BNSF 1Q22: Revenue Up Despite Lower Volume

Written by Marybeth Luczak, Executive Editor

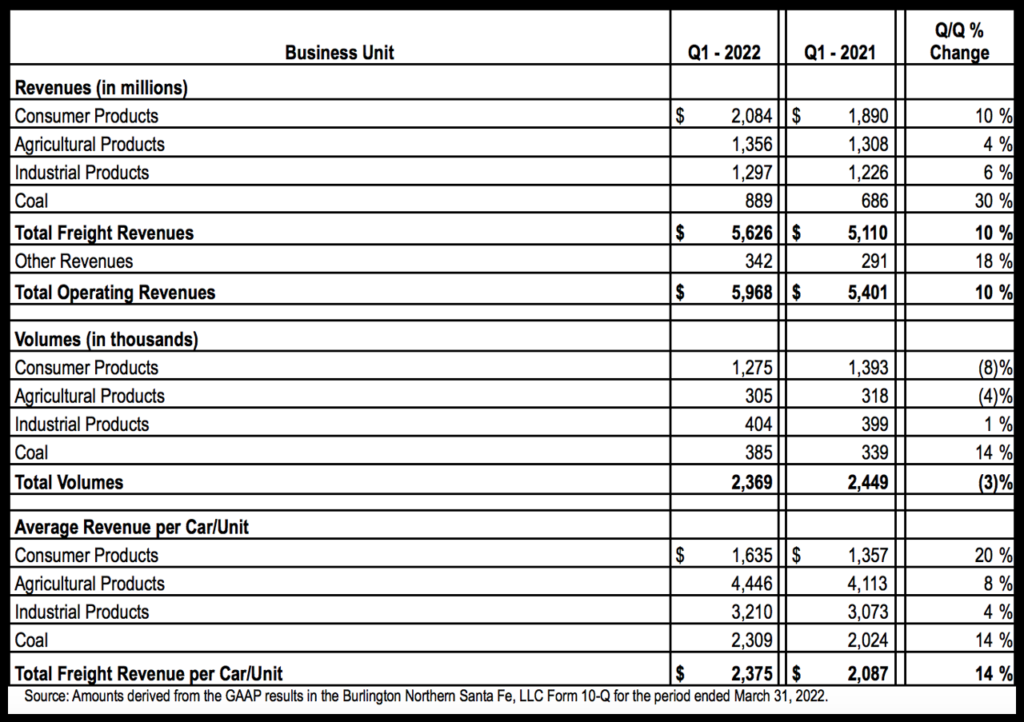

For the first three months of 2022, BNSF posted freight revenue of $5.968 billion, up 10% from the prior-year period, on 2.339 million revenue units, down 3% from 2021, the Class I railroad reported.

BNSF said the first-quarter 2022 revenue gain was “primarily due to a 14% increase in average revenue per car/unit resulting from higher fuel surcharge revenue driven by higher fuel prices along with increased rates per car, partially offset by a 3% decrease in unit volume.”

According to the Class I railroad, revenue changes also resulted from the following:

• Consumer Products volumes falling 8% for first-quarter 2022 vs. the prior-year period. BNSF attributed this “to lower international intermodal volumes as a result of supply chain challenges and lower automotive shipments due to production impacts from a global microchip shortage, partially offset by an increase in domestic intermodal volumes.”

• Agricultural Products volumes decreasing 4%, “primarily due to lower grain exports, partially offset by higher volumes of ethanol and related commodities,” according to the railroad.

• Industrial Products volumes rising 1%, “primarily due to growth in the U.S. industrial economy,” BNSF reported.

• Coal volumes rising 14%. BNSF said this was “primarily due to increased electricity generation, higher natural gas prices and improved export demand.”

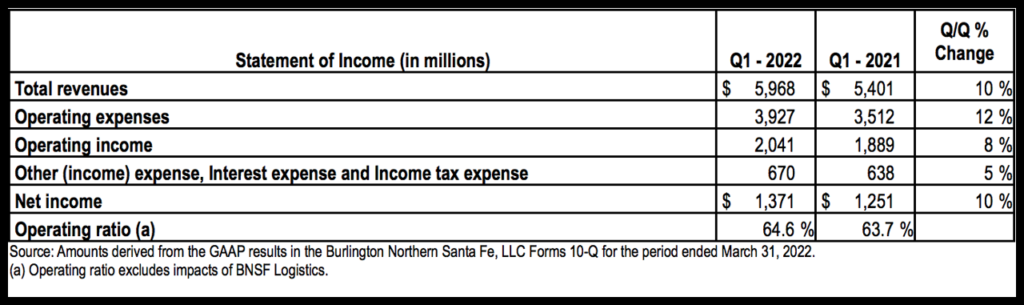

For first-quarter 2022, operating income came in at $2.0 billion, up 8% (or $152 million) compared with the same period last year. Operating ratio was 64.6%, an increase of 0.9% vs. 2021.

Operating expenses for the quarter rose 12% from the 2021 period. BNSF said a “significant portion” of the increase is due compensation and benefits expense increasing 5%, “primarily due to wage inflation, health and welfare costs, and lower productivity”; fuel expense increasing 57%, “primarily due to higher average fuel prices” (locomotive fuel price per gallon “increased at a similar rate in the first quarter of 2022 compared to the same period in 2021”); and materials and other expenses increasing 8%, “primarily due to increased general inflation and higher casualty costs.” There were “no significant changes in purchased services, depreciation and amortization, equipment rents or interest expense,” BNSF reported.