CN Updates 2023 Guidance, Reflecting ‘Strong’ 1Q; Outlines 3-Year Financial Perspective (UPDATED, May 4)

Written by Marybeth Luczak, Executive Editor

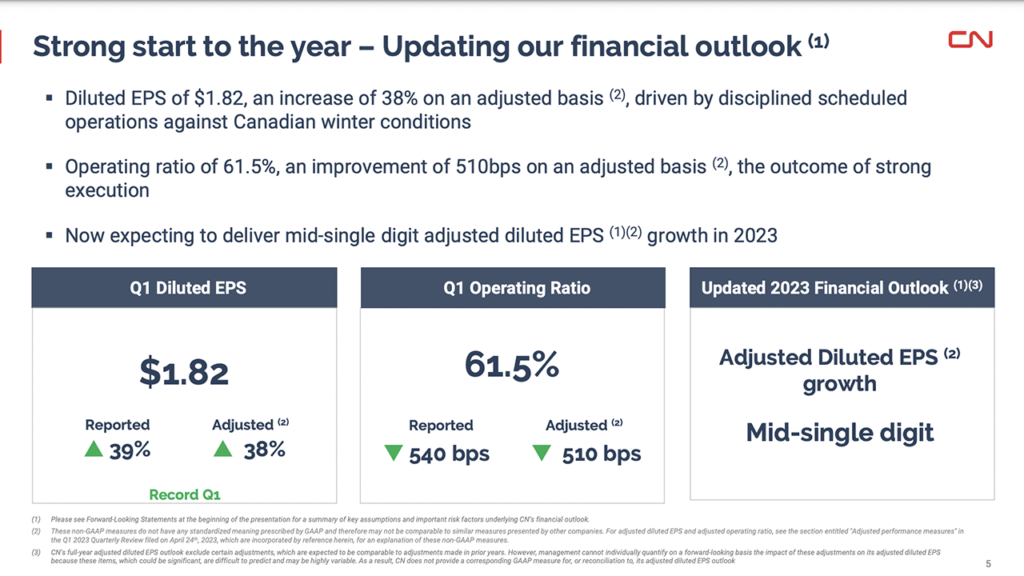

“In light of the strength of its first quarter results, CN is now expecting to deliver adjusted diluted EPS growth in the mid single digits over 2022,” the Canadian Class I railroad reported April 24.

“We remain confident in our long-term growth despite current economic uncertainty,” CN President and CEO Tracy Robinson said during the Class I’s first-quarter 2023 financial and operating announcement on April 24. “Our updated guidance reflects the strength of our scheduled operating model and its ability to drive strong operational results. For the immediate future, we remain focused on running our plan and providing reliable service to our customers.” Update: On May 3, CN offered its 2024-26 financial perspective to the investment community.

Among CN’s first-quarter 2023 results:

