BNSF Closes 2023 With Net Earnings, Volumes Down

Written by Marybeth Luczak, Executive Editor

“Railroads don’t get much attention when they are working but, were they unavailable, the void would be noticed immediately throughout America,” Warren E. Buffett, Chairman/CEO of BNSF parent company Berkshire Hathaway Inc., wrote in a shareholder letter. “A century from now, BNSF will continue to be a major asset of the country and of Berkshire. You can count on that.”

While Warren E. Buffett, Chairman/CEO of BNSF parent company Berkshire Hathaway Inc., told shareholders in a Feb. 24 letter that he “erred” in his 2023 expectations for the Class I railroad, he was “particularly proud of both BNSF’s contribution to the country and the people who work in sub-zero outdoor jobs in North Dakota and Montana winters to keep America’s commercial arteries open.”

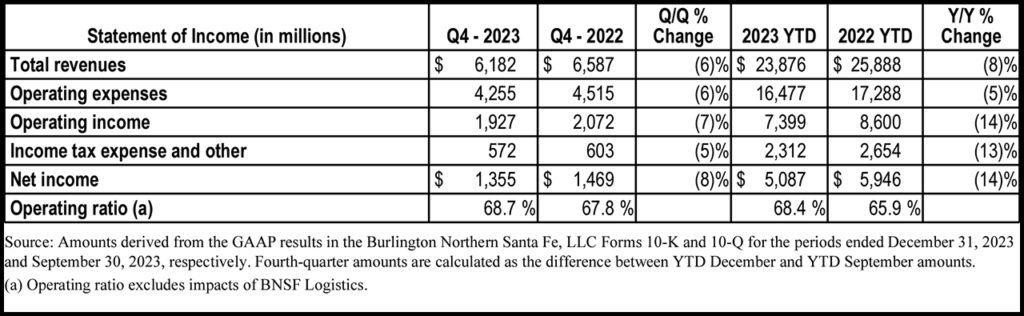

For 2023, BNSF posted net earnings of $5.087 billion, down 14% from the prior-year period; revenues of $23.876 billion, down 8% from 2022; and total volumes (in thousands) of 9,003, down 6% from 2022’s 9,549.

“BNSF’s earnings declined more than I expected, as revenues fell,” Buffett wrote in his letter, which was part of Berkshire Hathaway’s 2023 Annual Report (download below, and scroll down to read the letter in full). “Though fuel costs also fell, wage increases, promulgated in Washington, were far beyond the country’s inflation goals. This differential may recur in future negotiations.”

BNSF on Feb. 26 reported operating income for fourth-quarter and full-year 2023 of $1.9 billion—falling 7% or $145 million—and $7.4 billion—dropping 14% or $1.2 billion—respectively, compared with the same periods in 2022. Operating ratio (OR) came in at 68.7% for the fourth quarter, a 0.9% increase compared with 2022’s 67.8%; for full-year 2023, OR was 68.4%, up 2.5% from the prior year period’s 65.9%.

