Ancora Accelerates NS Takeover Attempt (Updated)

Written by William C. Vantuono, Editor-in-Chief

Proposed new leadership at Norfolk Southern includes Jim Barber (left) as CEO and Jamie Boychuk as COO.

Ohio-based Ancora Holdings Group LLC, with affiliates and other participants—collectively called the “Investor Group”—on Feb. 20 launched a formal takeover attempt of Norfolk Southern, announcing eight prospective board members, a new CEO and a new COO.

Claiming that it will be able to drive NS’s share price up by about 65% to $420 (as of 2:00 PM EST on 2/20/2024 it was trading at approximately $255), Ancora, which recently acquired a $1 billion-plus equity stake in NS, launched a blistering attack on the Class I and current CEO Alan Shaw. There’s a website, www.MoveNSCForward.com with downloadable presentations, among which are ones titled The Case for Leadership, Safety and Strategy Changes at Norfolk Southern (download below) and Network of the Future Strategy.

Ancora is proposing former United Parcel Service (UPS) COO James Barber Jr. as CEO and board member, and career railroader Jamie Boychuk, who until Aug. 4, 2023 was Executive Vice President Operations at CSX, as COO. Both are described as “proven leaders with operational and railroad industry expertise necessary to move Norfolk Southern forward” (bios below).

In addition to Barber, Ancora’s director slate includes Betsy Atkins, William Clyburn Jr., Nelda Connors, Sameh Fahmy, John Kasich, Gilbert Lamphere and Allison Landry (bios below). The octet has, according to Ancora, “deep experience in governance, finance, legislative and regulatory affairs, strategic transformations, transportation and the railroad sector.”

Ancora pulled no punches in attacking NS, saying, “Norfolk Southern, which has exceptional rail workers and the country’s best customers, has suffered for years due to its Board’s poor decisions with regard to the company’s leadership, safety priorities and strategy. Since the Board announced its appointment of Alan Shaw as CEO, Norfolk Southern’s status as the worst Class I railroad has been solidified by leadership delivering industry-worst operating results, sustained share price underperformance and a tone-deaf response to the devastating East Palestine, Ohio derailment.* The future looks equally bleak under Mr. Shaw, who has drawn the condemnation of policymakers and the skepticism of underwhelmed analysts and shareholders.

“In recent months, we engaged in good faith and shared a data-centric, facts-based case for meaningful change with Norfolk Southern’s Board. We privately conveyed, on several occasions, that Mr. Shaw’s strategy is equal parts unambitious and impractical (despite somehow having the unanimous backing of the Board). Moreover, we privately showed that Mr. Shaw’s background as a 30-year insider with a poor record of driving growth through marketing roles renders him unfit to get a second chance as CEO. We even met with Mr. Shaw in hopes of having him change our view. While all this was going on, however, Norfolk Southern was sending its private jet to Washington, D.C. so executives could pursue the support of regulators, and the Company started requesting public support from customers as part of its planned fight against us.

“The bottom line is that it is time to actually move Norfolk Southern forward. Moving ahead starts with identifying the right destination. Our slate and proposed management team believe they have the experience and strategy required to turn Norfolk Southern into a safer, more sustainable railroad that is growing profitably while also yielding more stability for customers and employees. As shown in our presentation, this is a far cry from where Norfolk Southern stands today under Mr. Shaw and his loyal backers in the boardroom. In the coming weeks, we look forward to sharing a second presentation that focuses on our 100-day transition plan and the details of our reliable network strategy that will leverage Norfolk Southern’s existing assets and people to get the organization to the right destination. We will show that a better day is in reach—one that includes enhanced value for customers, communities, employees and shareholders.”

Ancora has established an LLC, “Ancora Alternatives LLC” that intends, with its other participants, file a preliminary proxy statement and accompanying “BLUE” universal proxy card with the Securities and Exchange Commission to solicit proxies for the election of its slate of director nominees at the NS’s 2024 annual meeting of shareholders. The other participants in the proxy solicitation are currently anticipated to be Ancora Catalyst Institutional, LP, Ancora Merlin Institutional LP, Ancora Merlin LP, Ancora Catalyst LP, Ancora Bellator Fund LP, Ancora Impact Fund LP Series AA, Ancora Impact Fund LP Series BB, Ancora Family Wealth Advisors, LLC, Inverness Holdings LLC, Frederick DiSanto, Betsy Atkins, James Barber Jr., William Clyburn Jr., Nelda Connors Sameh Fahmy, John Kasich Gilbert Lamphere and Allison Landry.