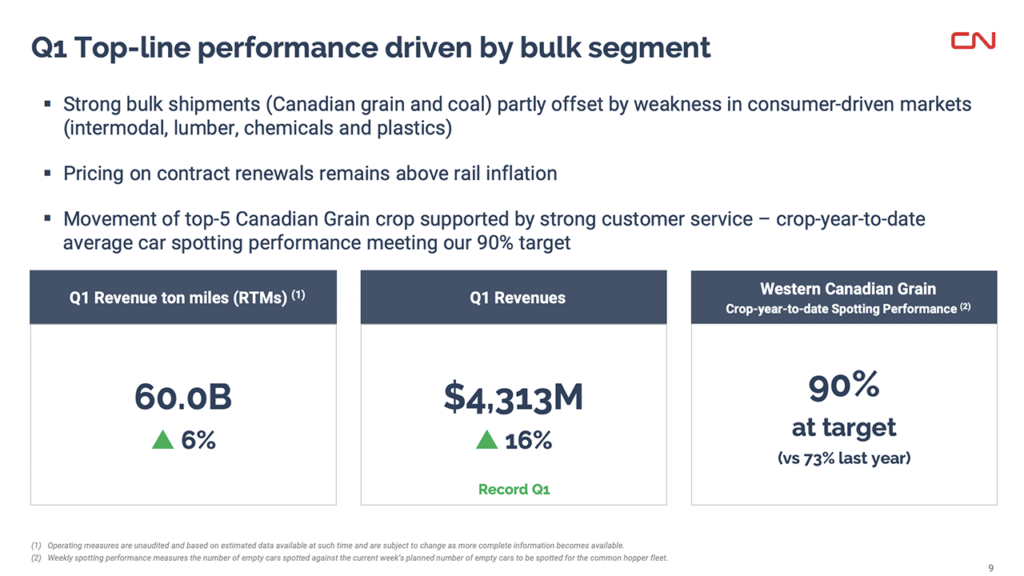

• Revenues of C$4.313 billion, up C$605 million or 16% from first-quarter 2022’s C$3.708 billion. The Class I reported that this first-quarter record “was mainly due to higher fuel surcharge revenue as a result of higher fuel prices, higher export volumes of Canadian grain, freight rate increases, and the positive translation impact of a weaker Canadian dollar; partly offset by lower intermodal volumes.”

• Revenue Ton Miles (RTM) increased 6% over the year-earlier period.

- Operating expenses were C$2.651 billion, up C$170 million or 7% from first-quarter 2022’s C$2.481 billion. This was “mainly due to the negative translation impact of a weaker Canadian dollar, increased purchased services and material expense, and higher labor and fringe benefits expense mainly driven by higher average headcount,” CN said.

- Operating income reached C$1.662 billion, a first-quarter record, according to CN. It was up C$435 million or 35% over first-quarter 2022 (or up 34% on an adjusted basis). This demonstrates the “strength and resiliency of the network,” CN said.

- CN’s operating ratio was 61.5%, an improvement of 5.4 points (or an improvement of 5.1 points on an adjusted basis) over the year-earlier period.

- Diluted EPS of C$1.82, a 39% increase (or a 38% increase on an adjusted basis) over first-quarter 2022. The Canadian Class I said this was “driven by disciplined scheduled operations against Canadian winter conditions.”

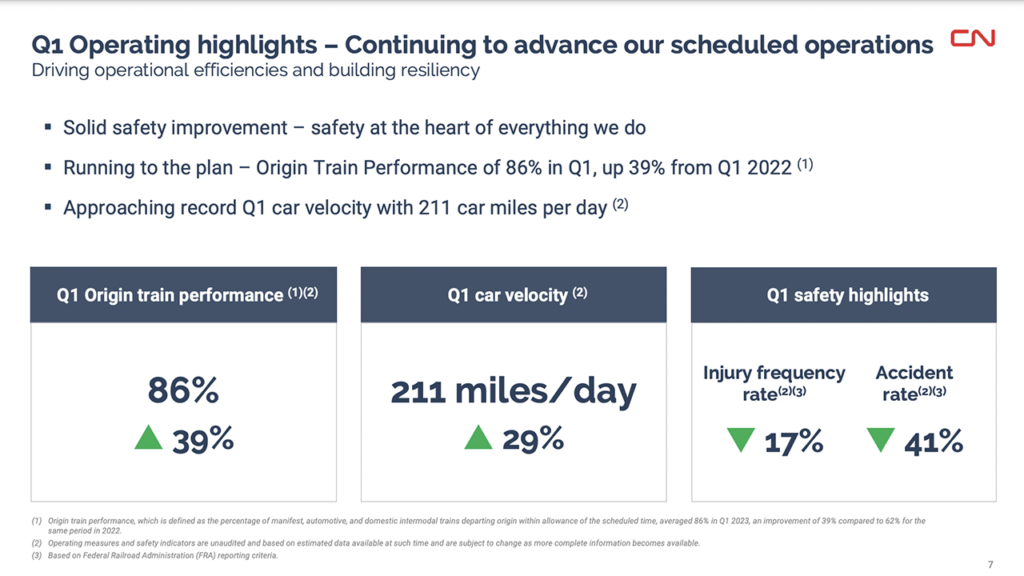

- Car velocity of 211 car miles per day, an improvement of 29% over first-quarter 2022.