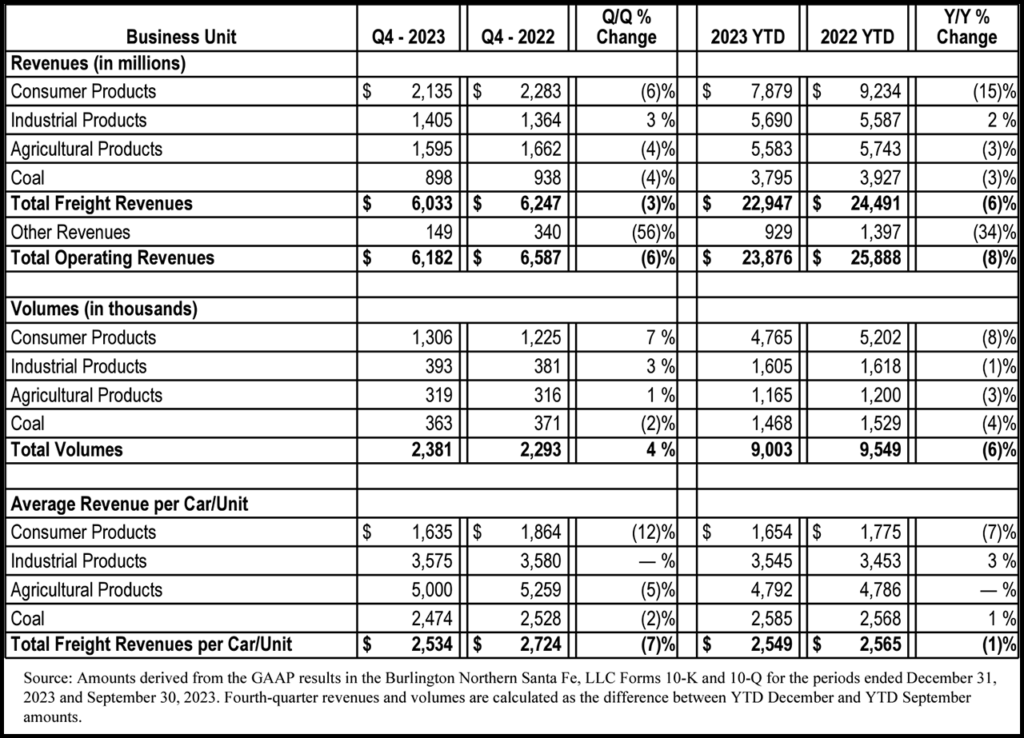

Total revenues for the three months ended Dec. 31, 2023, and full-year 2023 decreased 6% and 8%, respectively, compared with the same periods in 2022. BNSF attributed the fourth-quarter decline primarily to a 7% decrease in average revenue per car/unit, partially offset by a 4% increase in unit volumes. The full-year decline, it said, was primarily due to a 6% decrease in unit volumes and a 1% decrease in average revenue per car/unit. “The decreases in average revenue per car/unit for both the fourth-quarter and full-year 2023 were primarily attributable to lower fuel surcharge revenue, partially offset by favorable price and mix,” BNSF reported.

According to BNSF, revenue changes also resulted from the following:

- Consumer Products volumes increased 7% and decreased 8% for fourth-quarter and full-year 2023, respectively, compared with the same periods in 2022. The fourth-quarter rise, the Class I railroad said, was primarily due to “improved international and domestic intermodal volumes from increasing West Coast imports.” The full-year drop-off, it said, was primarily due to “lower West Coast imports, the loss of an intermodal customer, and competition from lower spot rates in the trucking market, which has impacted domestic intermodal demand, partially offset by an increase in automotive volume from higher vehicle production.”

- Industrial Products volumes increased 3% and decreased 1% for fourth-quarter and full-year 2023, respectively, from the 2022 periods. The railroad attributed the fourth-quarter increase primarily to “increased demand for chemicals and plastics as well as petroleum, partially offset by lower shipments of manufactured products.” The full-year decrease, it said, was primarily due to “lower demand for chemicals and plastics, minerals, paper, and lumber, partially offset by increased shipments of steel and aggregates from infrastructure demand.”

- Agricultural Products volumes increased 1% and decreased 3% for fourth-quarter and full-year 2023, respectively, vs. the 2022 periods. According to BNSF, the fourth-quarter increase was primarily due to “increased demand and exports for ethanol and exports of non-soybean related grains, partially offset by lower volumes of domestic grains and soybean exports from reduced international demand.” The full-year decrease was primarily due to “lower grain exports, partially offset by higher volumes of domestic grain shipments.” Both periods included increases in feedstocks and renewable diesel, the railroad reported.

- Coal volumes decreased 2% and 4% for fourth-quarter and full-year 2023, respectively, compared with the same periods in 2022. The volume decreases were primarily due to “moderating demand as a result of lower natural gas prices,” BNSF said.