Cadwalader, Wickersham & Taft LLP is serving as legal advisor, with Longacre Square Partners LLC serving as communications and strategy advisor and D.F. King & Co., Inc. serving as proxy solicitor.

INVESTOR SLATE BIOS

Betsy Atkins is a corporate governance expert and three-time CEO with experience in capital allocation, transformations and strategic planning. She is CEO and Founder of Baja Corporation, a venture capital firm focused on software, technology, energy and digital transformation; member of the boards of directors of SL Green Realty, SolarEdge Technologies, Enovix Corporation, Wynn Resorts, Rackspace Technology and GoPuff. She is also former CEO and Chair of SaaS Company Clear Standards, an energy management and sustainability software company, CEO and Chair of NCI, a functional food/nutraceutical company, and CEO of Key Supercomputer Labs, which delivers technology-driven seismic analytics and sustainability insights. Atkins previously served on the board of directors of such companies as Covetrus, Schneider Electric, HD Supply and Volvo Car Corporation.

James Barber Jr. is a shipping and logistics industry veteran with experience in finance, strategic planning and risk management at UPS, one of the nation’s largest railroad customers (additional details below).

William Clyburn Jr. is a former railroad regulator with 30 years of experience in all three branches of the U.S. government. He is Principal at Clyburn Consulting, which advises transportation and telecommunications companies on governmental issues and processes. He facilitated constructive dialogue and remediation efforts between Norfolk Southern and community stakeholders following NS’s January 2005 derailment in South Carolina. Clyburn spent 30 years in Washington, D.C., including as the Commissioner and Vice-Chairman of the U.S. Surface Transportation Board and a senior advisor to two U.S. Senators. He previously worked as a law clerk for the Honorable Rodney A. Peeples, Circuit Court Judge for the Second and Ninth Circuits of South Carolina.

Nelda Connors a former automotive industry executive with operations, engineering, risk management, human resources and financial expertise. She is CEO and Founder of Pine Grove Holdings, a privately held investment company. She serves on the boards of directors of Baker Hughes, Zebra Technologies and Otis Worldwide, and as an advisor to Nissan North America and Vibracoustic. Connors previously spent 25 years working in the automotive industry, including as President and CEO of Atkore International, which spun out from Tyco International, and in executive roles at Eaton Corporation, Ford Motor Company and Stellantis North America (formerly Chrysler Corporation). She previously served as a Class B director of the Federal Reserve Bank of Chicago.

Sameh Fahmy is a former Class I railroad and transportation industry executive with safety, supply management, engineering and mechanical experience. He was EVP of Precision Scheduled Railroading at Kansas City Southern, where he led implementation of KCS’s PSR methodology; Optimization Consultant at CSX, where he helped improve CSX’s mechanical and engineering departments, and SVP at CN, where he oversaw the mechanical and engineering functions, improving their safety record, reducing expenses and train delays, increasing freight car and locomotive availability, and leading a four-year fuel efficiency drive. Fameh previously worked at the Association of American Railroads and Amtrak, and served on the board of directors at Rumo Railwaywhere he chaired the Operations Committee. He is a Chartered Professional Accountant.

John Kasich is a former Ohio governor and congressman with regulatory, legislative and executive policy experience. As Governor of Ohio, he is credited with “significantly improving the state’s business climate, reducing red tape and regulations, streamlining operations, creating a private economic development entity and overseeing cumulative surpluses of nearly $3 billion.” A Republican, he spent 18 years as a congressman, during which time he served as Chair of the House Budget Committee, a member of the Balanced Budget Committee and a member of the House Armed Services Committee. He ran for President in 2000 and 2016. Kasich is former Managing Director in Lehman Brothers’ investment banking division, and served on the boards of directors of Worthington Industries, Invacare and Instinet.

Gilbert Lamphere is a railroad and transportation industry veteran credited as “the original financier of PSR, the strategy that revolutionized how freight railroads are run in the U.S. and Canada.” He is Chairman of MidRail Corporation and Co-Founder of MidSouth Rail Corporation. He previously served on the boards of directors of CN, where he was Chair of the Finance Committee, and CSX, where he was a member of the Operations Committee. Lamphere was Chairman of Illinois Central Railway, and a director of Florida East Coast Railway and Patriot Rail. He previously headed four operationally focused private equity firms and worked in the M&A division at Morgan Stanley.

