Adapt or Decline

Written by Alex Luna

Aerial view of CSX’s 56-track Radnor, Tenn., classification yard.

Growth has yet to materialize for the rail industry. What is holding this industry back? Can railroads grow again? If so, how? 2023 saw yet another decline in rail traffic volumes, continuing this industry’s decades-long gradual trend. What philosophy is leading to this outcome?

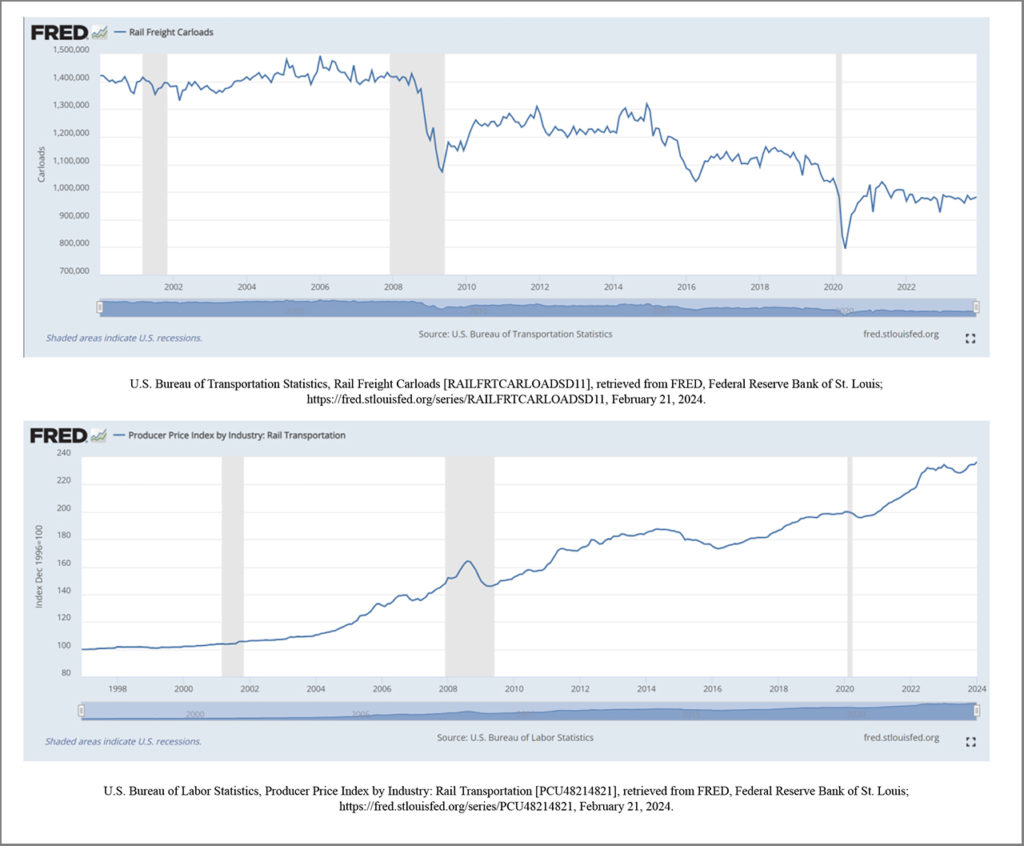

Part of the decline in rail volume seems to come from increasing prices. There is a clear correlation between the producer price index for rail transportation and rail freight carload volume decline. But, using 300 to 400 trucks is more expensive and harder to coordinate than using one train to move the same quantity of goods. The economics should favor rail.

It seems that regardless of cost economics, as customer heartburn from rail service problems keeps getting more expensive to stomach, they keep shifting their freight off the rail network. Why? Consider the following hypothetical example:

A soda bottling plant in the Southeast operates leveraging a just-in-time (JIT) inventory management system for its raw materials to optimize warehouse space utilization and minimize carrying costs. The production scheduling at the plant is directly influenced by the inventory demands of the grocery store retailers it supplies in the region, aiming to manufacture an exact number of soda cases for timely stock keeping unit (SKU) restocking to prevent stockouts from occurring for SKUs in the region’s grocery stores. The plant must produce 5,000 cases of soda per day this week to fulfill the SKU replenishment orders placed by the grocery retailers during the week prior. The cases are scheduled for delivery during the next day every two days, and failure to deliver the cases will lead to stockouts of the SKUs at the grocery retailers and lost sales. Each case is sold for $100 to the grocery retailer, and the plant’s daily fixed costs are $150,000. The plant’s rail carrier, based on its cost-optimized local service plan, provides the plant switching service three days per week, on Monday, Wednesday, and Friday. The plant depends upon its rail carrier’s switch to receive eight loaded railcars of high fructose corn syrup (HFCS) inventory per switch and uses the railcars as storage given the lack of on-site tank storage for the two days of production in between switches. The plant does not operate on Sundays.

