the Association of American Railroads’ (AAR) rail traffic report for December and the week ending Dec. 30, 2023.

December 2023 was the fourth consecutive month that total year-over-year carload and intermodal volumes rose for U.S. Class I railroads. They hauled 1,859,264 carloads and intermodal units last month, up 8.8%, or 150,685 carloads and containers and trailers, from December 2022, according to the AAR. This comprises 876,881 carloads—increasing 7.3%, or 59,804 carloads, from December 2022—and 982,383 containers and trailers—rising 10.2%, or 90,881 units, over December 2022.

In December 2023, 16 of the 20 carload commodity categories tracked by the AAR each month saw carload gains compared with December 2022. These included chemicals, up 14,636 carloads or 13.1%; coal, up 13,971 carloads or 5.9%; and motor vehicles and parts, up 7,212 carloads or 14.1%. Commodities that saw declines in December 2023 included crushed stone, sand and gravel, down 2,781 carloads or 4.1%; nonmetallic minerals, down 1,105 carloads or 9.8%; and all other carloads, down 625 carloads or 3.3%.

Excluding coal, carloads were up 45,833, or 7.9%, in December 2023 from December 2022. Excluding coal and grain, carloads were up 40,036, or 8.0%.

Total U.S. carload traffic for the first 12 months of 2023 was 11,701,875 carloads, up 0.7%, or 81,504 carloads, from the prior-year period; and 12,667,354 intermodal units, down 4.9%, or 657,165 containers and trailers, from 2022.

Total combined U.S. traffic for the first 52 weeks of 2023 was 24,369,229 carloads and intermodal units, dipping 2.3% from 2022.

Week Ending Dec. 30, 2023

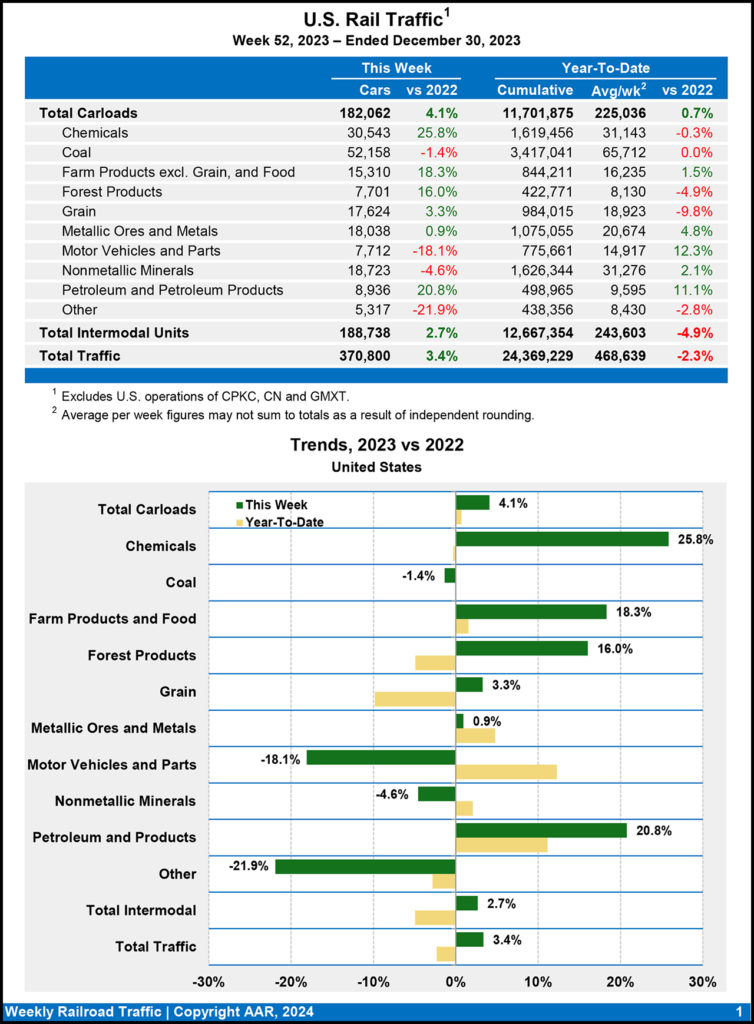

Total U.S. weekly rail traffic for the week ending Dec. 30, 2023, was 370,800 carloads and intermodal units, increasing 3.4% from the same week in 2022, according to the Jan. 2 AAR report.

Total carloads for the week came in at 182,062, up 4.1% from the prior-year period, and U.S. weekly intermodal volume was 188,738 containers and trailers, up 2.7% from 2022. This is the eighth consecutive week of increases in total U.S. rail traffic.

For the week ending Dec. 30, 2023, six of the 10 carload commodity groups posted an increase compared with the same week in 2022. They included chemicals, up 6,273 carloads, to 30,543; farm products excluding grain, and food, up 2,370 carloads, to 15,310; and petroleum and petroleum products, up 1,537 carloads, to 8,936. Commodity groups that posted decreases included motor vehicles and parts, down 1,705 carloads, to 7,712; miscellaneous carloads, down 1,493 carloads, to 5,317; and nonmetallic minerals, down 898 carloads, to 18,723.

North American rail volume for the week ending Dec. 30, 2023, on 10 reporting U.S., Canadian and Mexican railroads totaled 270,807 carloads, a rise of 5.0% compared with the same week in 2022, and 254,475 intermodal units, a gain of 3.8% from 2022. Total combined weekly rail traffic in North America came in at 525,282 carloads and intermodal units, up 4.4%. North American rail volume for the first 52 weeks of 2023 was 34,105,519 carloads and intermodal units, down 2.1% from 2022.