Allison Landry is a former U.S. transportation and logistics sector equity research analyst with expertise in corporate governance and compensation practices. She previously spent 16 years as the Lead Equity Research Analyst at Credit Suisse for the U.S. transportation sector, covering Class I railroads, trucking, parcel/air freight and logistics companies. Landry is a board member of XPO, where she is Chair of the Nominating, Corporate Governance and Sustainability Committee and a member of the Compensation Committee and Operational Excellence Committee. She is an advisory board member of Windrose Technology, which specializes in developing zero-emission heavy duty electric trucks, and former Senior Accountant at OneBeacon Insurance Company.

PROPOSED MANAGEMENT TEAM BIOS

James Barber Jr. is a former executive in the shipping and logistics industry credited with “a 35-year track record of growth and significant experience in operations, supply chain, strategic planning, employee relations and risk management, leading much of UPS’s growth, including mature and emerging international markets, and reaching scores of effective labor agreements through constructive negotiations, while overseeing lauded safety initiatives in both the Ground network and the UPS airline.” He spent 35 years at UPS, most recently serving as COO and President from 2018 to 2020, with prior leadership roles in UPS’s domestic and international business units as well as in supply chain solutions, including both Global Freight Forwarding and Coyote Logistics. Barber is board member at C.H. Robinson Worldwide, Inc., where he serves on the Audit Committee and is an SEC “Audit Committee Financial Expert,” and U.S. Foods Holding Corp.), where he serves on the Compensation and Human Capital Committee.

Jamie Boychuk is a carer railroader “with the safety record and scheduled railroading acumen needed to help turn around Norfolk Southern.” He previously served as Executive Vice President of Operations at CSX, where he is credited with “leading a variety of operational initiatives during a period in which the railroad improved performance across all operating metrics and unlocked significant value for shareholders. He worked directly with industry legend Hunter Harrison, and also helped CSX amass a strong safety record and reduce burdens on rail workers. Upon his departure from CSX in 2023, the company publicly thanked him his role in the implementation of scheduled railroading.” Previously, Boychuk spent nearly two decades at CN, where he held operations roles of increasing responsibility and seniority.”

“If elected, our slate intends to make every effort to appoint Barber CEO and Boychuk COO as expeditiously as possible,” Ancora said.

NS RESPONDS

“The Norfolk Southern Board and management team are committed to acting in the best interests of the company and our shareholders.

“As we consider all opportunities to enhance shareholder value, the perspectives of our shareholders are important to us. Since receiving Ancora’s nominations, members of both the board and management team have held multiple discussions with representatives of Ancora to better understand their views and communicate Norfolk Southern’s perspectives on the execution of our strategy. At Ancora’s request, and in accordance with the board’s normal process, members of the Governance and Nominating Committee and the board carefully evaluated and interviewed all of Ancora’s nominees.

“Board refreshment is integral to effective corporate governance, and we seek to ensure that our directors have the appropriate skills and experience to oversee our strategy and its execution. The Norfolk Southern Board is composed of highly qualified, independent directors. Each brings expertise in areas relevant to our business.

“The Norfolk Southern Board has maintained an ongoing process of refreshment, with six directors appointed to the board in the past five years. Since the 2023 Annual Meeting, the board has done and continues to do considerable work to evaluate new, independent director candidates. In July 2023, our newest independent directors, Admiral Philip Davidson, U.S. Navy (Ret.) and Francesca DeBiase, joined the board. Already, they have added significant operations experience and fresh perspectives on safety, supply chain integration, and sustainability.

“Concurrent with those appointments, we announced that current directors Mitchell Daniels, Jr. and Michael Lockhart will retire from the board following our 2024 Annual Meeting. As part of the board’s succession planning process, Norfolk Southern also announced the appointments of current directors Christopher Jones as Chair of the Safety Committee, succeeding Lockhart; and Jennifer Scanlon as Chair of the Governance and Nominating Committee, succeeding Daniels. Jones’ appointment became effective September 1, 2023, and Scanlon’s will become effective at or before Daniels’ retirement.

“The board continues to oversee management’s successful execution of our strategy to balance safe and reliable service, continuous productivity improvement, and the pursuit of smart, sustainable growth. We are making disciplined investments in resiliency while driving efficiency, all to position our business to secure growth and strong incremental margins as the market recovers.