The railroad misses the plant’s switch Wednesday morning, and the plant does not receive the loaded railcars it needs for its production runs for the next two days. All eight railcars the plant currently has on-site are now empty given the prior daily production runs. The plant, without HFCS to use in its production runs, shuts down for the next two days causing the groceries to stockout for two days as well. Given the plant’s rail service schedule, it will have to wait two days to receive its switch. The railroad’s per/car rate charged to the bottling plant is $4,000. The total cost to the plant for the missed switch in two days of lost sales and fixed cost? $1.3 million. The value of the deliveries for the railroad? $32,000.

Railroads have historically not only neglected the amplified financial and operational consequences of inadequate rail service on their customers’ downstream supply chains but also even increased the prices customers must pay to tolerate this supply chain risk. CSX CEO Joe Hinrichs put it bluntly: “The standards are too low in this industry for customer service … What we define as great most people would laugh at.” To grow, our philosophy needs to change. How can we evolve and grow?

Deliver Well

Railroads are delivery services that now want to grow. Uber and Amazon are well known delivery services that grew rapidly. The rise of e-commerce demand propelled Amazon’s rapid growth. But railroads have no such macroeconomic tailwind like the rise of e-commerce to rely upon. Railroads face a different growth challenge: They must create a service experience that is superior to that of other transportation modes, specifically trucks.

Uber’s growth challenge, and its need to prove that its delivery service was superior to that of the taxi ecosystem that already had the trust and faith of the consumers that used it, is a better case study for railroads to learn from. Its growth was fueled by its ability to apply modern technology to a decades-old industry problem in such a way that users loved. Uber then, using the same technology, digitized and standardized a hyper-fragmented, geographically distributed, time-sensitive, and extremely complex marketplace with Uber Eats by connecting restaurants to customers. The ACME plant shut down because the railroad failed to perform the switch on time. Time sensitivity is a core advantage that trucks are well known for having over rails. Freight rail service quality is freight rail on-time performance. For railroads to take freight from trucks, punctuality is required.

The technology that both Uber and Uber Eats used to execute 7.64 billion trips in 2022—235 times the total number of rail carloads delivered by U.S. and Canadian Class I railroads combined in 2022—can and should be adapted and applied to railroads to allow them to deliver on time and grow.

But is it even possible for railroads to grow?

Target Market

The synthetic operational capacity that exists on our rail networks today is not indicative of the inherent physical capacity that exists on the physical rail network itself. The financial engineering behind the deployed operating plans of railroads today constrains operational capacity intentionally. The physical rail network itself has enormous available space to handle additional freight. Three target markets exist for railroads to grow within to fill that capacity.

First, the traditional shiny target market: new industrial facilities locating on rail. These are home runs but take years to win and materialize. On-time performance-focused railroads can champion their service quality as a reason for large industrial customers to make the significant investments required to build these plants. Eliminating the need to account for rail service risk in the investment decision process will help railroads add industries.

Second, the existing rail customer base is truck freight. Joe Hinrichs made this point when discussing how an automotive plant he used to manage stopped shipping by rail: “We had loading docks. They do not exist anymore … They’re all trucks. Up and down I-75 all day long.” For that to change, and for those rail loading docks to reopen, on-time performance is required.

The third, and most interesting, is the market that punctual railroads make possible. The diversification of rail vehicle service offerings that customers can choose to use to ship by rail is the holy grail of growth railroading. Autonomous electric railcars now exist that offer movement flexibility, improved braking, and modularity. Smaller, time-sensitive, expedited, LTL, fragile, and spot market shipments could all be moved by rail if these new rail vehicles can be successfully integrated into traditional rail network service offerings. The available physical network capacity between traditional train movements can most certainly be filled by these vehicles. But to integrate such vehicles into existing rail service offerings, given that more vehicle traffic can make delay propagation worse, schedule adherence becomes even more important.

Growth is possible, but do we really need to adopt modern delivery service technology to help us grow?

We Are Different!