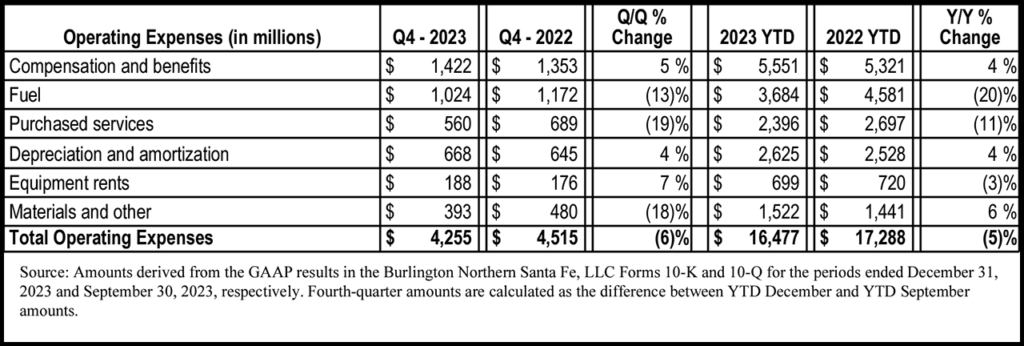

BNSF’s operating expenses for fourth-quarter and full-year 2023 came in at $4.255 billion—down 6% from the prior-year period’s $4.515 billion—and $16.477 billion—down 5% from 2022’s $17.288 billion—respectively. The railroad attributed a “significant portion” of the decline to:

- Fuel expense decreasing 13% and 20% in fourth-quarter and full-year 2023, respectively, compared with the same periods in 2022, primarily due to “lower average fuel prices, lower volumes, and improved efficiency; locomotive fuel price per gallon decreasing 13% and 16% in fourth-quarter and full-year 2023, respectively, compared to the same periods in 2022.”

- Compensation and benefits expense increasing 5% and 4% in fourth-quarter and full-year 2023, respectively, from 2022, primarily due to “increased headcount, wage inflation, and the inclusion of the Montana Rail Link’s (MRL) employee costs effective April 7, 2023.”

- Purchased services expense decreasing 19% and 11% in fourth-quarter and full-year 2023, respectively, from 2022, primarily due to “lower purchased transportation driven by the sale of brokerage operations of BNSF Logistics, LLC, lower purchased services expense from MRL effective April 7, 2023, and a reduction in drayage costs, partially offset by general inflation.”

- Materials and other expense decreasing 18% and increasing 6% in fourth-quarter and full-year 2023, respectively, vs. the same periods in 2022. BNSF said the fourth-quarter decrease was primarily due to “lower litigation costs, partially offset by higher casualties and general inflation.” Full-year 2023 vs. full-year 2022 changes were “not significant,” according to the railroad.

Additionally, BNSF said there were “no significant changes” in depreciation and amortization or equipment rents. Other (income) expense, net decreased in 2023 compared with 2022, BNSF said, due to “favorable interest income driven by higher rates. Changes were not significant for the fourth quarter 2023. There were no significant changes in interest expense.”

Capex

BNSF’s 2023 capital program was $3.92 billion, which it said “included activities that supported our efficiency and long-term growth objectives while ensuring we maintained a safe and reliable railroad.” The 2024 planned capital program is $3.92 billion, BNSF confirmed; it provided a detailed report of projects last month. The largest component of the program, $2.88 billion, is devoted to maintaining the railroad’s “core network and related assets.” Maintenance projects will consist of nearly 13,000 miles of track surfacing and/or undercutting work and the replacement of 365 miles of rail and approximately 2.8 million rail ties.

“Railroads don’t get much attention when they are working but, were they unavailable, the void would be noticed immediately throughout America,” Buffett concluded in his letter to shareholders. “A century from now, BNSF will continue to be a major asset of the country and of Berkshire. You can count on that.”

