Bad Luck Playing an Outsized Role

Written by Rick Paterson, Managing Director, Loop Capital Markets

BNSF Hobart Intermodal. BNSF photo.

This report often—and necessarily—focuses on the individual railroads that are struggling the most, for one reason or another, and trying to right the ship.

Norfolk Southern has spent the most time on here over the years (three meltdowns in 10 years will do that) and Union Pacific has also had its fair share of scrutiny. We monitored CPKC’s Mexico business last year that it inherited from KCS in a melted-down state (thanks for that), the fallout from Hunter Harrison’s rushed CSX PSR implementation in mid-2017, and CN’s meltdown on the back of surging container traffic later that same year. We’re equal-opportunity assassins and have no favorites. During the past month, the spotlight has been firmly fixed on BNSF, with the Smokehouse Creek wildfire in the Texas panhandle that severed BN’s Transcon route on Feb. 27 (38-hour outage followed by 47-hour single-track bottleneck), the last in a series of problems that significantly slowed the network and impacted service.

BNSF Stabilizing, Setting up Rebound

There’s modestly better news this week in terms of data that relates to the week ending March 15. BNSF’s network velocity came off its bottom, albeit by only 0.3 mph (1.2%), while critical resource availability also improved. Trains holding for crews fell from 39 per day two weeks ago to 28 in the week ending March 15, and trains holding for power also improved sequentially, from 17 to 12 per day.

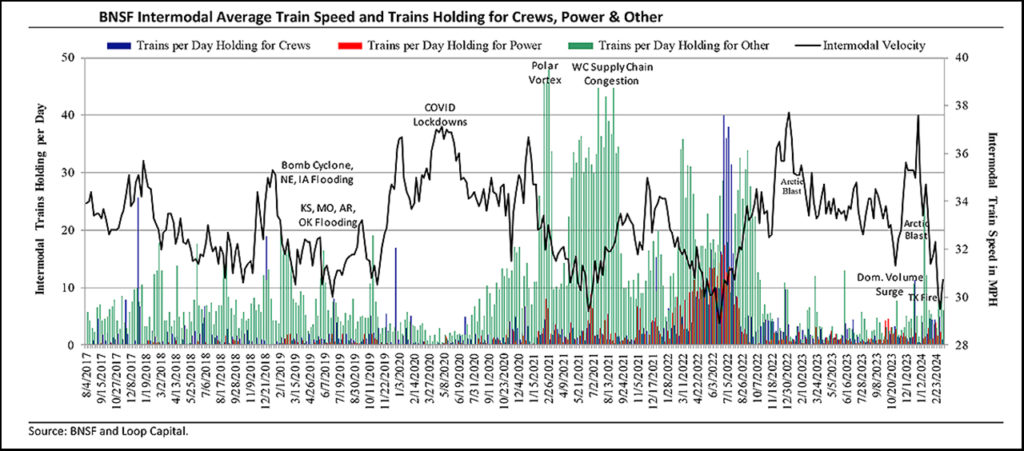

BNSF’s flagship intermodal network saw similar trends, with a positive inflection in speed off a low base and improving critical resource availability, which we show in the chart below. You can see the only other occasions in recent history the network has run so slowly was during the West Coast supply chain congestion during the pandemic, and of course the 2022 Service Crisis. If this was a stock chart you could argue 29 mph is a support level, we’ve probably bottomed, and the next move is higher. Let’s hope that’s the case.

Some other metrics that relate to the week ending March 15 aren’t as favorable. Car congestion remains worrisome. From a weekly cars-on-line average of 248,000 in 2023, it rose to 256,000 in January, 261,000 in February, and hit a four-year high of 263,326 two weeks ago. It came off that high-water mark last week, to 262,851. Last week we showed a chart on BNSF’s historic “cars per carload”, a measure of rolling stock congestion relative to loads hauled (lower is better), and that downticked from 2.1 to 2.0 in the week ending March 15 vs. BNSF’s historic 1.8-1.9. Meanwhile, the proportion of cars on line that sat idle for 48-hours or more was sequentially flat at 5.0% vs. 4% or lower when BNSF is running well.

Finally, terminal dwell remains stubbornly high and deteriorated sequentially last week. BNSF did some good work to drive dwell down in 2023, but those gains have fully reversed.

The bottom line is that most key metrics appear to have inflected positively last week, but one week doesn’t make a trend, and we’ll be looking for some directional corroboration in next week’s data. Ideally, the material falloff in trains holding would suggest a rapid recovery in network velocity and on-time performance, but we need to temper that with the fact that some car congestion and high dwell are stubborn things that take time to correct. Class I networks get into trouble quickly and out of trouble slowly; it’s just the way it works.

STB EP770 Reporting Expiration has Proven Premature

Hindsight is, of course, 20/20, and when the STB allowed the EP770 temporary reporting requirements to expire at the end of December it sort of made sense. We wrote at the time that discontinuing the reporting of on-time performance was a mistake, but otherwise the industry had largely earned a reporting reprieve. CSX, UP and BNSF had fully recovered from the Service Crisis and were all running well, critical resources in terms of crews and power were adequate, and even excessive in some cases (hence the stealth furloughs we’ve seen in recent weeks) and the winter forecast was mild due to a strong El Niño and climate change. That forecast proved accurate, with NOAA recently declaring winter the warmest on record, there was no polar vortex, and only one arctic blast vs. two the prior winter. And yet, somehow they’ve dropped the ball.

It’s not just BNSF, where bad luck has played an outsized role. UP can’t get above 24 mph when 25 mph is its historic “good service” benchmark. CSX has slowed to the point where speed is only 0.1 mph above its YTD low and its Q1 metrics are significantly inferior to 2023, and Norfolk Southern’s manifest business still can’t find its groove in terms of service and efficiency (intermodal looks much better to be fair). Yes, it’s winter and the weather’s cumulative braking effect will often cause network velocity to bottom late in the season, but it still feels like the industry has lost a step even adjusting for the weather. On-time performance visibility would have been helpful to all stakeholders over this period.

Rant over.