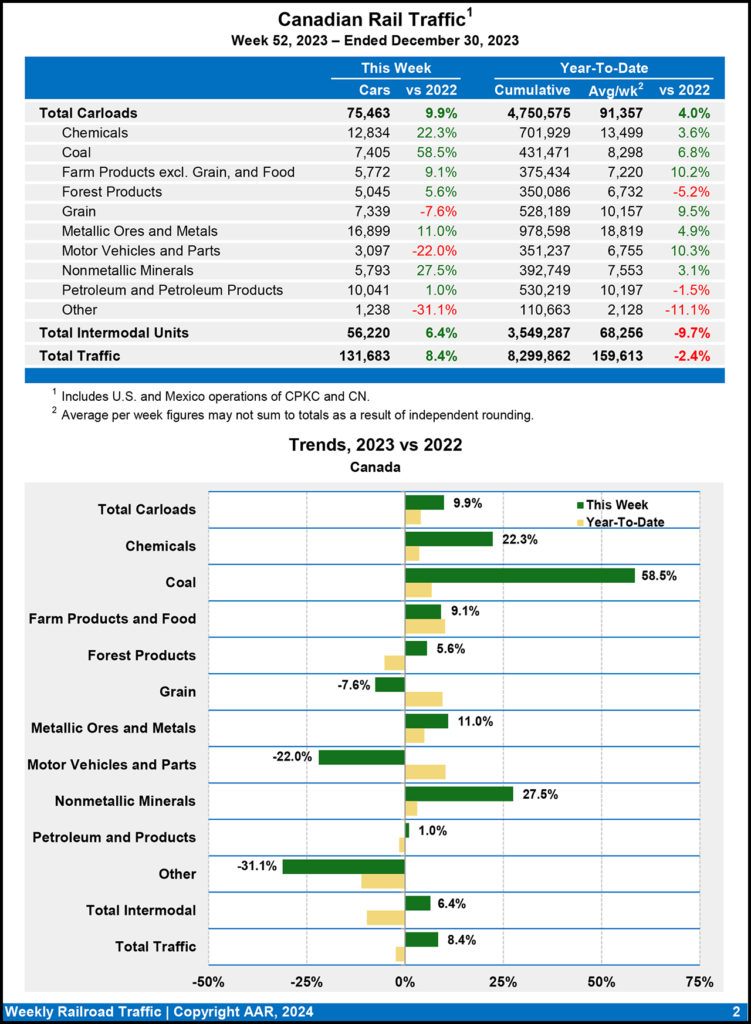

Canadian railroads reported 75,463 carloads for the week ending Dec. 30, 2023, up 9.9%, and 56,220 intermodal units, up 6.4% compared with the same week in 2022. For the first 52 weeks of 2023, they reported cumulative rail traffic volume of 8,299,862 carloads, containers and trailers, down 2.4%.

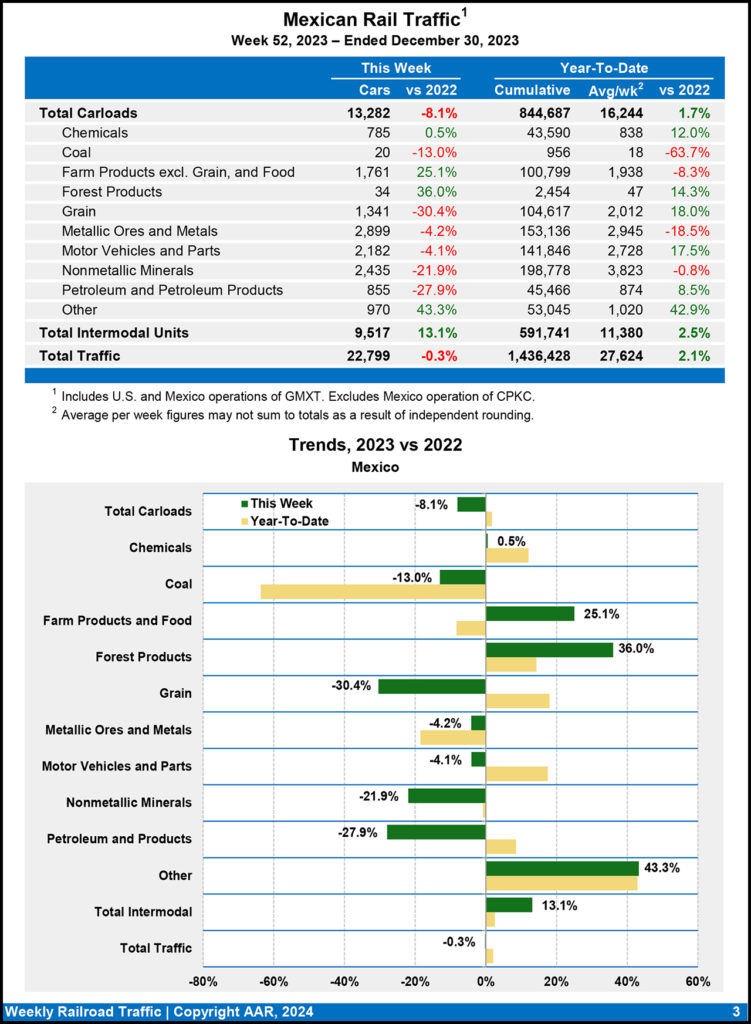

Mexican railroads reported 13,282 carloads for the week ending Dec. 30, 2023, decreasing 8.1% from the same point in 2022, and 9,517 intermodal units, increasing 13.1%. Their cumulative volume for the first 52 weeks of 2023 came in at 1,436,428 carloads and intermodal containers and trailers, up 2.1% from the prior-year period.