“Railroads are different!” shout the naysayers. “We do not have routing options because railroads are not roadways!” “Our train schedules and crew assignments are planned, not spontaneous!” “Locomotives are not cars, and their movements are constrained!” “Uber has no interchange coordination!” “Uber lacks operational regulations and rules!” “Uber has no classification yards!” “Rail customers are complex and, in some cases, large industrial facilities, not restaurants or humans!” “We have managed these yards and territories for years, there is no way an iPhone app could do what we do!” “Uber does not plan or perform maintenance!” “We don’t need delivery service technology to help us railroad!”

Fine. But, the new bottling plant manager, who is now having to explain why the plant shut down on his watch, is not concerned with the intricacies of why railroads believe their operations are different. At the moment, he is more concerned about his job. Moving forward, this new plant manager will be sure to not repeat the mistake of totally trusting the operational commitments a railroad makes. As the scoreboard shows, rail customers have learned not to trust the operational integrity of railroads.

For railroads to win back the trust of the transportation marketplace and grow, they need to prove to customers that they can arrive on time. Adoption of the technology that enables modern delivery services to be punctual is the only way railroads will be able to do so.

Modernize

The bottling plant, with its switch window expiring, contacts the railroad asking it to help prevent its shutdown and save its planned production run. The train with the plant’s loaded railcars originally scheduled for delivery had derailed in a customer’s facility scheduled for service prior to the plant causing the crew to run out of time. The plant has additional loaded HFCS railcars in the local serving yard, and requests that those cars be delivered immediately to prevent the shutdown. The trainmaster needs to find a way to set out the other loaded railcars, source a locomotive to deliver them, call an extra crew to operate the extra train, and integrate the extra train into the existing local service schedule for that day. Time is not on their side, and solving this interconnected schedule disruption problem needs to be done as quickly as possible to prevent the plant’s shutdown while also mitigating a delay propagation that could impact the rest of the railroad’s local service schedule for the day.

This complex scenario is exactly where the GPS-enabled algorithmic routing and scheduling delivery technology that Uber Eats relies on thrives. If a disruption occurs in the planned delivery execution schedule, like a driver cancelling, the Uber Eats app can immediately source a new driver for a delivery by matching available drivers within the area based on their real-time location provided by GPS, generate a new route and schedule for them to perform the delivery, and notify the customer that its delivery request has been reassigned to a new delivery driver while providing a new expected ETA directly to the customer. This automated and instantaneous re-orchestration minimizes the disruption and delay associated with the original plan for the delivery failing and minimizes the pain the customer could experience from the unplanned operational problem. Most important, it does this at scale, constantly, for an entire city’s worth of deliveries, ever single night. The orchestration of this process is automated, GPS-enabled, algorithmically generated, fast, and effective. It is what enables Uber Eats to have excellent delivery service quality. It is the technology that keeps Uber Eats deliveries arriving on time, and it can be for a railroad as well.

But you cannot build digital mansions on sandy digital foundations. For punctual performance to be possible for railroads, the real-time data generation and digital infrastructure must be modernized. This industry seems to understand this given the RailPulse initiative, but not all railroads believe it necessary. Some short line railroads even lack fully GPS-equipped locomotive fleets.

Uber Eats exemplifies the critical role of GPS-enabled real-time location tracking in ensuring seamless delivery operations, where each meal’s journey is meticulously monitored via the driver’s cellphone, eliminating any possibility of location data gaps. This level of precision and monitoring is essential for its real-time work execution generation capabilities to function. Given the necessity of capabilities like automated train consist verification to match locomotive and crew capacity more quickly and accurately to the locations of the railcars they need to deliver, it is also necessary for real-time punctual growth railroads to exist. Despite the interconnected physical rail network, railroad companies still suffer from significant digital fragmentation when it comes to real-time data generation. The information sharing and digital systems infrastructure this industry is currently built on were not designed for real-time automation. Instead, the human influenced operational decision-making processes, like dispatching, complicate the deployment of any real-time automated interoperability and inter-carrier coordination and visibility tools. To achieve the operational efficiency, transparency, and real-time responsiveness seen in modern delivery service platforms, all railroads must embrace comprehensive GPS tracking and address the real-time digital fragmentation hindering effective system-wide coordination.