Buffett Commentary

Railway Age reproduces Warren Buffett’s shareholder letter in its entirety below.

“Rail is essential to America’s economic future. It is clearly the most efficient way—measured by cost, fuel usage and carbon intensity—of moving heavy materials to distant destinations. Trucking wins for short hauls, but many goods that Americans need must travel to customers many hundreds or even several thousands of miles away. The country can’t run without rail, and the industry’s capital needs will always be huge. Indeed, compared to most American businesses, railroads eat capital.

“BNSF is the largest of six major rail systems that blanket North America. Our railroad carries its 23,759 miles of main track, 99 tunnels, 13,495 bridges, 7,521 locomotives and assorted other fixed assets at $70 billion on its balance sheet. But my guess is that it would cost at least $500 billion to replicate those assets and decades to complete the job.

“BNSF must annually spend more than its depreciation charge to simply maintain its present level of business. This reality is bad for owners, whatever the industry in which they have invested, but it is particularly disadvantageous in capital-intensive industries.

“At BNSF, the outlays in excess of GAAP depreciation charges since our purchase 14 years ago have totaled a staggering $22 billion or more than $1-1⁄2 billion annually. Ouch! That sort of gap means BNSF dividends paid to Berkshire, its owner, will regularly fall considerably short of BNSF’s reported earnings unless we regularly increase the railroad’s debt. And that we do not intend to do.

“Consequently, Berkshire is receiving an acceptable return on its purchase price, though less than it might appear, and also a pittance on the replacement value of the property. That’s no surprise to me or Berkshire’s board of directors. It explains why we could buy BNSF in 2010 at a small fraction of its replacement value.

“North America’s rail system moves huge quantities of coal, grain, autos, imported and exported goods, etc. one–way for long distances and those trips often create a revenue problem for back-hauls. Weather conditions are extreme and frequently hamper or even stymie the utilization of track, bridges and equipment. Flooding can be a nightmare. None of this is a surprise. While I sit in an always-comfortable office, railroading is an outdoor activity with many employees working under trying and sometimes dangerous conditions.

“An evolving problem is that a growing percentage of Americans are not looking for the difficult, and often lonely, employment conditions inherent in some rail operations. Engineers must deal with the fact that among an American population of 335 million, some forlorn or mentally-disturbed Americans are going to elect suicide by lying in front of a 100-car, extraordinarily heavy train that can’t be stopped in less than a mile or more. Would you like to be the helpless engineer? This trauma happens about once a day in North America; it is far more common in Europe and will always be with us.

“Wage negotiations in the rail industry can end up in the hands of the President and Congress. Additionally, American railroads are required to carry many dangerous products every day that the industry would much rather avoid. The words ‘common carrier’ define railroad responsibilities.

“Last year BNSF’s earnings declined more than I expected, as revenues fell. Though fuel costs also fell, wage increases, promulgated in Washington, were far beyond the country’s inflation goals. This differential may recur in future negotiations.

“Though BNSF carries more freight and spends more on capital expenditures than any of the five other major North American railroads [CSX, Norfolk Southern, Union Pacific, CN and Canadian Pacific Kansas City], its profit margins have slipped relative to all five since our purchase. I believe that our vast service territory is second to none and that therefore our margin comparisons can and should improve.

“I am particularly proud of both BNSF’s contribution to the country and the people who work in sub-zero outdoor jobs in North Dakota and Montana winters to keep America’s commercial arteries open. Railroads don’t get much attention when they are working but, were they unavailable, the void would be noticed immediately throughout America.

“A century from now, BNSF will continue to be a major asset of the country and of Berkshire. You can count on that.”

Further Reading:

- BNSF: A Record Year for Safety in 2023

- J.B. Hunt, BNSF Launch New Intermodal Service

- J.B. Hunt to Purchase Walmart’s Intermodal Assets