- Through network train speed of 20.1 mph, an improvement of 20% over the prior-year period.

- Through dwell of 7.1 (entire railroad, hours), an improvement of 22% over the prior-year period, and a first-quarter record, according to CN.

- Fuel efficiency of 0.902 (U.S. gallons of locomotive fuel consumed per 1,000 gross ton miles/GTMs), an improvement of 1% over the prior-year period, and a first-quarter record, according to CN.

2023 Outlook

“In light of the strength of its first-quarter results, CN is now expecting to deliver adjusted diluted EPS growth in the mid single digits over 2022,” the Canadian Class I railroad reported. This compares to its Jan. 24, 2023 target of “low single digits.”

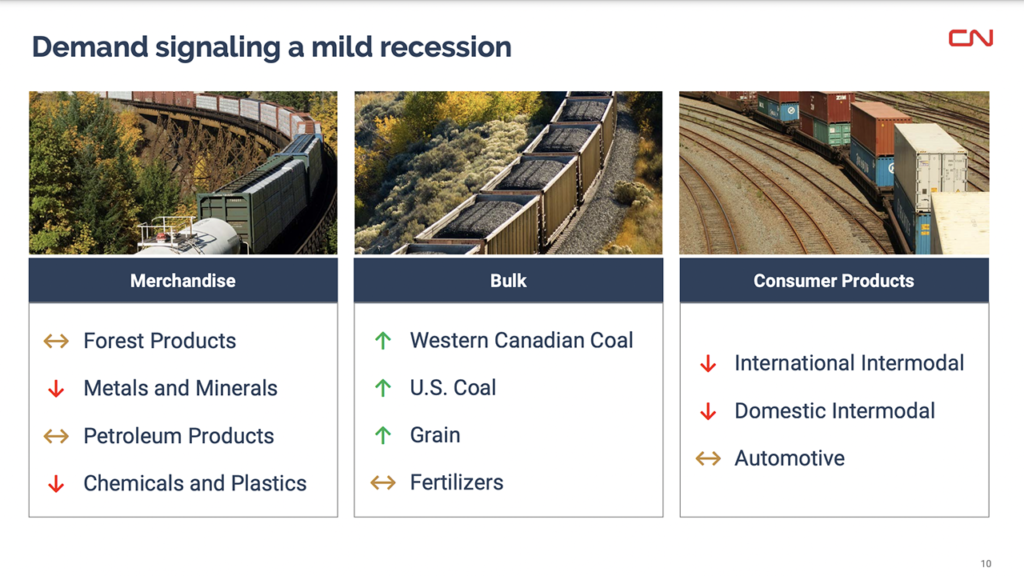

CN also noted that “North American industrial production [is] still assumed to be negative in 2023.”

For more details, visit the CN Investors webpage.

2024-26 Financial Perspective

CN on May 4 told investors that it is targeting to deliver 10%-15% diluted EPS compounded annual growth (CAGR) over the next three years “by growing volumes more than the economy, pricing above rail inflation and incrementally improving efficiency.”

The Class I noted that it has made a number of “economic and market assumptions” in preparing its three-year financial perspective. It assumes North American industrial production will increase by approximately 2% annually over the next three years; continued pricing above rail inflation; and the value of the Canadian dollar in U.S. currency will be approximately $0.75 and the average price of crude oil (West Texas Intermediate) will be approximately US$80 per barrel during this period.

“We are confident in what the future holds for CN,” Tracy Robinson reported. “The path to sustainable and profitable growth is clear. We have the proven record of our operating model combined with our integrated approach and the right people to see it through. The future of railroading is here, and it starts now.”