“Coming out of the COVID pandemic, we dramatically improved our safety metrics and service product in each of the past two years. In fact, Norfolk Southern delivered record annual revenue in 2022. Indeed, we delivered our best intermodal service in more than three years in fourth-quarter 2023 and grew volumes in intermodal, which is our most service-sensitive business, by 5% on a year-over-year basis. We also significantly improved train velocity and dwell in fourth-quarter 2023, with both metrics reaching their best levels in several years. We achieved these improvements despite the network disruptions we experienced last year.

“While there is more work to do to recover from the short-term impacts to margins, customers are seeing our progress. They recognize our commitment to delivering consistent, reliable service and are awarding us new business. We are now implementing the same Scheduled Railroading operating principles that improved velocity and resilience in our intermodal network across our merchandise network, which accounts for two-thirds of our train starts. As we do so, we will reduce variability, complexity, and cost. That is our strategy in action.

“With our balanced approach based on the operating principles of Scheduled Railroading, we are committed to delivering top-tier revenue and earnings growth at industry-competitive margins. We remain confident in our ability to further grow volumes, improve service, and deliver long-term value for Norfolk Southern as well as our shareholders and customers.

“Since day one following the East Palestine derailment, members of the Norfolk Southern team have been on the ground working with members of the community, elected officials, and government agencies to support affected residents and businesses. We are proud of our response in East Palestine and the relationships we’ve built throughout the community. Norfolk Southern is making it right, delivering on our promises to fully and safely remediate the site and ensuring East Palestine and the surrounding communities thrive for the long-term.

“More broadly, we are building upon our strong safety culture and furthering our performance. We are continuing to implement our six-point safety plan, installing cutting-edge digital train inspection portals, and incorporating feedback from our labor leaders. In September 2023, Norfolk Southern’s independent safety consultant, Atkins Nuclear Secured, released its first report, which was shared with all 20,000 of our employees. Thanks to these efforts and others, we achieved a dramatic 42% reduction in our main line accident rate year-over-year in 2023.

“The board regularly evaluates its composition and will continue its careful review of Ancora’s nominees with a focus on advancing our goal of building the safe, reliable and resilient railroad our customers and shareholders expect. The board will present its formal recommendation on the nominees in the company’s definitive proxy statement, which will be filed with the Securities and Exchange Commission and mailed to all shareholders eligible to vote at the 2024 Annual Meeting. The date of the company’s 2024 Annual Meeting has not yet been announced. Norfolk Southern shareholders are not required to take any action at this time.

“The Company intends to file a proxy statement on Schedule 14A and WHITE proxy card with the SEC in connection with the solicitation of proxies for its 2024 Annual Meeting of Shareholders.”

TD COWEN INSIGHT by Jason Seidl, Railway Age Wall Street Contributing Editor

Ancora took another step Tuesday to propose a new management team and Board at NSC. Ancora is recommending Alan Shaw be removed as CEO and replaced with UPS-veteran Jim Barber. Barber spent nearly four decades at UPS and was COO until December 2019 when he announced his retirement. We believe Barber to be respected by investors in the transportation sector, though not revered within railroading given the bulk of his experience is in parcel. Recall Ancora pushed for CHRW to name Jim Barber CEO last year and that was not ultimately seen through. Regardless of the potential CEO succession, we believe an activist involved in NSC may still lead to changes that close the gap between its U.S. Class I peers. Ancora also recommended Jamie Boychuk as COO, who had a strong record at CSX and would bring rail experience to management, who was let go from the company in 2023.

Ancora is calling for a complete board and management team overhaul at NSC in a bid to drive the operational changes they envision. The activist’s proposed Board on paper is robust in our view with representation of regulators, operators, technology and finance experts while also being a significantly diverse arrangement. Given the challenged outlook facing NSC currently, we believe it is likely that the current Board will be under pressure. Though we acknowledge that the existing team at NSC has faced external shocks that exacerbated weak performance, shareholders could look past the uncontrollables in favor of a fresh slate and revised strategy.

SFG ANALYSIS by Bascome Majors, Susquehanna Financial Group

We believe Ancora’s public escalation of its private dispute with NSC’s board is evidence that 1) Ancora doesn’t see a path to a settlement without a commitment to management change, and 2) NSC’s board continues to back CEO Alan Shaw to give him and his longer-term growth strategy more time.

Ancora’s proposal of former CSX EVP of Operations Jamie Boychuk to join NSC as COO was very much expected, though we see former UPS executive and rail outsider Jim Barber as CEO as a bit of a surprise despite his prior association with Ancora in their push for change at CHRW. We believe investors would widely support handing Boychuk in the operational reins at NSC, and while we have tremendous respect for what Barber accomplished at UPS’s International business, we want to hear more about his plan for NSC as a railroad outsider.