If railroads want to make safe punctuality their top priority, and if they want to demonstrate to the target markets they can win within that rail service quality will forever be a competitive advantage for them to leverage in their supply chains instead of a source of pain and risk, investing in the modernization of the digital domain to improve the real-time delivery service experience and mitigate the costly pain that can occur when a railroad’s original delivery plan fails due to an unplanned event has to happen.

First to be Second

Railroads are slow to change. The nascent ecosystem of rail tech companies which has emerged over the last five to ten years within the industry is not. PTC, the most recent significant digital upgrade in the rail industry, was led primarily by Class I railroads. But now, this small new rail tech ecosystem that short lines have enabled to emerge is the industry’s best hope to start growing faster, for it is quickly building targeted solutions that can solve many of the problems that continue to plague this industry today despite a lack of robust Class I support.

The pace of technological advancement in the world outside of the rail industry is so much faster than it seems to want to acknowledge or understand. When it comes to new technology adoption, railroads since the 1950s have seemed to want to be first to be second, or even last. If this industry wants to change, evolve, modernize and grow, it needs to start wanting to be first. And all industry stakeholders should work toward enabling railroads to lead again in the technology domain.

Railroading is a team sport, and to get this industry to alter its trajectory of decline, railroads should want to deploy every resource available to them to help make growth happen faster and should approach this new rail tech ecosystem with that same mindset. Every industry stakeholder, from unions, to regulators, to suppliers, to customers, to employees, and to the railroads themselves must cooperate and collaborate to make growth happen. Leveraging the new rail tech supply community, which sits at the forefront of technical innovation in the industry today thanks to largely to shortline railroads fostering its emergence and growth, is one of this industry’s best resources to use to accelerate the modernization process.

The taxi industry was slow to recognize the potential of smartphone technology to revolutionize transportation. Uber’s model of using an app for everything from hailing a ride to payment was a significant departure from the way traditional taxis operated. Taxi companies misjudged how quickly consumers would embrace a new technology-enabled model that offered greater convenience and transparency. There was a general complacency among taxi companies about their market position, and many were slow to respond as Uber gained traction. They thought their taxi medallions were an insurmountable barrier to entry, and the false sense of security that belief provided cost them their market position permanently.

Sound familiar? Railroads have an opportunity to have a different outcome. A growth outcome. It will not be easy, but it is possible.

America Needs Great Railroads

Dan Elliott, the former STB Chairman, stated publicly that “at the very heart of the common carrier obligation is the belief that railroads are in a position of unique public trust. They are therefore held to higher standards of responsibility than other private enterprises”.

Ensuring that our rail networks are healthy and operationally competitive is part of the fiscal duty that comes with the economic sovereignty that American society has entrusted rail leaders and owners with as owners and operators of the vascular system of the U.S. industrial economy. If railroads continue the dereliction of that fiscal duty in favor of short-term shareholder indulgence, the impending degradation of that sovereignty will become imminent, and in the worst case, necessary. We should not let that happen. And we should not need a regulator to force railroads to be good at railroading.

We cannot keep building highway systems. We do not have the infrastructure capacity to handle de-marketed freight traffic that rails could move today. We need a great rail system in this country. And we need rail operations to be the gold standard of safety, reliability and service quality for our industrial economy. The capacity is out there, the supply base is eager, rail customers demand it, and most important, the men and women railroaders who are out there in the field every day and night doing the job the most don’t want deserve to be proud of the work they do that enables our society to function. We should stop waiting and delaying and not only start but accelerate this necessary evolutionary process now.

It is time to prove that railroads can compete, win, and be the standard for delivery service excellence in our digital-first world. Our heritage deserves nothing less. If we do not adapt, we will continue to decline.

Alex Luna is the Founder and CEO of AlphaRail, a 2020 Creative Destruction Lab Quantum Computing Stream graduate and the only rail-focused founding member of the United States Quantum Economic Development Consortium (QED-C). Alex started his rail career as an intern on Norfolk Southern’s Ag Marketing team. After modeling and renewing $1.6 billion in rail customer contracts as the Market Manager for Norfolk Southern’s sweeteners commodity franchise, the railroad’s’ most profitable agriculture franchise, Alex left to start AlphaRail to bring high performance algorithmic and computing technology into the rail industry to improve the quality of rail service that rail customers experience. Alex holds a BS in Supply Chain Management and Business Analytics from The University of Tennessee, Knoxville, an MBA from Vanderbilt University, and Venture Capital Executive Education from The University of California Berkeley. He also serves on the Use Case Technology Advisory Committee for the US QED-C.