To be clear, we believe the “outsider as rail CEO” plan is working very well at NSC competitor CSX, but also note there’s more operational heavy lifting to do at NSC compared to CSX, which was operating extremely well under Boychuk when CEO Joe Hinrichs arrived in September 2022.

Ancora’s takedown of NSC’s operating plan appears well-thought-out, quantitatively supported, and strategically avoids the simplistic “cut heads, plug in the other rails’ OR” approach that could empower stakeholder opposition. In short, Ancora argues NSC should get back to PSR basics by simplifying blocking at origin, reducing car touches in the merchandise network, and focusing more on efficiently running higher-margin manifest and bulk trains instead of prioritizing faster-growing but lower-margin intermodal across the network.

While lacking a deep dive supporting each component, Ancora’s initial NSC deck shared a share price bridge from today’s value to $420 (~65% upside). Unsurprisingly, the single biggest driver is “productivity improvement” at $63 (+25%, which would be less than the $1.6B operating profit gap they call out vs. CSX), with some other larger components sounding more cyclical than change-driven ($47/+19% from “volume improvement,” $25/+10% from “pricing opportunity”) and others more likely to follow change ($18/+7% from “capital return,” $15/+6% from “valuation re-rating”).

What’s next? A busy two months of NSC vs. Activists. After NSC’s initial response to Ancora’s first public volley, we’d expect preliminary proxies from both sides in March, a more in-depth deck and argument from Ancora by early April ahead of their pitches to proxy advisory firms ISS and Glass Lewis, recommendations from the proxy advisory firms sometime around mid-April, and the NSC annual meeting in early to mid May.

We’re making no changes to our NSC forecasts or valuation frameworks today but will continue to review both sides’ arguments and update our views as appropriate going forward.

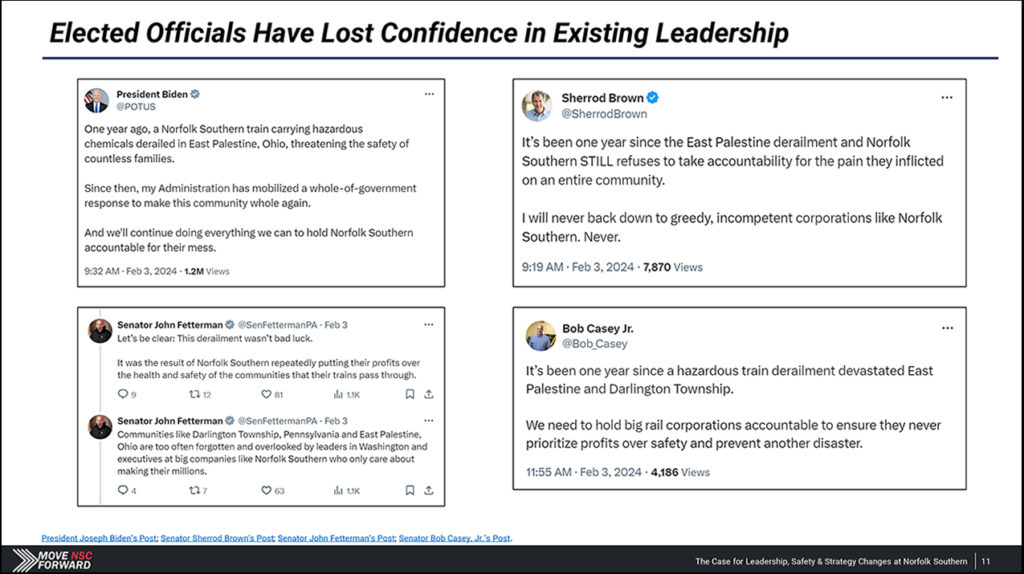

*Editor’s Comment: Calling NS’s response to East Palestine “tone-deaf” is ridiculous, unfair, unnecessary, thoroughly irresponsible and harmful to the railway industry. Leave it out of the discussion, unless you (Ancora) have what you think is a better response. The slide below from the “The Case for Leadership, Safety and Strategy Changes at Norfolk Southern” quoting social media posts from politicians promotes pure political horse manure. It’s meaningless, mean-spirited nonsense, borderline la bugia, la menzogna, le falsità. “I will never back down to greedy, incompetent corporations like Norfolk Southern,” tweeted U.S. Sen. Sherrod Brown. Really? Chiudi la bocca, senatore. Non hai idea di cosa stai parlando! – William C. Vantuono